- Increased calls to sell BTC could fuel a further rally towards $68,600

- An important metric revealed that the currency has not yet reached the peak of this cycle

In an interesting turn of events, Bitcoin emerged [BTC] The drop below $63,400 has generated a lot of fear, uncertainty and doubt [FUD] In the market. This assertion can be supported by looking at trader sentiment over the past 12 to 24 hours.

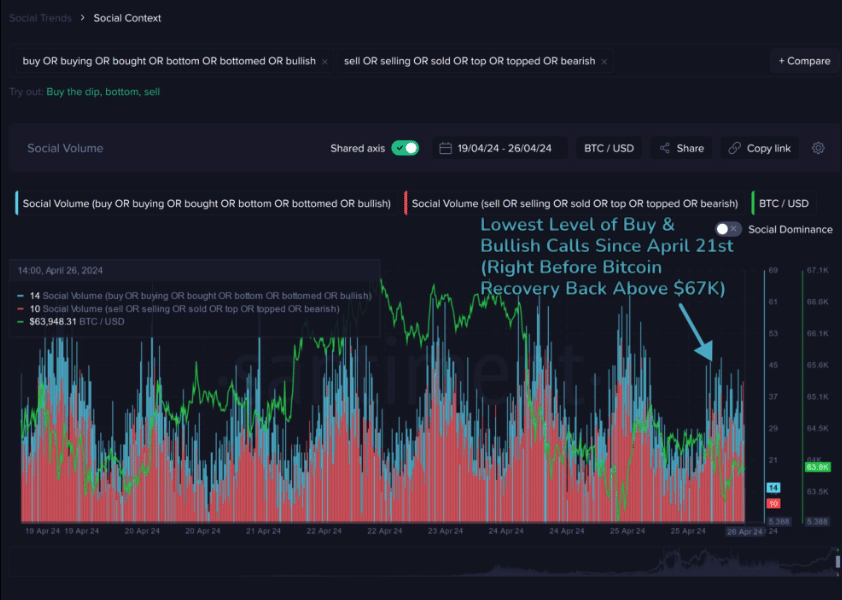

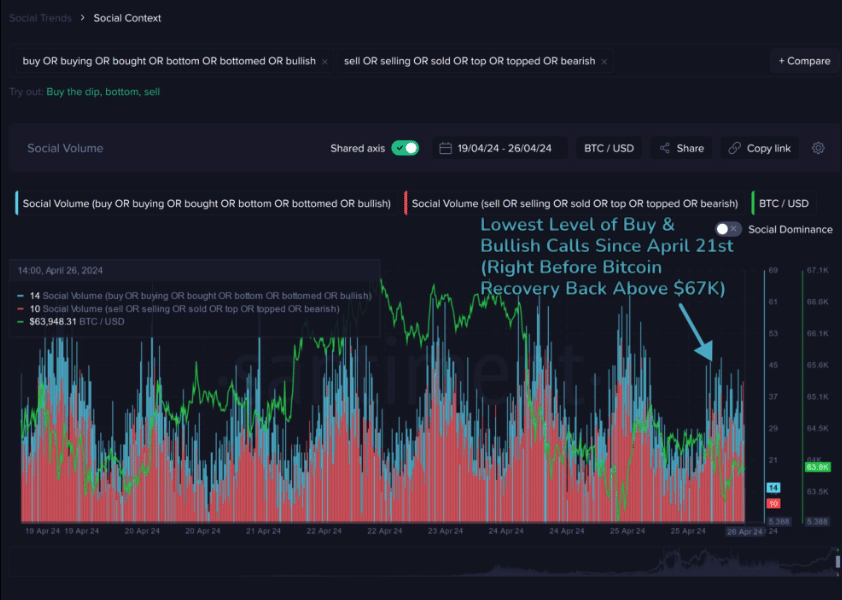

Using Santiment's on-chain social tool, AMBCrypto noticed that calls to sell were much more than just cries of “buy the dip.” A few weeks ago, this was not the case. This is because any slight decline in the price of the cryptocurrency triggered a wave of bullish calls at that time.

Is fear the source of strength for hiking?

However, this situation is not all bad for Bitcoin, as a peak in FUD could lead to a bounce on the charts. In fact, something similar happened recently, on April 21.

On that day, Bitcoin's value plummeted and fell to $64,531, with many traders seeing that a further decline was imminent. But contrary to those expectations, Bitcoin swung upwards and reached $67,169.

Source: Santiment

With that being said, it's possible we could see a repeat of this situation if the Bears continue to share their sentiments publicly. However, it is also important to look at the potential through the PoV metric.

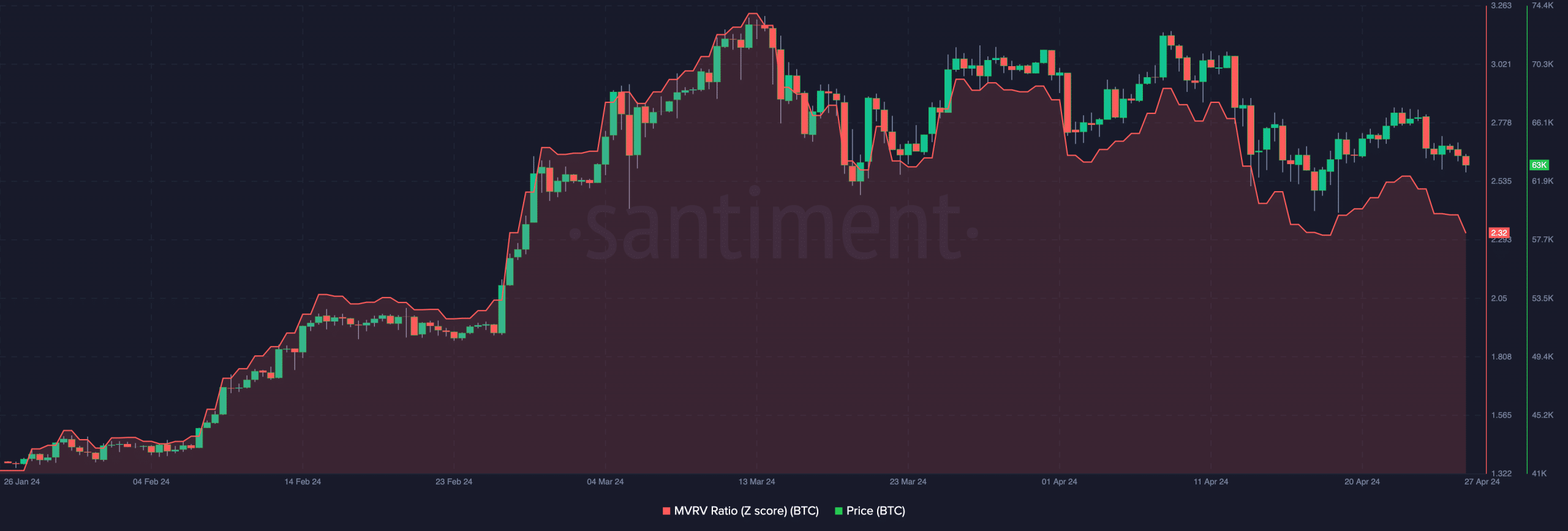

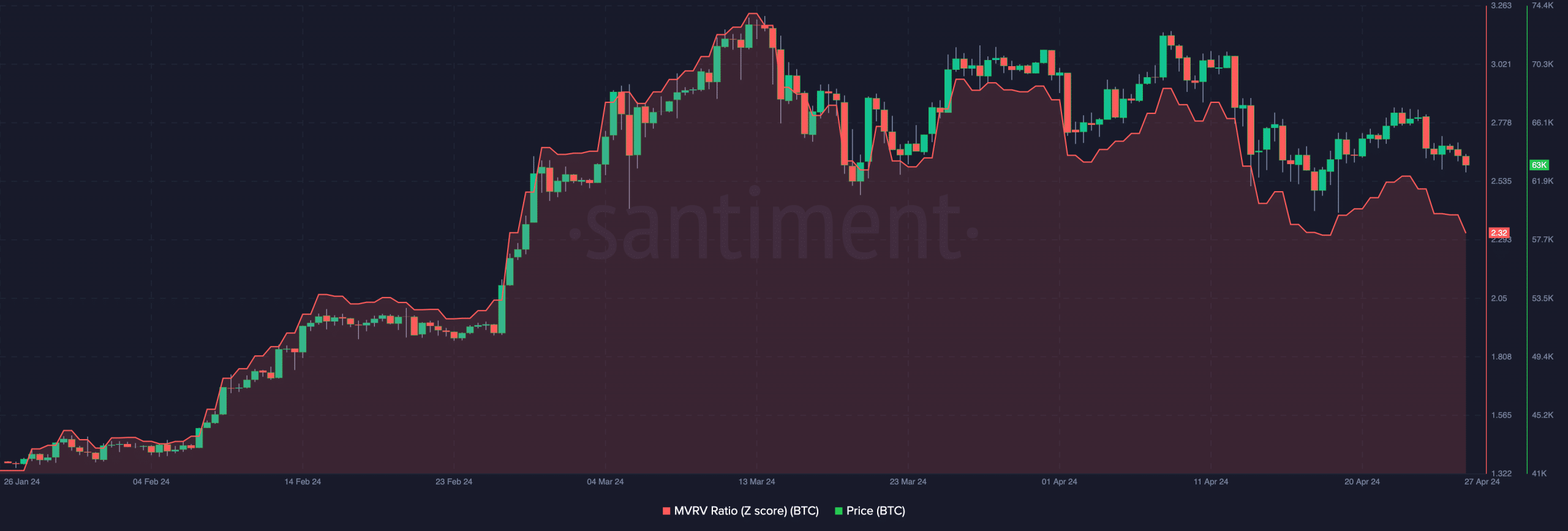

To start, AMBCrypto looked at the Market Value Realized Value (MVRV) Z Score. For starters, MVRV Z Score can detect the bottoms and tops of a cryptocurrency. It can also tell if an asset is overvalued or undervalued.

At the time of writing, Bitcoin's MVRV Z score is 2.32. Looking at the chart below, we can be seen Since March, the price has recovered every time the gauge has fallen below 2.60.

Source: Santiment

However, there is a possibility that Bitcoin could fall below $62,400 if the bears maintain control of the price. If this is the case, the recovery could be better, and a rally to $68,600 could be next.

BTC looks healthy for the last part

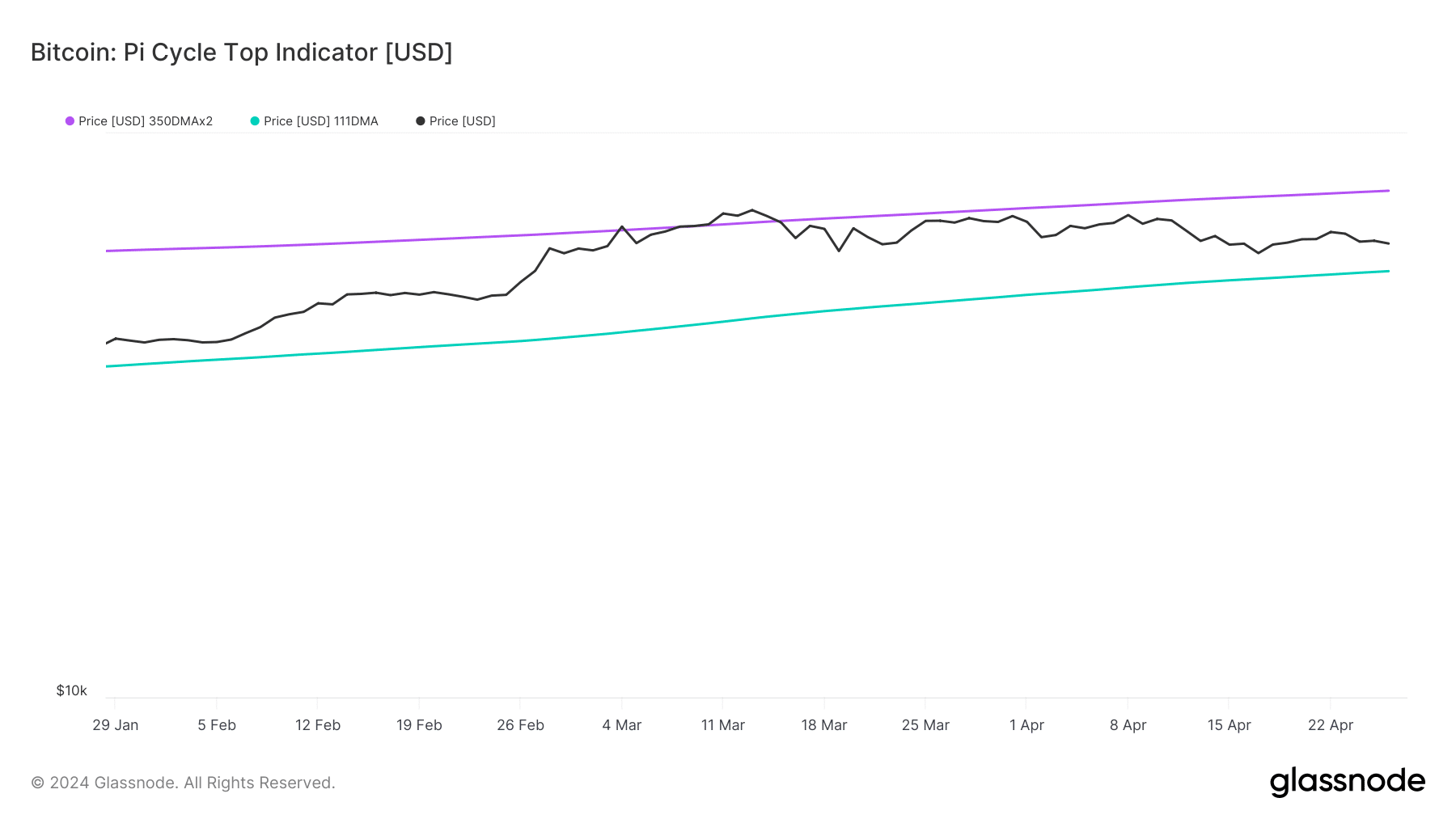

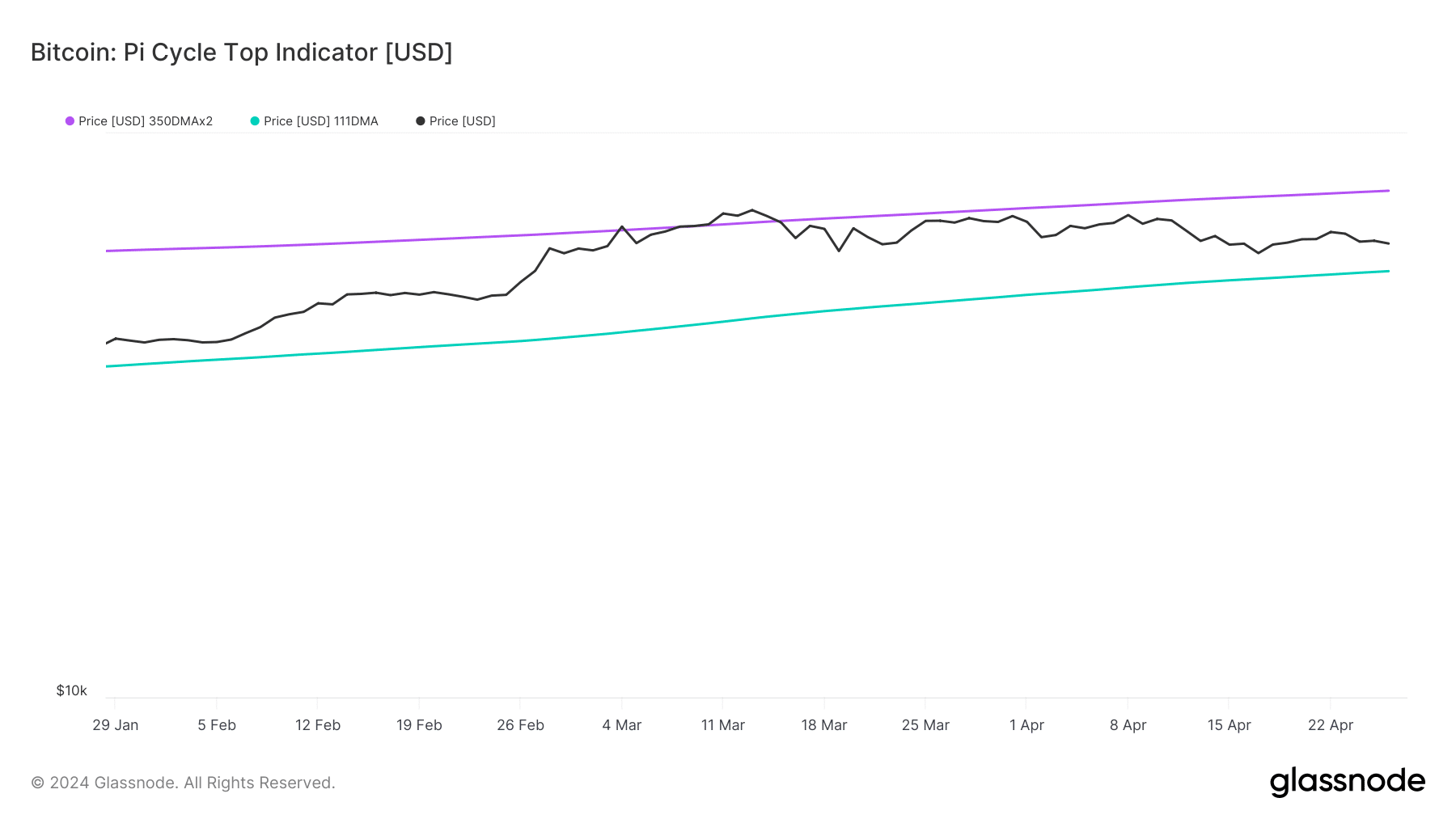

Another metric evaluated by AMBCrypto is the Pi Cycle Top indicator. Historically, this has been the standard Useful In determining when BTC is overheating or otherwise. On the indicator, you will find two lines – a green line and a purple line. The green line represents the 111-day simple moving average (SMA) while the purple color represents the 350-day SMA.

In most cases, Bitcoin closes at the top when the 111 SMA reaches the same point or crosses the 350 SMA. However, at the time of writing, this was not the situation as the green line remained below the purple line.

Source: Glassnode

Read Bitcoin [BTC] Price forecasts 2024-2025

The condition for this metric looked great for Bitcoin bulls, and not just in the short term. But for most of this course.

If Pi Cycle Top maintains its position in the coming months, BTC could rise. A goal of $80,000 to $85,000 may also be possible.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote