- At the time of writing, Litecoin was among the biggest gainers over the past 24 hours.

- LTC respects the trend line because it dominates payments via cryptocurrencies.

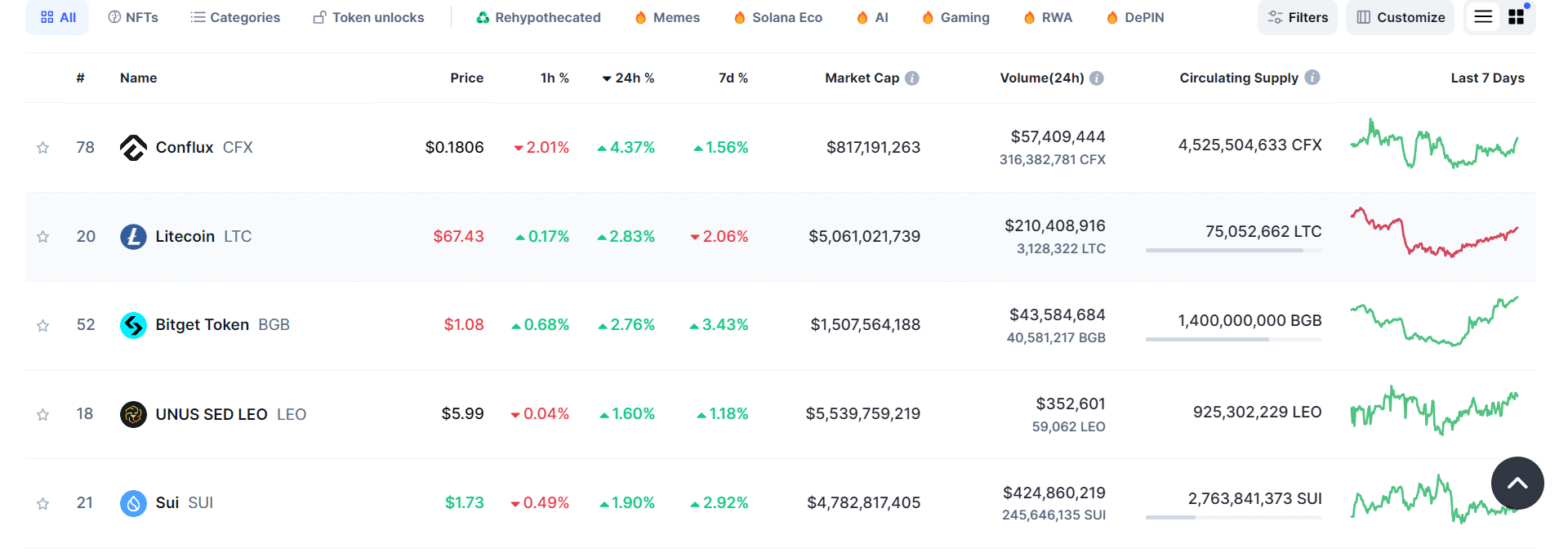

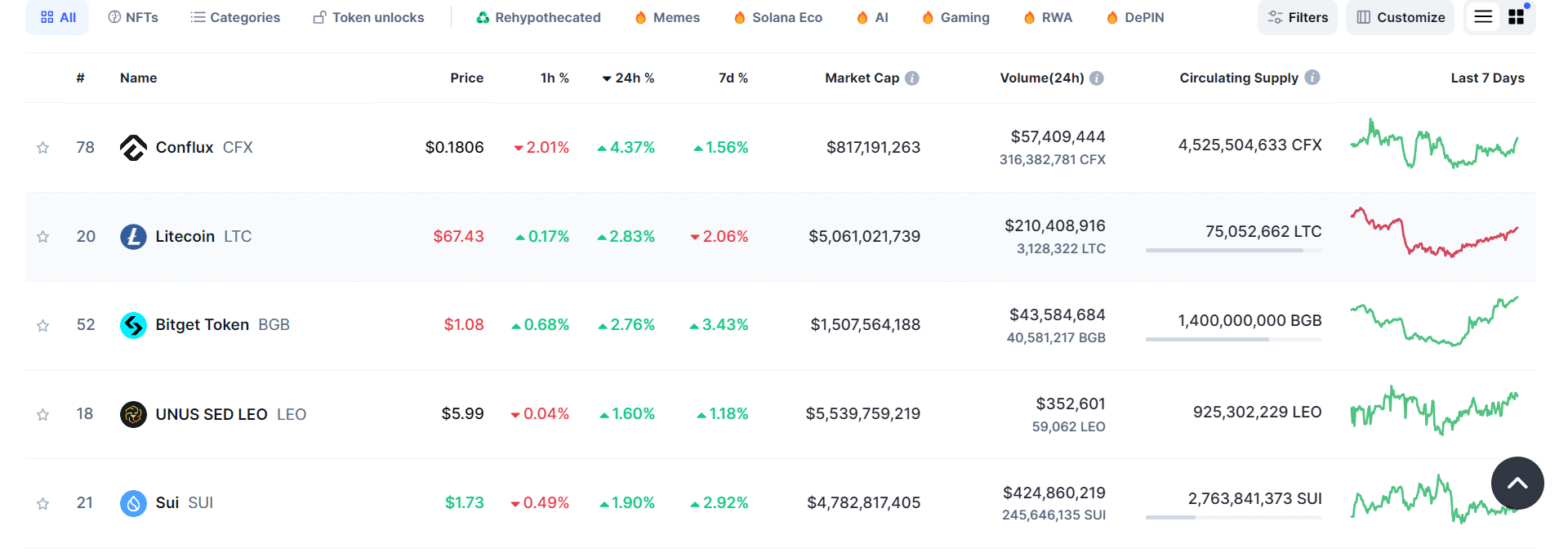

Litecoin [LTC] It was one of the best-performing coins in the past 24 hours, surpassing all of the top 100 cryptocurrencies by market cap, with the exception of Conflux. [CFX] To secure second place among the winners.

Although other cryptocurrencies are seeing modest change, Litecoin has shown its strength, reminding the market of its potential. Once it reached a peak of over $400 in 2021, LTC has proven its ability to perform at the same high level as Bitcoin. [BTC] And Ethereum [ETH].

As of press time, LTC was up more than 2%, it reported CoinMarketCapwhile other large coins struggled. This indicates Litecoin’s growing momentum amid sluggish market conditions.

Source: CoinMarketCap

LTC trading volume has increased by more than 17% in the past 24 hours, which in turn has increased its volume to market cap ratio by 4.25%. This rise in trading activity provides the liquidity needed to fuel further price movement.

With this performance, Litecoin is now well placed to target higher price levels, with many traders eyeing the $80 target, but is this possible?

Respect the trend line and forecast

Following Litecoin’s recent gains, the price action is showing clear signs of bullish momentum. The cryptocurrency has respected an upward trend line since the market crash on August 5, following a similar pattern to other coins that have rebounded since that period.

Over the past four days, LTC has maintained its upward trajectory, indicating that it may be one of the standout performers during the last quarter (Q4).

Historically, the fourth quarter has often been bullish for the broader cryptocurrency market, but is subject to the unpredictable nature of financial markets.

Source: Trading View

Indicators also support continued upward movement. A golden cross of the MACD indicates potential upward momentum. At the same time, seller volume decreases, and bullish traders take control of the market.

Additionally, the CMF is reading positive values, indicating that funds are flowing into Litecoin, supporting the upside potential.

However, LTC must break above $70 to maintain this momentum. If so, reaching the $80 target becomes increasingly likely, representing a potential upside of 22% from its current price.

Litecoin dominates payments

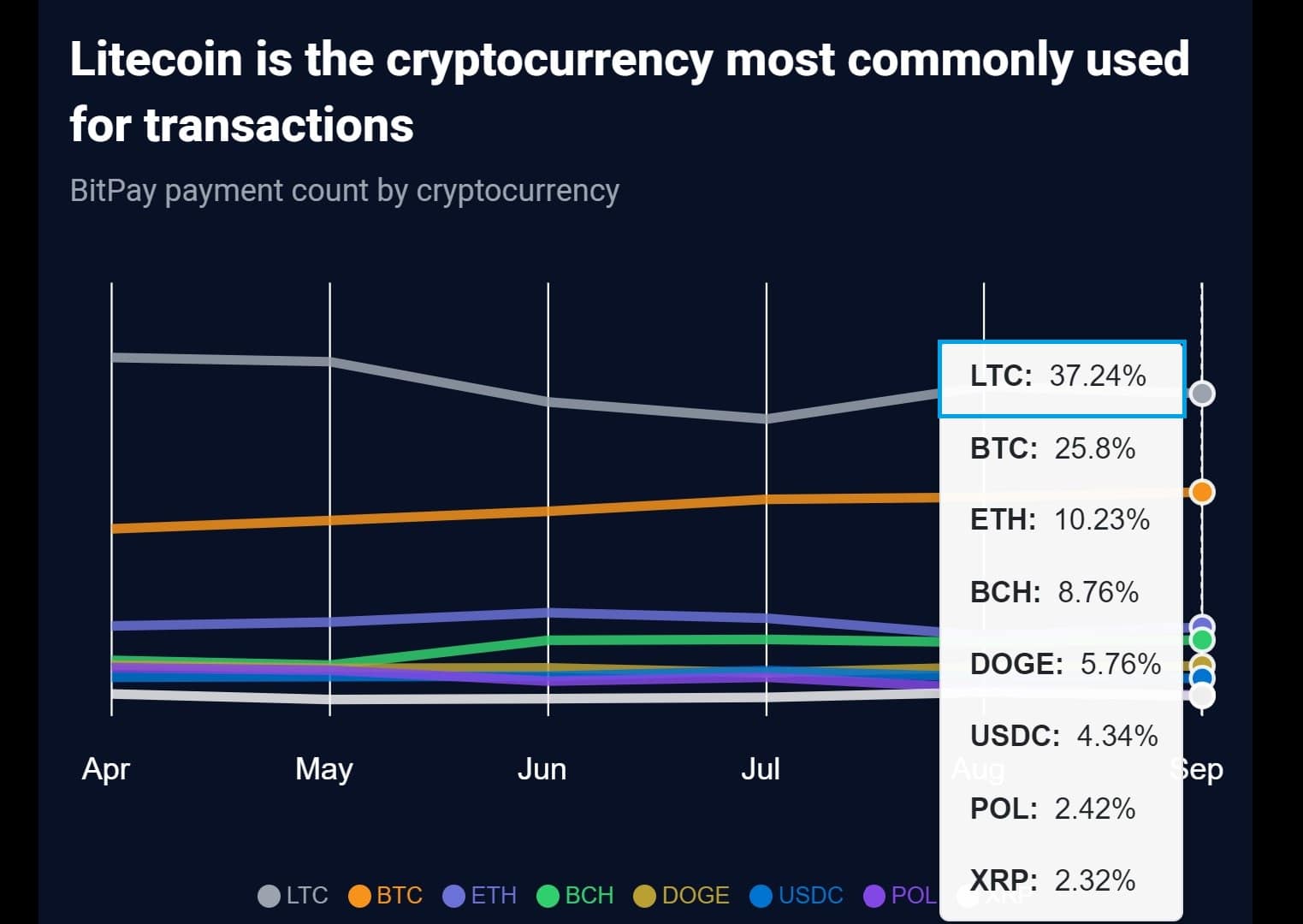

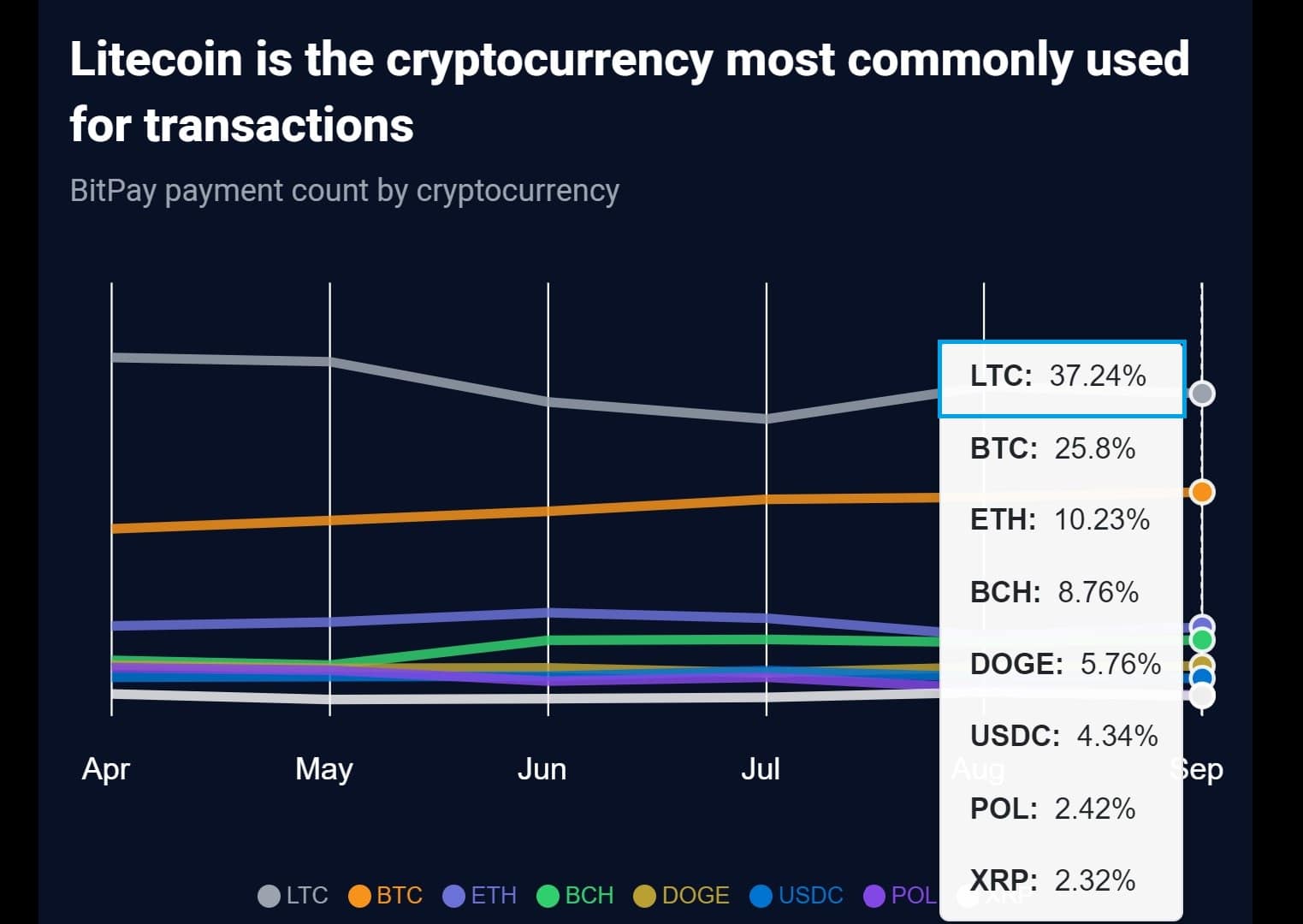

Looking at additional metrics, LTC’s dominance of cryptocurrency payments on BitPay continues to be a driving force.

According to the latest September statistics from BitPay, LTC remains the most widely used cryptocurrency for transactions, controlling more than 37% of all cryptocurrency payments on the platform. This is more than 12% ahead of BTC, which is in second place.

Litecoin maintained this top position throughout the year, surpassing even Ethereum (ETH) and Bitcoin Cash (BCH).

Source: X

LTC and BTC halving date

Finally, there is historical precedent for Litecoin’s performance, particularly regarding the relationship between LTC and BTC halving events.

Read Litecoin [LTC] Price forecasts 2024-2025

Historically, Litecoin halvings occur approximately eight months before Bitcoin’s decline, and both cryptocurrencies tend to rise in the months before and after these events.

Source: Trading View

If this pattern holds true, LTC could see an uptrend during Q4, which would add further confluence to the possibility of reclaiming the $80 level if broader market conditions continue to improve.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote