- BTC price has increased by more than 3% in the past 24 hours.

- Most metrics and indicators were positive about the currency.

Bitcoin [BTC] After several weeks, Bitcoin showed signs of recovery as it crossed the $60,000 mark. While this development seemed optimistic, recent analysis suggests that Bitcoin could reach new highs in 2024. Let’s take a look at Bitcoin metrics to see if this is likely to happen.

Bitcoin’s Road to New Highs

Coin Market Cap Data Bitcoin, the king of cryptocurrencies, has reportedly surged more than 3% in the past 24 hours, allowing it to once again surpass $60,000. At the time of writing, Bitcoin was trading at $60,172 with a market cap of over $1.17 trillion.

Thanks to this, more than 83% of BTC investors have made profits.

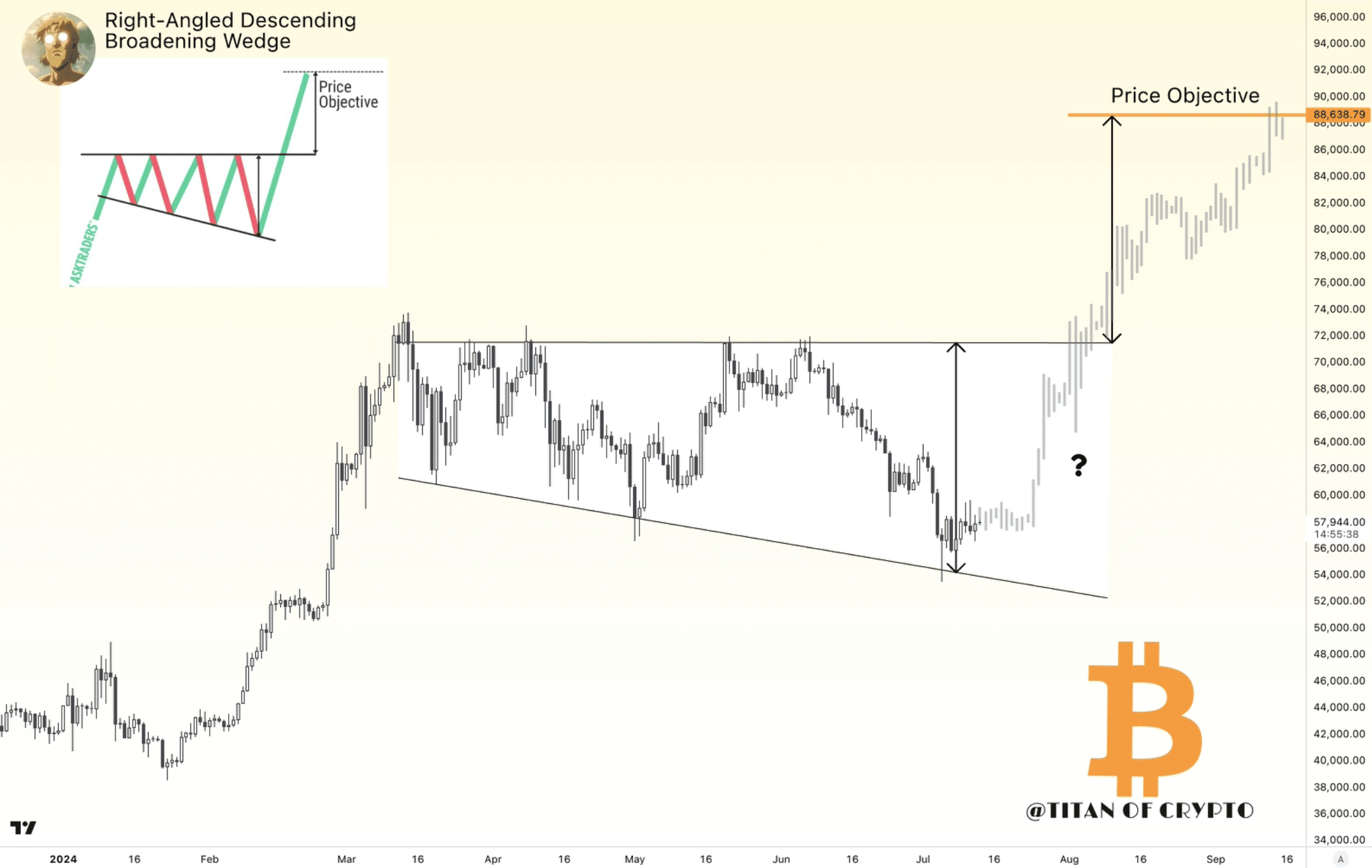

Things may get better in the coming days, as Titan of Cryptos, a popular crypto analyst, has posted, tweet Pointing to an interesting development. According to the tweet, a falling widening wedge pattern has appeared at a right angle on the Bitcoin chart.

If Bitcoin tests this pattern, the recent price surge could be just the beginning of a massive rally. In fact, the next rally could push Bitcoin to $88,000 in September. If that happens, 100% of Bitcoin investors will make a profit.

Source:X

Is Bitcoin ready for pumping?

Since the analysis revealed the potential for a significant price spike, AMBCrypto planned to take a look at its metrics to see what they indicate.

Our Analysis of CryptoQuant Data Data revealed that net Bitcoin deposits on exchanges were lower compared to the average of the past seven days. This means that buying pressure on the coin was high.

Its CDD binary indicator was green, indicating that long-term coin holders’ movements over the past seven days were below average. They have an incentive to hold their coins.

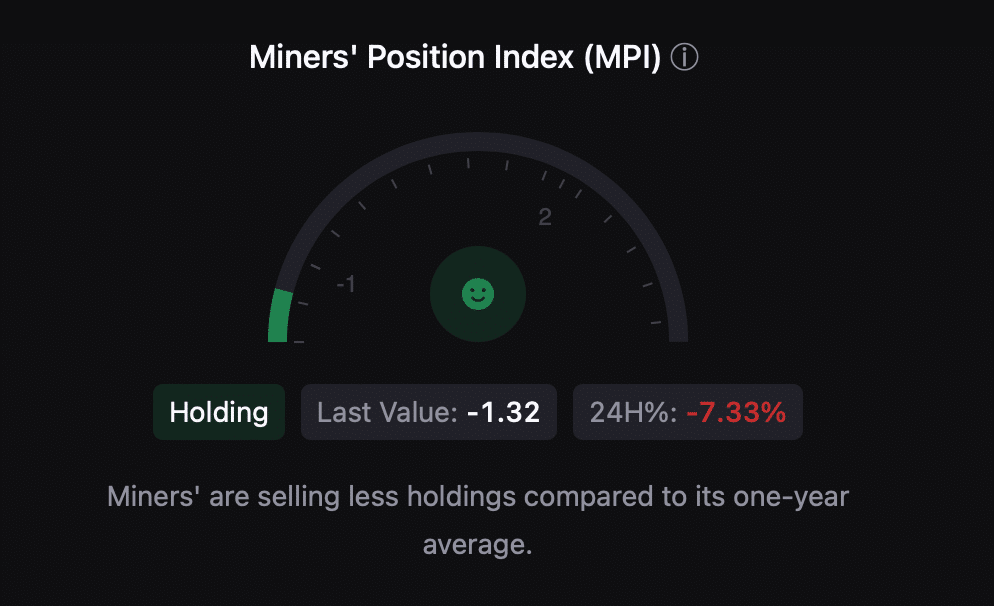

Additionally, miners also showed their confidence in Bitcoin. This was evident from the fact that the Miner Position Indicator (MPI) was in the green, indicating that miners were selling fewer holdings than its yearly average.

Source: CryptoQuant

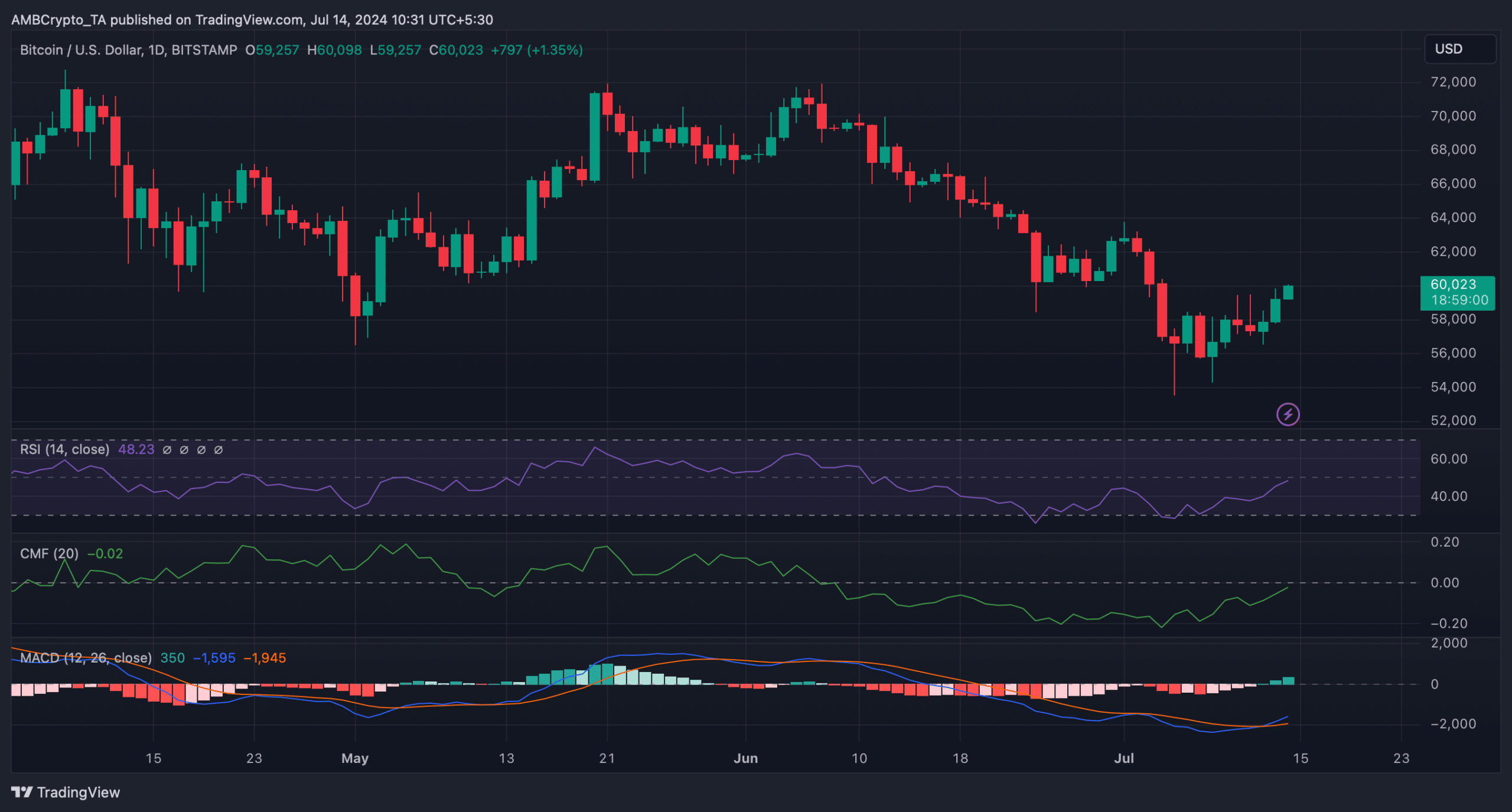

We then took a look at the daily chart of the currency to see what the market indicators were indicating. We found that most indicators were in favor of the bulls and indicated that the price would continue to rise.

is reading Bitcoin [BTC] Price prediction 2024-2025

For example, the MACD showed a bullish crossover, and its Relative Strength Index (RSI) registered a slight increase.

A similar upward trend was also observed on the coin’s Chaikin Money Flow (CMF) chart, suggesting that BTC may continue to increase in value and reach a new high by September.

Source: TradingView

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote