- The Bitcoin market structure has revealed that it is close to a reaccumulation zone.

- A rebound to $65,065 could be the target for BTC once the coin recovers.

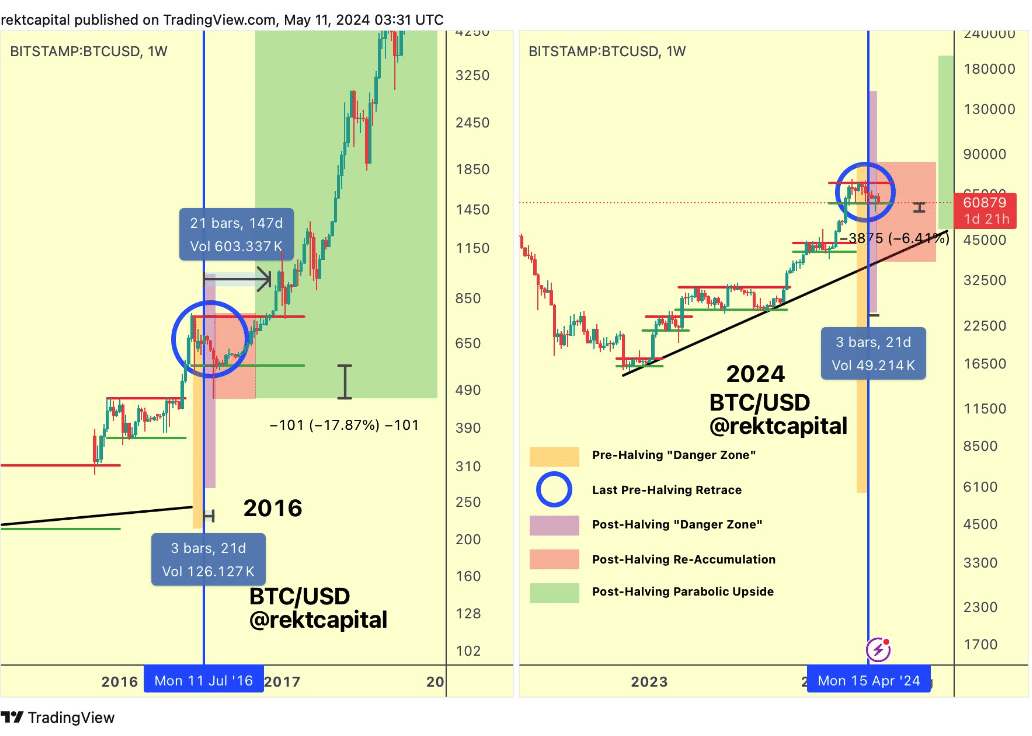

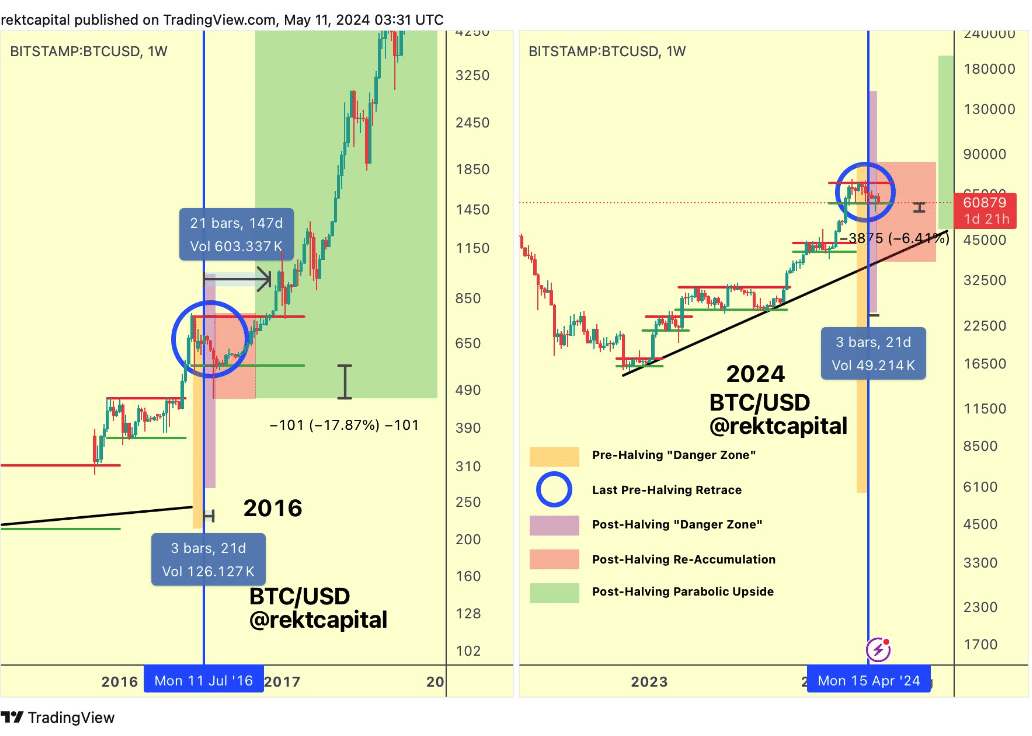

According to cryptocurrency trader Rekt Capital, Bitcoin [BTC] He left the danger zone and arrived at the regrouping zone. The analyst mentioned this in a post on X (formerly Twitter) on May 11.

From the chart shared by Rekt Capital, it shows how the coin met the post-halving correction, and within a couple of days, Bitcoin may have left the danger zone completely.

The red days are almost over

To support his reasoning, he pointed to the 2016 post-possession cycle. At that time, three bearish candlesticks appeared within 21 days. Later, Bitcoin rose to over $4,250 within a few months.

On the 2024 chart, another set of red candles has appeared, indicating that Bitcoin’s correction may be nearing its end. At press time, Bitcoin’s price was $60,509.

Source: Reckitt Capital/X

This was a decline of 5.61% in the past seven days. As a result of this decline, many Bitcoin contracts were liquidated in the market.

Using Hyblock data, AMBCrypto observed a magnetic area around the liquidation levels. This indicator shows the price levels at which traders risk liquidation.

The magnetic zone (blue) indicates a high level of liquidity and indicates that the price may move in this direction. For Bitcoin, the price could move towards $65,065 in the short term.

This may only happen if BTC bounces. Failure to reverse higher may lead to a further decline in the price. The CLLD, which is the cumulative clearance level delta (CLLD), was also negative.

Negative values of CLLD indicate that short positions are starting to feel more liquidation. If this continues, this could be bullish for the Bitcoin price.

Source: Hyblock

HODLers are out

We also found evidence of a potential price increase from another metric on Glassnode. The measure in question was the net Hodler position change.

Hodler net position change Tracks Monthly net position of long-term investors. If the value is negative, it means that Bitcoin holders are making gains, or cashing out of their assets.

However, a positive reading on the net Hodler position change indicates accumulation. Until the last week of April, the gauge was negative, indicating that investors were taking profits.

But since the first week of May, that has changed. Specifically, long-term holders bought 26,990 BTC on May 10th. In the current situation, this accumulation may continue.

Read Bitcoin [BTC] Price forecasts 2024-2025

Maintaining this momentum could ensure that Bitcoin trades above $60,000 in the coming days. In the long term, this could be beneficial in a parabolic uptrend.

Source: Hyblock

However, traders may need to be careful as Bitcoin may decline further. As Rekt Capital saw it, Bitcoin may still have a couple more days of decline before the price starts to slowly rise.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote