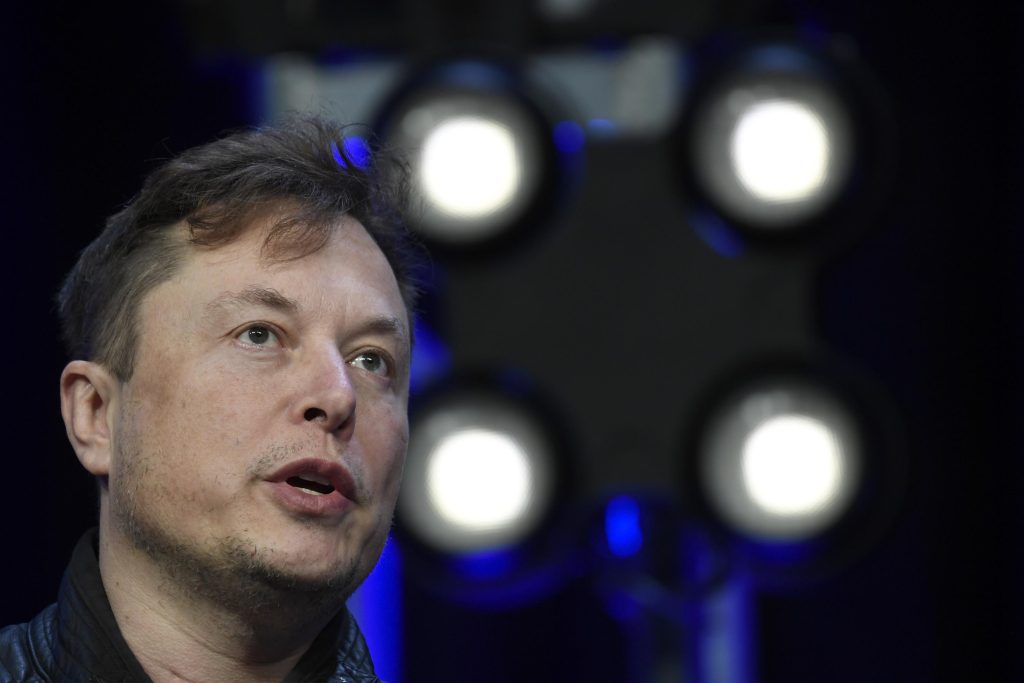

DETROIT (AFP) – A federal judge has rejected Elon Musk’s bid to get rid of a securities fraud settlement over tweets that claimed Musk had secured funding to make Tesla private in 2018.

On Wednesday, Judge Lewis Lehman also dismissed a request to strike a subpoena from Musk seeking information about possible violations of his settlement with the US Securities and Exchange Commission.

Musk had asked a Manhattan federal court to overturn the settlement, which required approval from Tesla’s attorney for his tweets before they were posted. The Securities and Exchange Commission is investigating whether the Tesla CEO violated the settlement with tweets last November asking Twitter followers if he should sell 10% of his Tesla stock. Lemon’s ruling states that Musk posted tweets without obtaining prior approval.

The entire dispute stems from the October 2018 agreement with the Securities and Exchange Commission that Musk signed. Tesla and Tesla have each agreed to pay $20 million in civil fines over Musk’s tweets about obtaining “secured financing” to make Tesla private at $420 per share.

Funding was far from closing, and the electric car company remained public, but Tesla’s stock price jumped. The settlement outlined changes to governance, including the removal of Musk as chairman of the board, as well as pre-approval of his tweets.

Lemon’s ruling paves the way for the Securities and Exchange Commission to obtain a court order to enforce the subpoena, and to investigate another possible breach of the settlement by Musk.

Musk’s attorney, Alex Spiro, asserted that the Securities and Exchange Commission is using the settlement and “unlimited resources” to smooth over Musk’s rhetoric. He wrote in court documents that Musk signed the settlement when Tesla was less mature and that the SEC’s action put the company’s financing at risk at a critical time.

He also claimed that the SEC’s subpoena is illegal, and that the agency could not take action on Musk’s tweets without court permission.

But in a 22-page judgment, Lehman wrote that Musk’s claim that economic coercion made him sign the settlement was “completely unconvincing.”

Even if Musk was concerned that litigating with the Securities and Exchange Commission would damage Tesla financially, Lehman wrote, “this does not establish him to exit the judgment that he voluntarily signed.”

The judge also said that the argument that the Securities and Exchange Commission had used the settlement order to harass Musk and initiate investigations was “unfounded.”

“It was hard for Musk to believe that by the time he entered the ordinance (the settlement) he would have been immune to non-public SEC investigations,” Lyman wrote. “It’s no surprise that when Musk tweeted that he was considering selling 10% of his interest in Tesla… the Securities and Exchange Commission had a few questions.”

Now the Securities and Exchange Commission could ask Lehman to enforce the subpoena, which Lehman wrote is the appropriate legal forum for Musk to challenge. In the settlement, Musk also agreed not to deny the SEC’s allegations in the 2018 securities fraud complaint. The SEC can also investigate Musk’s latest denial.

Musk confirmed in a recent interview that he did get funding in 2018. But a judge in a separate case ruled that his tweets about it were false.

An SEC spokesperson did not respond to a message asking if it would attempt to execute the subpoena. A message was left on Wednesday asking for comment from Spiro on whether Musk would appeal the Lyman order.

In his ruling, Lehman wrote that the “secured financing” tweet was allegedly false. “Musk did not discuss the terms of a specific deal with any of the potential financing partners, and he knew that a potential deal was uncertain and subject to many contingencies,” Lehman wrote.

He also agreed with the Securities and Exchange Commission that Congress had given it broad powers to investigate whether someone had violated federal securities laws. “Musque may wish it to be otherwise, but he remains subject to the same enforcement authority—and has the same means to challenge the exercise of that authority—as any other citizen,” wrote Lyman.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote