- SAND breaking out of the falling wedge pattern indicates an 80% price rally if it crosses the 100-day moving average.

- The bullish momentum is supported by increasing active addresses, lower exchange reserves, and short liquidations.

the sand box [SAND] The price confirmed its breakout from the falling wedge pattern, sparking expectations of a major upward price movement. With key targets set at $0.31 and $0.40, analysts are closely watching the 100-day moving average.

A break above this critical level could send prices up 80%. Will SAND stock sustain this momentum and ignite a long-term bull run?

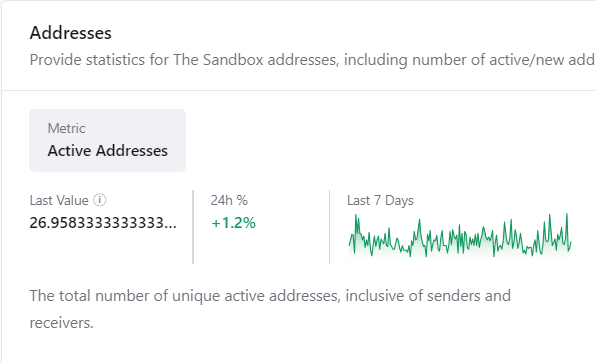

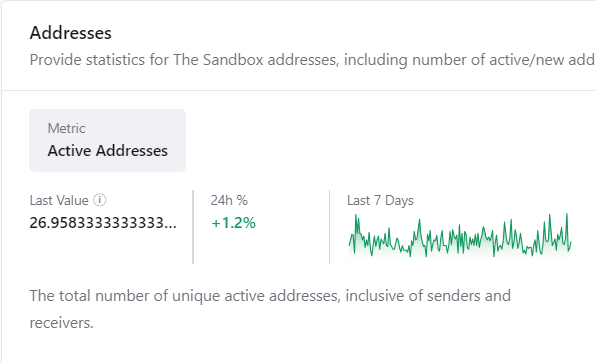

How do transactions and active addresses work?

One of the key indicators of market activity is the number of unique active addresses. At the time of writing, the number of active addresses on SAND stood at 26.96, reflecting a 1.2% increase over the past 24 hours.

Source: CryptoQuant

Additionally, the transaction volume supports this positive momentum, showing a 1.37% increase to 529 transactions, according to CryptoQuant data.

This steady increase in activity indicates that more users are interacting with the network, which could build the foundation for the expected price increase.

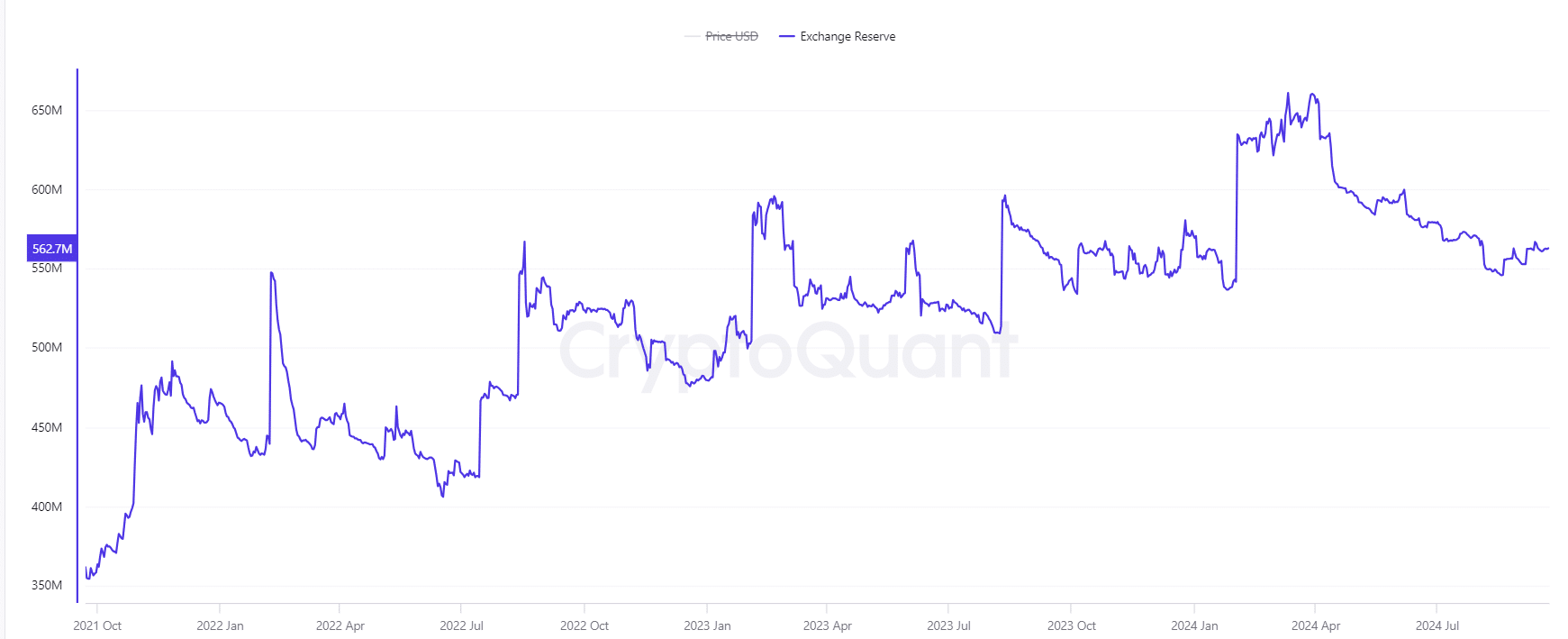

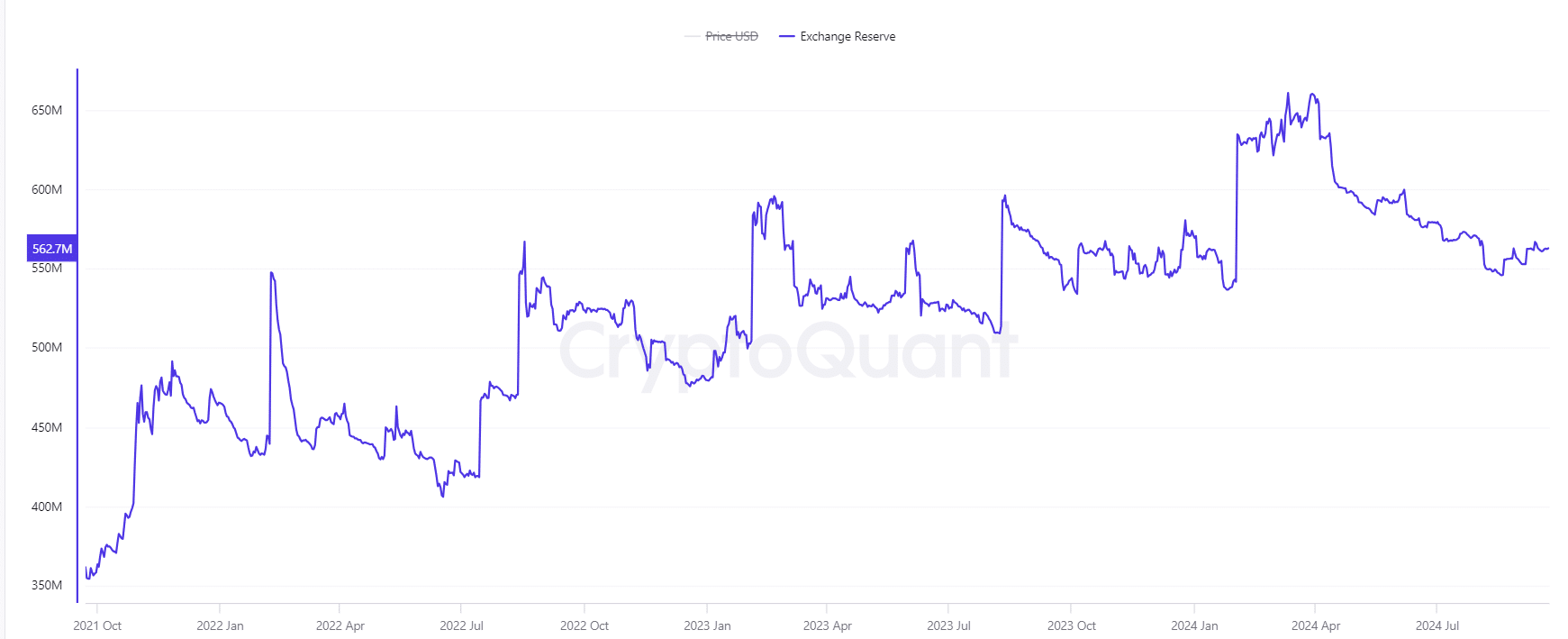

Foreign exchange reserve analysis: what does it mean?

SAND’s exchange reserve currently stands at 562.76 million tokens. The slight 0.02% decline indicates a decrease in selling pressure.

In general, a lower exchange reserve indicates that there are fewer tokens available for sale, indicating that investors are holding onto their assets in anticipation of higher prices.

Hence, this is in line with the bullish breakout pattern observed on the daily chart, which reinforces the possibility of an upcoming rally.

Source: CryptoQuant

Sand Filtering: Can Bulls Take Over?

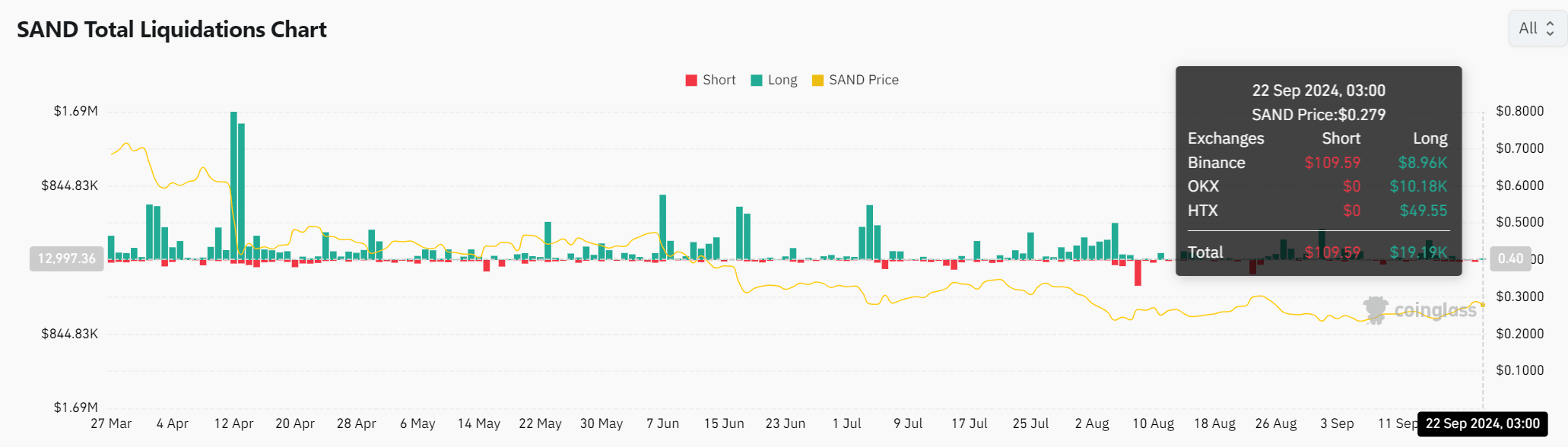

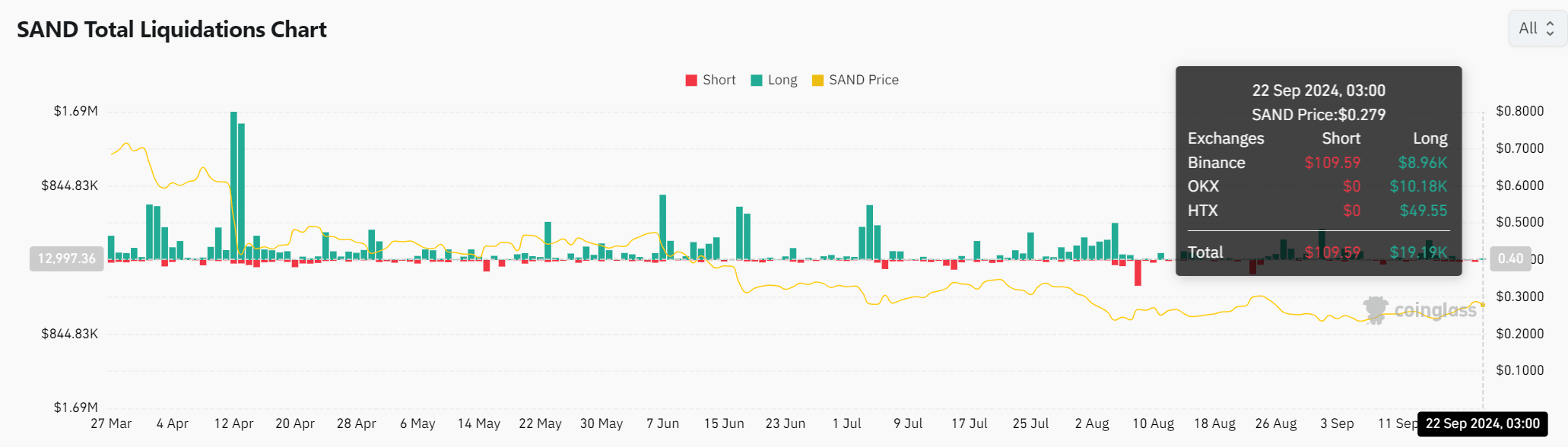

Liquidation data provides a clear picture of the pressures the market is under. The latest figures reveal $109.59K of short positions liquidated, compared to just $19.19K of long positions.

This imbalance indicates that traders who bet against SAND face losses as the asset strengthens.

With the price hovering around $0.279 at the time of publishing, this liquidation trend could pave the way for further bullish momentum, which could push SAND to test the $0.31 target and beyond.

Source: Coinglass

Whether it’s real or not, here’s the market cap of SAND in terms of BTC

Will SAND be able to maintain its momentum?

With rising trading volumes, increasing active addresses, and declining exchange reserves, the SAND market structure appears well-positioned for a sustained upward move. Liquidation data reinforces the bullish scenario, as short positions continue to shrink.

A break of the 100-day moving average could put SAND firmly on a path for significant gains, targeting short-term targets at $0.31 and $0.40.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Bank of Japan decision, China PMI, Samsung earnings

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’