- Buying pressure, indicated by spot volume on exchanges, pushed the price to $4.50.

- The RSI and Funding Rate signals indicate that CVX could drop below $4 since it was overbought.

Convex financing [CVX], the native token of the yield optimizer for various protocols, surprised the market with a 90.85% rise in the last 24 hours. On June 16, the CVX cryptocurrency was trading at around $2.14.

But in the early hours of the 17th, the value reached $4.50. Later, it fell to 4.17, its price at the time of publication. For those unfamiliar, Convex started out as a yield enhancer on Curve Finance [CRV] Before extending to other protocols.

This time, it appears that Curve was one of the reasons for the CVX pump. A few days ago, Michael Egorov, founder of Curve Finance, put the project and CRV holders at risk.

CVX’s volume exceeds the previous achievement

This is because Egorov liquidated up to $27 million on his lending positions. As a result of the event, CRV fell to an all-time low of $0.21.

However, the founder later revealed that he had paid off $10 million in debt. The overlay of CRV’s collateral has opened the way for CVX’s incredible upside.

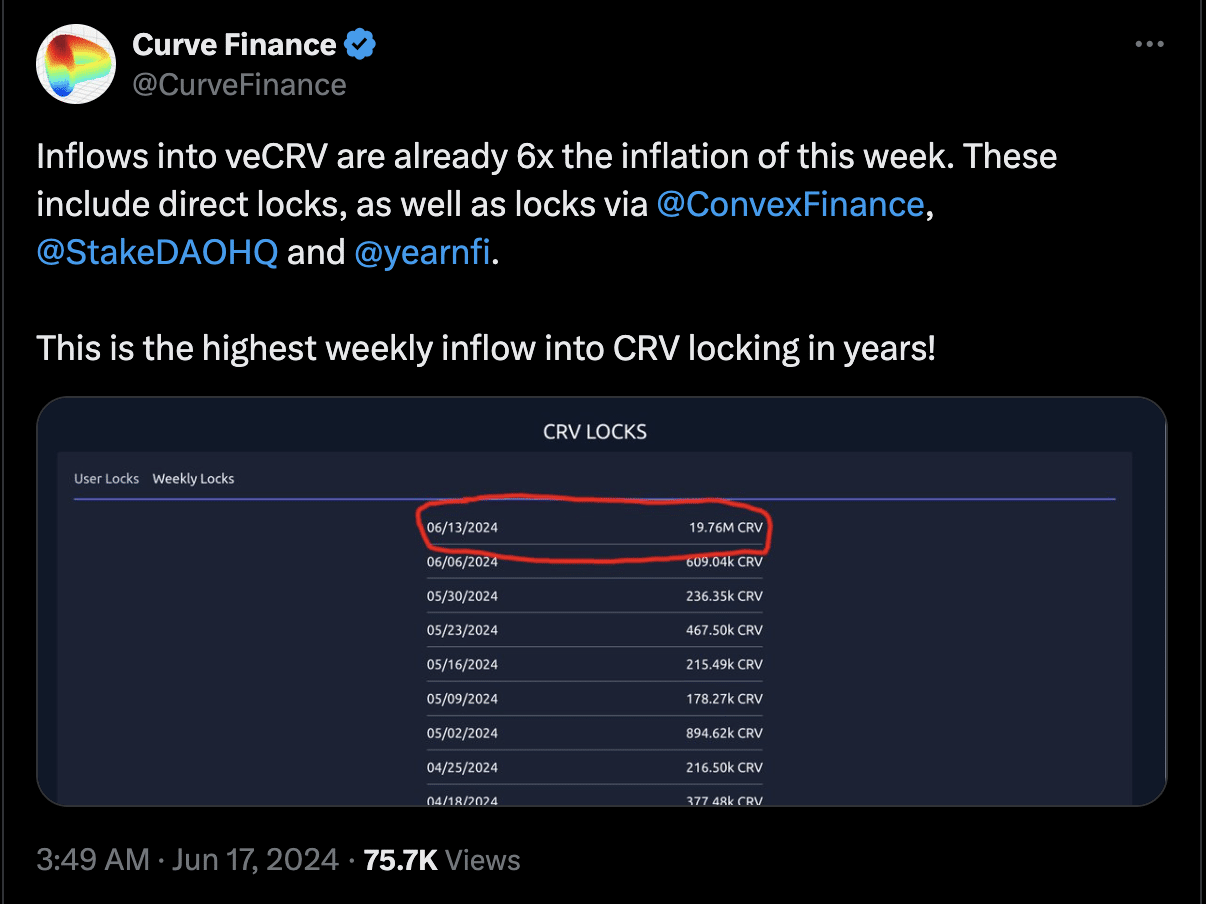

The evidence was also reflected in the inflows to veCRV, of which Convex Finance was a part. This increase in flows indicates that a lot of users closed their assets on Convex while expecting a good return.

Source: X

Regarding the development, Jason Hitchcock, an analyst, explained that the Convex process may not be implemented. Explaining his thesis, Hitchcock male which,

“Convex has taken over Curve, Frax, f(x)n, Prisma, and others will come. They take a big cut of all their fees and build great incentive markets for them. Stablecoins and related assets have found a place on Curve, and those markets are taking off as is expected.”

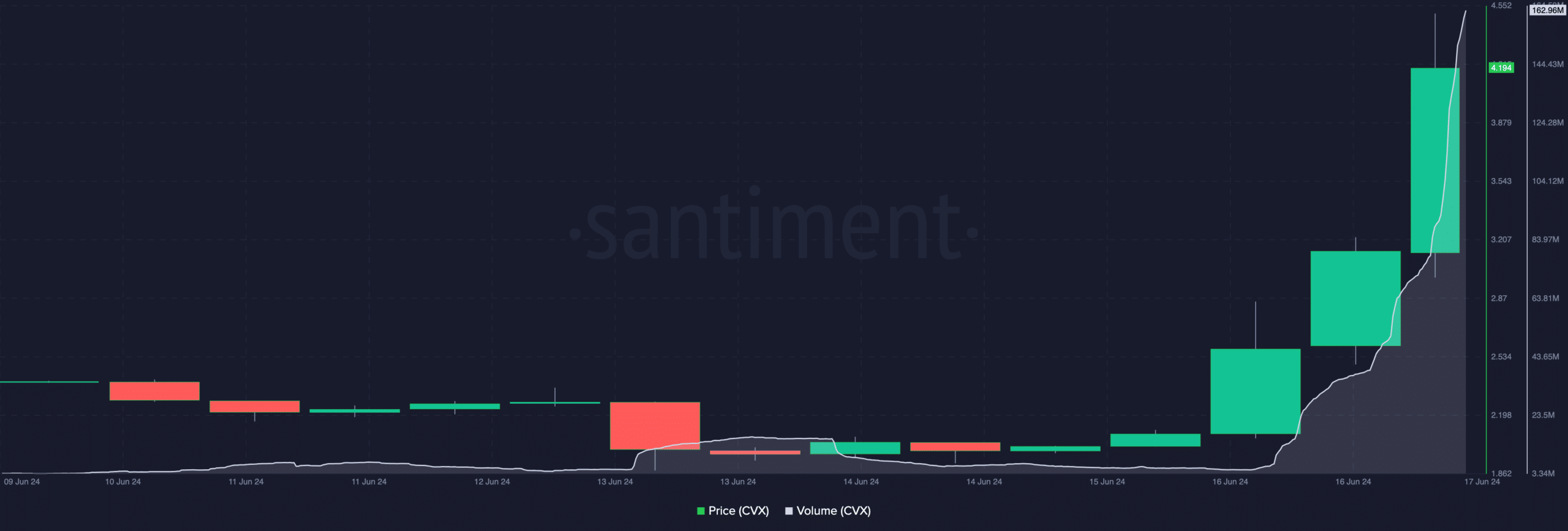

Meanwhile, the price of CVX crypto was not the only notable rise. According to Santiment, token volume has jumped by a staggering 2,677% in the past 24 hours.

As of this writing, total 24-hour trading volume reached $161.61 million. Furthermore, AMBCrypto found evidence of increased interest in the CVX cryptocurrency.

For example, spot CVX/USD amount On Binance, the value of the coin reached nearly $32 million, marking a new single-day high for the token. However, traders in the derivatives market are not left out.

Source: Santiment

Like spot volume, derivatives lie in line

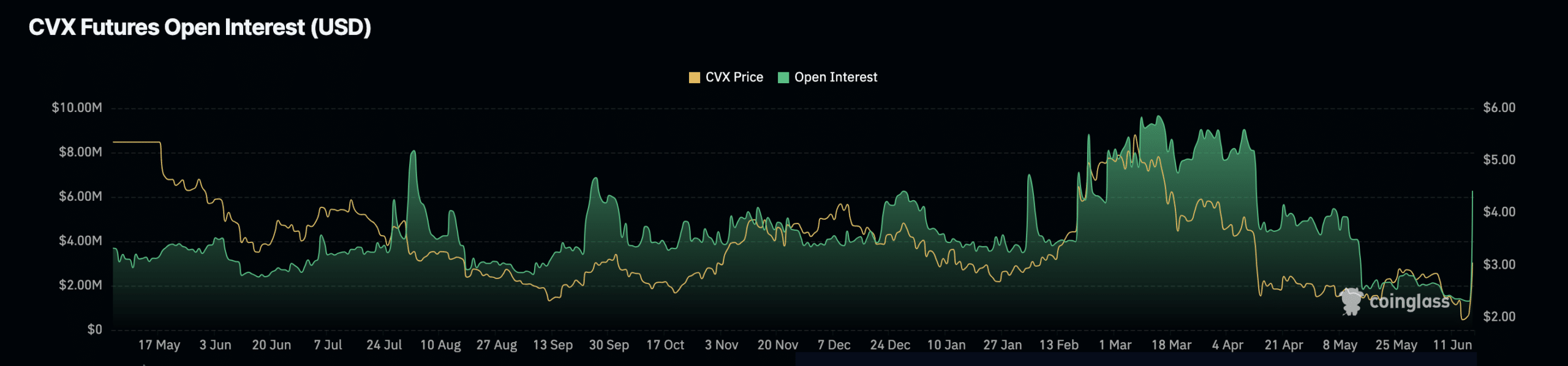

According to Coinglass data, open interest (OI) jump By 759.50%. An increase in OI indicates the entry of new money into the market. However, when the OI indicator decreases, it means that traders are closing their positions in the market.

At the time of writing, the OI of the CVX cryptocurrency was $6.28 million. If the value continues to increase, it could be strength for the price.

If this happens, the native CVX token may try to reach $5 in the short term.

Source: Coinglas

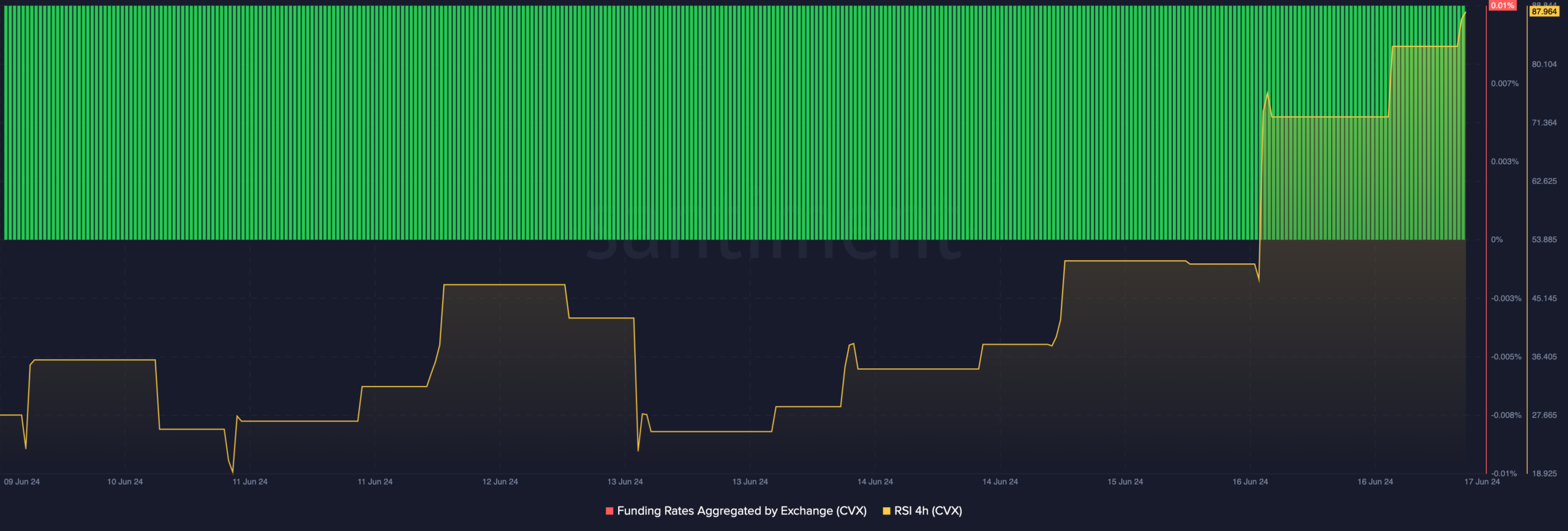

However, it is important to evaluate other indicators. To assess the next direction for CVX, AMBCrypto analyzed the funding rate.

CVX Price Prediction: Is a decline coming?

The funding rate measures whether market sentiment is bullish or bearish. When you do this, the meter tracks buy and sell fees.

If funding is positive, it means that long position holders are paying an amount to keep their positions open. In this case, the broader trader sentiment is bullish.

Conversely, passive financing means that short trades pay fees, and sentiment is bullish. At the time of writing, the funding rate for CVX token was positive, indicating that the perp price was at a discount to the spot price.

However, it seems that the price has started to move down. When this happens alongside positive financing, it means buyers are in disbelief. This also means that traders in the spot market are starting to take profits aggressively.

If this continues, CVX price may fall from the highs. In addition, AMBCrypto to examine Relative Strength Index (RSI) on the 4-hour chart. The Relative Strength Index measures momentum.

Source: Santiment

When the reading is below 30, it means that the cryptocurrency is in the oversold zone. On the other hand, a reading above 70 indicates overbought positions. At the time of writing, the indicator was at 87.96, indicating that CVX was overbought.

Is your wallet green? Check out our Convex Financial Profit Calculator

Given the condition of both indicators above, the symbol may have difficulty continuing its rise. The way things look, if selling pressure intensifies, CVX could fall to as low as $3.70 over the next few days.

This prediction can also be invalidated if market participants continue to place buy orders.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote