Celsius Network, one of the largest cryptocurrency lenders, told customers Sunday night that it is temporarily halting withdrawals, swaps and transfers between accounts in a move that sparked discussions and sent the company’s token price down 60% in the past one hour at a price as low as 19 cents.

“We are taking this action today to put Celsius in a better position to meet, over time, its obligations to withdraw,” Wrote Celsius, which includes stablecoin issuer Tether International, equity growth fund WestCap Group and Canadian pension fund Caisse de Dépôt et Placement du Québec are among the investors.

“Working for the benefit of our community is our highest priority. In service of this commitment and adherence to our risk management framework, we have activated a clause in our Terms of Use that will allow this process to occur. Celsius has valuable assets and we are working hard to meet our commitments.”

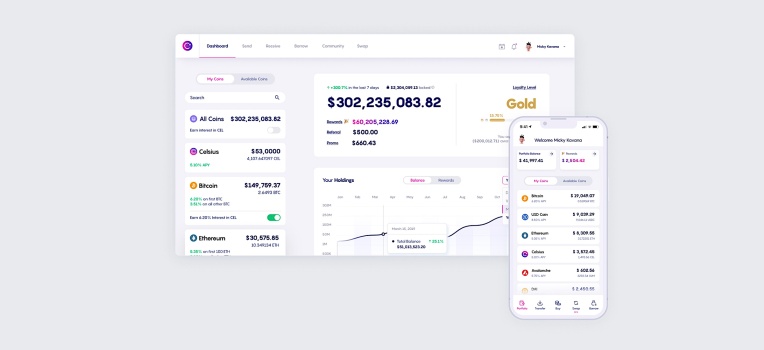

percentage, which was $3.25 billion at the time they expanded The “oversubscribed” Series B funding round reached $750 million in November, allowing users to deposit Bitcoin, Ethereum and Tether and receive weekly interest payments. Depending on the time horizon and token, the platform offers an interest rate of up to 18% per annum. Celsius says on its website that 1.7 million people call “Celsius their home for cryptocurrency.”

The announcement comes after one of the brutal weekends in the cryptocurrency market that saw hundreds of millions of dollars liquidated. At press time, Bitcoin was trading at around $25,585 and Ethereum at $1,346, some of the lowest levels in more than a year. Other high-profile crypto projects including Solana, BNB, and FTT have also fallen behind.

Cryptocurrency lenders face increased scrutiny in the wake of The breakdown of Luna from Terraform Labs and her brother, the UST icon Last month. Alex Mashinsky, CEO of Celsius Network, has tried to reassure customers in recent weeks, saying they can withdraw their assets at any time and questioning the skeptics. The company also launched a recurring promotion recently, offering customers bonuses if they transfer assets to Celsius accounts and helping positions for up to 180 days.

But Celsius has also struggled with a high sell-off in recent months. The lender says on its website that it has about $3.8 billion in assets, down from the $24 billion it disclosed in late December 2021.

“The beauty of what Celsius has been able to do is we give the yield, we pay people who would never be able to do it themselves, we take it from the rich, and we hit the pointer. It’s like going to the Olympics and getting paid for it,” Mashinsky said in a video that aired in December. 15 medals in 15 different fields.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote