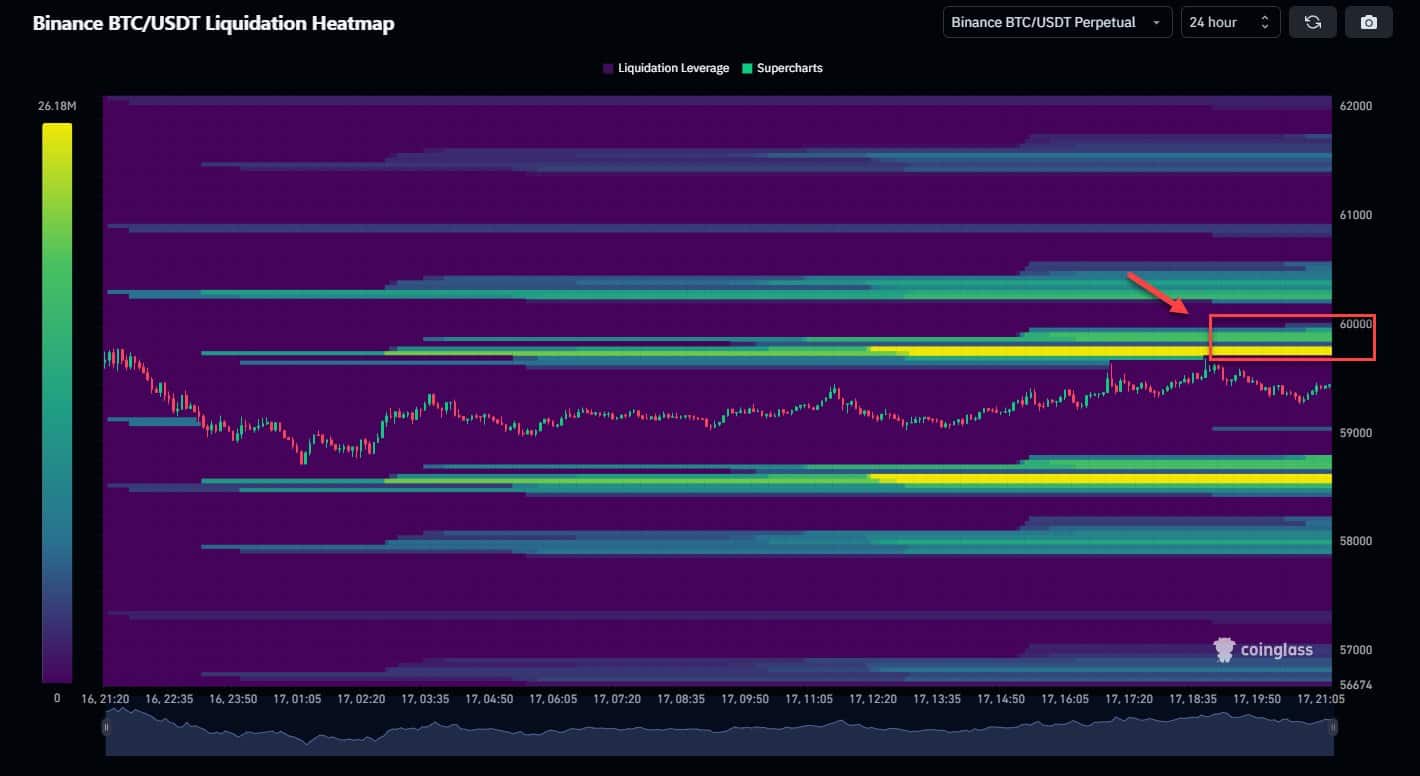

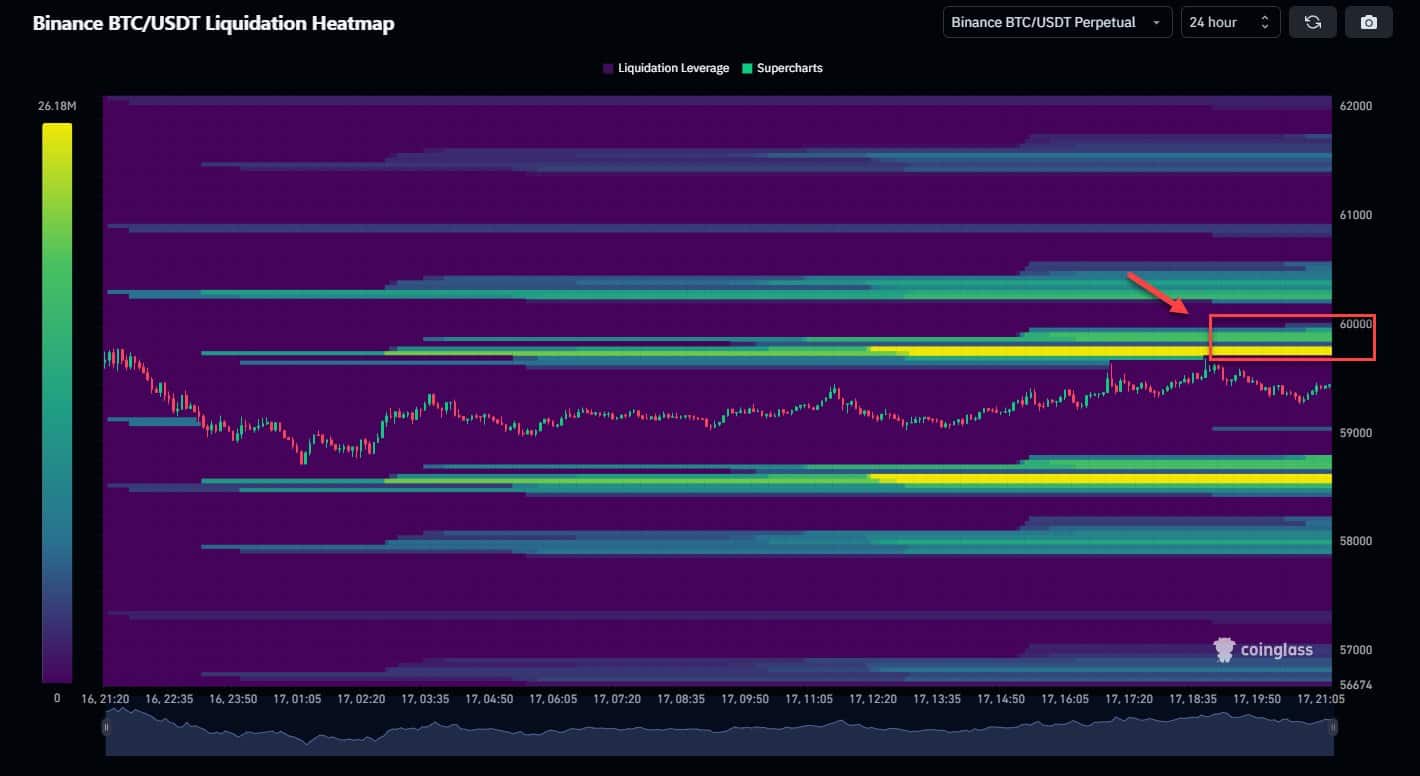

- $244 million worth of Bitcoin will be liquidated in the new short sale at $61,000, and $9.17 billion worth of Bitcoin will be liquidated at $68,000.

- However, the achieved price, high whale ratio, and new record high in money supply suggest buying BTC.

Bitcoin [BTC] The market is currently uncertain, struggling to maintain a clear upward trajectory after recovering from the August 5th decline, caused by the collapse of Japanese stocks.

At the time of writing, Bitcoin is still just below the $60,000 level, but challenges remain. A pool of 4,000 new short positions are waiting, with immediate sell orders just above $61,000.

So, Bitcoin may break $60K overnight, but it will stop at $61K. That was the downside as highly leveraged long liquidations were looming at $58K.

Source: Coinglass

Additionally, $9.17 billion in Bitcoin short sales could be liquidated if Bitcoin hits $68,000, which also threatens its ability to reach new highs.

However, other data supports Bitcoin’s continued recovery, with it likely to hit a new record high by Q4 2024 or Q1 2025.

Bitcoin: A Future Buying Opportunity?

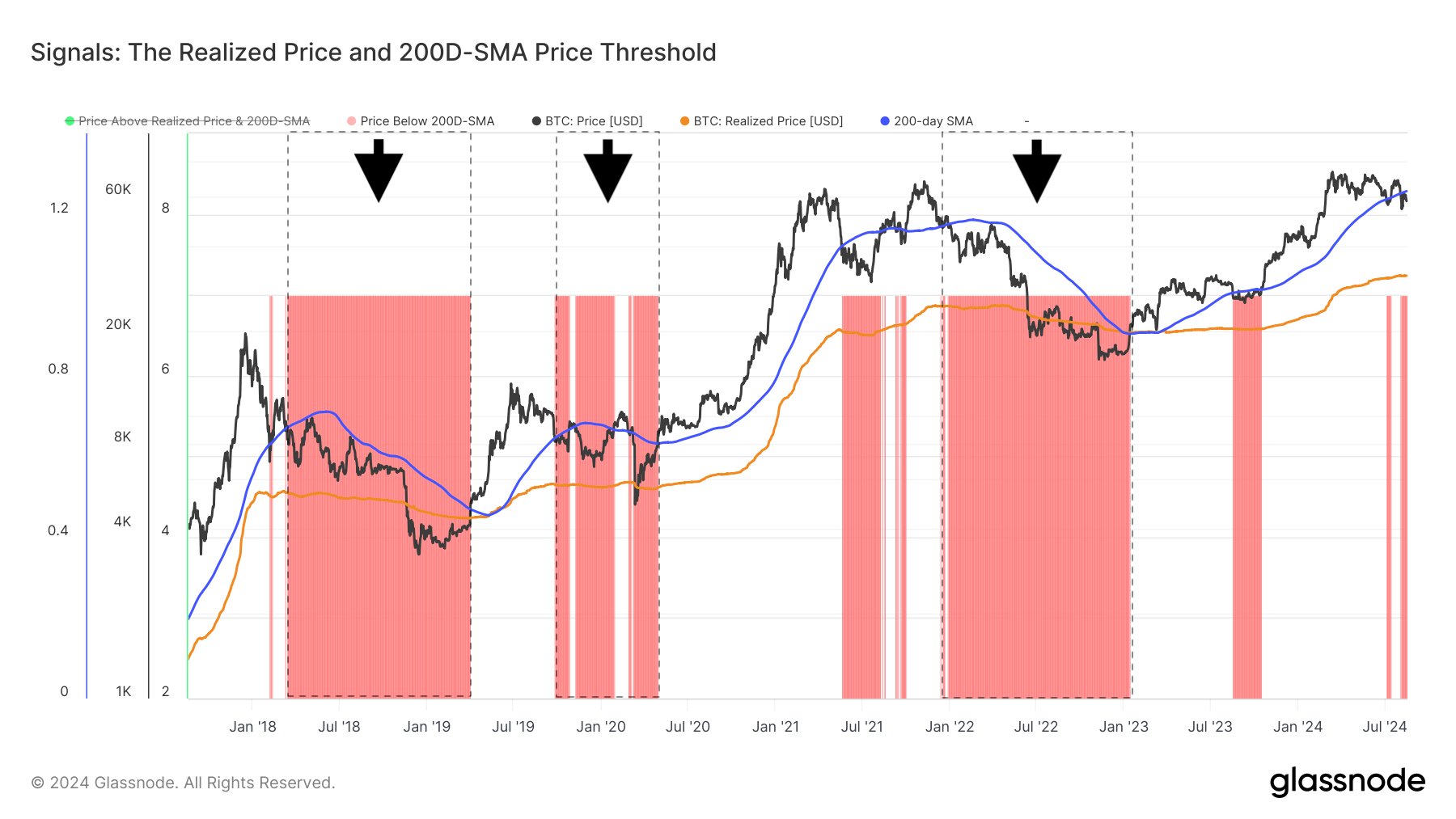

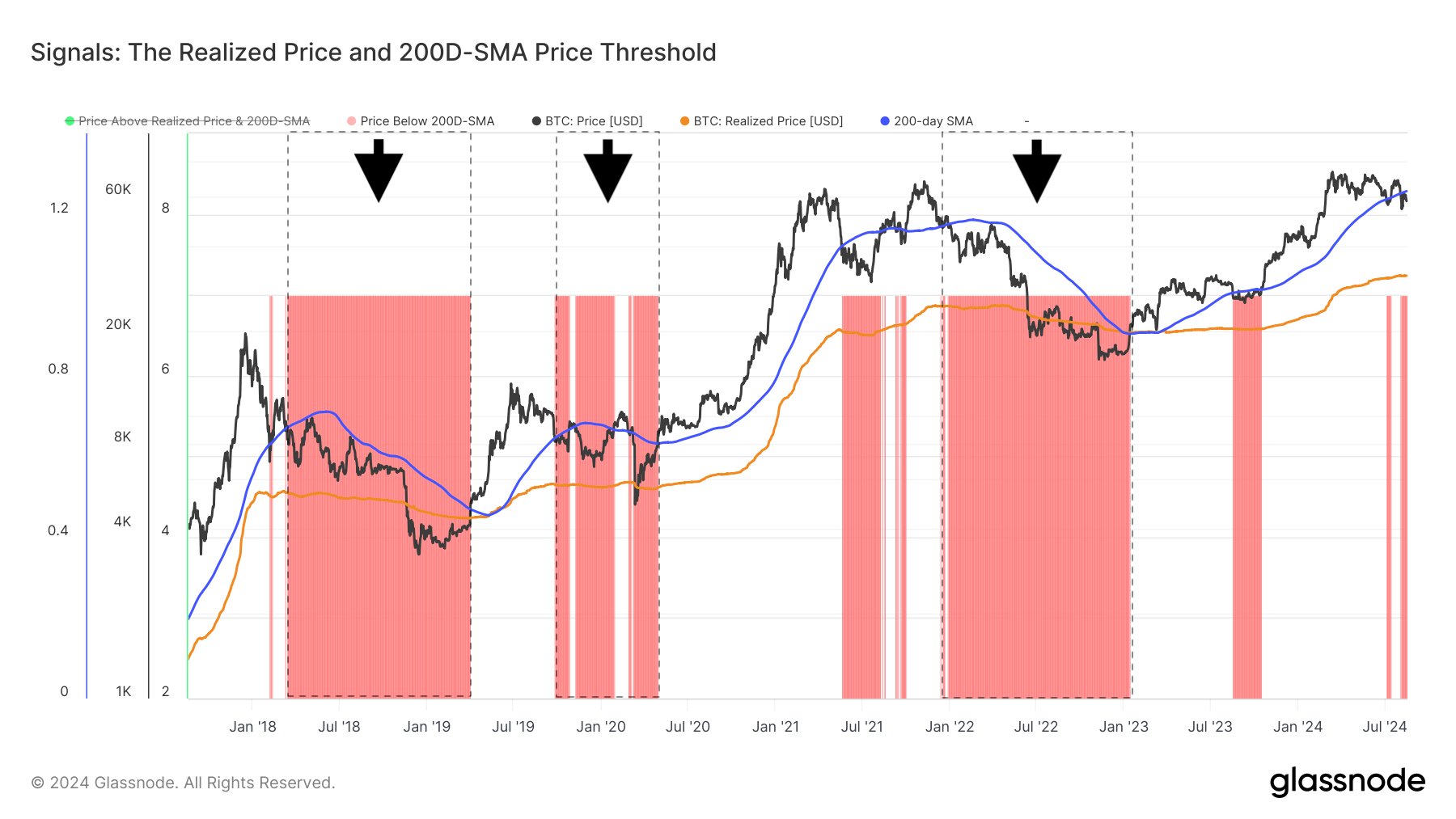

Bitcoin recently fell below the 200-day simple moving average but saw a double bottom, a key indicator of a continuation of long-term trends.

In a bull market, this decline could represent a buying opportunity, indicating a potential recovery.

However, if the Bitcoin price remains below the 200-day simple moving average for an extended period of time, it may indicate the beginning of a bear market.

Source: Glassnode

Despite this risk, analysts believe that Bitcoin is unlikely to enter a long-term bearish phase at this point.

The current situation indicates a temporary decline and not the beginning of a downward phase, with a strong possibility of recovery and continued growth.

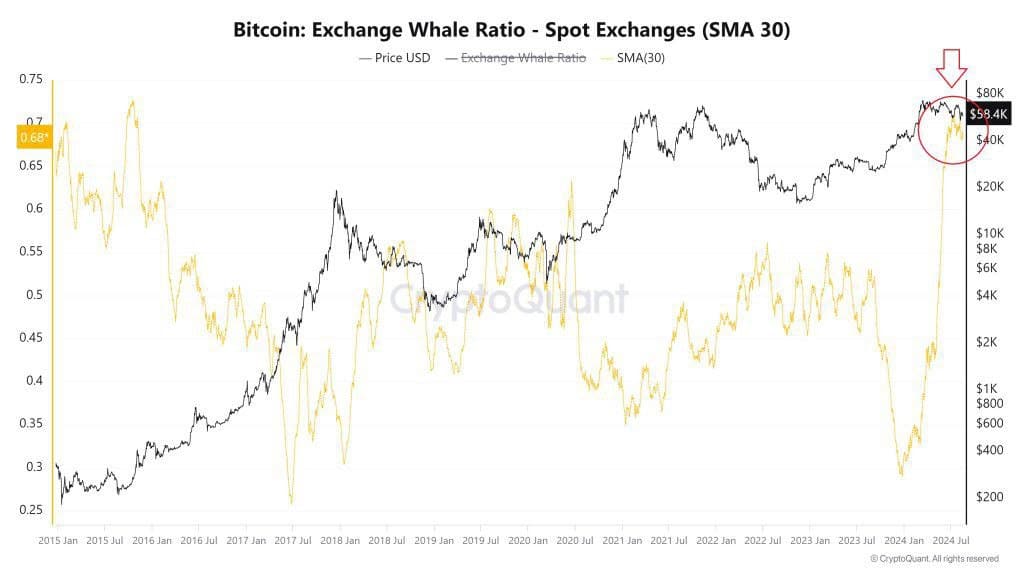

Whales pile in as global liquidity rises

Bitcoin whales are also increasing their holdings, indicating a potential price spike. Analysts point out that large investors and traders buy during periods of low prices, a pattern that often leads to higher prices.

This trend, coupled with recent halving events and increased institutional interest through Bitcoin ETFs, suggests that Bitcoin prices could soon rise.

Source: CryptoQuant

Is Your Investment Portfolio Green? Check Out Our Bitcoin Profit Calculator

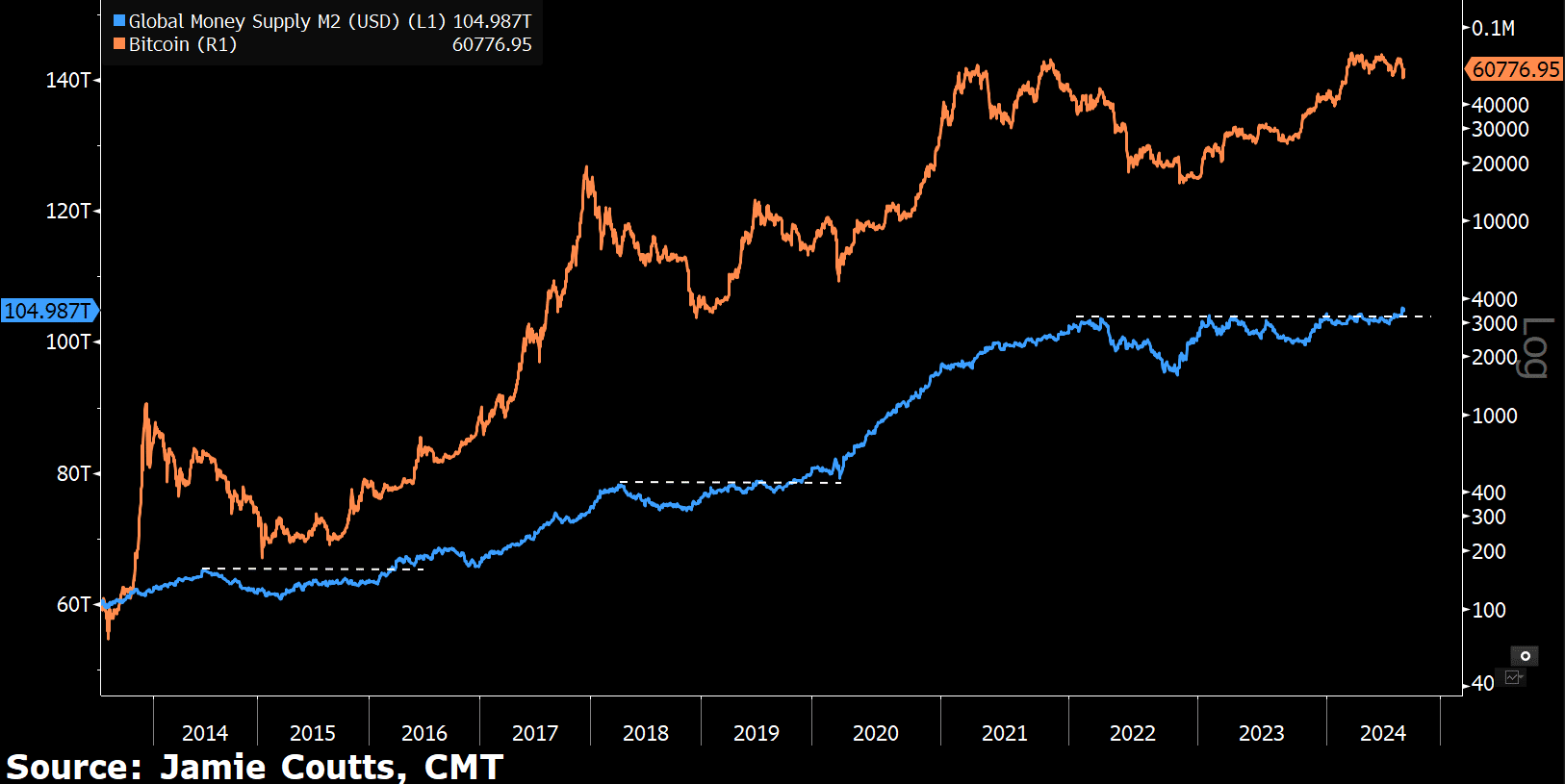

The global money supply has also reached an all-time high, boosting purchasing power and likely driving up the price of Bitcoin.

As more money circulates, buying pressure increases, making Bitcoin a strong long-term investment. The continued increase in the money supply supports Bitcoin’s potential for future gains.

Source: Jamie Coates, CMT

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote