- Ethereum has a slightly more bullish bias for next week.

- Bitcoin’s consolidation phase was still ongoing, and it was likely that it would return to $60,000.

Bitcoin [BTC] Traders have been going through a relatively difficult period after the easy and straightforward rallies that have been the norm since last October.

Ethereum [ETH] It used to be more complicated, but the BTC halving event last month changed market conditions to chop and form formations across the market.

AMBCrypto investigated what market sentiment looked like over the weekend, and where price action could be headed this week.

One has speculators anticipating bullish returns in the near term

source: Currency analysis

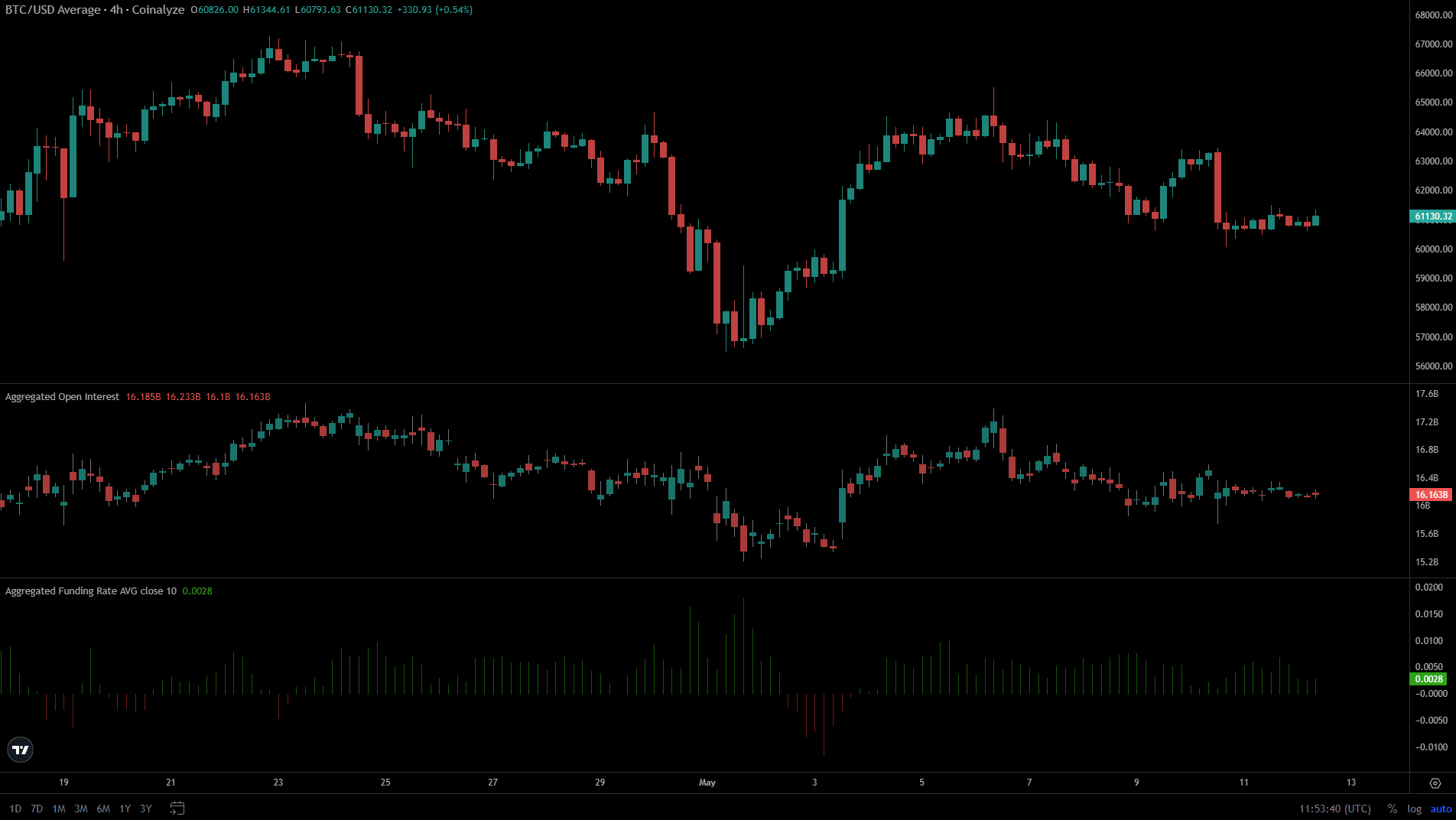

May 10th saw an increase in Bitcoin open interest, but OI has been trending down since the price spike on May 6th.

Meanwhile, the price also formed a series of lower highs over the past week, falling from $64K to $61.1K at press time.

The funding rate was negative at the beginning of May when Bitcoin fell to $56,000. Since then, the funding rate has recovered.

However, in the past few days, it has barely been above zero, indicating that sentiment was not strongly bullish.

source: Currency analysis

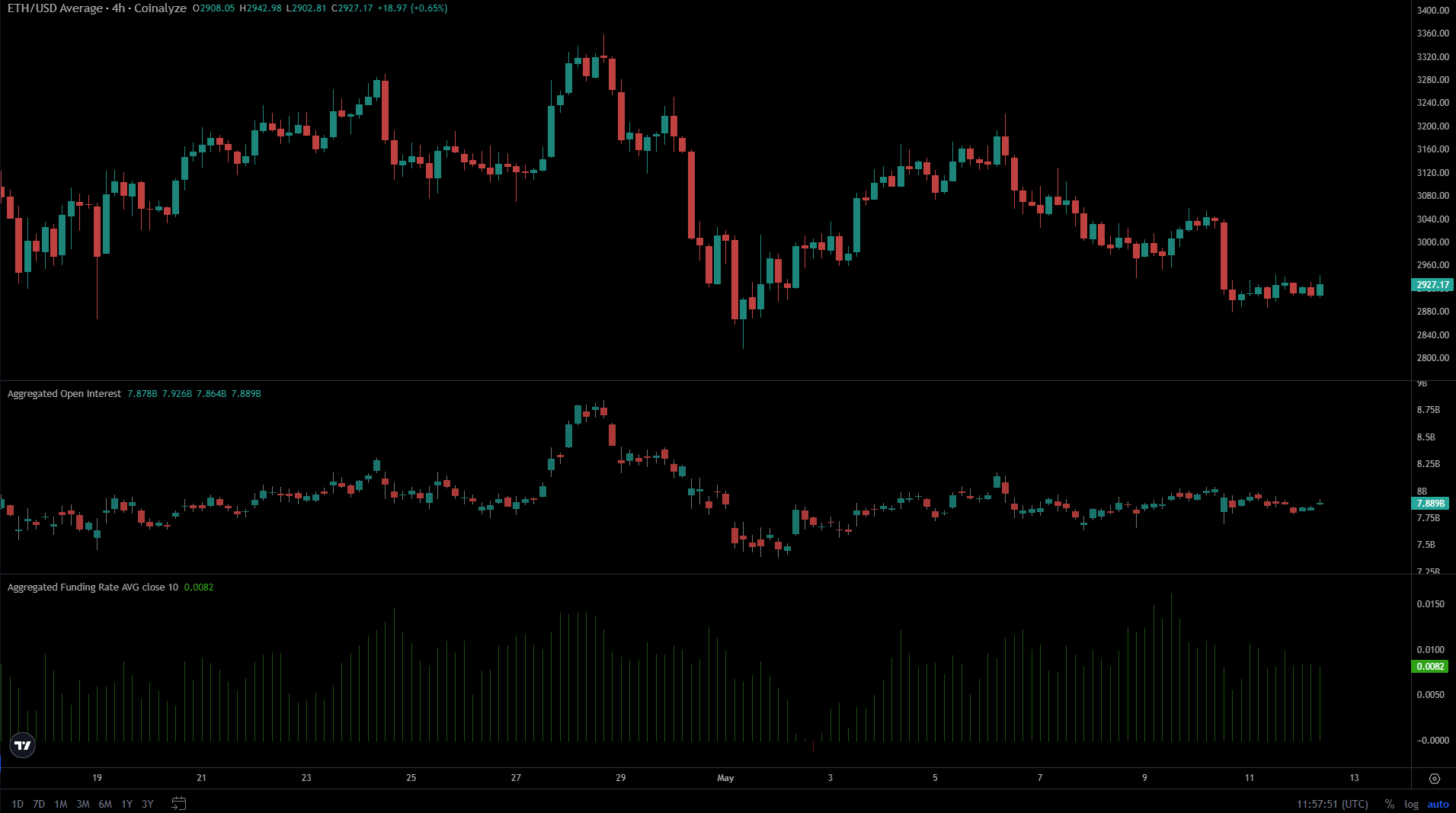

Ethereum also saw funding prices fall into negative territory in early May but has since recovered. Last week’s downtrend saw the funding rate hover around the +0.01 baseline.

A slight bounce from $2,980 to $3,040 on May 9th sent open interest and the funding rate higher.

This was not repeated with Bitcoin despite a similar price bounce, suggesting that speculators were more keen to buy Ethereum than Bitcoin.

What are the upcoming pockets of liquidity that could attract prices?

source: Cryptoquant

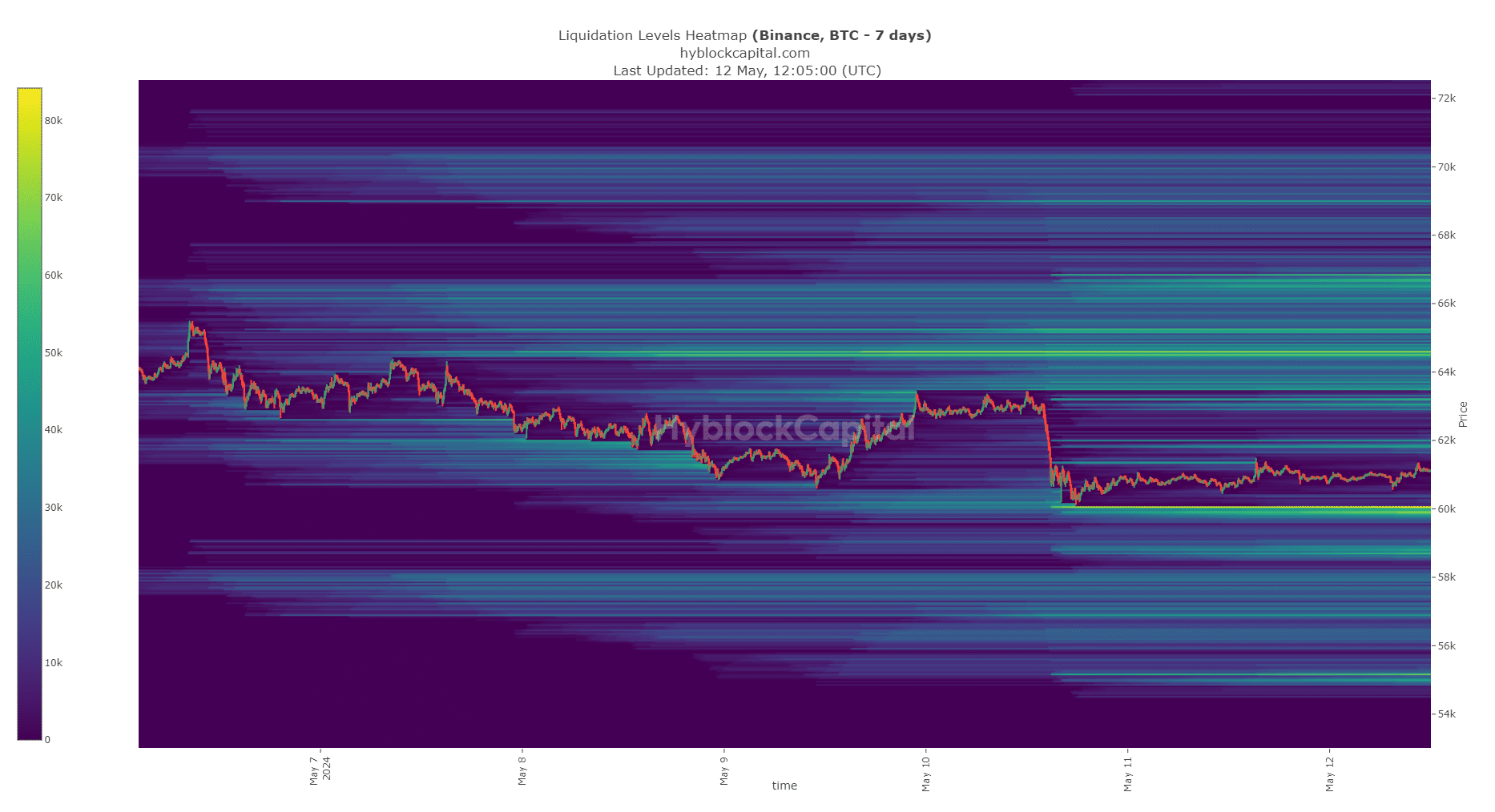

Bitcoin’s 7-day liquidation heat map showed a bright set of liquidations at the $60,000 region. To the north, $61.8K and $63K are the next upside targets.

On May 5th, we saw prices jump above the $64K level to raise liquidity before a sharp reversal occurred in the short term.

Likewise, we may see a lower pullback on Monday to gather liquidity at $60,000 before bouncing higher. Hence, Bitcoin traders may want to buy on the dip to the $50.6K-$60K area.

However, traders should also be prepared for a move below $59.4k for Bitcoin, and set stop losses accordingly in case of a drop to $60k.

source: Cryptoquant

Read Bitcoin [BTC] Price forecasts 2024-25

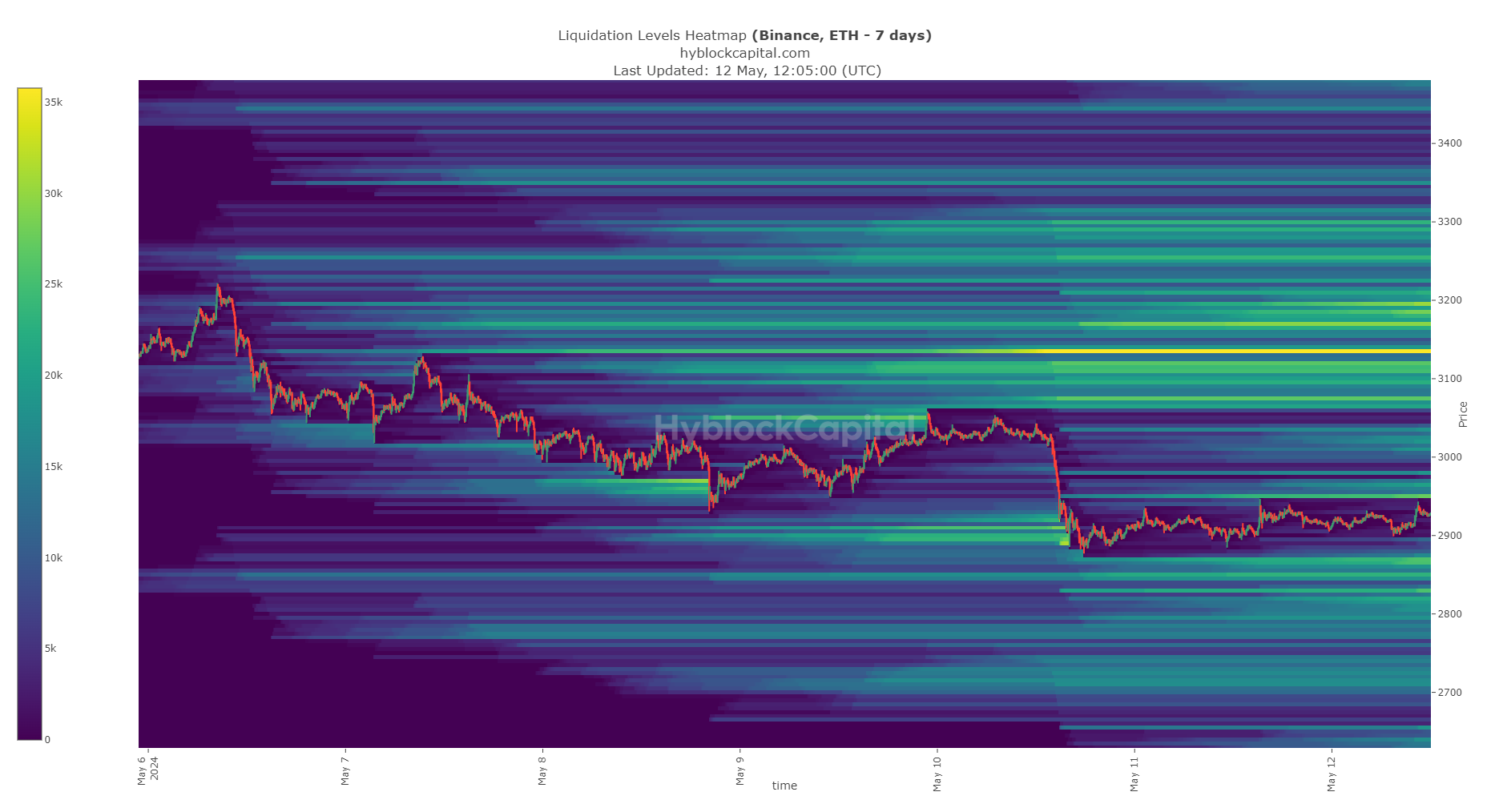

On the other hand, Ethereum has a pool of liquidity near north of $2,950. This was close to the current market price of $2,928. A decline to the $2860 area is likely to represent a buying opportunity.

Liquidation levels around the $3.1K-$3.2K area represent an attractive target. A drop below $2.8K would likely herald a strong downtrend in the short term, and traders can cut their losses in this scenario.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote