The 3, 5 and 20 percent fees at the bottom of your menu may be here to stay. With little time left, a new law will allow restaurants and bars to continue charging service fees, health care costs and other surcharges when they’re clearly listed for diners to see. The practice is set to be banned starting Monday.

on saturday, governor Gavin Newsom Signed Senate Bill 1524, an emergency measure to exempt California food and beverage vendors from… Senate Bill 478 — Law Which goes into effect in July and targets ticket sellers, hotel and travel sites and other companies that charge “hidden” or “unsolicited” fees.

Before Newsom signs Draft Law No. 1524which was submitted In early June, Restaurants and bars were included among the affected businesses, and Attorney General Rob Bonta advised food and beverage vendors to include these fees in their listed menu prices to avoid the possibility of legal action.

“These deceptive fees prevent us from knowing how much we will be charged to begin with,” the Attorney General, who co-sponsored Bill 478, said in a statement issued the day it was signed. Bonta could not be reached for comment regarding the exemptions allowed by SB 1524.

Many service industry business operators have been vocal against SB 478, which passed in October. They said they feared that list prices would be raised during A turbulent year marked by closures and inflation It will cost them more customers and support. Several restaurant owners told the Los Angeles Times that reviewing or completely overhauling the tipping and surcharge system could result in the loss of employee benefits or outright closure. SB 1524’s rules allowing such surcharges could affect tens of thousands of restaurants across the state.

Read more: The dire state of the restaurant industry: “We can’t be open.” We can’t stay closed.

“We are more organized than any other business, and we are struggling to survive in the broken system that has been handed to us for so many decades,” said Eddie Navarrete, co-founder of the Independent Hospitality Alliance. Restaurant advocacy group. “When you add more regulations, whatever they are, it makes things more difficult. Things are already difficult… There’s an exodus of our small restaurant community. I think it’s a huge relief to have one less thing thrown at them now.”

Navarrete spent weeks campaigning for the passage of SB 1524, writing letters, meeting with more than 35 policy advisors, legislators or their representatives, knocking on doors at the state Capitol, and explaining the use of service charges within the restaurant industry, whose employees rely on the information. The profits make it different from most areas that would be affected by SB 478.

Surcharges, health fees and service charges are regularly used within the industry to stabilize wages across dining rooms and kitchens — where servers often receive tips but cooks and dishwashers do not — and to help offset the cost of benefits like health care. Companies with larger service fees, such as 18% or 20%, often notice that tips are not expected.

“It’s puzzling why restaurants claim they need to do things differently, because it’s as if they’re saying they need to do things differently,” said Jane Engstrom, executive director of the California chapter of the Public Interest Research Group (CALPIRG), a nonprofit organization that advocates for consumer interests and protections. “Hiding the cost of their food from us, that doesn’t seem right.”

“It feels like you’re being scammed,” she said. “And that’s what it feels like: They’re trying to scam you.”

Read more: Restaurants may be able to keep the service charge if the menu displays the charge.

Some local restaurants have Criticism Because of accusations of abuse of service fees or other surcharges, though several chefs and restaurateurs told the New York Times that such “bad actors” are few and far between.

“Every restaurateur I know who cares about this industry is using it in a very appropriate, responsible, progressive way, and if it were to disappear, it would be really detrimental to everyone,” Ryan Bailey, owner of Kato, told The Times earlier this year.

The new bill, which passed unanimously in the General Assembly and Senate in late June, was written by Sen. Bill Dodd (D-Napa) — who also co-wrote Senate Bill 478 — as well as Sen. Scott Wiener (D-Napa). San Francisco) and Assemblymembers Matt Haney (D-San Francisco), Jesse Gabriel (D-Encino) and Cecilia Aguiar-Curry (D-Winters).

This campaign is supported by the California Restaurant Association and the labor union Unite Here, both of which represent thousands of California hospitality workers.

“Bill 1524 will allow restaurants to continue to support increased pay equity and contribute to worker health and other employee benefits,” Matthew Sutton of the California Restaurant Association said in a statement. “And importantly, consumers will still be able to make informed choices about where they choose to eat.”

While some restaurant and bar owners are breathing a sigh of relief that service charges will continue, others are frustrated by the rapid change in their policy.

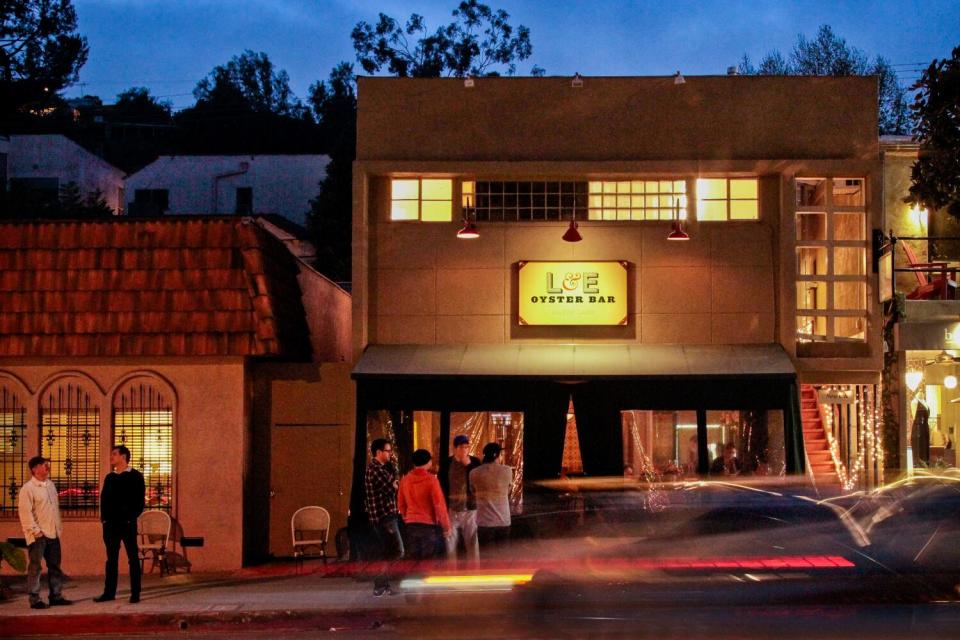

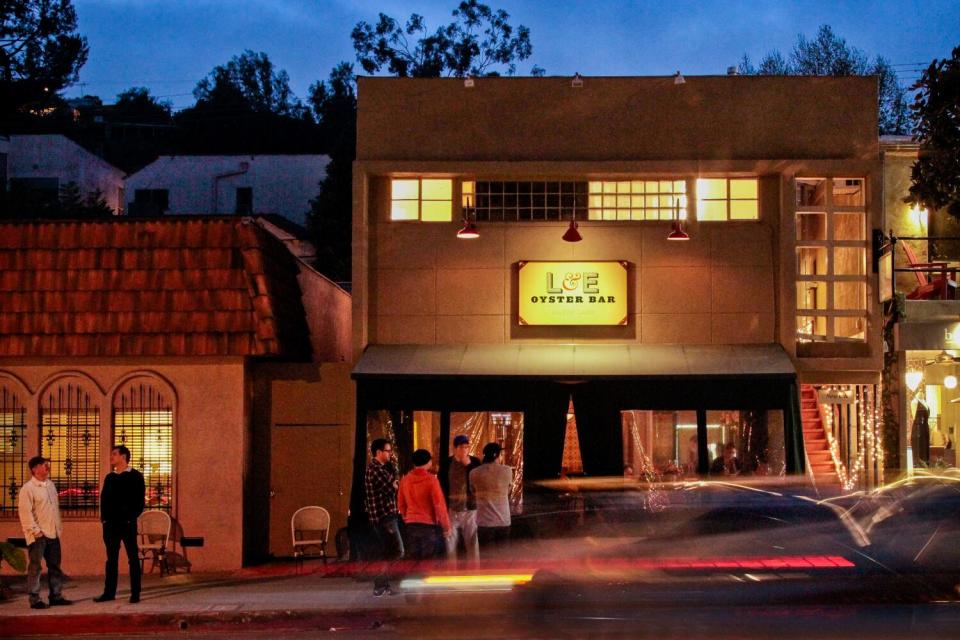

Following the Attorney General’s guidance on SB 478, in April restaurateur Dustin Lancaster An additional 4% charge has been added to the menu price for food For two of his Los Angeles restaurants, L&E Oyster Bar and El Condor, he said SB 1524 would not force him to return to a service charge model, at least for the foreseeable future, and that it was “not very easy to take the cake out of the oven.”

“This is, unfortunately, all-too-familiar territory for restaurants in California,” Lancaster told the Los Angeles Times this week. “Just like with the coronavirus, they’re harassing us and expecting us to change our model repeatedly as if it’s no big deal for small businesses. Restaurants continue to close.” [at] “An alarming rate in Los Angeles, and this kind of unnecessary change is why California remains the least friendly state for small businesses in America.”

At Bell’s, a Michelin-starred restaurant in Los Alamos, Santa Barbara County, the owners tracked the progress of state Senate bills and waited for final word before deciding whether to eliminate the 20% service charge, which benefits all non-management employees.

Even before SB 1524 passed, Bell’s listed the fees on its lunch and dinner menus, on its frequently asked questions web page, and in the section of its home page on take-out orders. The new law will allow the restaurant to continue its practices without reshaping its business model.

Greg Ryan, owner of Bells, He told the Times That he listened to and understood customers, lawmakers, and his team, and that he wanted to do what was best for his employees.

For several months, this practice seemed like a balancing act.

As SB 1524 made its way through the California Assembly and Senate, outcry on social media and in public forums like Reddit was swift and vocal, with many anonymous posters commenting that in retaliation for the exemption, they would stop leaving tips. Another Reddit user created Spreadsheet Which tracks surcharges and service charges at restaurants across the state.

Read more: “Do you think tipping culture is out of control?” Inside our evolving tipping dilemma

One Los Angeles restaurant owner, speaking anonymously for fear of retaliation from customers, told The Times they saw tips increase by $1, 0%, or other low amounts over the course of the month, perhaps in response to the $3-4 service charge. % that their restaurant was charging.

“I couldn’t be more thrilled,” CALPIRG’s Engstrom said of SB 1524. I think it would have been better if restaurants and bars also had clear prices upfront, so consumers could shop easily. “When I decide to go to a restaurant with my family, I check the prices first, on the menu, online.”

Senate Bill 1524 requires fees to be clearly posted, but it’s not as robust as Senate Bill 478 with the attorney general’s initial guidance that called for service fees to be incorporated into listed prices, she said. Engstrom called Senate Bill 478 “a great model bill,” saying she would love to see similar consumer protection legislation in other states, or at the federal level — without as many exceptions for industries, regardless of how service fees impact their business plans.

“I suspect [SB 1524] “It’s unfortunately a step backwards, but it’s still clear, you can still see it; you just have to do the math,” she added.

This story originally appeared in Los Angeles Times.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote