Nigeria will soon begin restricting ATM withdrawals to just $45 per day as part of a campaign to move the country towards cashless economy.

The policy – which will also apply to banks and cashbacks on purchases – follows the launch A country in West Africa Newly designed currency notes to control the money supply.

FILE: Customers use automated teller machines (ATMs) at a United Bank of Africa Plc (UBA) branch in Lagos, Nigeria, on Tuesday, November 22, 2022.

(Benson Ibuchi/Bloomberg via Getty Images)

The Nigerian Central Bank Weekly cash withdrawals limited to 100,000 naira ($225) for individuals and 500,000 naira ($1,124) for businesses, with processing fees required to access more.

When the policy comes into effect in January, ATMs will no longer dispense Nigeria’s high denominations of 1,000 naira ($2.25) and 500 naira ($1.10) while withdrawals from ATMs and point-of-sale terminals will also be limited to 20,000 naira ($45) per day.

Nigerian Military Secrets, Forced Abortions Of 10,000 Women In Fight Against Boko Haram: Report

Haruna Mustafa, the bank’s director of banking supervision, said cash withdrawals may be allowed “in force majeure circumstances not exceeding once a month.”

Policymakers say withdrawal limits and recent monetary initiatives from the central bank will bring more people into the banking system and reduce currency hoarding, illicit flows and inflation.

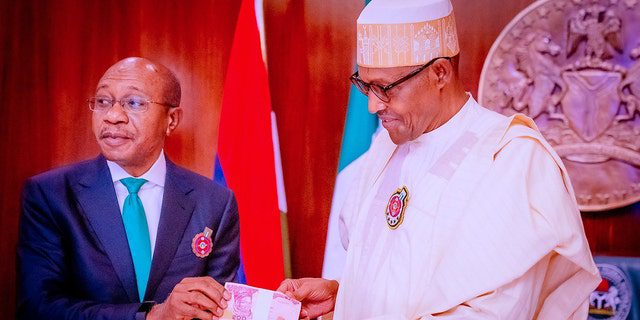

FILE: Godwin Emifiele, left, President of the Central Bank of Nigeria (CBN), attends the presentation of the new banknotes after Nigerian President Muhammadu Buhari, right, unveiled the newly designed banknotes due to counterfeiting and increasing security problems on November 23, 2022, in Abuja, Nigeria.

(Nigerian Presidency/Anadolu Agency via Getty Images)

Brave explodes in the Senegalese parliament after a lawyer runs into the women’s college

But other analysts are concerned that the initiative could hurt the day-to-day transactions made by individuals and businesses, given the unreliability of digital payments in Nigeria.

Nigeria’s economy relies heavily on the “informal sector” – activities outside the legal framework and government regulation such as agriculture, street trading, the market, and public transportation. In this sector, where most Nigerians work, cash is usually preferred for transactions as many lack bank accounts.

Click here for the FOX NEWS app

Only 45% of adults in Nigeria have accounts with regulated financial institutions, according to the World Bank. In the absence of bank accounts, point-of-sale terminals have emerged as one of the fastest growing areas of financial inclusion in the country.

The Associated Press contributed to this report.

“Travel specialist. Typical social media scholar. Friend of animals everywhere. Freelance zombie ninja. Twitter buff.”

More Stories

Taiwan is preparing to face strong Typhoon Kung-ri

Israel orders residents of Baalbek, eastern Lebanon, to evacuate

Zelensky: North Korean forces are pushing the war with Russia “beyond the borders”