44 minutes ago

Japanese trading houses rise after Buffett raises stakes

Japanese trading houses jumped at the open on Tuesday after Berkshire Hathaway raised its stake in five Japanese trading companies to more than 8.5% on average.

Mitsui shares jumped 4.55%, Marubeni rose 3.44%, Mitsubishi rose nearly 4%, while Itocho and Sumitomo rose 3% each.

Japan’s top five trading houses saw renewed momentum thanks to Warren Buffett, bucking the trend as Japanese stocks continued to fall for a second day.

The company noted that the total value of these interests exceeds the value of shares owned by Berkshire in any country outside the United States, the company said.

– Jihye Lee, Elliot Smith, Ruxandra Iordach

53 minutes ago

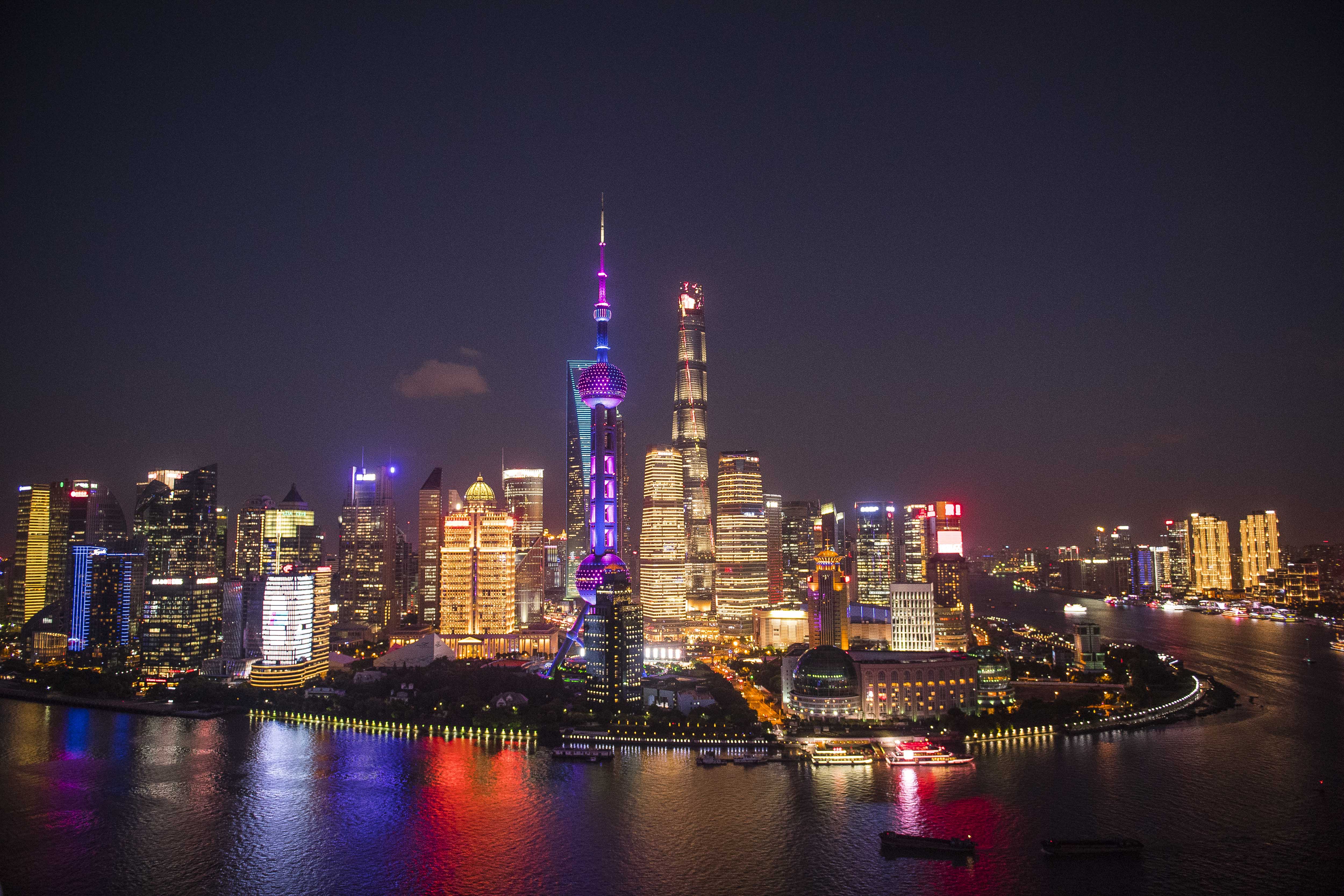

China expected it to cut the initial interest rates for its loans

The People’s Bank of China is expected to cut interest rates on its 1-year and 5-year prime loans later today.

Economists polled by Reuters expect a 10 basis point cut to the one-year base rate and a 15 basis point cut to the 5-year base rate, according to Factset.

China last cut its LPR notes in August 2022. Investors will be watching today’s decision closely after the central bank cut its medium-term lending facility and reverse repo rate for seven days.

– Jihe Lee

one hour ago

CNBC Pro: This automaker could be next in the Tesla charger deal, analyst says

The global auto giant may be the next company to sign a deal with Tesla to use its supercharger stations, according to RBC analyst Tom Narayan.

If the agreement passes, the deal would follow similar partnerships that Tesla has agreed with Ford and General Motors.

Investors have rewarded all parties to the transaction in the past. The day after the agreement, Tesla and Ford shares rose 4.7% and 6.2%, respectively. The automaker’s share prices have risen more than 25% since then.

CNBC Pro subscribers can read more here.

– Ganesh Rao

one hour ago

CNBC Pro: This veteran investor’s money has done better since 2006. Here are his top strategies

Outstanding portfolio manager Jordan Svitanovsky has looked for certain traits in the companies he has selected in the past nearly 20 years.

And the results have proven consistent throughout the global financial crisis, the era of zero interest rates – and now high interest rates.

One fund managed by Pella Funds Management’s Cvetanovski has outperformed its benchmark by a whopping 27% in a four-year period.

CNBC Pro subscribers can read more here.

– Wizen tan

2 hours ago

A strong week – even with a weak Friday ending

The three major averages hit milestones with wins last week, though Friday ended in a slump.

While the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite ended Friday’s session in the red, all three indices were up for the week.

The S&P 500 jumped 2.6% over the week, its strongest weekly performance since March and its fifth consecutive positive week — the first since it ended a streak of similar length in November 2021. The week, it’s the best since March and its eighth consecutive positive week for the first time since It finished its 10-week streak in March 2019.

The Dow Jones also posted modest weekly gains, adding 1.25% and posting its third consecutive positive week since April of this year.

–Darla Mercado, Chris Hayes

2 hours ago

Stock futures open lower

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote