It is already clear that the Fed is ready to raise interest rates by a quarter point this month, as it looks to make borrowing more expensive in an effort to cool the economy.

The head of the central bank, Jerome Powell, explained this week.

But the February employment data released on Friday will inform policy makers as they discuss plans to shrink the central bank’s balance sheet (something that could further derail the economy) and as they make estimates of how quickly interest rates will increase in the months. Before.

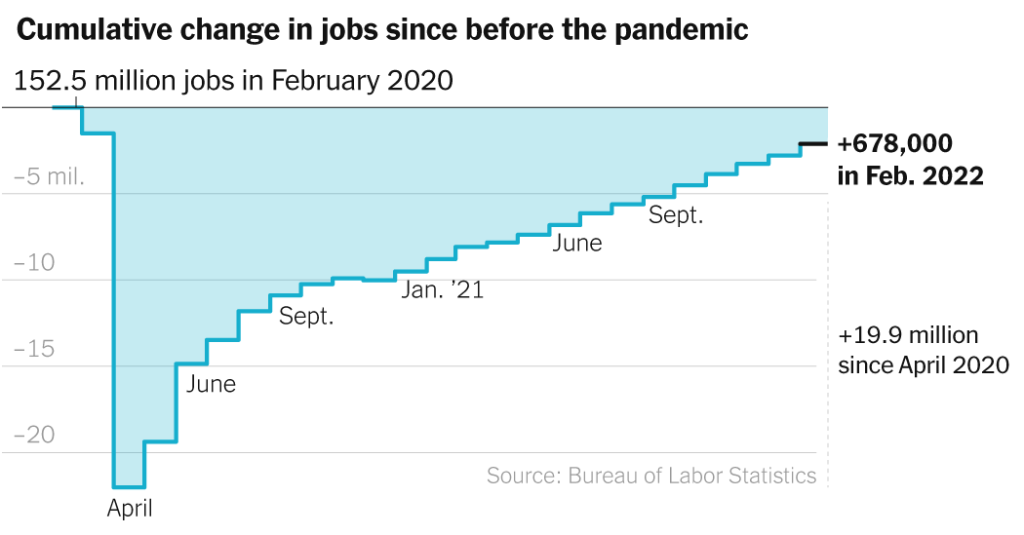

The latest employment report showed that the economy added 678,000 jobs last month. But more importantly, from the Federal Reserve’s point of view, it showed unemployment fell to 3.8 percent, workers joined the workforce and wage growth stabilized after a series of rapid increases.

The data reaffirms that the labor market is vibrant, and may also reduce concern that the nation is at the beginning of an inflationary spiral in which wage and price increases are steadily pushing each other upward.

That could affect how officials think about interest rate expectations in the coming months and years. The Federal Reserve will release forecasts in its quarterly report Economic Outlook Summary Combined with its March policy decision, and given that an interest rate hike is already expected, these policy expectations are likely to take center stage.

The Russian invasion of Ukraine has made the path ahead more uncertain, so the economic forecast will be more of a rough blueprint than a hard plan. But for now, the economy is looking strong — and officials are likely to expect a series of policy changes in 2022 and into 2023.

But the numbers may give the Fed a little more breathing room to withdraw support steadily, but not frantically. As jobs proved plentiful and workers difficult to find, wages began to rise rapidly, attracting the attention of the Federal Reserve. Rapid wage gains made it more likely that labor costs would start to rise in prices, making them last longer.

“The important thing that we don’t want is for inflation to become entrenched and self-sustaining,” Powell said during his testimony to Congress this week. “That’s why we are moving forward with our program to raise interest rates and control inflation.”

The report released on Friday is just one number and the data is reviewed regularly, but the new numbers may ease pressure on the margins. Average hourly wages rose 5.1 percent in the year to February, well short of the 5.8 percent gain economists had expected. On a monthly basis, the salary is not collected at all.

The annual gains remain a solid pace of wage increases for American workers — hourly earnings rose 2 to 3 percent in the years leading up to the pandemic — but if wage gains continue to moderate, they could strike central banks as more sustainable.

This is especially true because the slowdown came with an increase in the percentage of people working or looking for work, and with more hours worked per week, indicating that employers are able to find a more willing supply of labor. With more workers available, the economy may be able to produce more and grow more quickly without overheating.

Federal Reserve officials indicated that they will closely monitor this employment report, which is the last one they will have before the meeting.

Fed Governor Chris Waller said late last month that he could support a strong start to the Fed’s rate hike if inflation reports and the February jobs report “show that the economy is still running very hot”.

Mr. Powell appears to have dropped the idea of a massive rate hike in March, but Mr Waller’s focus has shown how much each new data point can help confirm – or complicate – how central bankers understand the economy at a critical moment.

But officials will have to weigh the latest numbers with what is happening in Ukraine. It is not clear, at this point, how this might affect the future course of policy, because the war raises gas prices but may affect consumer spending.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote