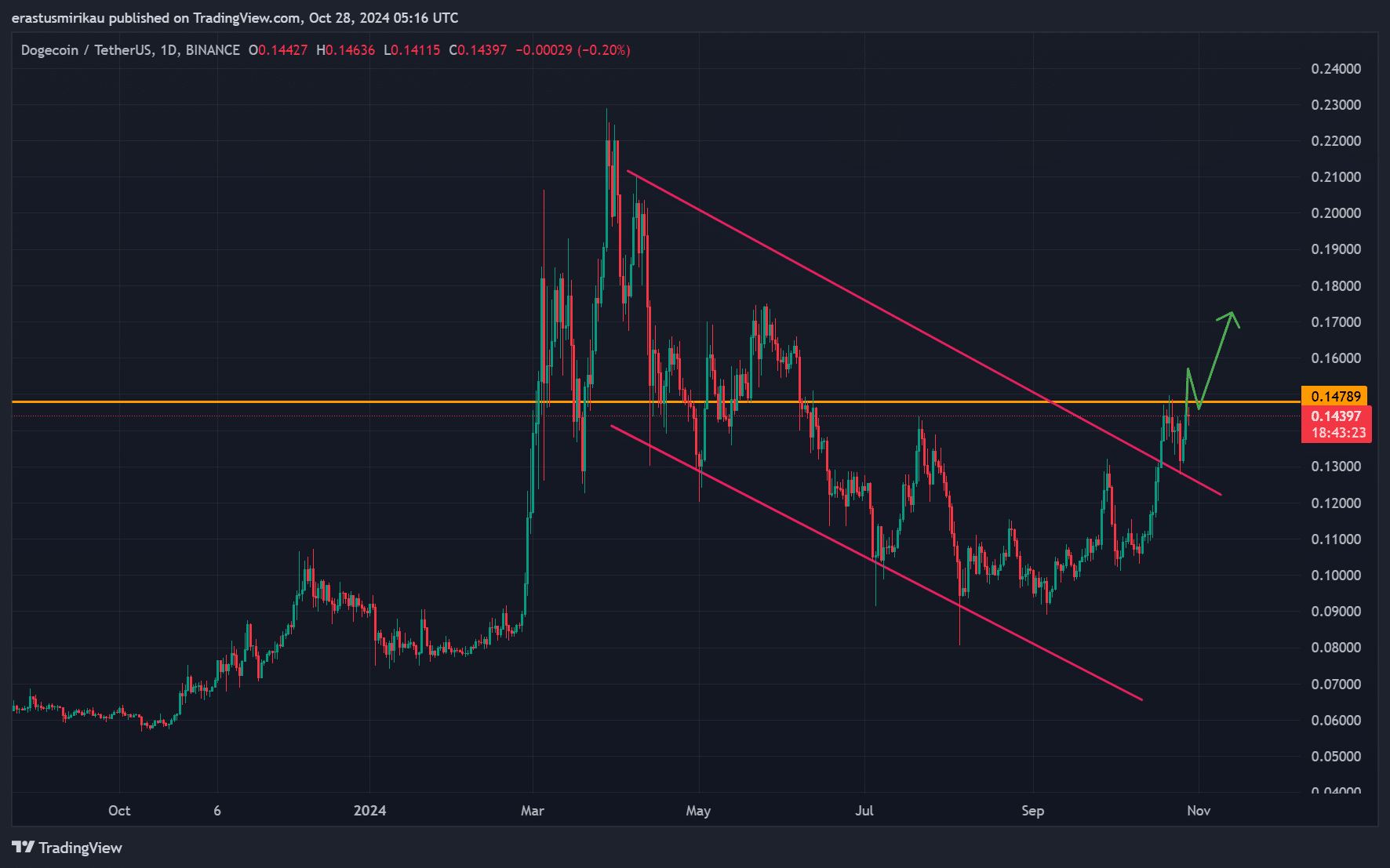

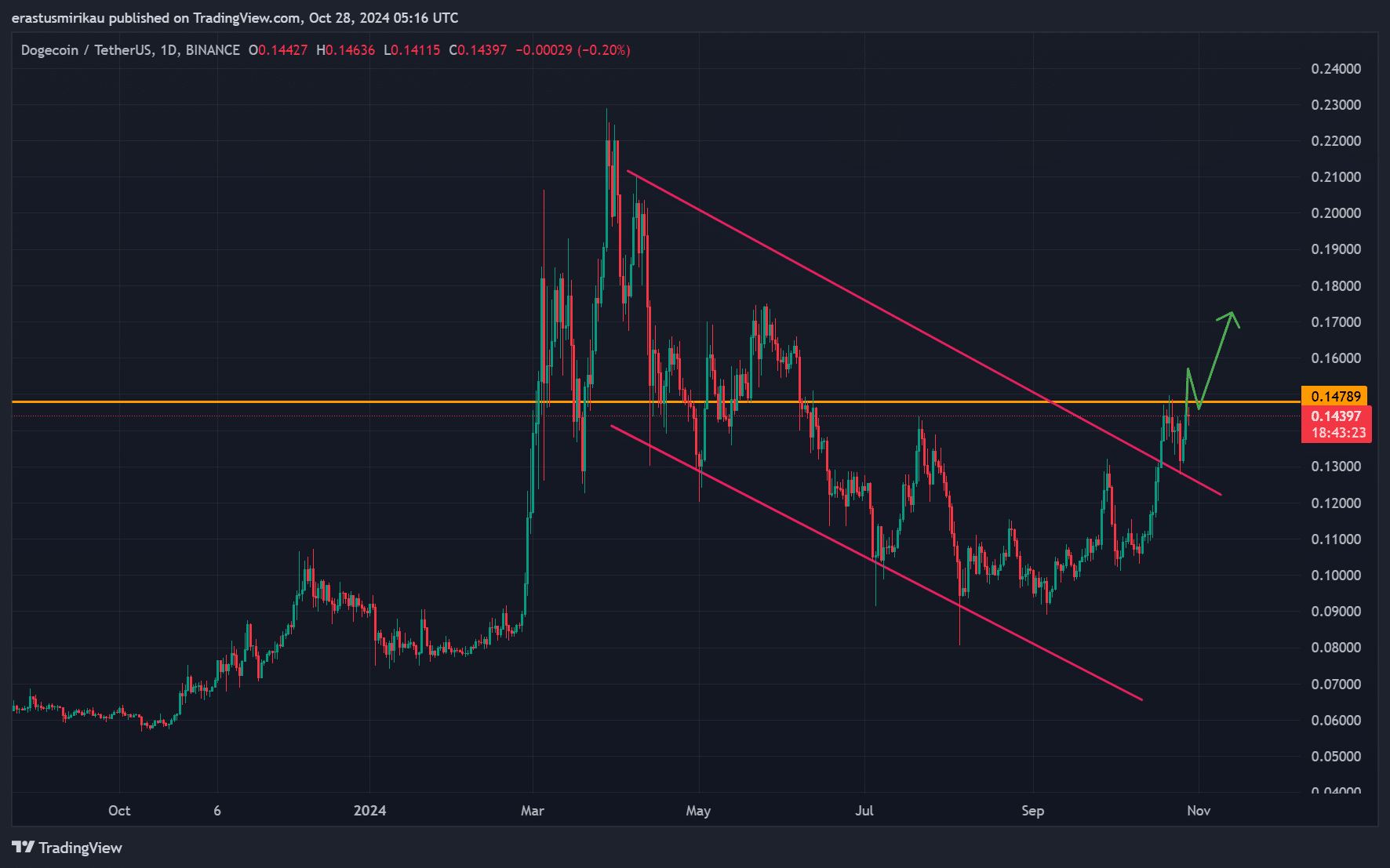

- DOGE broke out of the downward channel, holding support at $0.14789.

- On-chain metrics and rising open interest indicate strong investor interest, indicating potential gains ahead.

Dogecoin [DOGE] It is enjoying a wave of bullish sentiment, fueled by crowd enthusiasm and “smart money” confidence. The recent price action has pushed DOGE out of a long-term downtrend channel, indicating renewed upside potential.

But will this breakout, coupled with its current support at $0.14789, really pave the way for a broader crypto rally?

DOGE exits the channel: key resistance levels to watch

At press time, Dogecoin was trading at $0.1436, showing a 3.99% increase over the past 24 hours. However, DOGE’s breakout from the downward channel remains the key technical development, with the $0.14789 resistance level acting as a critical threshold.

Staying above this level may signal a bullish reversal, paving the way for further gains. If momentum continues to build, the next resistance near $0.17 could serve as a trigger point, which could push DOGE into higher price territory.

Source: Trading View

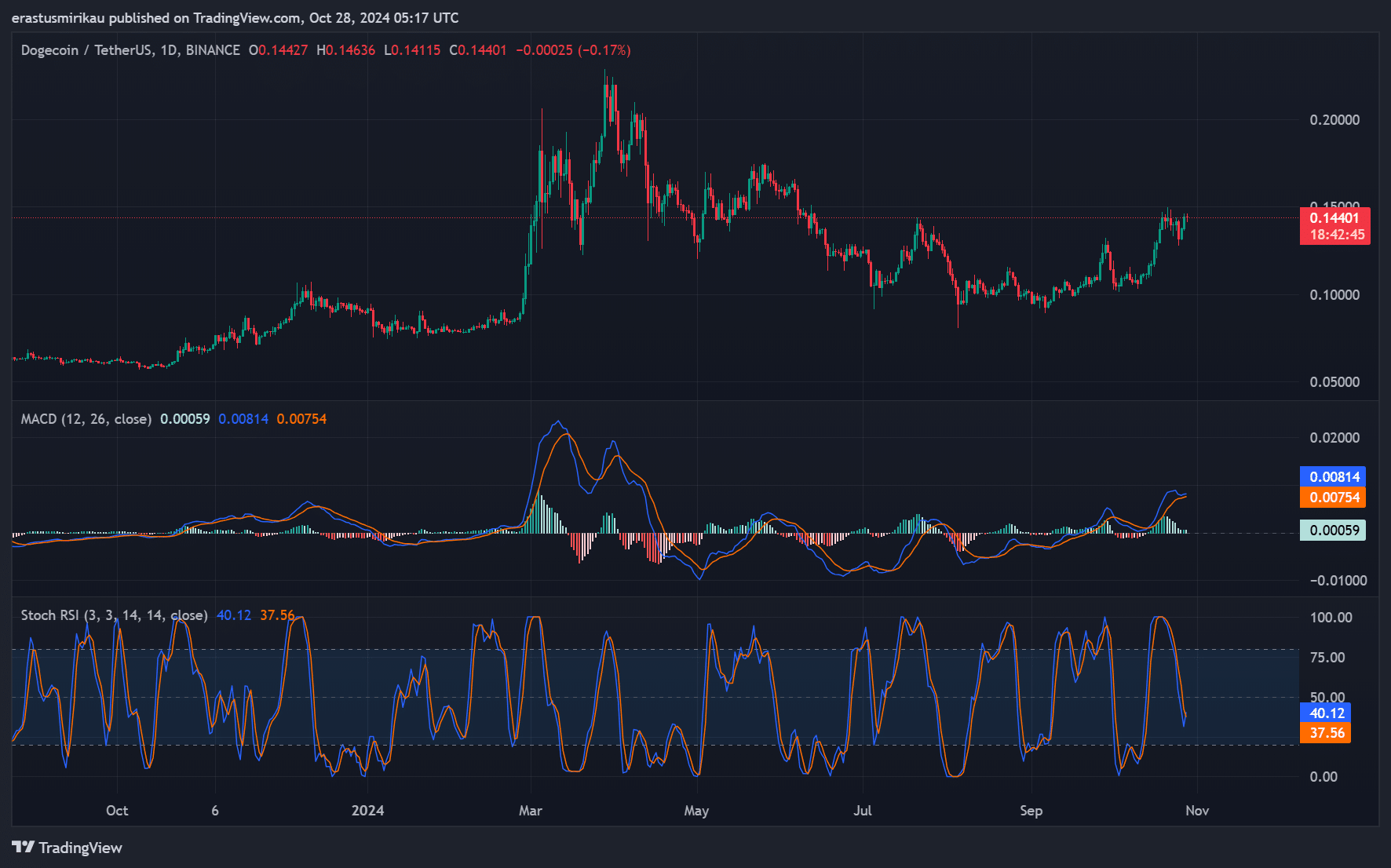

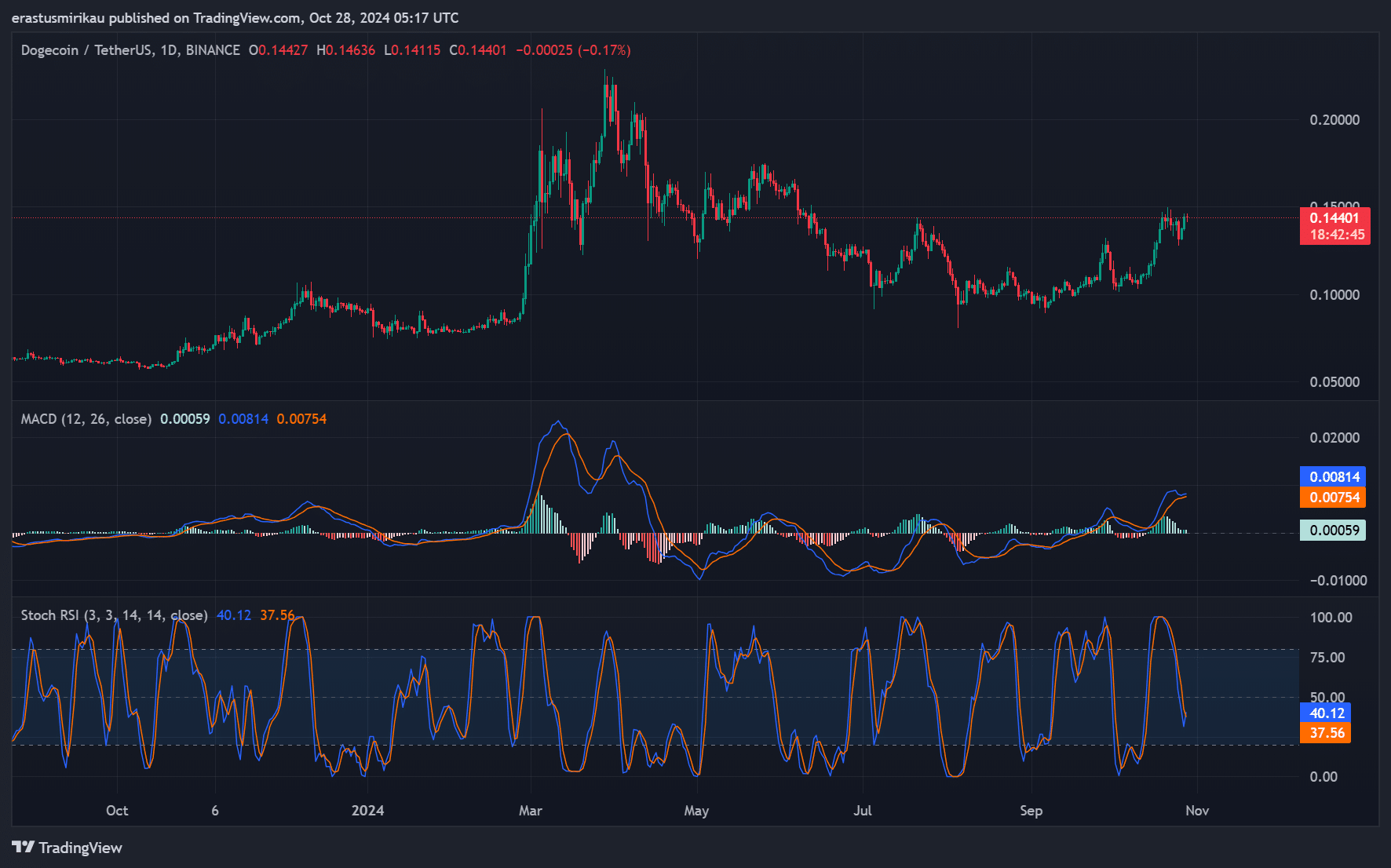

Technical indicators indicate potential momentum

Technical indicators support the continued rise. The MACD (Moving Average Convergence Divergence) indicator is currently showing a slight positive divergence, with the MACD line positioned above the signal line. This setup indicates potential upward momentum.

Meanwhile, the Stochastic RSI, which recently fell below the 40 mark, indicates DOGE moving into the oversold territory. While some correction may occur in the short term, these indicators suggest that underlying sentiment remains optimistic, paving the way for potential gains.

Source: Trading View

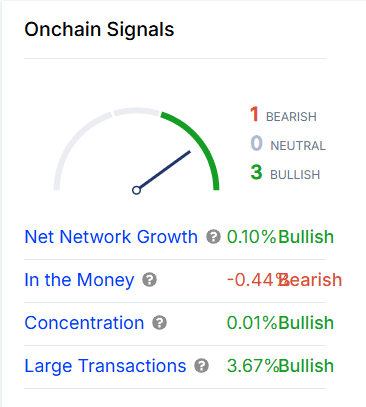

On-chain metrics reveal growing interest from investors

On-chain signals add another layer to Dogecoin’s bullish setup. The network’s net growth of 0.10% reflects a gradual increase in the number of network participants. Furthermore, large transactions increased by 3.67%, indicating increased activity of “whales” or large holders.

Although “In the Money” shows a slight bearish signal at -0.44%, a 0.01% increase in the concentration gauge indicates continued interest from large investors.

Therefore, these metrics indicate positive network health and a growing base of large holders, which may contribute to further price support.

Source: IntoTheBlock

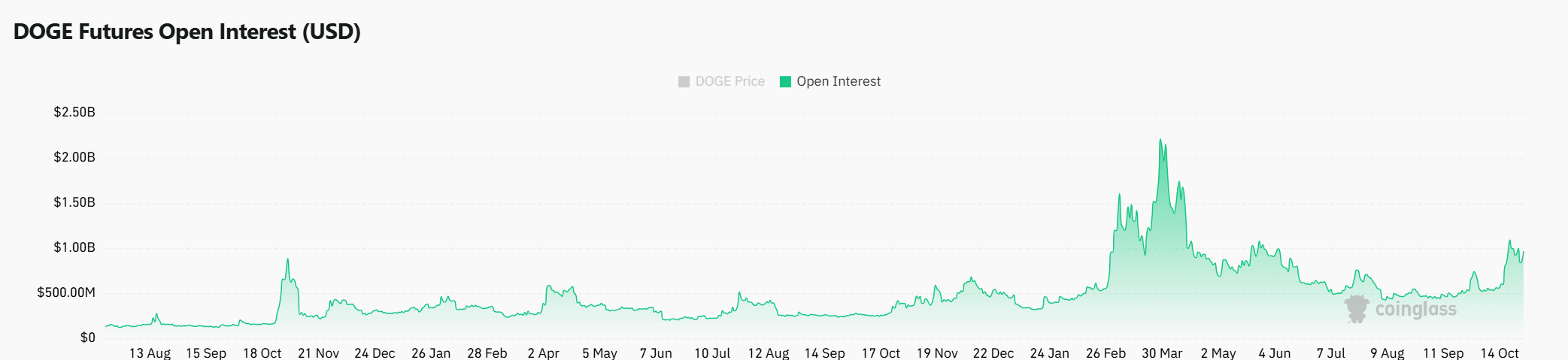

A rise in open interest indicates increased trader activity

Furthermore, open interest in Dogecoin rose by 15.69%, now totaling $988.75 million. This increase indicates a significant spike in speculative activity, likely in response to the hack.

This high level of open interest often indicates increased trader engagement, which can fuel short-term momentum. However, higher open interest can also lead to higher volatility, so investors should be careful.

Source: Coinglas

Read Dogecoin [DOGE] Price forecast: 2024-2025

Dogecoin’s breakout from a downward channel, coupled with strong on-chain data and rising open interest, indicate a promising setup for continued gains. If DOGE can maintain support above the critical level of $0.14789, a broader rally could be on the horizon.

While technical indicators support the bullish outlook, monitoring key support and resistance levels remains essential to assess the durability of this rally.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote