US stocks continued their dramatic rally this week on Friday after that Slowdown in inflation data in the consumer price index caught The densest gathering On Wall Street since early 2020.

S&P 500 Index (^ Salafist Group for Preaching and Combat) rose 0.9%, marking its biggest week of gains since June, while the tech-heavy Nasdaq Composite Index (^ ninth) gained 1.9%. Dow Jones Industrial Average (^ DJI) closed slightly higher, up 0.1%, lagging behind other indicators.

All three major averages jumped on Thursday, each posting their biggest single-day progress since recovering from the pain of the COVID crash more than two years ago. Mega moves were triggered by Lighter consumer price data for October That has fueled bets that the Federal Reserve may stop tightening financial conditions as early as next year. The S&P 500, Dow and Nasdaq are up 5.5% and 3.7%, or 1,200 points, and 7.4%, respectively.

On Thursday, Treasury yields and the US dollar index posted their biggest one-day declines since the global financial crisis more than a decade ago. The bond market was closed for Veterans Day on Friday.

a A reflection on China’s policy on the non-proliferation of the Corona virus To reduce the amount of time travelers spend in quarantine in the country, morale is spent on early trade. Oil markets advanced as traders speculated that the move could boost demand for commodities, with West Texas Intermediate (WTI) futures rebounding nearly 3% to above $88 a barrel.

Meanwhile, on the economic data front, the preliminary reading of the University of Michigan Survey of Consumer Confidence for November fell to 54.7 from. 59.9 in October, the lowest level since July.

“Overall, the report suggests that peak inflation may finally be behind us, although inflation may remain elevated for a while,” head of investment management at BNY Mellon US Macro Sonia Miskin said of the CPI report in a note on Monday. Thursday.

She noted that the figure supports the smaller 0.50% increase for December that was telegraphed at this month’s Federal Open Market Committee meeting, which investors are pricing in.

“However, it is also important not to overemphasize a single report on inflation and the course of policy,” she added.

The Consumer Price Index (CPI) in October rose at an annual rate of 7.7% and increased by 0.4% during the month. on me “essential” basiswhich excludes the volatile food and energy components of the report, prices rose 6.3% year-on-year and 0.3% month-on-month.

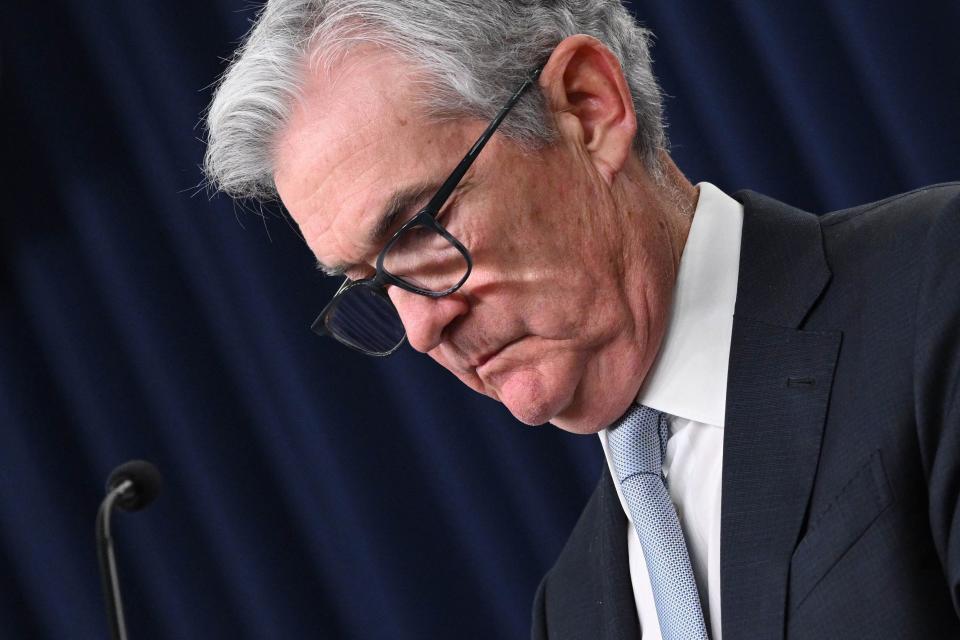

Despite the moderation, many strategists maintain that the excitement with Fed officials is premature Still willing to stress After President Jerome Powell said last month that policymakers stillSome ways to go“on restoring price stability — a message that his colleagues at the central bank have since echoed in a series of public speeches.

Gregory Dako, chief economist at EY Parthenon, said in comments via email: “The Fed’s over-reliance combined with the fact that economic data will only show the labor market in real time and slowing inflation with lag, increases the odds of Excessive accident. .

Meanwhile, DataTrek’s Nicholas Colas points out another fact: Although inflation trends decline once they peak and begin to decline—as we saw in 1970, 1974, 1980, 1990, 2001, and 2008—this downward shift typically comes with Recessions, and there are no exceptions to the rule.

disturbance Continued into the world of coding Such as The FTX disaster unfolds And the company announced on Friday morning that it is Application for bankruptcy. Billionaire Crypto Champion Sam Bankman-Fried Has Also Stepped Down As CEO, Reportedly So Under investigation by the US Securities and Exchange Commission As the stock market seeks a cash bailout. Bitcoin was trading around $16,500 on Friday afternoon.

–

Alexandra Semenova is a reporter for Yahoo Finance. Follow her on Twitter Tweet embed

Click here for the latest trending stock indices for Yahoo Finance

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for apple or Android

Follow Yahoo Finance on TwitterAnd the FacebookAnd the InstagramAnd the FlipboardAnd the LinkedInAnd the Youtube

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote