- DOT price faces a major threshold; If it can break above the current supply level, a rally could follow.

- Technical indicators are sending mixed signals – some indicate a bullish shift, while others indicate continued bearish pressure.

Over the past month, Polkadot [DOT] The performance was lackluster, with bearish sentiment prevailing leading to an 18.97% decline.

DOT’s next move remains uncertain as conflicting metrics keep market sentiment divided, leaving room for volatility over the coming trading sessions.

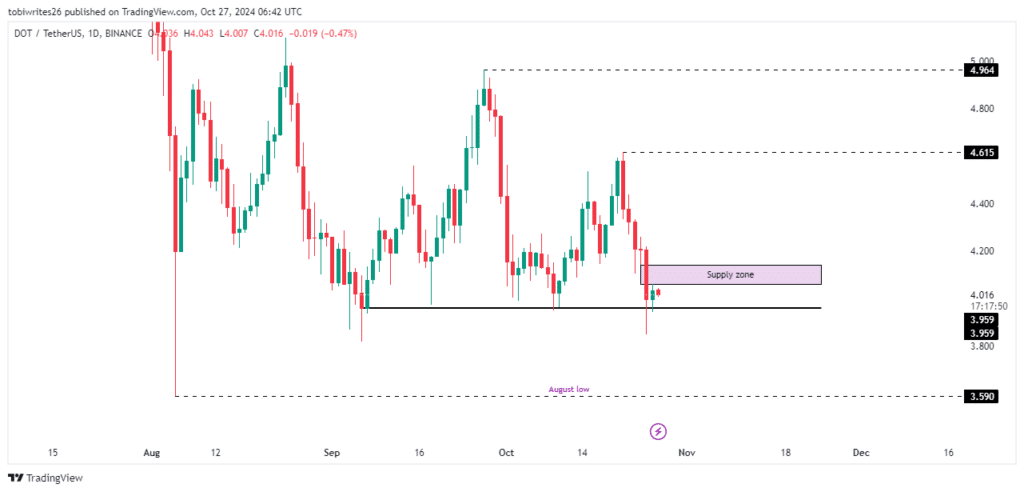

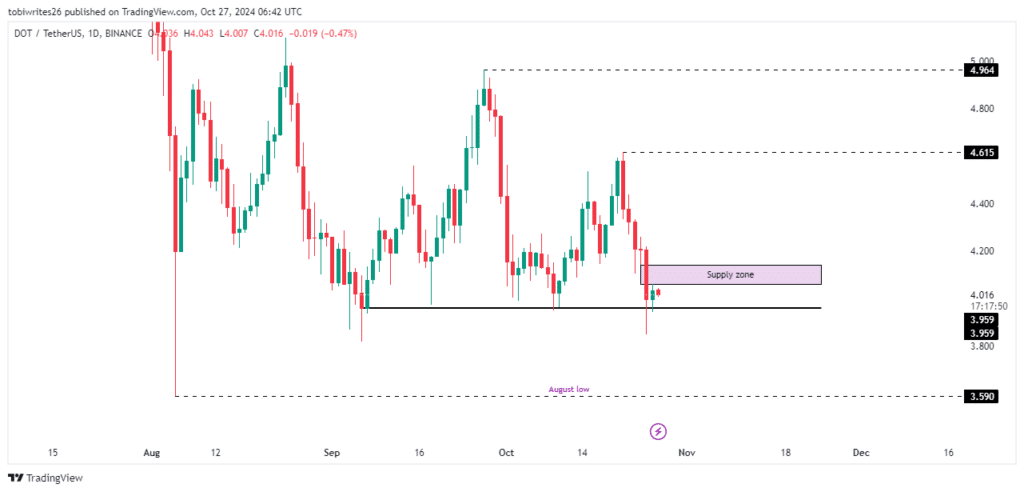

DOT is stuck between key levels

DOT is currently trading between two important levels that could shape its trend in the coming sessions.

After recently bouncing off the support at 3,959, DOT could rise to 4,615 or 4,964 if this support holds. However, the supply zone is located just above, which could create selling pressure and push the price lower, which could bring DOT back to the August lows.

Source: Trading Offer

To assess the potential movement, AMBCrypto analyzed technical indicators, but found mixed signals, leaving the outlook uncertain.

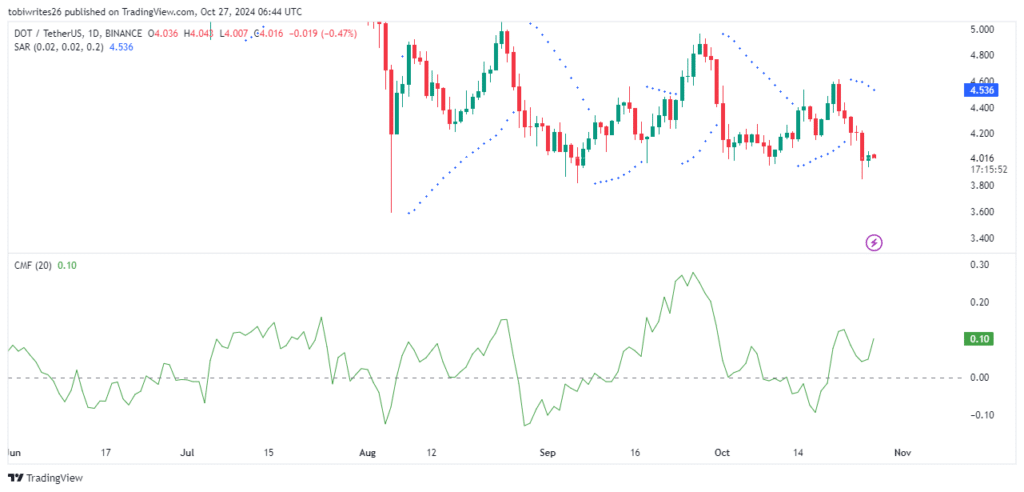

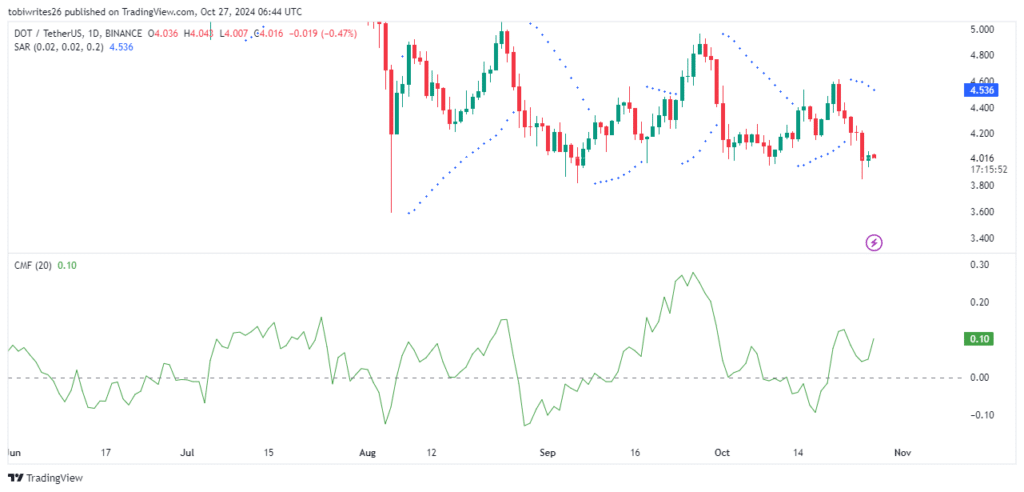

No clear pattern from traders: Mixed signals for DOT

Two major indicators, Chaikin Money Flow (CMF) and Parabolic SAR (Stop and Reverse), provide a mix of bullish and bearish signals for DOT, leaving its future direction uncertain.

The Chaikin Money Flow (CMF), which assesses the flow of liquidity into or out of an asset, showed a slight increase, with a current reading of 0.11. A positive CMF value indicates increasing buying pressure, which usually corresponds to a potential upward price movement for DOT.

This reading suggests that if this momentum continues, the MoT may push through the current supply zone, which could sustain the rally.

Conversely, the Parabolic SAR, an indicator that follows the trend and signals reversals, displays bearish sentiment. This is indicated by multiple pips above the DOT price, indicating ongoing selling pressure and a possible continuation of the downtrend.

When Parabolic SAR points appear above an asset’s price, they indicate resistance and the potential for further price declines.

Source: Trading Offer

With these two indicators pointing in opposing directions, AMBCrypto turned to on-chain activity to provide additional insights into what’s next for DOT.

Gradual buying pressure is emerging on Polkadot

Data from Quinglass It indicates a positive funding ratio for DOT, indicating an increase in long interest from traders. According to the latest reading, the DOT funding rate is 0.0109%.

Read Polkadot [DOT] Price forecasts 2024-25

A positive funding rate means that traders holding long positions pay those holding short positions to keep prices balanced. This trend usually indicates an underlying bullish sentiment, as more traders are betting on price increases, which could push DOT higher.

If this buying pressure continues, DOT may break out of the current supply zone and head higher.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote