- Saylor plans to make MicroStrategy a bitcoin bank.

- MSTR rushed and hit ATH after the reveal.

MicroStrategy’s MSTR Stock Reaches ATH (All-Time High) After Revealing Its Ultimate Goal of Becoming $1 Trillion Bitcoin [BTC] Bank.

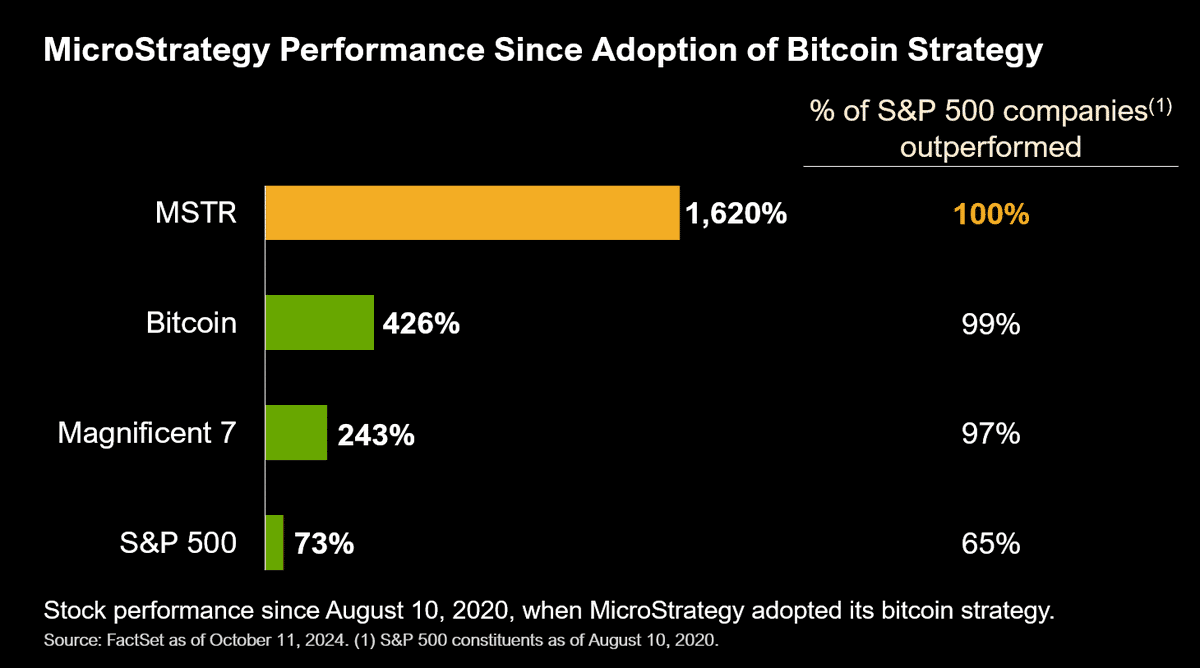

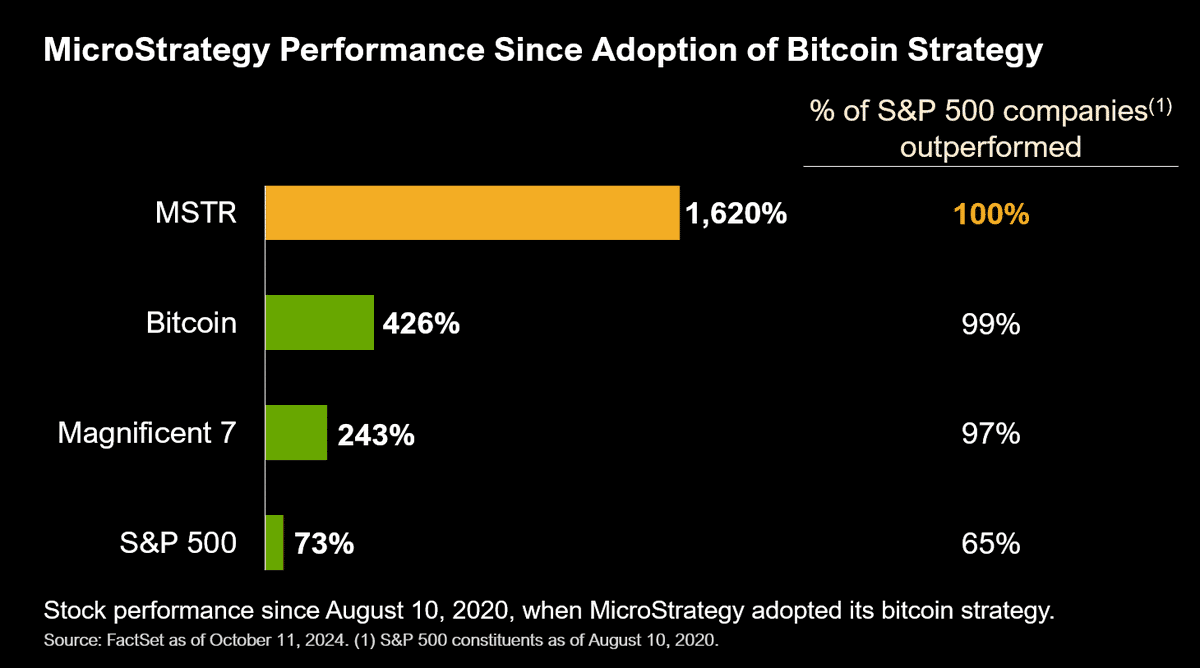

MicroStrategy founder Michael Saylor told Bernstein analysts that his company is eyeing a trillion-dollar valuation as the largest BTC bank.

This may be supported in part by the strong accumulation of the world’s largest assets, with analysts predicting a price target of $290 per share.

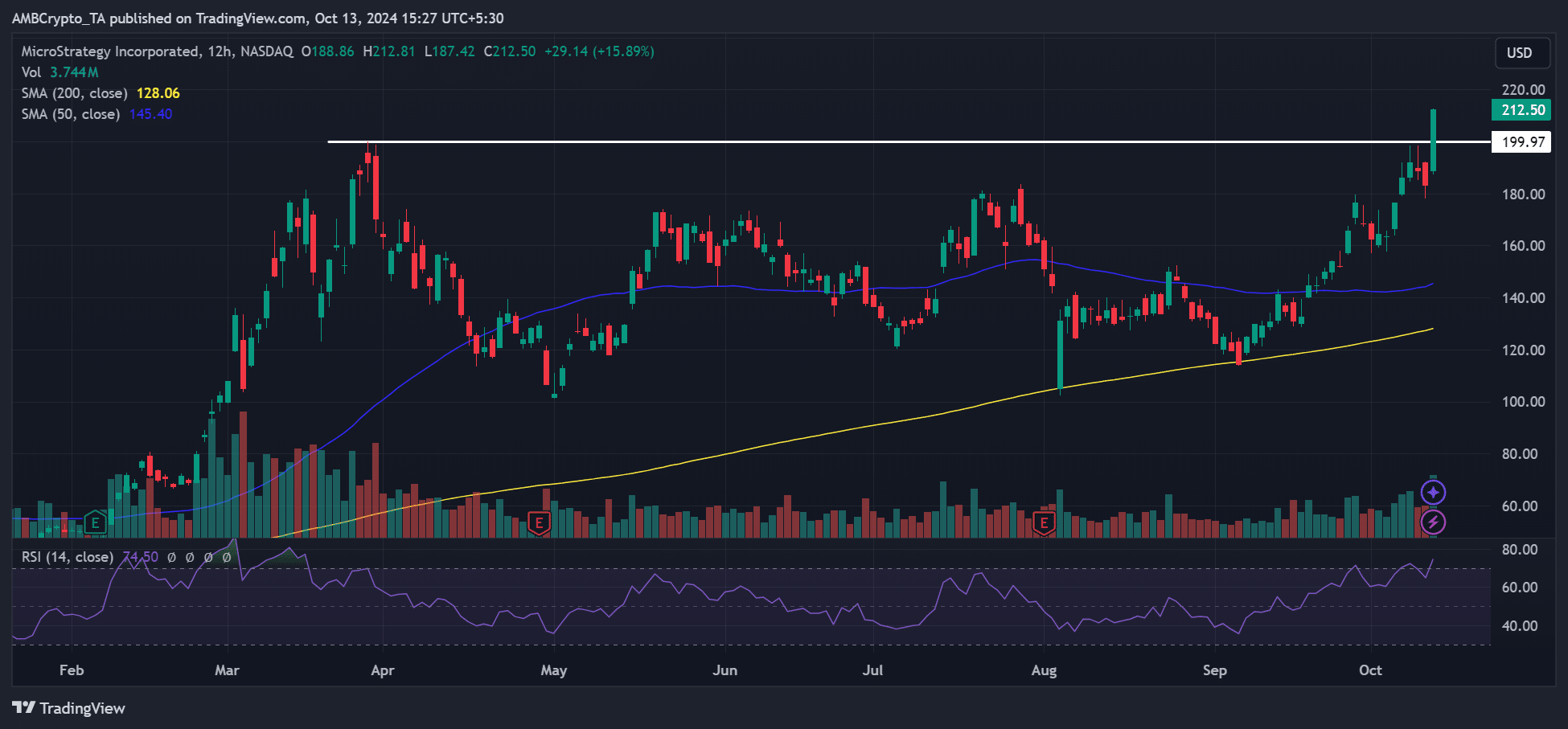

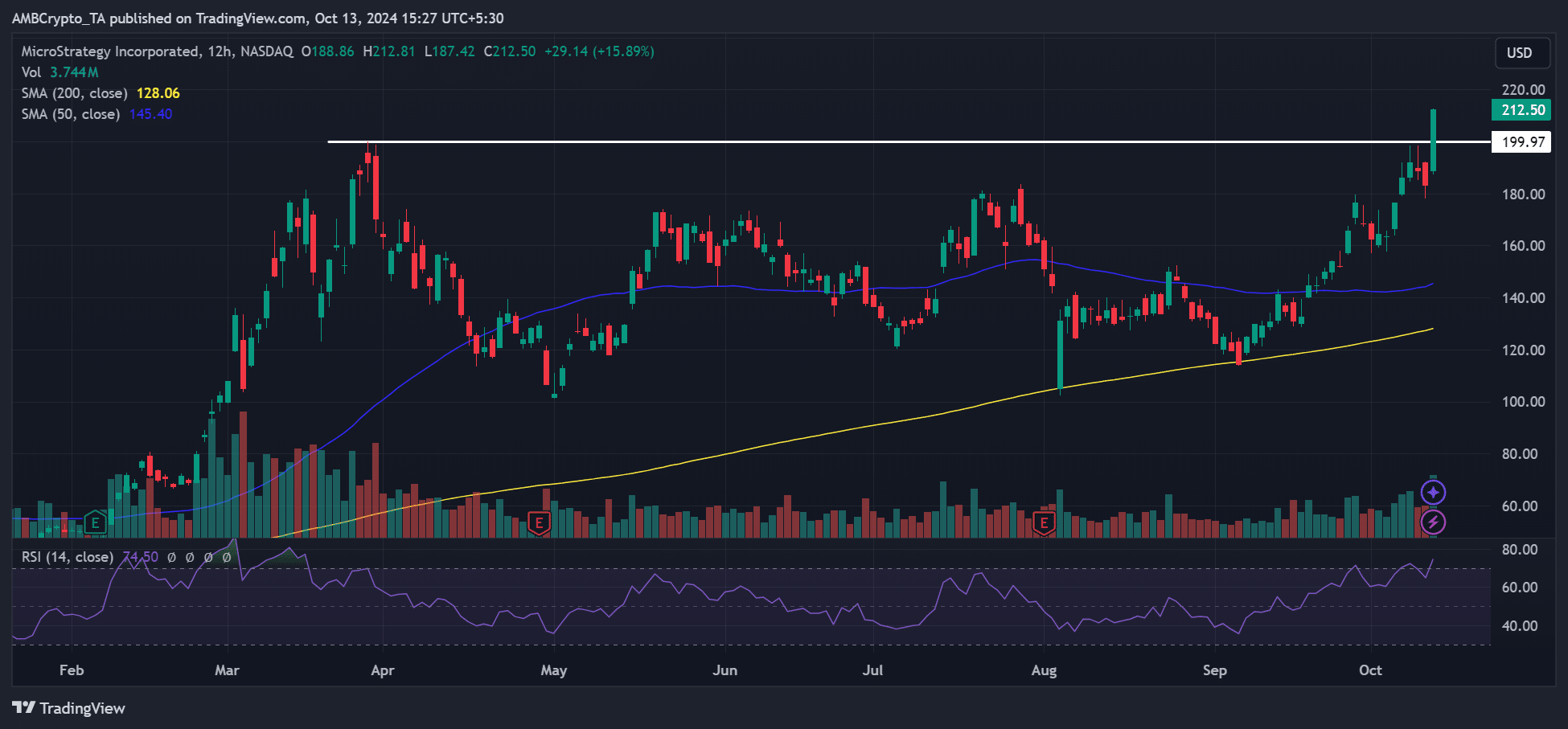

Source: MSTR, TradingView

After the update, MSTR rose to a record high of $212.50, an increase of 15%, during the intraday trading session on October 11. It even broke the $200 resistance level.

Bitcoin bank endgame

In response to the MSTR rally, Saylor male The only thing that performs better than BTC is more BTC.

“The only thing better than #Bitcoin is more Bitcoin.”

Source: X

At the time of writing, MicroStrategy owned 252,220 Bitcoin, worth approximately $15.8 billion USD per day. Data Of Bitcoin Treasuries. In most interviews, Saylor never mentioned whether the company would sell its Bitcoin stock or what its ultimate goal would be.

But the endgame became clear last week.

So, what is a Bitcoin bank?

According to Saylor, BTC Bank They will operate like other asset classes and have financial entities built around them. Bernstein’s report reads in part:

“Michael believes MSTR is in the core business of creating capital market instruments for Bitcoin across equities, convertibles, fixed income, preferred shares, etc.”

Saylor had previously Expected That BTC could reach $3 million – $49 million by 2045 as assets expand as part of global capital.

Thus, the executive predicted that making money from creating Bitcoin-based financial instruments such as bonds or stocks would be easier than lending out coins held by MicroStrategy.

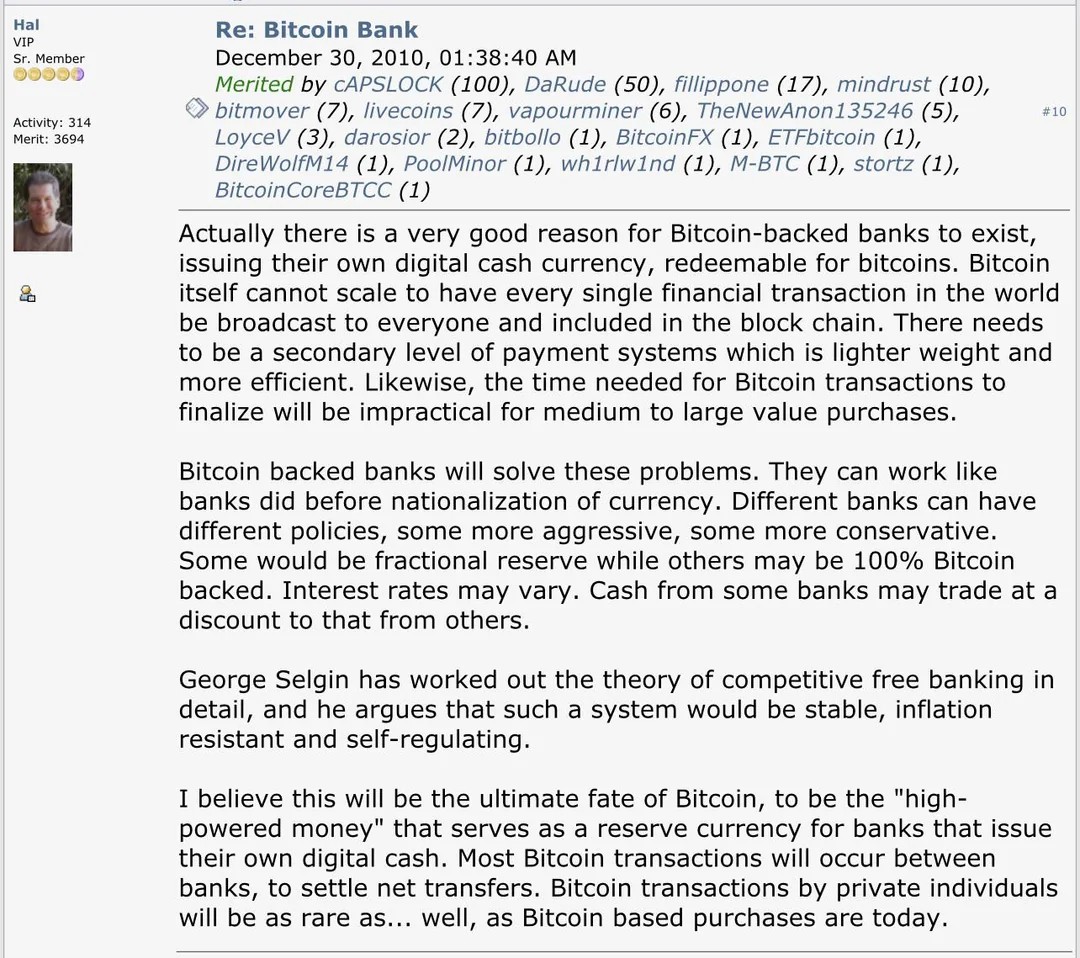

Interestingly, Hal Finney, one of the early contributors to the BTC network, I posed Similar idea in 2010.

Source: X

But some have called for advanced self-protection technology to ensure such a system remains honest.

However, some market experts predicted a strong rise in Bitcoin as a positive catalyst for the MSTR value.

According to the financial advisor Ben FranklinDepending on MicroStrategy’s financial health and the rise in BTC value, the value of MSTR could grow by 6x-10x.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote