- Maker stock rose 8.93% in 24 hours after a week of gains.

- Market sentiment and key technical indicators point to an uptrend

MakerDAO’s MKR has been bullish for the past seven days. It has increased by 4.80% over the past week while recording an increase of 8.93% over the past 24 hours.

At press time, Maker was trading at $2,414.47 on a 24-hour trading volume of $109 million. MKR was also 61% above ATH while posting a rally that pushed current prices to 11,475% above its lows.

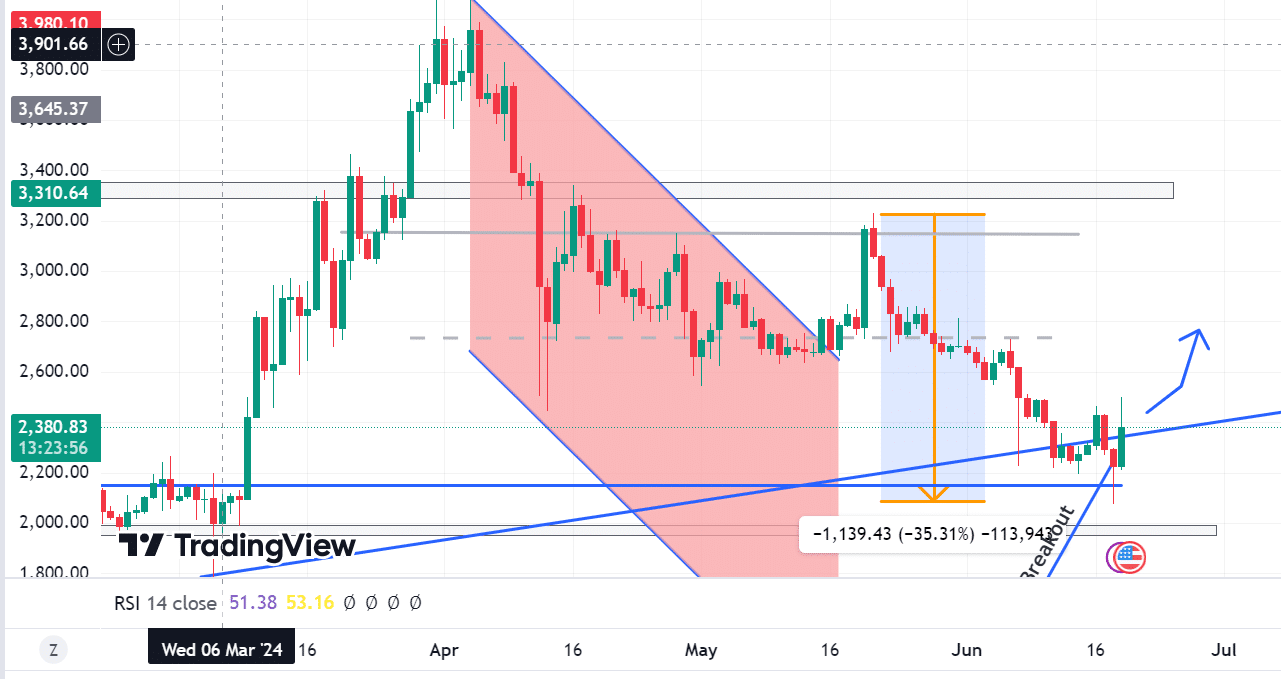

Source: TradingView

AMBCrypto analysis indicates that MRK’s momentum is bullish as it attempts to challenge the nearest resistance level around $2,729. If it breaks this level, it will target $3145 for the next level.

The current support level is around $2,150, with the low at around $1,945. With indications that the $2,150 support level is being respected, MKR aims to challenge the $2,745 level.

MKR will launch with just 2.7% change and aim for further gains.

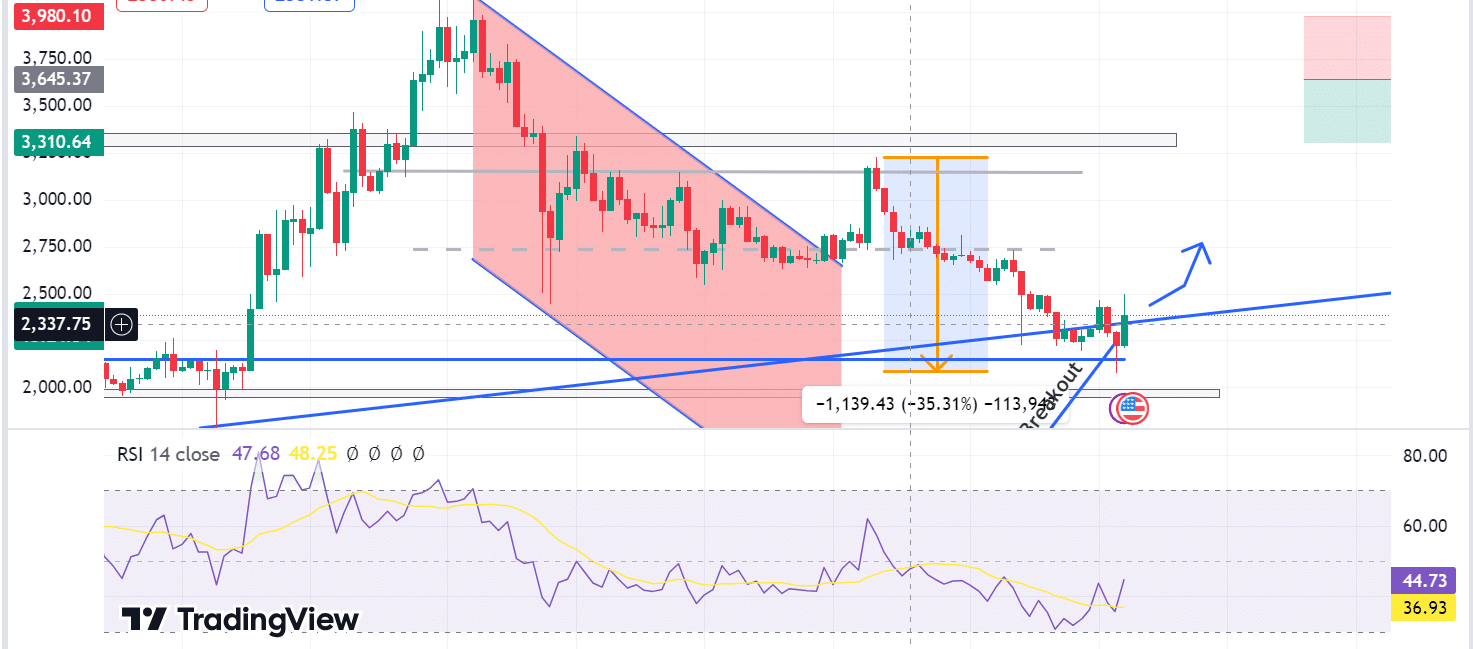

Source: TradingView

Moreover, the RSI indicates strong upward momentum over the past seven days. The RSI at 44.68 lies above the RSI-based moving average of 36.93.

When the RSI is above its moving average, it indicates a bullish signal. Typically, current gains outweigh losses, indicating upward momentum.

Thus, with the RSI at 46, the Maker shows opportunities for a long trade, anticipating further price gains.

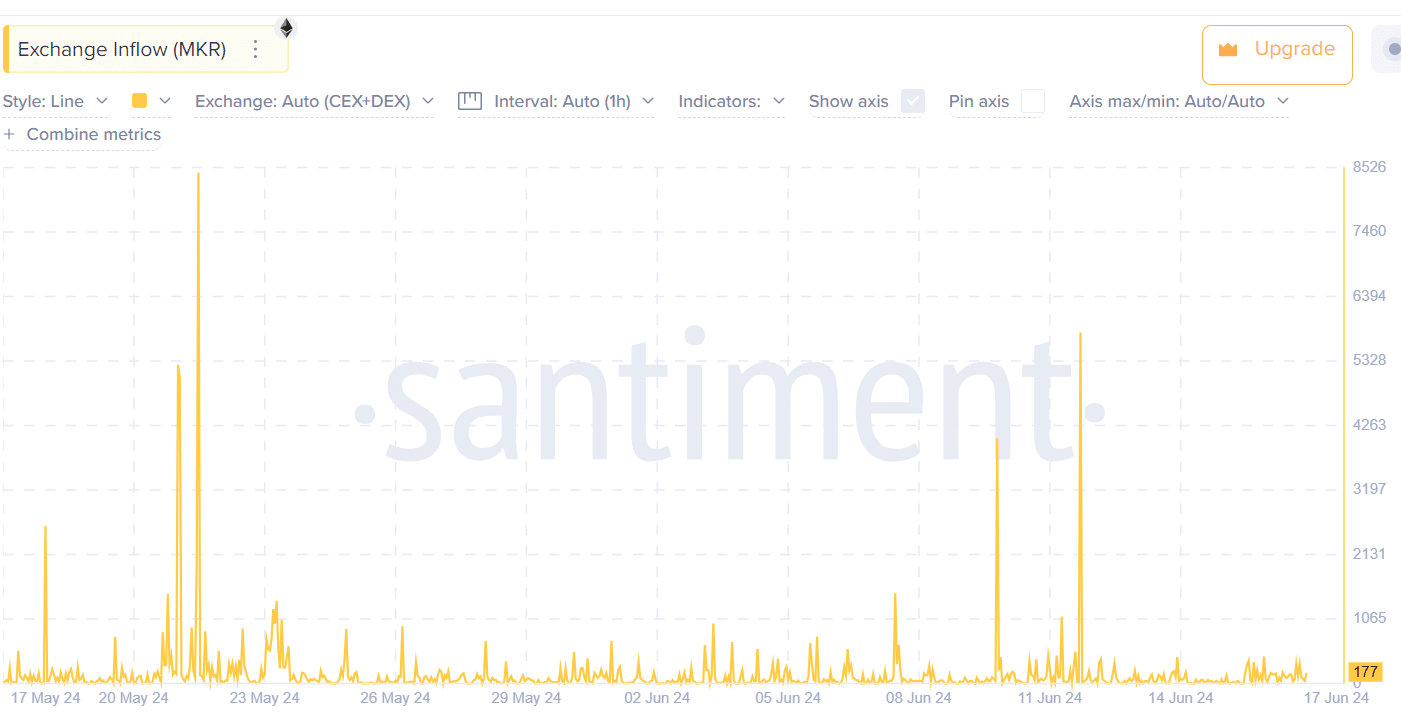

Additionally, according to Santiment, MKR exchange flow has seen a decline over the past week. Exchange flow fell from a high of 5,799 on June 12 to a low of 177 on June 17.

Source: Santiment

In general, higher exchange flow means that users are preparing to trade their assets, resulting in higher selling pressure. High selling pressure pushes prices down.

Thus, the lower exchange flow reported by MKR indicates fewer assets are available, which reduces selling pressure and leads to higher prices.

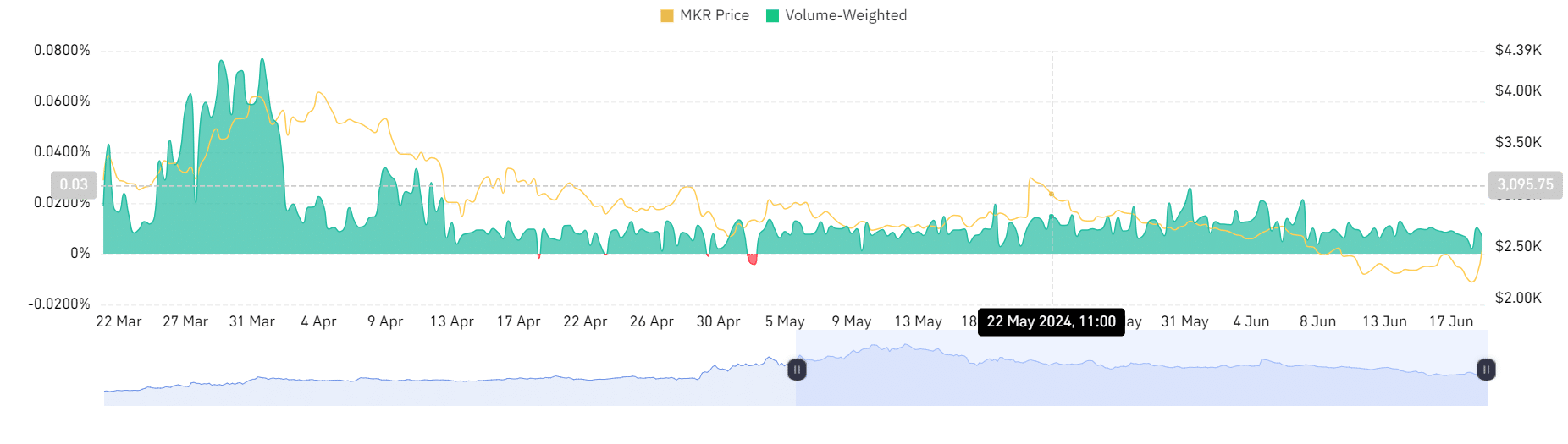

Interestingly, according to Coinglass, MKR reported a balanced funding rate in terms of volume.

Source: Coinglas

The financing rate is neutral and positive. This means that long and short positions are balanced and the market enjoys stability without bearish or bullish dominance.

Realistic or not, this is the market cap of MKR in terms of BTC

Will MKR’s recent boom hold up?

In the past seven days, MKR has seen significant gains. Major indicators are pointing to bullish momentum after holding support at $2,150.

With a breakout from the downtrend imminent, MKR aims to challenge the resistance level around $2,729. Likewise, market sentiment is bullish, with the RSI rising and stock market flow falling.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote