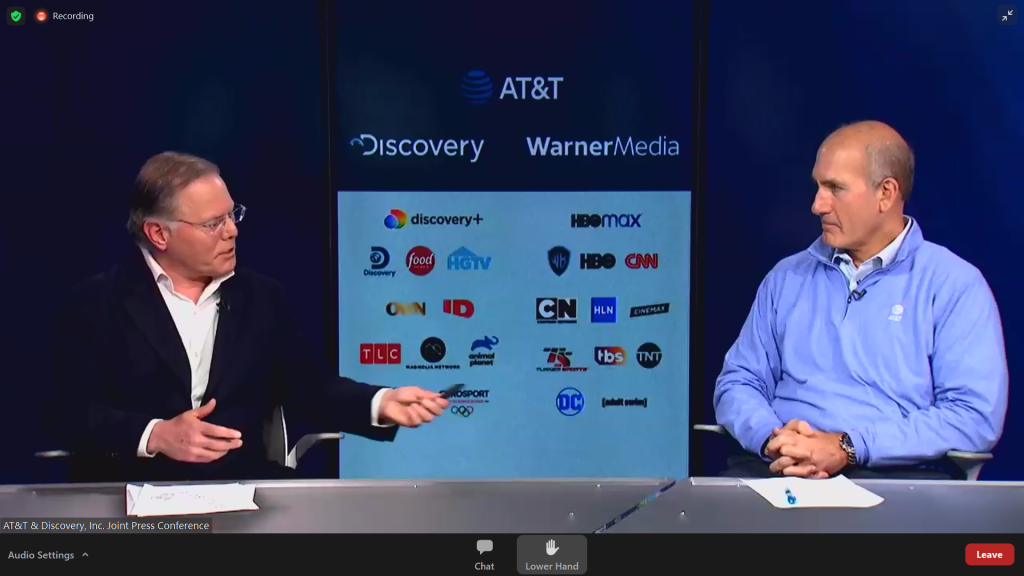

AT&T He has confirmed more details about his sub-show of Warner Mediawhich is preparing to merge with Discovery in a $43 billion merger.

In an SEC filing, the telecom giant said it will issue a special dividend to its shareholders on April 5. For every share of AT&T common stock, stockholders will receive 0.24 shares of Warner Bros Discovery.

AT&T stock will begin trading in two directions on April 4, with shareholders having the option to buy or sell AT&T shares with or without WBD shares.

Shareholders will also receive a quarterly dividend of less than 28 cents per share of AT&T stock, which is a portion of the company’s $1.11 annual dividend after the offering closes. Because the unusually large number of individual investors, rather than institutions, that own its stock, AT&T’s dividend is a closely watched commitment on its balance sheet. Dividends are paid on May 2 to shareholders of record as of April 14.

The quarterly dividend is in line with the company’s previous guidance.

Regulators and shareholders have signed off on the WarnerMedia-Discovery deal, leaving only final paperwork to be completed before the deal goes into effect. An exact closing date has not been set in today’s filing, but it is expected to come in the next week or two. Discovery CEO David Zaslav is set to run the combined entity as CEO. The merger will punctuate AT&T’s exit from media and entertainment. The company had previously spun off DirecTV into a new entity that is 30% owned by private equity firm TPG. The acquisition of Time Warner and DirecTV resulted in losses estimated at tens of billions of dollars.

AT&T and Discovery proposed the merger last May, surprising Wall Street after several weeks of backdoor negotiations.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote