- Grayscale’s Bitcoin ETF recorded a negative outflow of over $43 million, leading to outflows to other products.

- However, the Bitcoin market was not particularly affected by it

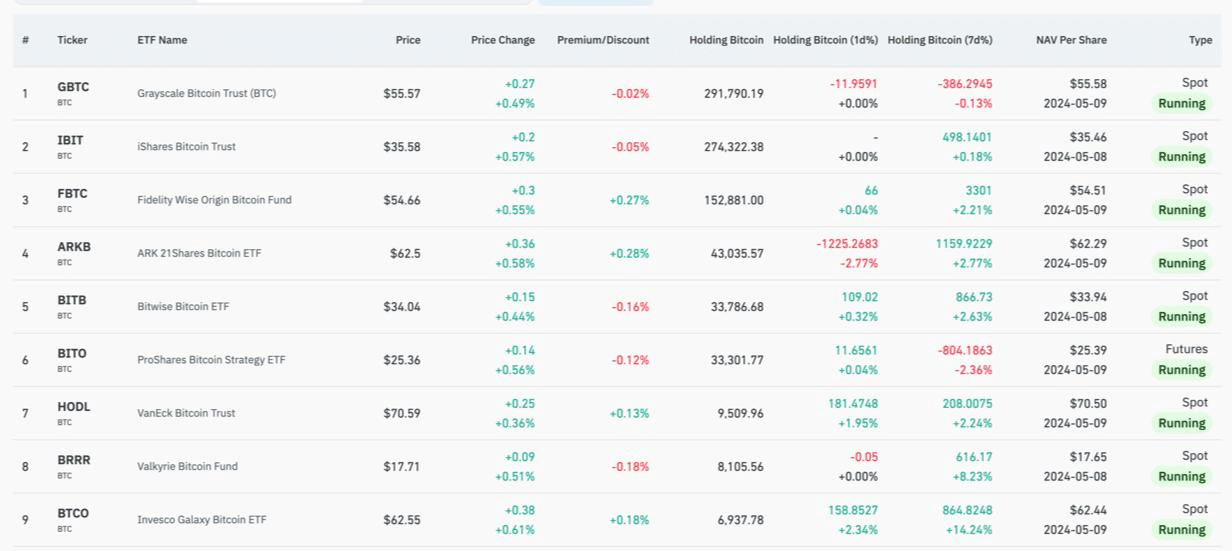

It’s been a slow month for U.S.-based Bitcoin ETFs, which were once lauded as a big catalyst for a 2024 bull market that could see Bitcoin rise to as high as $100,000. In fact, just yesterday, products saw approximately $11.3 million in outflows, due to Grayscale.

Change in investor sentiment?

Information from Quinglass It revealed a worrying trend for Grayscale’s GBTC fund, which continued to bleed as $43.4 million fled the fund. Despite this exodus, GBTC had a brief moment of respite last Friday, with a surprise inflow of $60 million, indicating its strong presence in the market.

Conversely, optimism seems to be shining through for BlackRock’s IBIT Bitcoin ETF, which received a cool $14.2 million. This rebound paints a picture of growing investor confidence in the Bitcoin ETF. Fidelity’s Wise Bitcoin ETF also wasn’t far behind, posting a $2.7 million increase.

Bitwise’s BITB ETF also caught investors’ attention, raising $6.8 million and emerging as a favorite on Thursday with inflows of $11.5 million, while its peers lagged behind. Meanwhile, the Ark 21shares (ARKB) ETF received a $4.4 million wave of support on the same day. WisdomTree’s BTCO funds and Franklin Templeton’s EZBC Bitcoin ETFs saw more modest gains, with inflows of $2.2 million and $1.8 million, respectively.

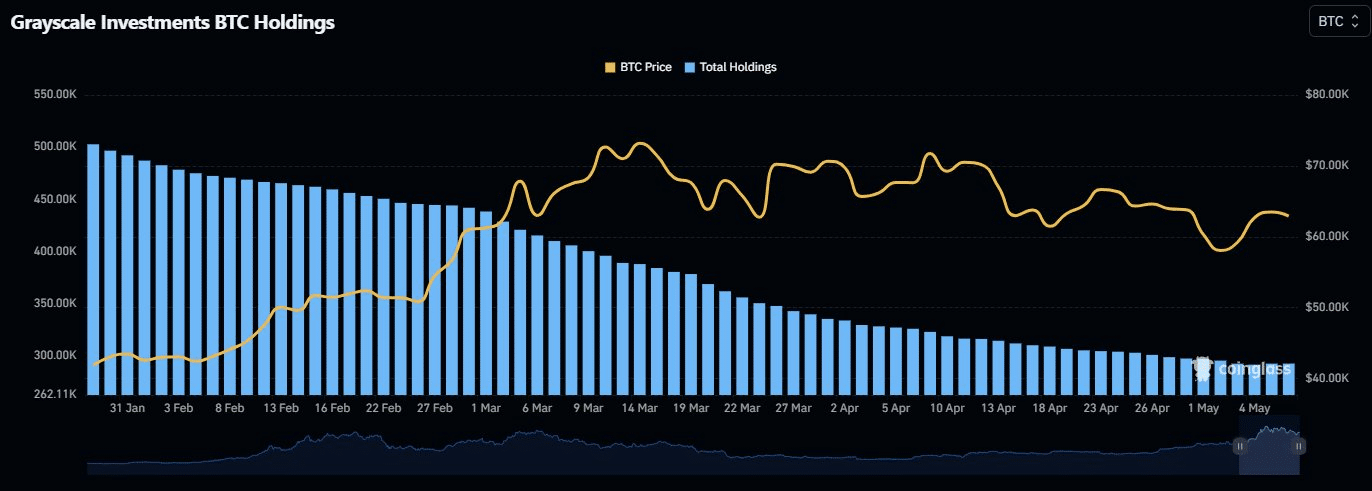

Source: Coinglas

It was a quieter day for ETFs from Hashdex, VanEck, Valkyrie, and Invesco Galaxy, which did not record any new inflows, highlighting a potential lack of interest in Bitcoin ETF products among institutional investors.

Since their inception, these funds have collectively seen $12.1 billion in inflow, with giants like BlackRock’s iShares and Fidelity Investments accounting for the lion’s share. Despite similar performance across the board, with returns of around 28%, investor reactions varied widely.

The biggest loser? Grayscale. The fund has seen a staggering $17.2 billion in withdrawals since its conversion. Even after cutting its fees, Grayscale’s fees remain much higher than its competitors, which mostly hover around an expense ratio of 0.20% to 0.25%.

Meanwhile, Quinglass open Grayscale still holds approximately 293 BTC, which is worth $18.4 million.

Source: Coinglas

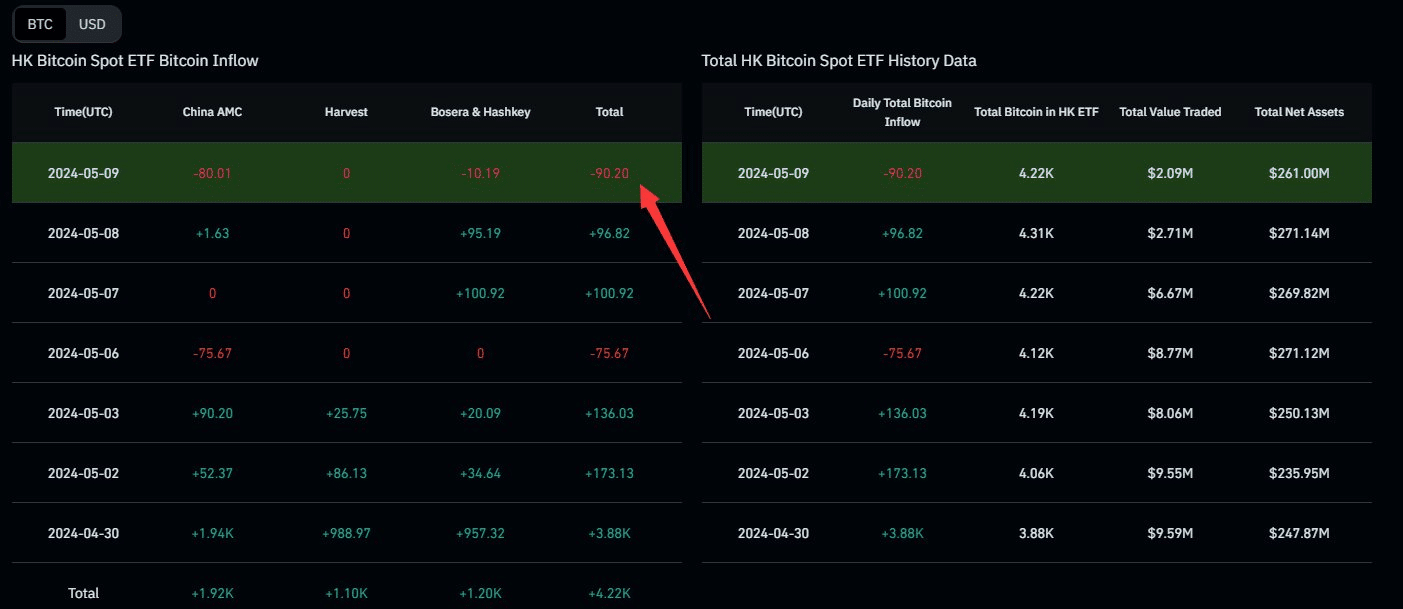

Outflows into crypto ETF products are not limited to the US alone.

In fact, data show up Spot Bitcoin ETFs in Hong Kong saw outflows of more than $5.5 million in the past 24 hours, indicating a general loss of interest in the products.

Source: Coinglas

What about Bitcoin?

Amidst this, Bitcoin has managed to maintain its position. At press time, the crypto king was still able to hover above $63,000, with a 4% rise in the past 24 hours. The community is currently 78% bullish on BTC, according to data from Queen Gekko.

The Bitcoin halving did not achieve the results that many of us were hoping for, and since then, all of the top 10 cryptocurrencies have been mostly bullish. Feelings By investors and sometimes even traders.

However, with skepticism reaching its peak, the continued exit of small investors may ironically pave the way for Bitcoin and cryptocurrencies like it to make a comeback as summer approaches, signaling a potential reset in the volatile cycles of the cryptocurrency market.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote