(Bloomberg) — Traders paused to catch their breath after optimism about eventual federal interest rate cuts and easing inflation pushed the S&P 500 to a new record high.

Most read from Bloomberg

The rally in big tech companies that lifted the S&P 500 above 5,000 for the first time on Friday appears set to extend, as Amazon.com Inc. And Nvidia Corp. And Tesla Inc. In pre-market trading. Moves beyond those milestones were weak, in futures trading for the S&P 500 and Nasdaq 100, as well as for US Treasuries and the dollar.

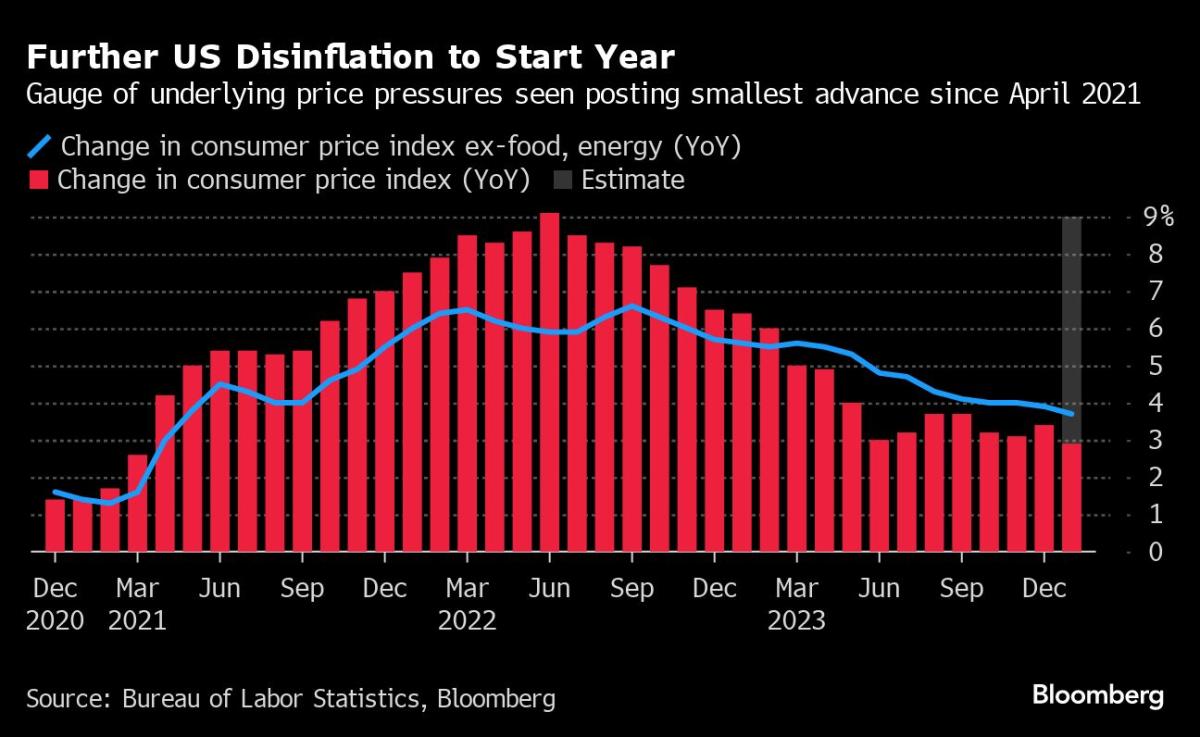

The next pressure point for markets is Tuesday's CPI report. Annual U.S. inflation is expected to fall to 2.9% in January from 3.4% the previous month, according to estimates from economists polled by Bloomberg.

This would be the first reading below 3% since March 2021, supporting the deflationary trend that will determine the scope and timing of interest rate cuts by the Federal Reserve.

“As long as we see this gradual progress tapering, they should be in a position to feel confident in their willingness to cut,” said Pooja Sriram, a US economist at Barclays, referring to Fed policymakers. “It still looks like we're in a place where interest rates are rising, and they could impact the economy and maybe there's room to start tapering them. There's really no reason to keep interest rates at these levels for very long,” she added in an interview with Bloomberg TV.

Swaps markets suggest the Fed will implement just four rate cuts in 2024, down from seven forecast at the end of last year, and only slightly more than the three that policymakers expected.

“Market pricing is trying to encourage central banks to go ahead and start lowering interest rates. The market has arguably been overly encouraging recently,” Ian Steele, chief investment officer for international fixed income at JPMorgan Asset Management, wrote in a note to clients. “Employment has remained strong, purchasing manager surveys are good and economic growth is strong.”

The yen held steady near its lowest levels in two months, which it reached on Friday after comments from central bank governors that the Bank of Japan would take its time raising interest rates. The Japanese currency has weakened against all its G10 peers this year.

Most prominent companies

-

Shares of Italian luxury brand Tod SpA rose as much as 18% after the founding family said it had hired buyout firm L Catterton in a new attempt to take the company private.

-

Diamondback Energy Inc. to an agreement to buy fellow Texas oil and gas producer Endeavor Energy in a $26 billion deal that would create the largest pure-play operator in the prolific Permian Basin.

-

Shares of PepsiCo rose after the beverage and snacks company was upgraded to buy from neutral at Citi, which said lower expectations for organic sales growth had created a “good setup.”

Main events this week:

-

Consumer price index in India, Monday

-

Minneapolis Fed President Neel Kashkari, Fed Governor Michel Bowman, and Fed Chairman Tom Barkin speak on Monday

-

ECB Executive Board member Piero Cipollone and chief economist Philip Lane speak on Monday

-

US Consumer Price Index, Tuesday

-

Unemployment in the UK, Tuesday

-

Producer prices in Japan, Tuesday

-

UK inflation, Wednesday

-

Eurozone GDP, industrial production, Wednesday

-

Presidential elections in Indonesia, Wednesday

-

Bank of England Governor Andrew Bailey speaks on Wednesday

-

ECB Governing Council member Boris Vujčić and ECB Vice President Luis de Guindos speak

-

Chicago Fed President Austin Goolsbee speaks on Wednesday

-

Jobs australia thursday

-

Japanese GDP, Thursday

-

UK GDP, Thursday

-

US Initial Jobless Claims, Retail Sales, Thursday

-

Central Bank of the Philippines meeting on interest rates, Thursday

-

European Central Bank President Christine Lagarde speaks on Thursday

-

Federal Reserve Governor Christopher Waller speaks Thursday

-

Bank of England policymakers Catherine Mann and Megan Green speak on Thursday

-

US housing construction begins, producer prices, Friday

-

San Francisco Fed President Mary Daly and Fed Vice Chairman for Supervision Michael Barr speak Friday

Some key movements in the markets:

Stores

-

S&P 500 futures were little changed as of 7:10 a.m. New York time

-

Nasdaq 100 futures were little changed

-

Dow Jones Industrial Average futures were little changed

-

The Stoxx Europe 600 index rose 0.3%.

-

The MSCI World Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro fell 0.1 percent to $1.0769

-

There was little change in the pound sterling at $1.2616

-

The Japanese yen rose 0.2% to 149.00 to the dollar

Digital currencies

-

Bitcoin fell 0.4% to $47,926.7

-

Ethereum fell 0.7% to $2,487.5

Bonds

-

The 10-year Treasury yield fell 2 basis points to 4.15%.

-

The yield on 10-year German bonds fell by four basis points to 2.34%.

-

The yield on British 10-year bonds fell by five basis points to 4.04%.

Goods

This story was produced with assistance from Bloomberg Automation.

–With assistance from Robert Brand, Sagarika Jaisinghani, and Richard Henderson.

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote