- As of press time, dYdX was the second best performing coin in terms of gains.

- Nearly $1 million worth of DYDX was liquidated at $1.18 on Binance.

dYdX [DYDX] It saw a notable breakout, with gains of over 38% in the past 24 hours. This strong rise has contributed to placing it in second place as the best performing cryptocurrency among the top 100 cryptocurrencies in terms of market capitalization. CoinMarketCap.

With protocol fees mainly distributed to USDC shareholders, dYdX continues to attract attention as the cryptocurrency piles in, especially as the market heads into what is expected to be a bullish final quarter of the year.

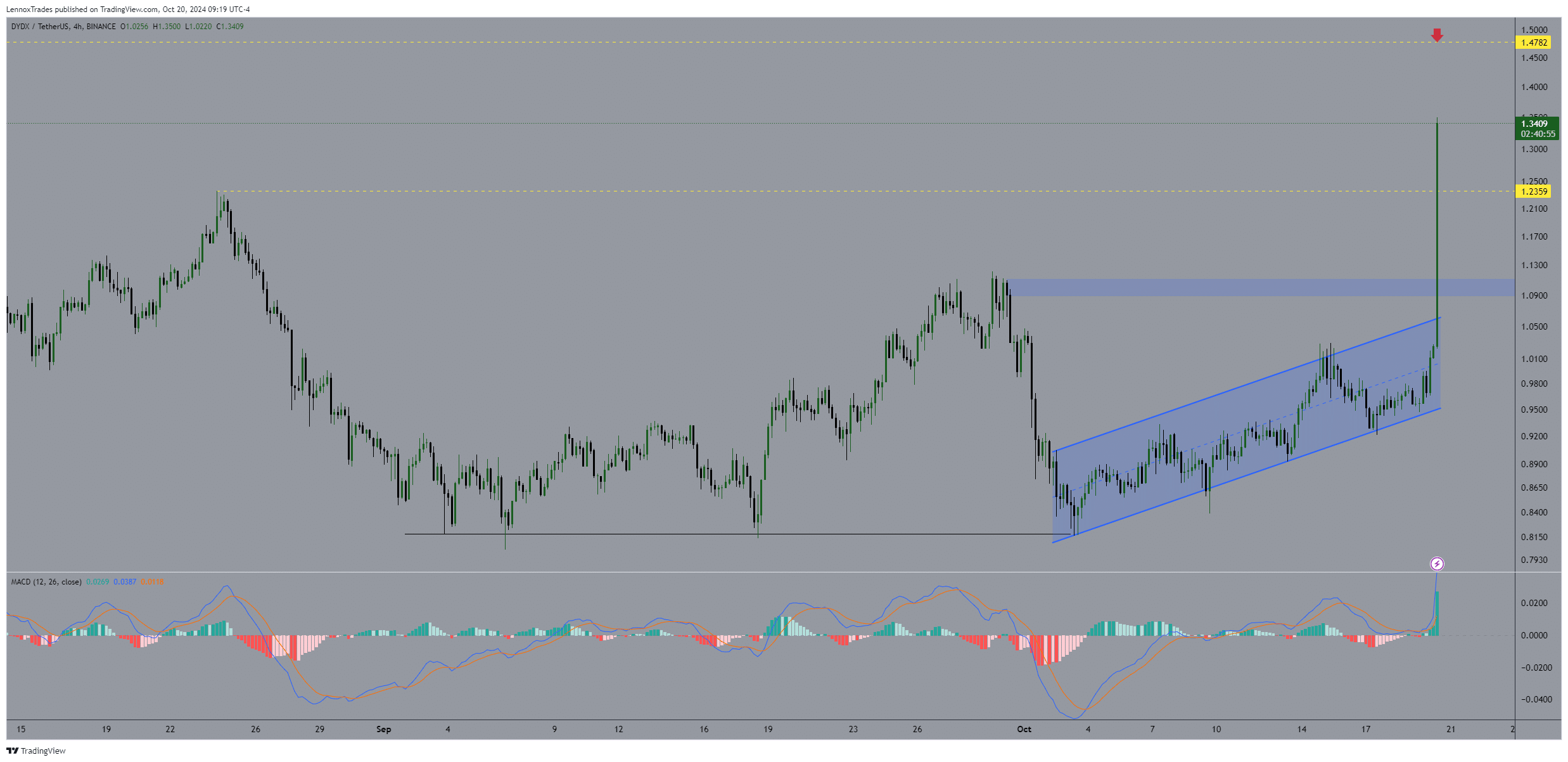

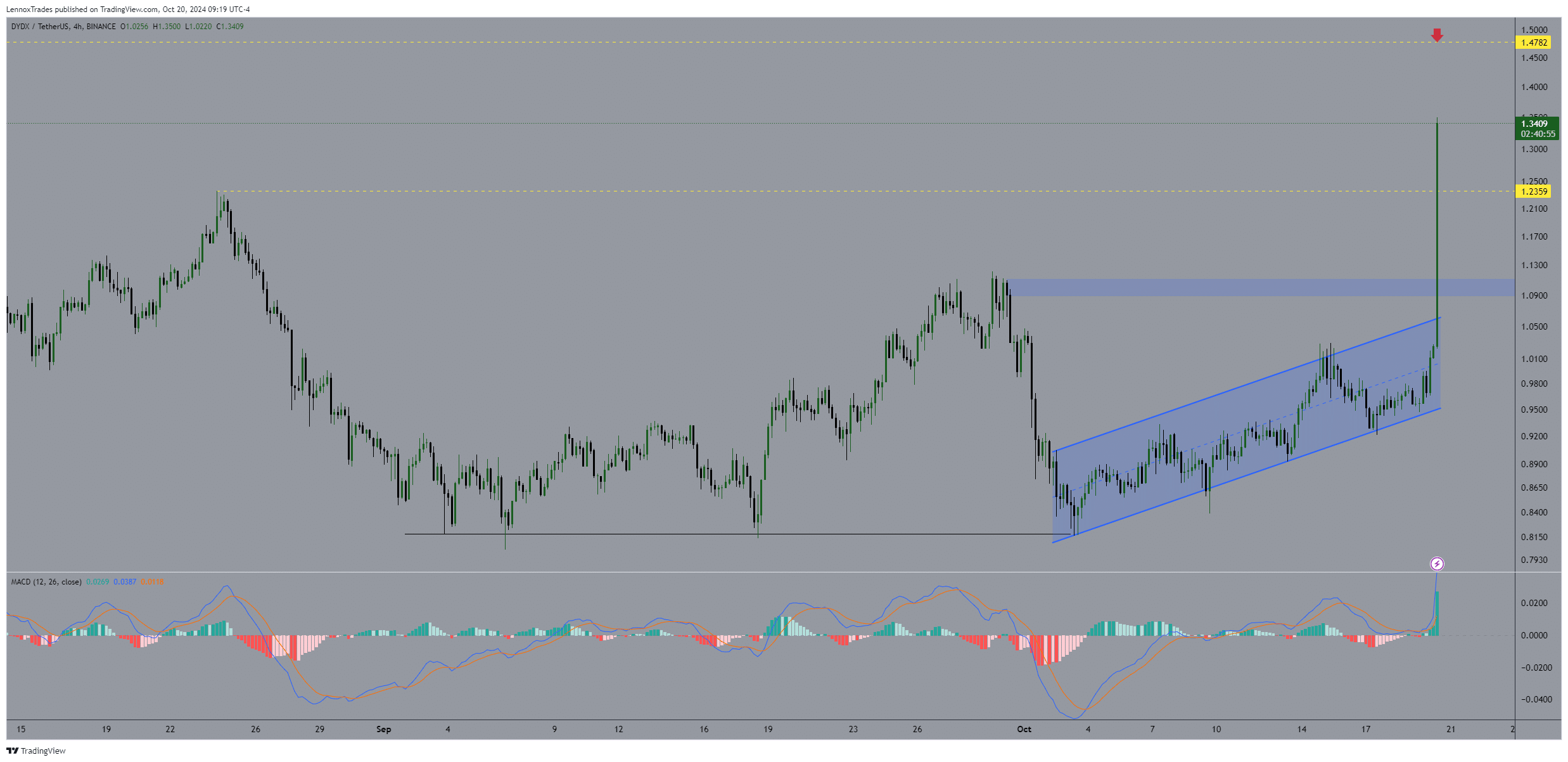

dYdX price action and forecasting

Trading at $1.24 at press time, DYDX saw trading volume increase by more than 892%, reaching nearly $130 million in 24 hours. The volume to market capitalization ratio is 11%, which indicates a high level of liquidity, which reduces the risk of significant price fluctuations in the near term.

In terms of price action, it broke out of the ascending triangle, making impressive gains. The DYDX/USDT pair continues to break through resistance levels, and will likely set its sights on the $2 mark before the end of the month.

While DYDX is still down 48% for the year, today’s breakout could signal a reversal if it can hold above the $1.4 level, paving the way for the $2 target.

Source: Trading View

The $0.83 support level, which has been tested four times without breaking, has proven to be the bottom for this cycle, indicating a potential uptrend leading into 2025. The MACD has also turned higher, supporting a bullish price case.

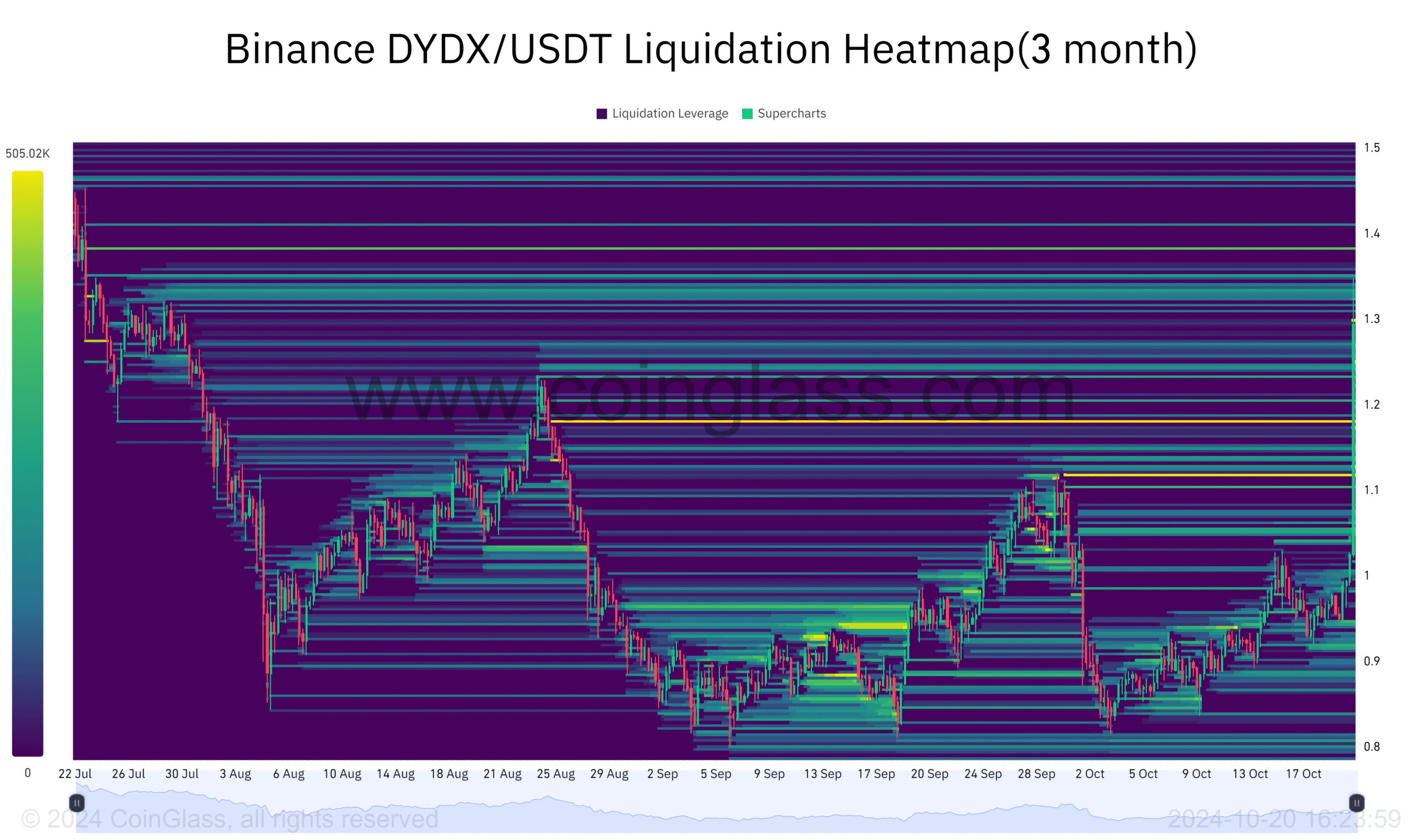

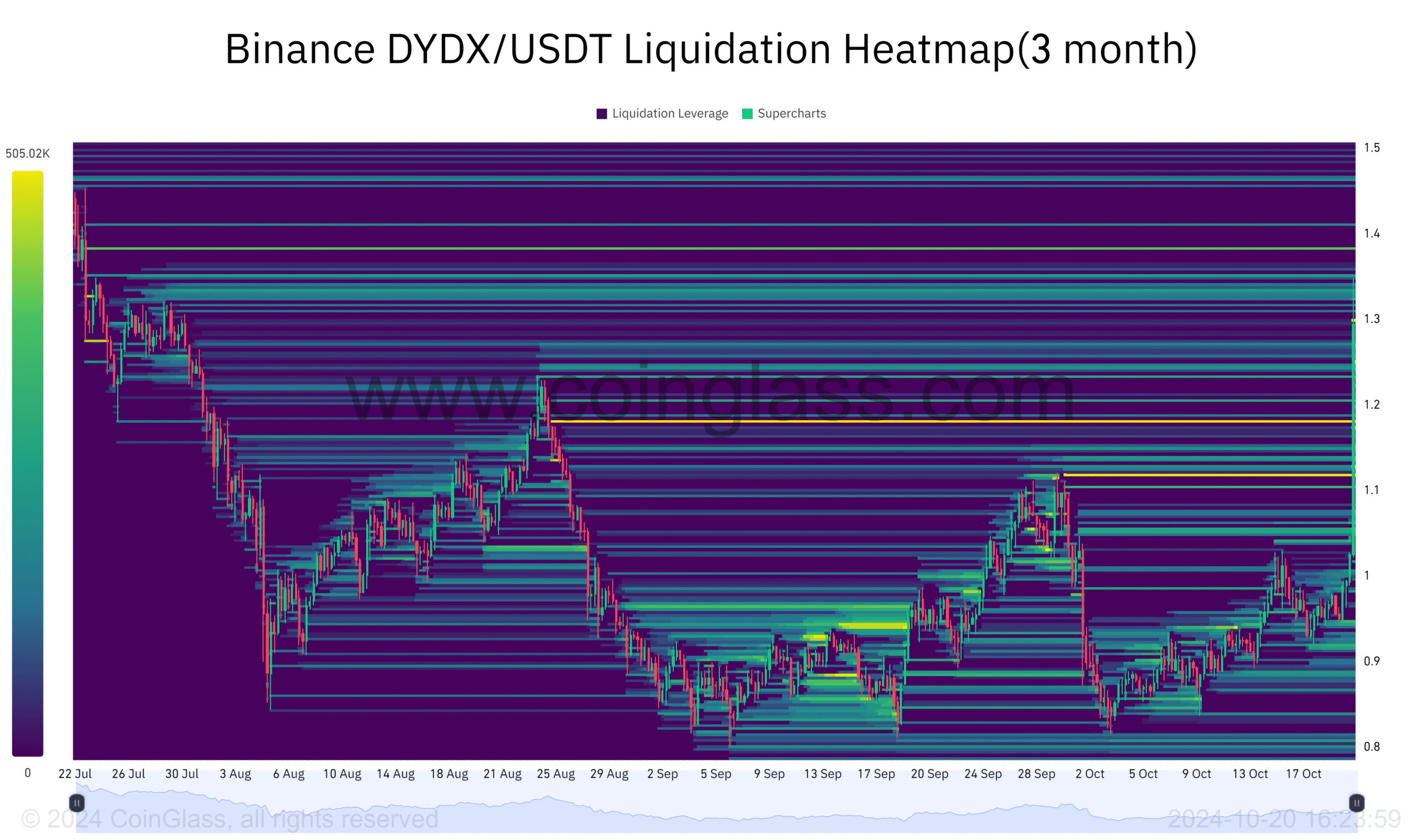

Liquidation and open interests

Additionally, the liquidation heat map shows that DYDX price is moving towards areas of high liquidity, causing significant liquidations.

As of press time, traders have liquidated nearly $1 million worth of DYDX at $1.18 on Binance. The price action of the L1 token is now targeting the $1.3 area for the next liquidation.

As liquidity increases above current levels, the DYDX price is likely to follow, reinforcing the bullish outlook for the end of the year. This makes the $2 target realistic.

Source: Coinglas

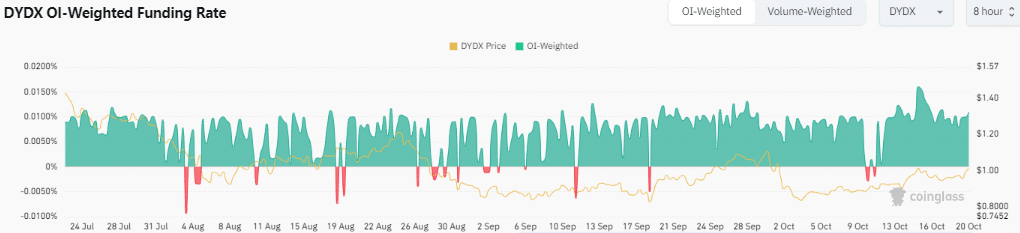

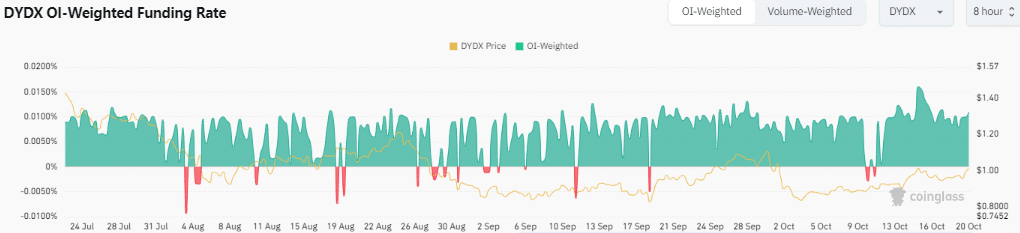

In terms of open interest, the weighted funding rate for OI is 0.0109%, which indicates that long-term traders are pushing short positions.

Realistic or not, here is the market cap of DYDX in BTC terms

This positive rate indicates that token holders are confident about its future, with increasing interest in purchasing and holding the chain’s token.

Source: Coinglas

DYDX is showing strong market momentum, supported by favorable technical indicators and increasing liquidity, making it capable of achieving gains by the end of the year.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote