- SAND’s open interest jumped 5.6% in the past 24 hours following the bullish breakout.

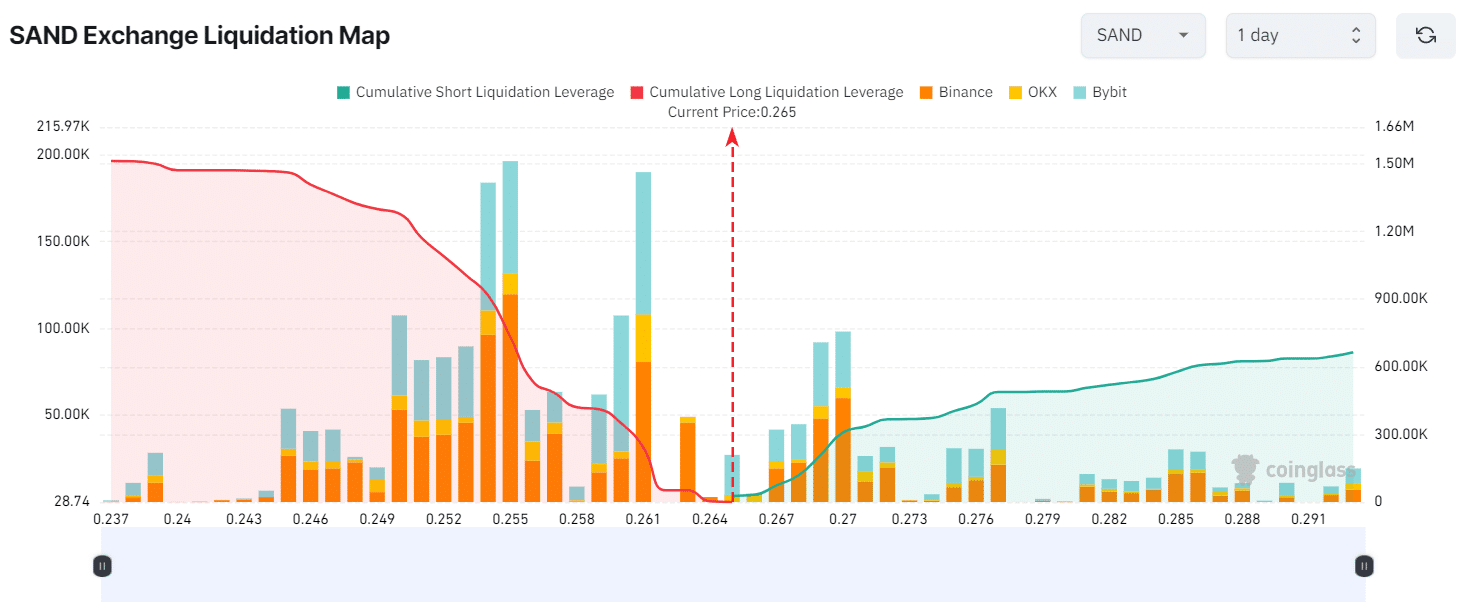

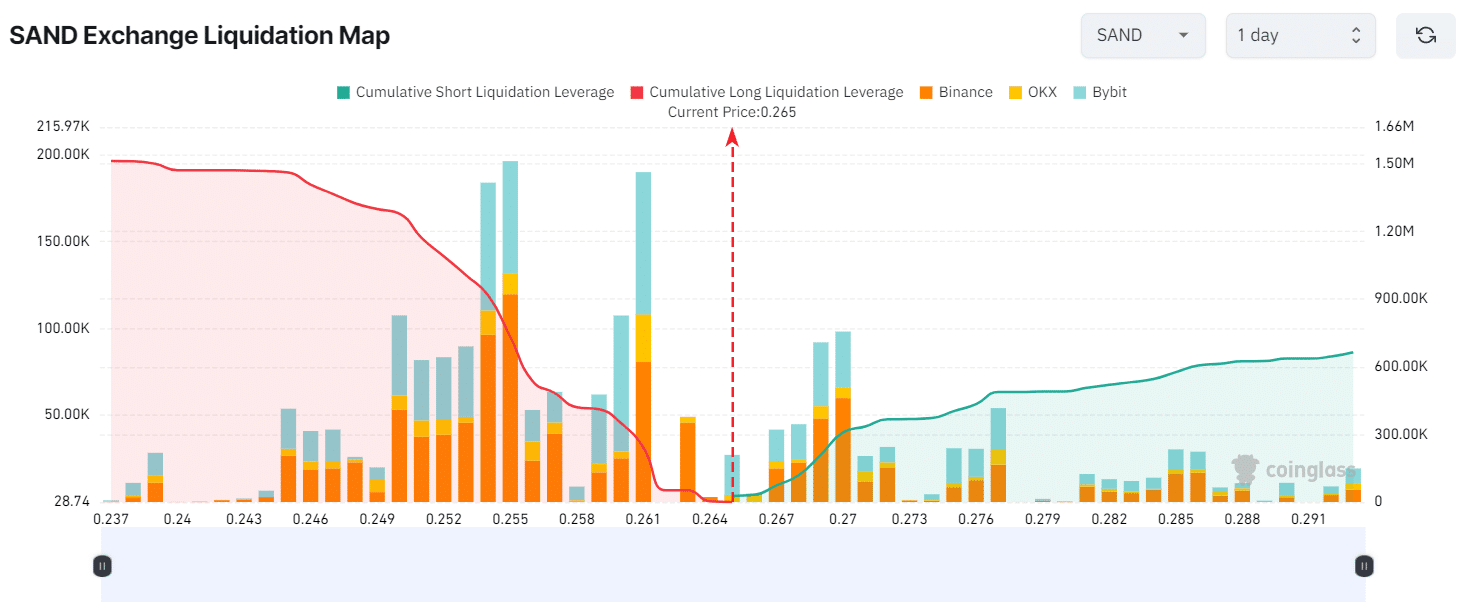

- Key liquidation levels were at $0.255 and $0.27, with traders excessively using leverage at these levels.

The overall cryptocurrency market is experiencing a notable recovery.

In the midst of this, is the virtual gaming platform The Sandbox [SAND] It broke out in a strong uptrend and turned sentiment from bearish to bullish.

SAND technical analysis and key levels

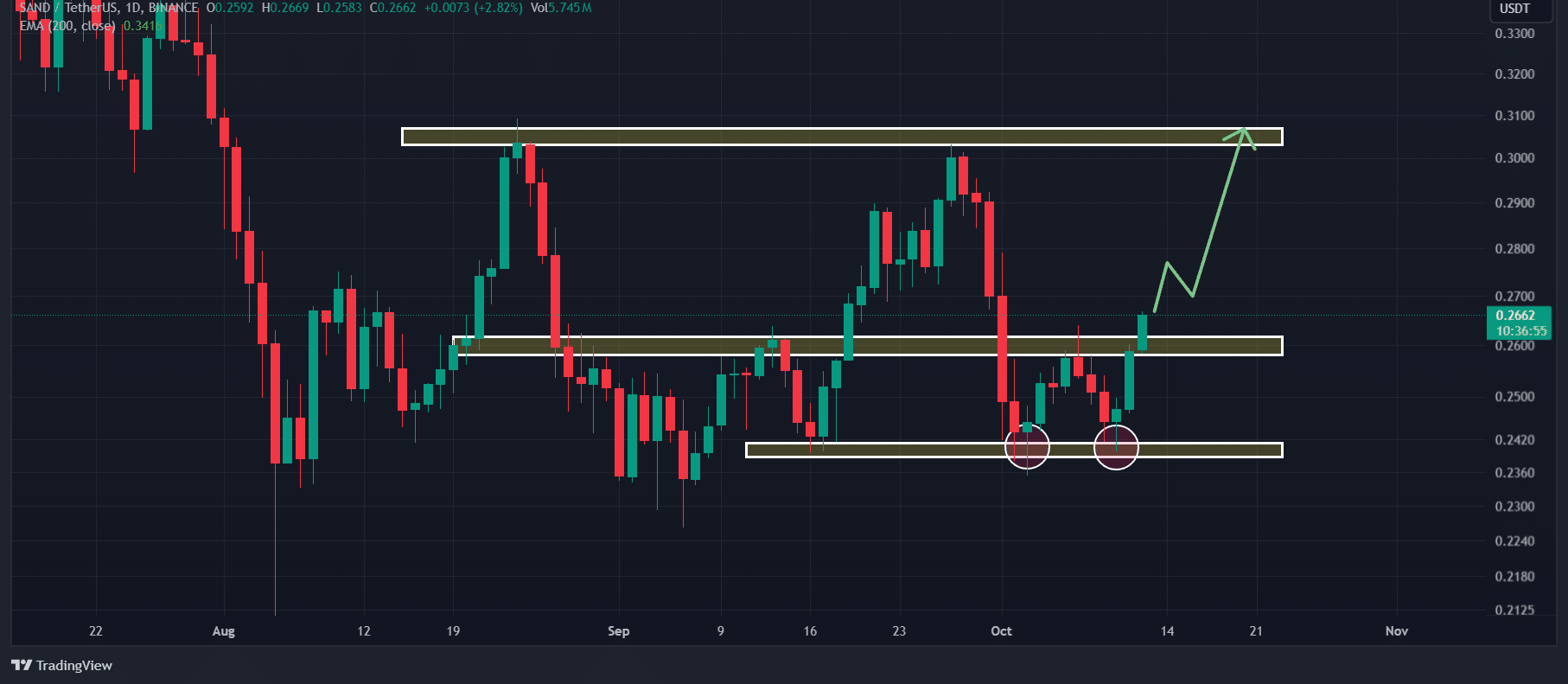

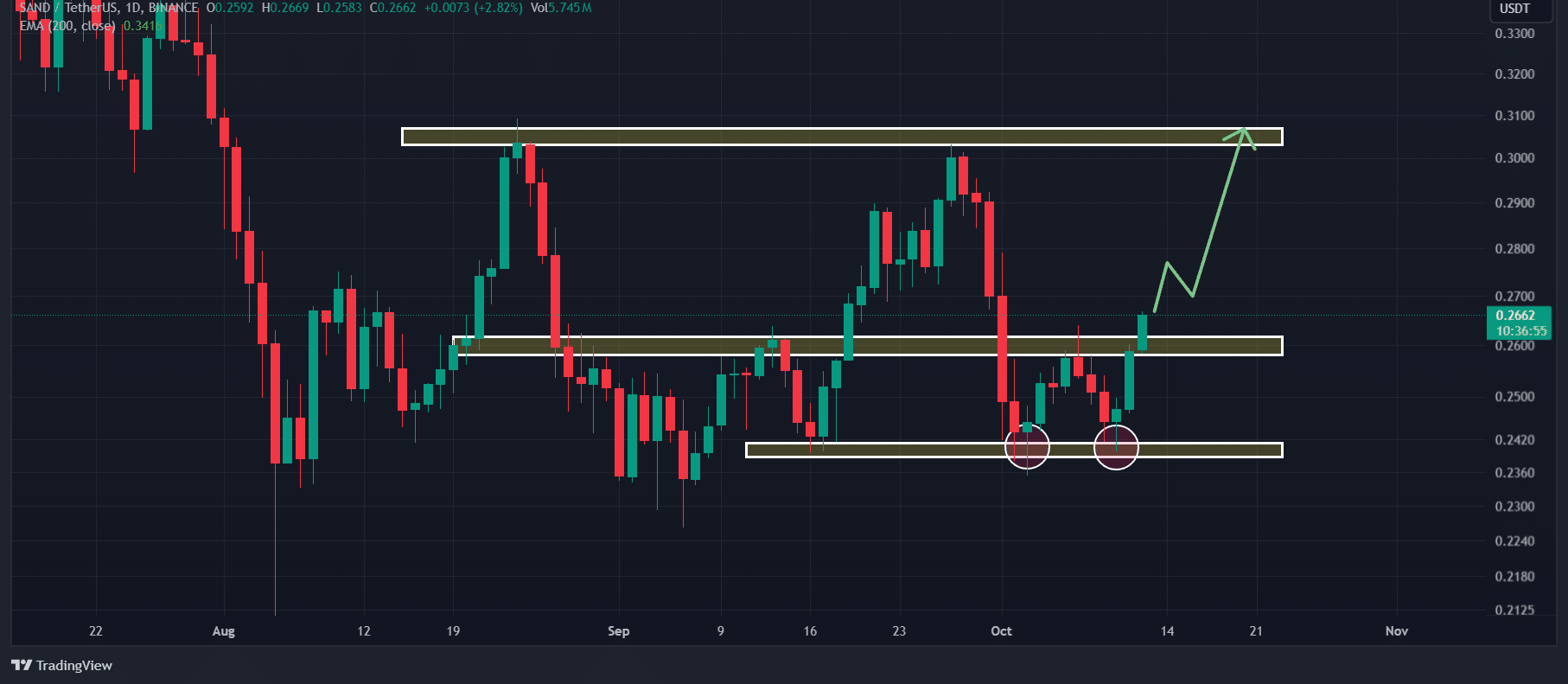

According to AMBCrypto technical analysis, the SAND looked bullish at press time as it broke out of a double bottom price action pattern. The breakout is confirmed by the daily candle closing above the neckline.

Source: Trading View

Based on the recent price performance, if SAND closes a daily candle above $0.264, there is a strong possibility that it will rise by 15% to reach the $0.305 level in the coming days.

Additionally, the Relative Strength Index (RSI) for SAND is at 52.30 at the time of writing, indicating a potential rally ahead.

Despite the bullish outlook for SAND, the 200 Exponential Moving Average (EMA) indicated a downtrend. When an asset is trading below the 200 EMA, traders and investors generally consider it to be in a downtrend, and vice versa.

SAND metrics are bullish on-chain

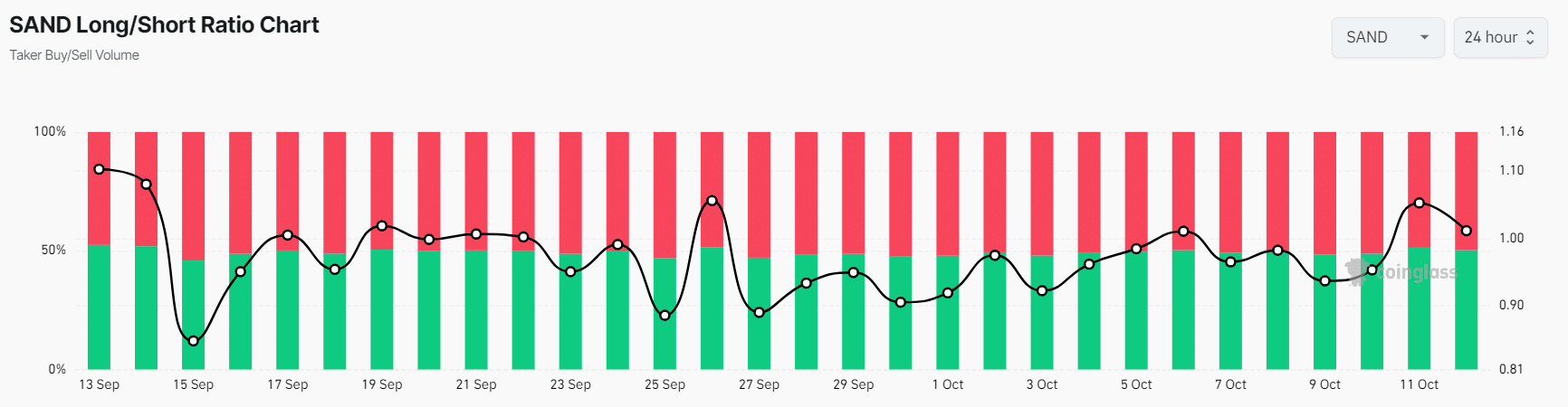

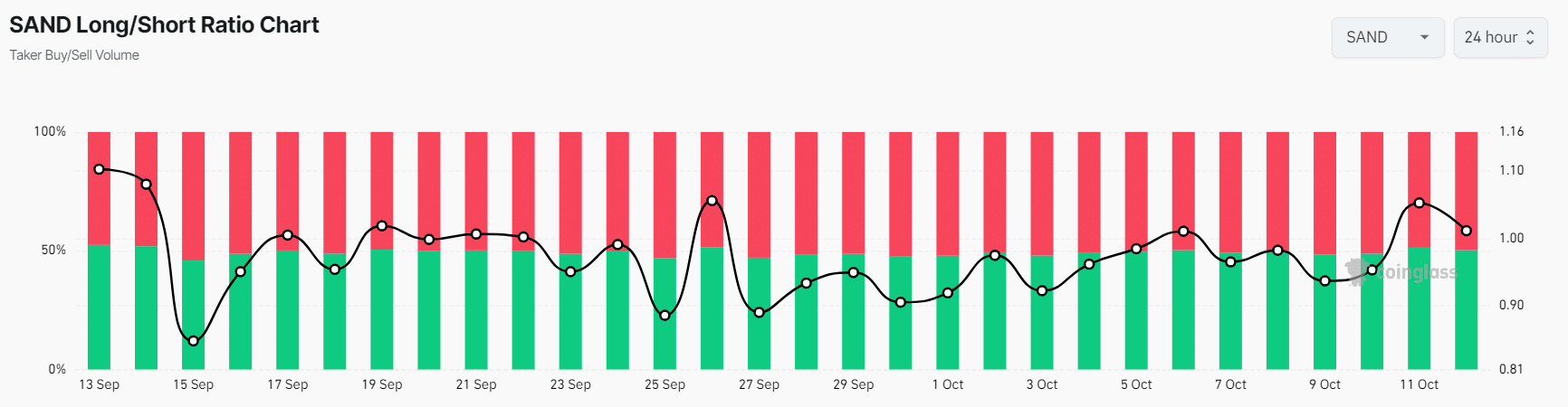

SAND’s bullish outlook is further supported by on-chain metrics. According to the on-chain analytics company QuinglassSAND’s buy/sell ratio was 1.03 at the time of writing, indicating bullish market sentiment.

Source: Coinglas

Additionally, futures open interest jumped 5.6% over the past 24 hours and 3.91% over the past four hours.

This indicates increased traders’ interest in the SAND token after the breakout of the double bottom price action pattern.

Main filter levels

As of now, the key liquidation levels are $0.255 on the downside and $0.27 on the upside, with traders overusing leverage at these levels, according to Coinglass.

Source: Coinglas

If market sentiment remains unchanged and the price rises to the $0.27 level, approximately $308,620 of short positions will be liquidated.

Conversely, if sentiment changes and the price drops to the $0.255 level, approximately $732,960 of long positions will be liquidated.

This liquidation data shows that the long positions of bulls are more than double the short positions of bears.

Combining all of these on-chain metrics and technical analysis, it appears that the bulls are currently dominating the asset and have the potential to support the SAND on its next bull run.

Read the sandbox [SAND] Price forecasts 2024-2025

Current price momentum

At press time, SAND is trading near $0.266 and has seen a price rise of more than 5.2% over the past 24 hours.

During the same period, trading volume decreased by 6%, indicating reduced participation by traders and investors.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote