- Cryptocurrency funding rates for Bitcoin and Ethereum have dropped significantly over the past few days.

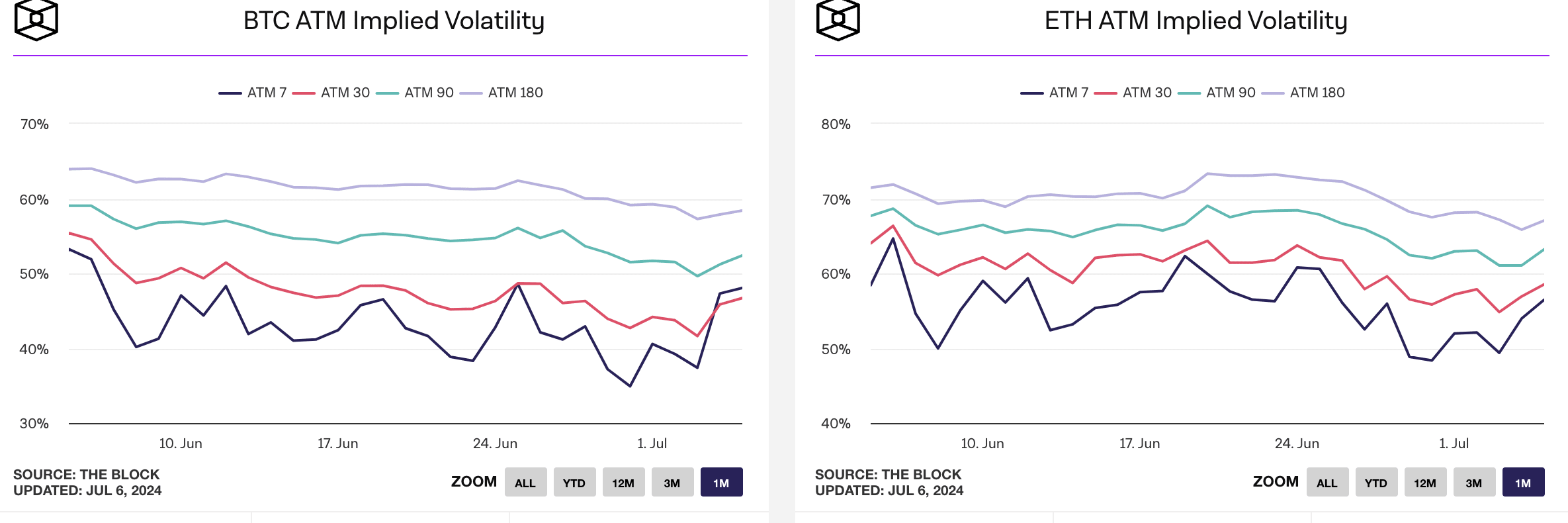

- Implied volatility for Bitcoin and Ethereum has risen significantly during this period.

Bitcoin [BTC] and Ethereum [ETH] Shareholders have been hit hard by the recent market downturn. However, it is not just shareholders who have been affected.

Low funding rates

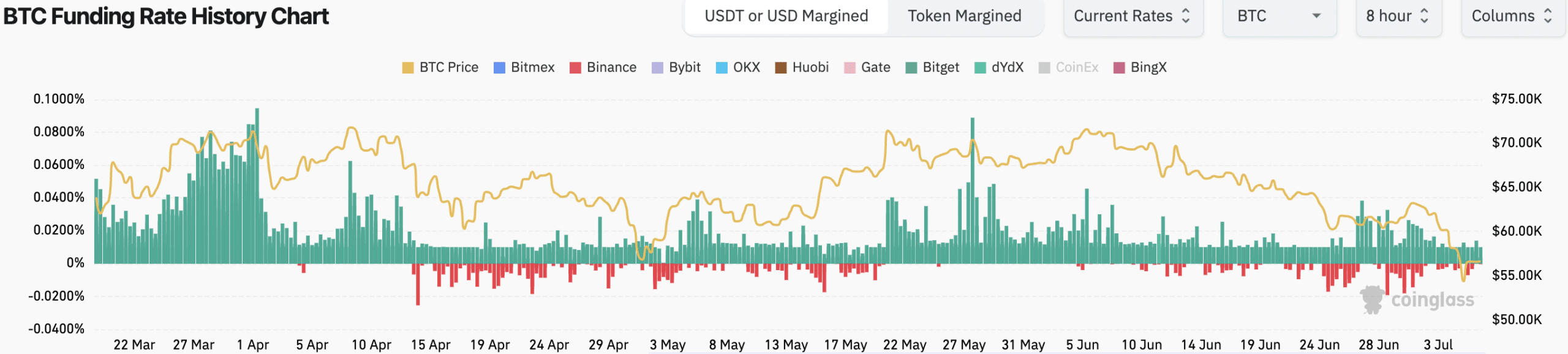

Both BTC and ETH have seen their funding rates drop significantly over the past few days. Negative funding rates for cryptocurrencies could lead some investors to believe that a price drop is imminent, encouraging them to sell their holdings or take short positions themselves.

This selling pressure could contribute to an actual decline in the price of BTC and ETH.

With negative funding rates, holding long-term futures contracts becomes less attractive. Fees reduce potential profits, prompting some traders to unwind their long positions or be more cautious about opening new ones.

This reduces overall buying pressure, which could weaken the price support for BTC and ETH.

The shift in sentiment could lead to higher volatility in the near term. As long and short positions compete, price volatility for BTC and ETH could become more pronounced.

Conversely, some investors may view a significant and sustained decline in funding rates as a counter-trend indicator.

They may view this as a sign of excessive bearishness, representing a potential buying opportunity for BTC and ETH at what they consider a discounted price.

Source: Coinglass

At the time of writing, traders are somewhat bullish on Bitcoin as long positions have finally outpaced short positions, accounting for 50.7% of all trades.

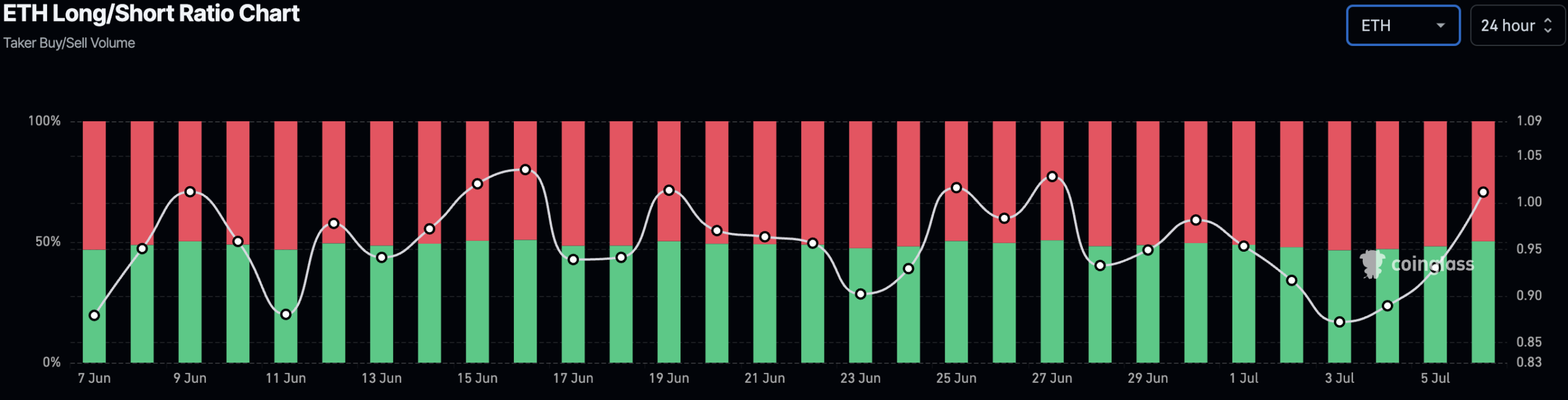

Ethereum saw a similar surge in bullish sentiment as the percentage of long positions on Ethereum increased by 50.9%.

Source: Coinglass

CPI grows as prices fluctuate

Implied volatilities for both BTC and ETH also rose during this period. Higher implied volatilities indicate that options traders are pricing in a higher probability of large price movements for BTC and ETH in the future.

Read about Bitcoin [BTC] Price forecast 2024-2025

This indicates increased uncertainty about the future direction of the markets. If market sentiment turns strongly bearish, negative financing could amplify any price decline due to increased short selling.

Conversely, a sudden positive shift may lead to a larger price increase due to higher volatility.

Source: IntoTheBlock

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote