- Ethereum is showing signs of consolidation amid the ETF noise, indicating the lack of a strong market trend.

- Overall sentiment and technical indicators indicate that the consolidation phase has already begun.

Coming off the highs of spot ETF hype, Ethereum [ETH] The rise seems to be slowing down by the minute. What was a 17% rise last week turned into less than 1% this week. Is the world’s second largest cryptocurrency at risk of consolidation?

Let’s take a look.

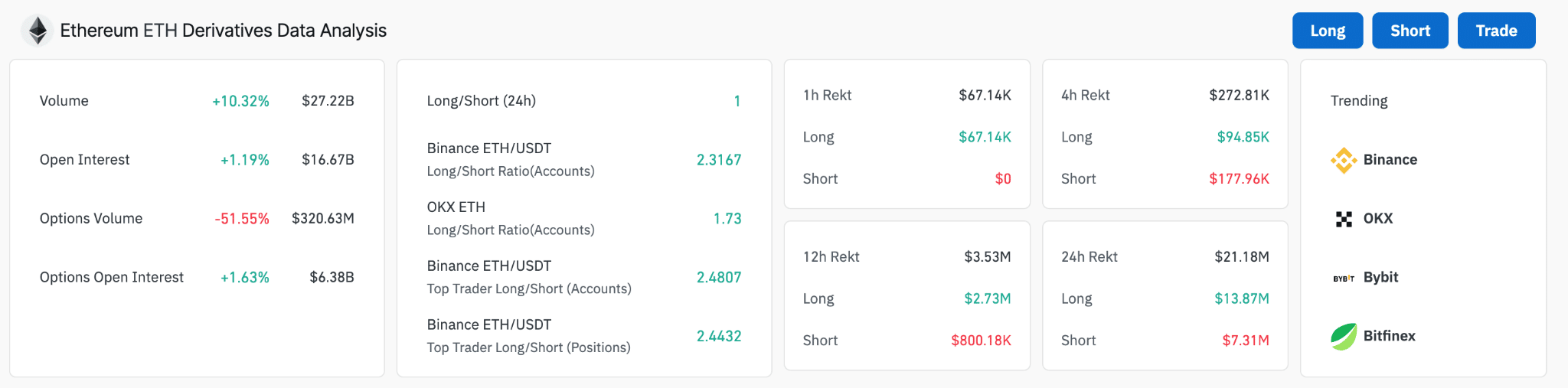

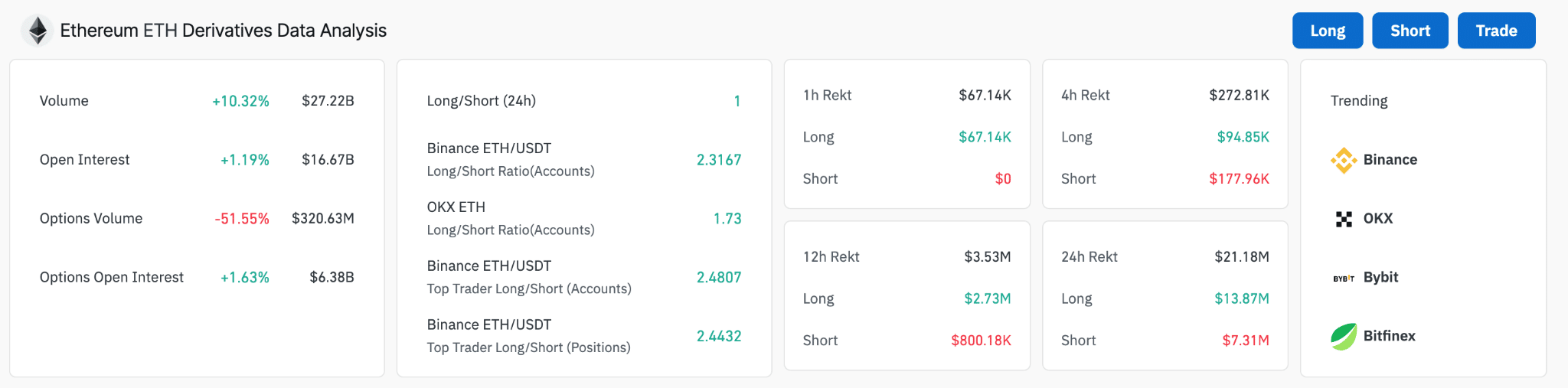

Ethereum derivatives Data It presents mixed sentiment, which may indicate a slowdown in Ethereum’s rise. The increased trading volume of 10.32% and open interest of 1.19% shows that traders are still very active with ETH.

Source: Coinglas

Looking at the long/short ratios, we see the dominance of long positions over short trades, suggesting that despite the slowdown, many traders are still betting on Ethereum’s upside as ETFs prepare to start trading next week.

Source: Coinglas

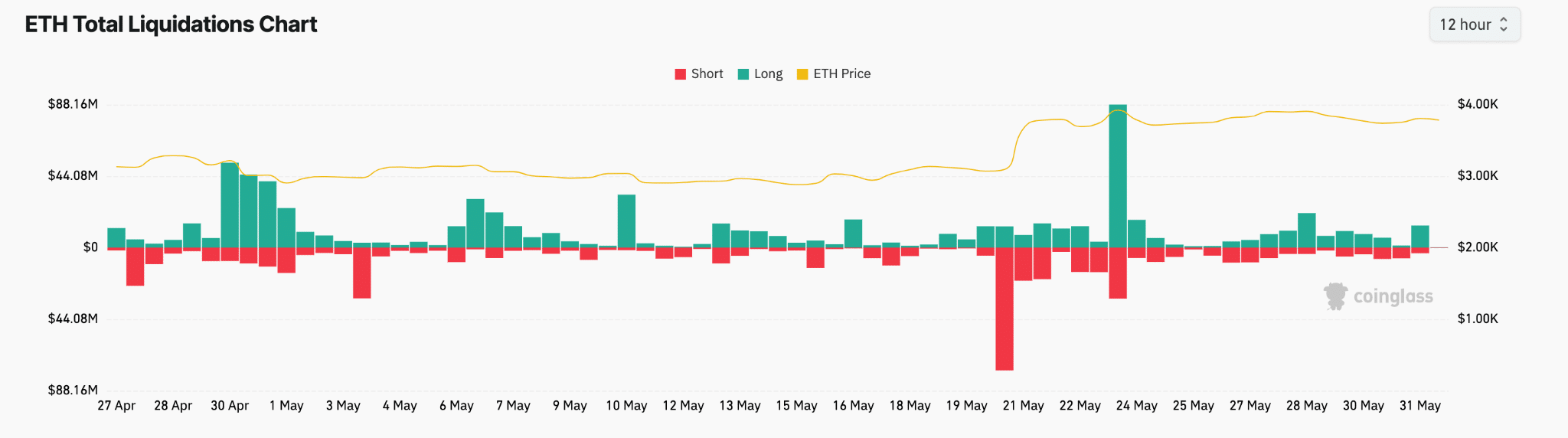

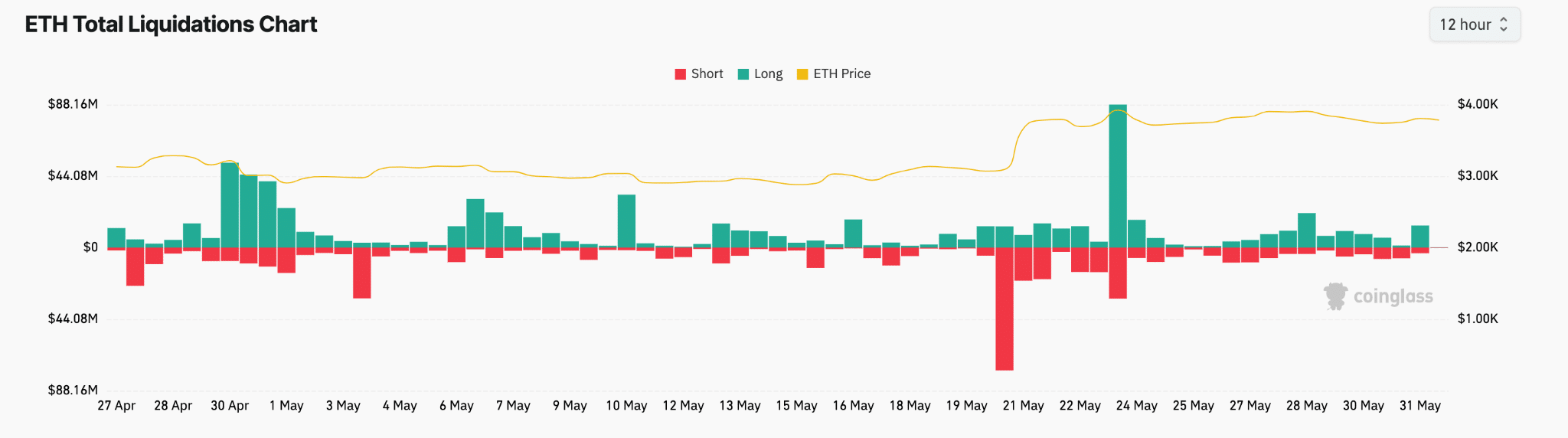

Ethereum’s current liquidation pattern could indicate that despite the prevailing bullish sentiment, Ethereum is facing increasing market caution. This is usually preceded by a short-term consolidation, as we saw from Bitcoin after breaking its all-time highs earlier this year.

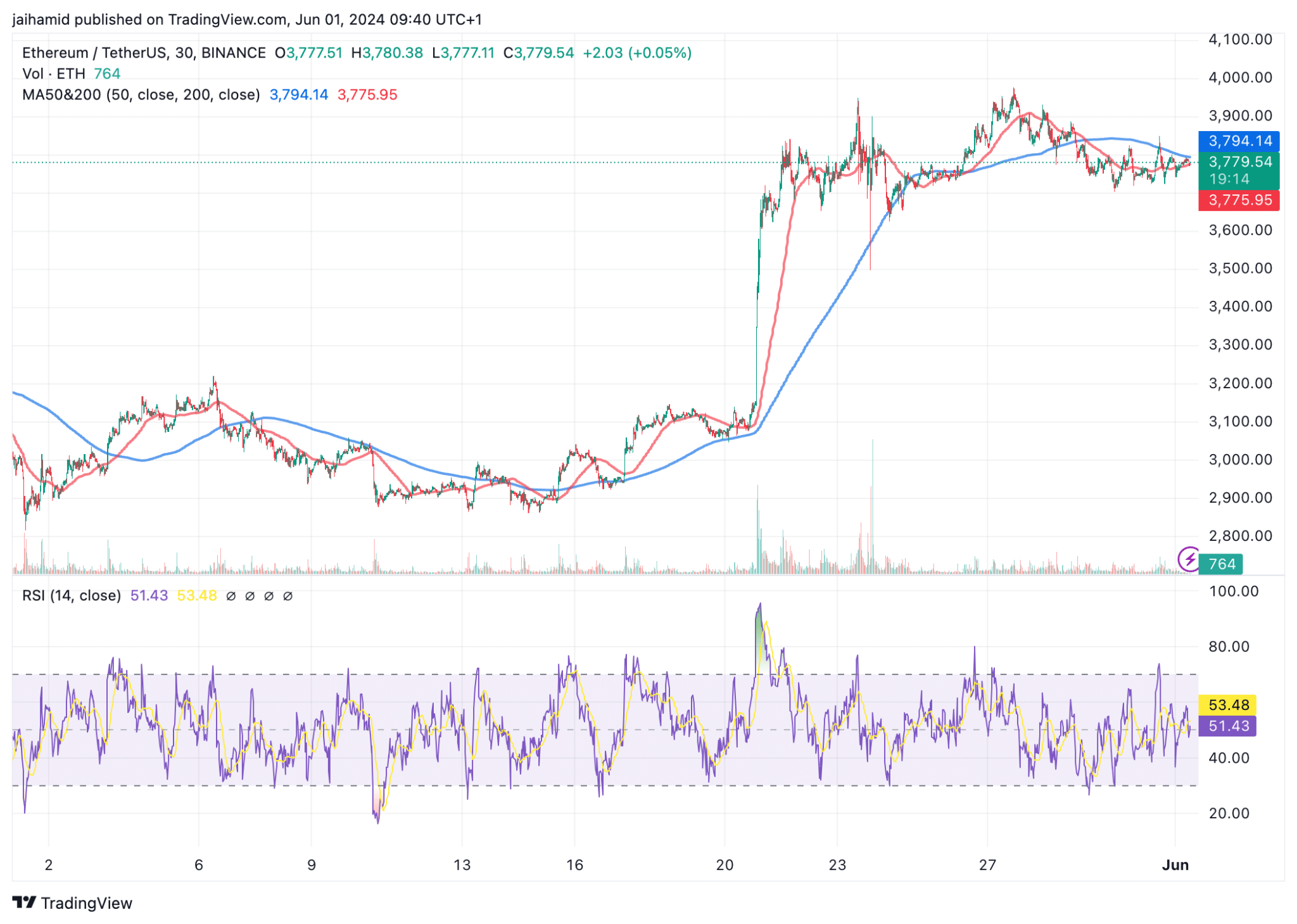

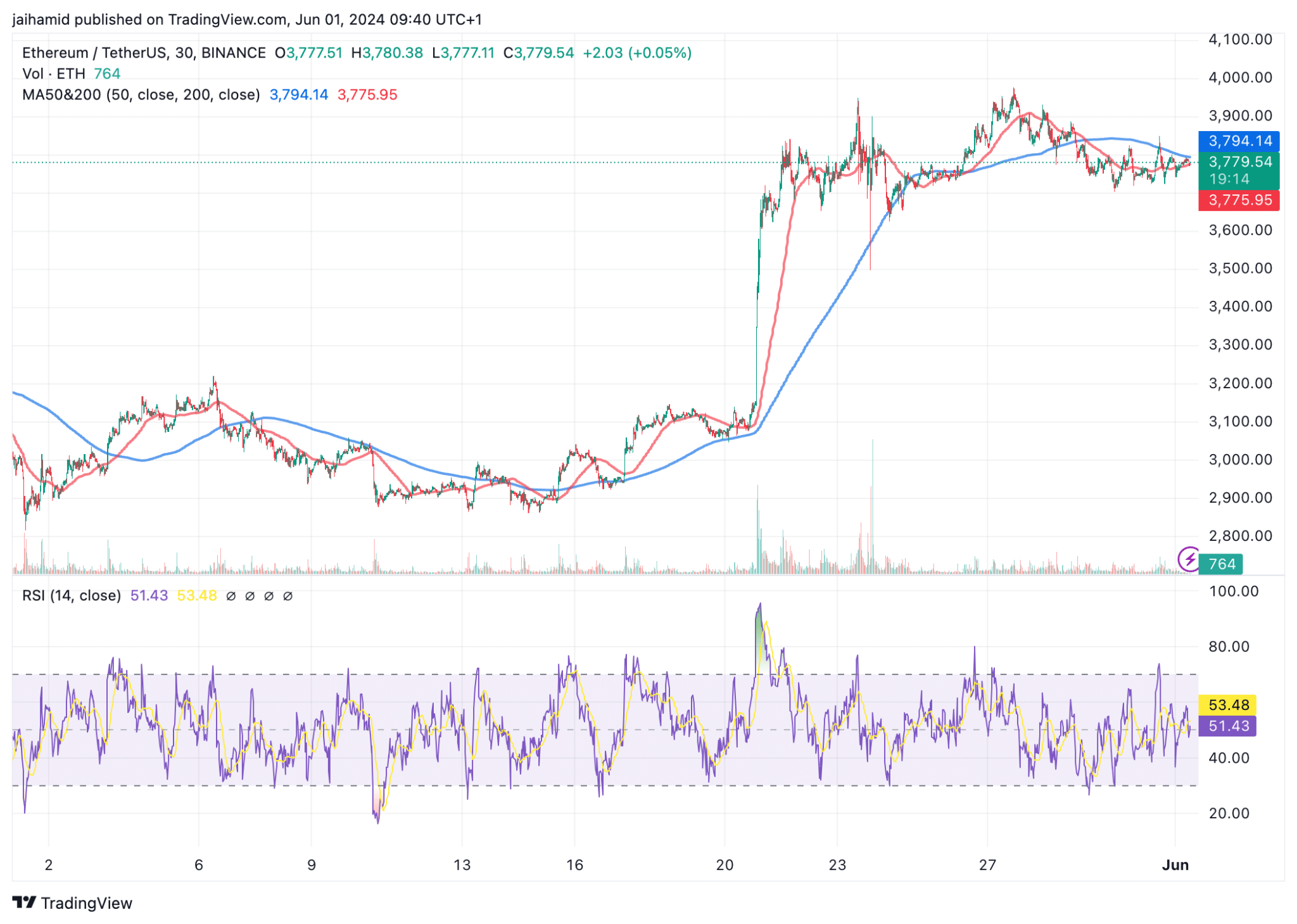

The ETH/USDt chart shows further consolidation coming. After peaking at around $3,980, Ethereum encountered resistance and has since formed a consolidation pattern, generally fluctuating between $3,770 and $3,900.

Source: Trading View

The Relative Strength Index (RSI) is currently reading at 51.43, indicating neutral momentum in line with continued price consolidation.

This does not indicate overbought or oversold conditions, providing no strong bias towards bullish or bearish momentum in the near term.

From a technical analysis perspective, the key support level to watch is around $3,770, which has been marked by several touches over the past few days, preventing further declines.

On the upside, resistance is near $4,000, as Ethereum struggles to sustain upward moves.

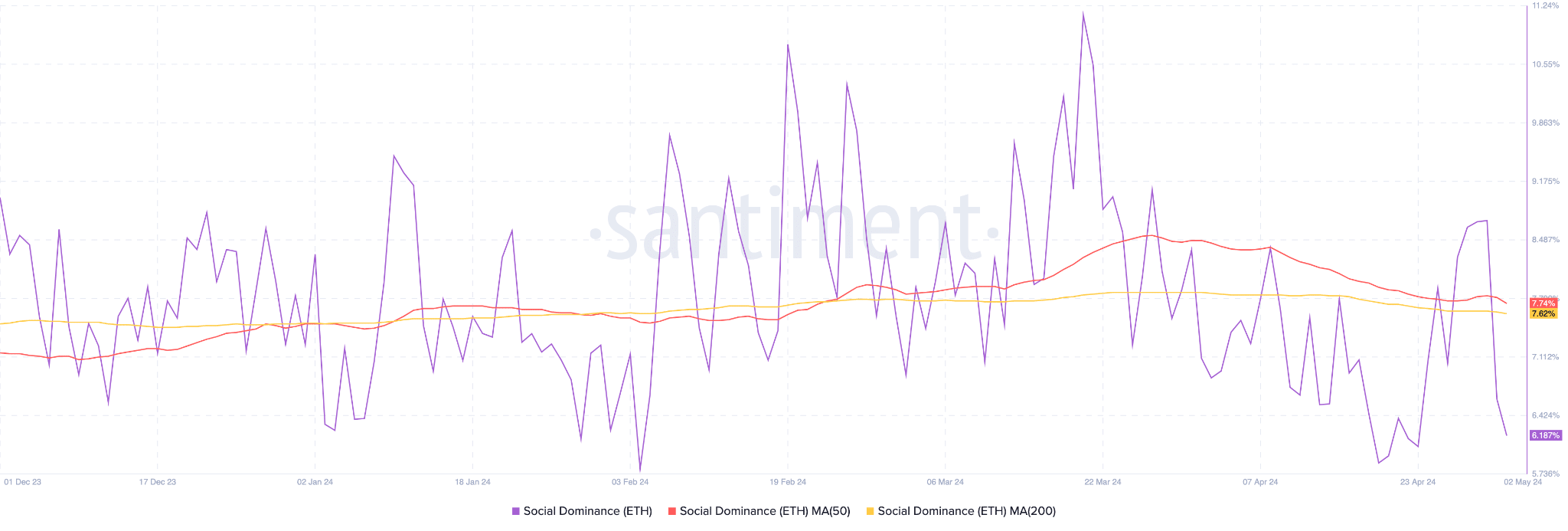

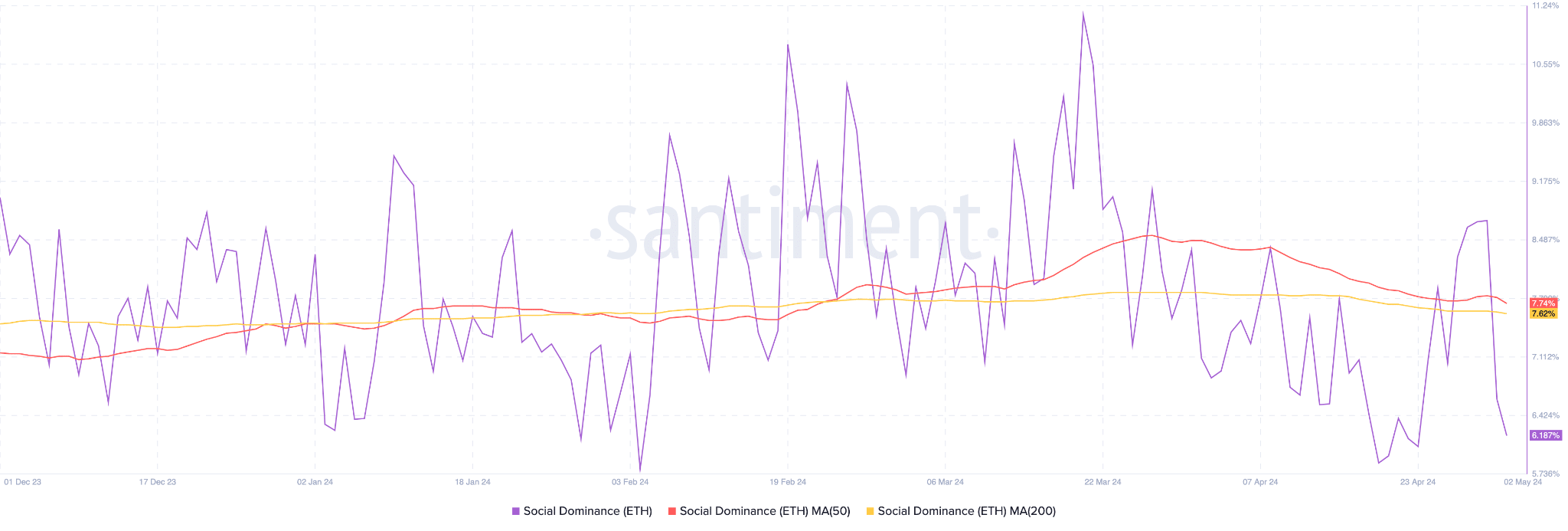

Source: Santiment

Meanwhile, the observed peak in social dominance indicates a recent increase in discussions or interest around Ethereum, which is clearly driven by ETF hype.

Is your wallet green? Check out our Ethereum Profit Calculator

However, the moving averages show a downward trend in the long term, predicting a general decline in the level of interest in Ethereum.

Overall, Ethereum is not at risk of consolidation. It has already been consolidated.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote