- MANTRA, MultiversX, and Notcoin were the biggest winners last week.

- ORDI, Pendle and Fantom ended last week as the biggest losers.

Mantra dominated the gainers’ list over the past week, leading the market with a strong performance. In contrast, Pendle struggled, remaining on the losers’ list for the second week in a row.

Biggest Winners

Mantra (Om)

In a week marked by general declines in the cryptocurrency market, MANTRA (OM) stood out with notable gains.

according to Coin Market CapOM stock is up 25.05% over the past week, maintaining its position as the top gainer. Price action analysis reveals that OM stock started the week at around $0.7 and gained momentum as the week progressed.

Despite experiencing some declines that temporarily pushed its price below the starting point of the week, it closed the week trading above $0.8.

As the new week begins, OM continues its upward trajectory, trading at around $0.9. Its market cap has also increased significantly, currently standing at over $765 million, marking an 8% increase in the last 24 hours.

However, its trading volume has dropped by more than 20%, now standing at around 32.3 million.

Multiverse X (EGLD)

MultiversX (EGLD) ended the week as the second-biggest gainer in the market, with data from CoinMarketCap indicating a 20.66% increase by the end of the week.

An analysis of its price trend revealed that EGLD started the week at around $28.8 and closed near $35 despite some volatility. Overall, the asset showed more uptrends than downtrends throughout the week.

EGLD’s price movements have been marked by sharp spikes, a prominent feature of its weekly trading pattern. At the time of writing, the stock was trading at around $34.1.

EGLD’s market cap has risen to over $927 million, up 2% in the past 24 hours. However, it is important to note that trading volume has dropped significantly, falling by around 50%, now standing at around $34 million.

Notcoin (NOT)

Notcoin (NOT) marked a major turnaround on the weekly gainers chart, following MultiversX as the next cryptocurrency in line but with single-digit gains initially.

Analysis of the NOT price chart revealed that it started the week up by around 6%, trading at around $0.014. However, it faced a series of declines in the subsequent trading sessions, culminating in a drop of over 9% by July 5. At the end of that trading session, its price was around $0.010.

Despite these setbacks, a massive rally at the end of the week turned things around dramatically. NOT surged 28.61%, pushing it back into the winners’ chart and closing the week at around $0.013.

Source: TradingView

At the time of writing, NOT is trading at around $0.014, an additional increase of over 15%. This recovery is accompanied by a significant increase in trading activity, with trading volume increasing by over 150% in the last 24 hours to over 877 million.

Moreover, its market cap has increased by more than 44%, reaching more than $1.5 billion, making it the only asset among the top three gainers with a market cap in the $1 billion range.

Biggest loser

Urdu (Urdu)

ORDI (ORDI) saw a huge drop last week, topping the losers list with a 23.26% drop, according to Coin Market Cap.

The data revealed that ORDI stock started the week at $38, but has been trending steadily lower since then. The most dramatic drop occurred around July 5, when its price fell from around $32 to around $27.

Despite a slight recovery later in the week, Ord’s stock closed at $30.7, not enough to lift it out of the red. As of writing, the stock is trading in the $30 range.

ORDI’s market cap is up slightly over 4% to over $630 million, indicating some level of buying interest despite the recent price decline.

However, trading volume dropped significantly by more than 28% to around $124.3 million.

Bendel (Bendel)

Pendle (PENDLE) continues to struggle in the market, recording its second consecutive week of heavy losses. Down 22.45%, it was the second biggest loser of the week.

Data shows that PENDLE started the week at around $5 and initially tried to make some minor gains.

However, it soon succumbed to the downtrend and remained in decline throughout the week, eventually closing at around $4.

As the new week began, the price of PENDLE dropped to around $3.8.

Despite this continued price decline, there has been a somewhat unexpected development in its market valuation; the market cap has increased slightly, now exceeding $592 million, showing an increase of more than 1% in the last 24 hours.

PENDLE stock has a trading volume of around $65 million, which is down about 10%.

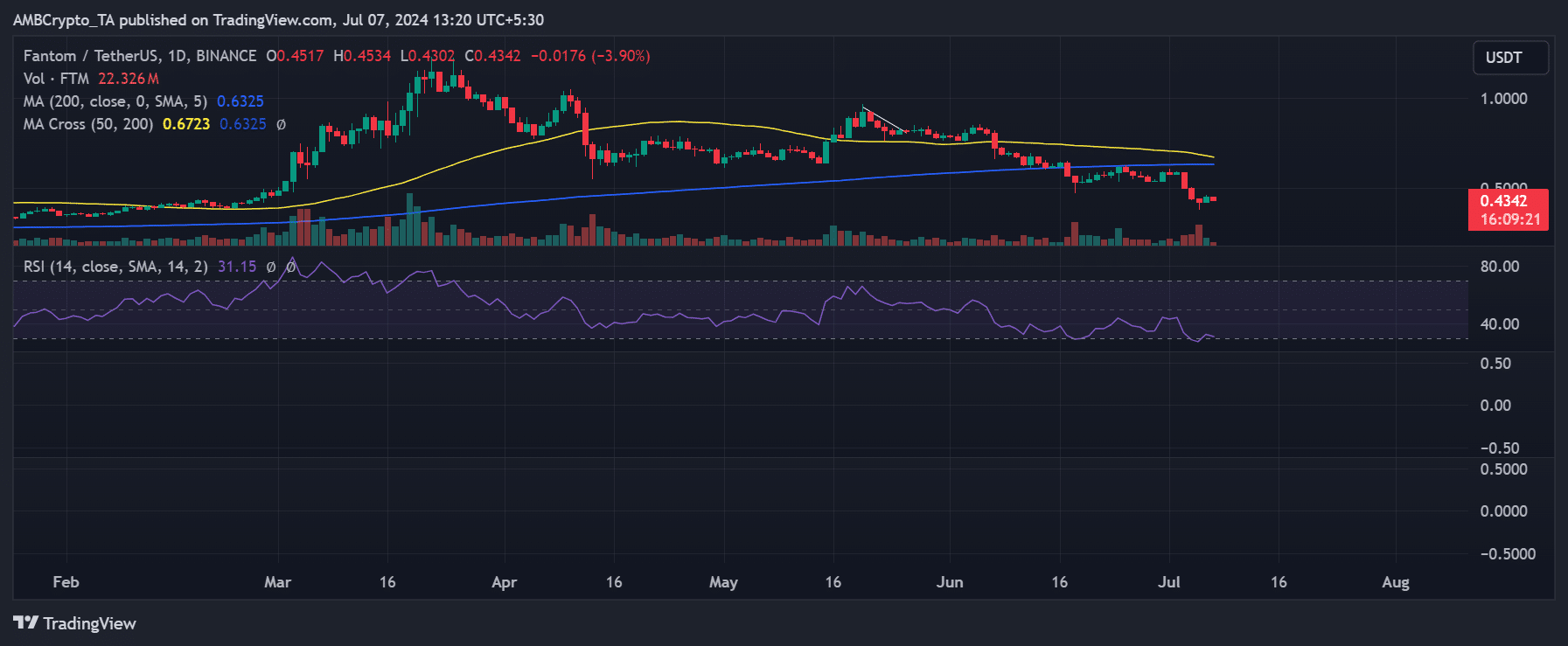

Phantom (FTM)

Analysis of the Phantom (FTM) stock on the daily time frame indicated that it started last week on a positive note, trading at around $0.58, up 8.80%.

However, the asset faced major setbacks on July 3 and 4, seeing declines of 14.71% and 11.53% respectively, bringing its price down to around $0.44.

By the end of the week, FTM managed to stage a modest recovery with a 6.41% increase, pushing its price to around $0.45. However, more was needed to recoup earlier losses.

Source: TradingView

According to CoinMarketCap, these moves led Fantom to end the week as the third-biggest loser, down 20.95% overall.

Its market value reached about $1.2 billion, reflecting a decrease in its value, and trading volume also decreased, reaching about $118.6 million, indicating a decrease in trading activity.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote