(Bloomberg) — The U.S. commercial real estate market has been in turmoil since the onset of the COVID-19 pandemic. But the New York Bancorp community offered a reminder that some lenders are just starting to see the pain.

Most read from Bloomberg

The bank's decisions to cut its dividend and stock reserves sent its shares down a record 38% and dragged the KBW Regional Banking Index to its worst day since the collapse of the Silicon Valley bank last March. Japanese bank Ozora Bank exacerbated real estate concerns when it warned of a loss associated with investments in American commercial real estate, which led to a decline in its shares in Asian trading.

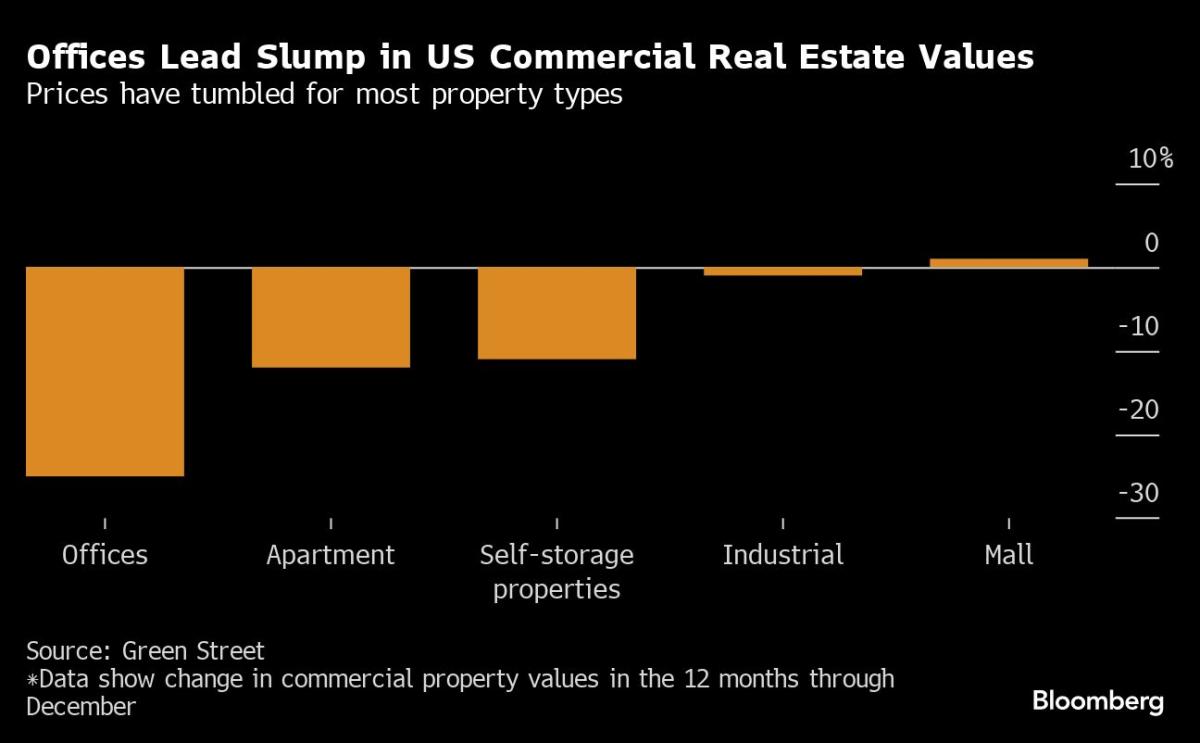

This concern reflects the continuing decline in commercial real estate values coupled with the difficulty of predicting which specific loans may fail. Defining this stage is the pandemic-induced shift to remote work and rapidly rising interest rates, which have made refinancing more expensive for stressed borrowers. Billionaire investor Barry Sternlicht warned this week that the office market is headed toward losses of more than $1 trillion.

For lenders, that means the potential for more defaults, as some landlords struggle to pay loans or simply walk away from buildings.

“This is a huge issue for the market to take into account,” said Harold Bordwin, principal at Keen-Summit Capital Partners LLC in New York, which specializes in renegotiating distressed properties. “Banks’ balance sheets don’t take into account the fact that there is a lot of real estate that will not pay off at maturity.”

Moody's Investors Service said it was reviewing whether to downgrade New York Community Bancorp's credit rating to junk following developments on Wednesday.

Read more: NY Community Bancorp sinks as real estate risks shake up market

Banks face nearly $560 billion in commercial real estate maturities by the end of 2025, according to Tripp, representing more than half of all real estate debt maturing during that period. Regional lenders in particular are more exposed to the industry, and will likely be hurt more than their larger peers because they lack large credit card portfolios or investment banking businesses to insulate them.

Commercial real estate loans represent 28.7% of assets at small banks, compared to just 6.5% at large banks, according to a JPMorgan Chase & Co. report published in April. This exposure has drawn additional scrutiny from regulators, which were already on high alert following last year's regional banking turmoil.

While real estate woes, especially for offices, have been evident in the nearly four years since the pandemic hit, in some ways the real estate market has been in limbo: transactions have declined due to uncertainty among buyers and sellers alike about the value of buildings. Now, the need to address looming debt maturities — and the possibility of the Fed cutting interest rates — is expected to spark more trades that will demonstrate just how low values have become.

These declines may be stark. The Aon Center, the third tallest office tower in Los Angeles, recently sold for $147.8 million, about 45% less than its previous purchase price in 2014.

“Banks — community banks, regional banks — were really slow to mark things to market because they didn't have to, they were holding them to maturity,” Borduin said. “They are manipulating the true value of these assets.”

Multifamily loans

Adding to the tension surrounding small lenders is the unpredictability of when and where defaulted mortgages can occur, with only a few defaults potentially wreaking havoc. New York Community Bancorp said the increase in charging was related to a co-op building and office property.

While offices are a particular area of concern to real estate investors, the company's largest real estate exposure comes from multifamily buildings, where the bank holds about $37 billion in residential loans. Nearly half of these loans are backed by rent-controlled buildings, making them vulnerable to New York State regulations passed in 2019 that strictly limit landlords' ability to raise rents.

At the end of last year, the Federal Deposit Insurance Corporation took a 39% discount when it sold about $15 billion in loans backed by rent-regulated buildings. In another sign of the challenges these buildings face, nearly 4.9% of rent-stabilized buildings in New York City that carry securitized loans were in delinquency as of December, three times the rate of other residential buildings, according to To analyze Tripp based on when properties went bankrupt. building.

“Conservative Lender”

New York Community Bancorp, which acquired part of Signature Bank last year, said Wednesday that 8.3% of its residential loans are considered in default, meaning they are at high risk of default.

“The Central Bank of New York has been a more conservative lender compared to Signature Bank,” said David Aviram, principal at Maverick Real Estate Partners. “However, because loans secured by rent-stabilized multifamily properties make up a larger percentage of New York Commercial Bank’s lease book than their counterparts, the 2019 change in rent laws may have a more significant impact.”

Pressure is increasing on banks to reduce their exposure to commercial real estate. While some banks halted senior loan sales due to uncertainty over the past year, they are expected to market more debt now that the market is thawing.

Canadian Imperial Bank of Commerce recently began marketing loans on distressed office properties in the United States. While US office loans make up just 1% of the total asset portfolio, CIBC's profits have declined due to higher provisions for credit losses in this sector.

“The proportion of loans that banks have reported so far as delinquent is a drop in the bucket compared to the defaults that will occur during 2024 and 2025,” Aviram said. “Banks are still exposed to these significant risks, and a potential drop in interest rates next year will not solve the banks’ problems.”

–With assistance from Sally Bakewell.

(Updates on Aozora Bank's real estate warning in second paragraph)

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote