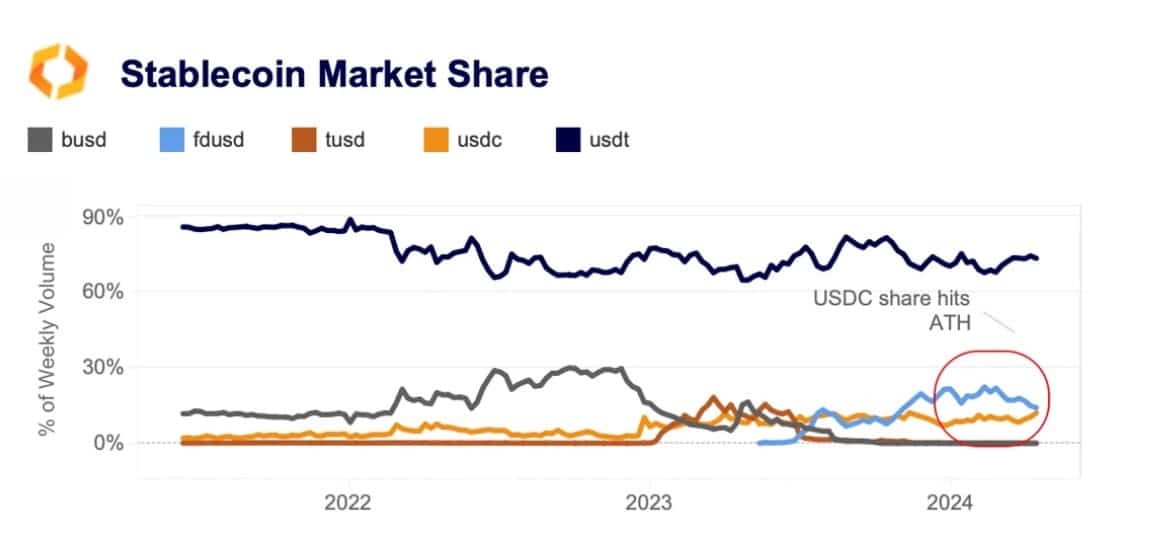

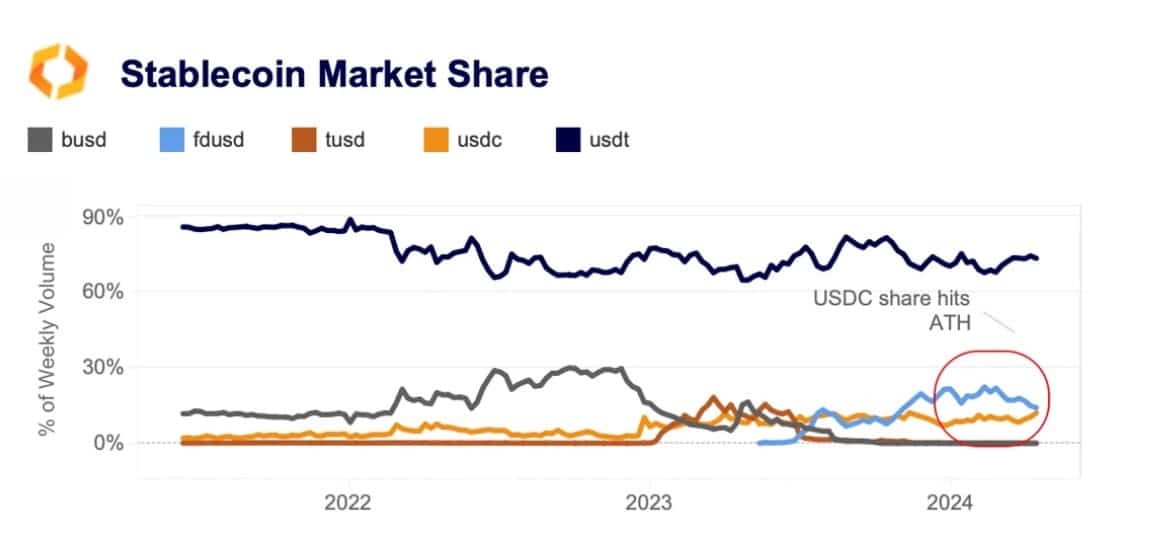

- Tether USDT market share drops from 82% to 74%

- Regulated stablecoins like USDC are gaining market share reflecting changing market preferences.

With the increasing adoption and widespread use of cryptocurrencies worldwide, stablecoins have emerged as a favorite among investors and a store of value for many cryptocurrency users.

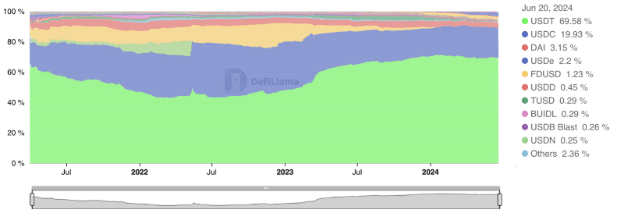

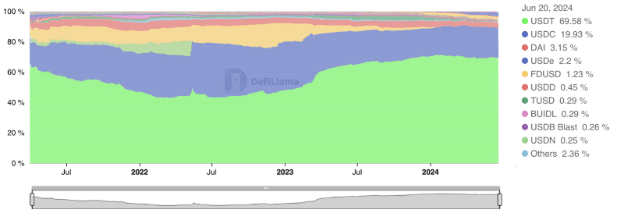

Over the past few years, Tether has been the dominant cryptocurrency in the highly concentrated stablecoin market. Despite its dominance, market sentiment is changing, and Tether’s dominance is slowly fading.

As of this writing, Tether’s USDT trading volume has decreased by 8.8% in 24 hours to $38.65 billion.

Tether USDT Market Share Decreases

According to Kaiko’s report, Tether’s market share is steadily declining. It also found that USDT’s market share on centralized exchanges has dropped from 82% to 74% in 2024.

The decline stems from a growing shift in market sentiment and regulation on stablecoins. Over the past year, other stablecoins, such as FDUSD, have taken over the market, especially since the partnership with Binance.

These factors have put Tether’s market dominance to the test.

Increased competition

According to AMBCrypto, USDC trading volume rose to $23 billion in 2024 from a low of $9 billion in 2023. USDC’s rise stems from the growing demand for compatible stablecoins.

Large investors, especially institutional ones, are slowly turning to legally accepted stablecoins to ensure they comply with operational requirements, especially in the European Union.

Source: Kaiko

According to Kaiko, USDC’s market share has risen to 12%, approaching FDUSD’s 14%.

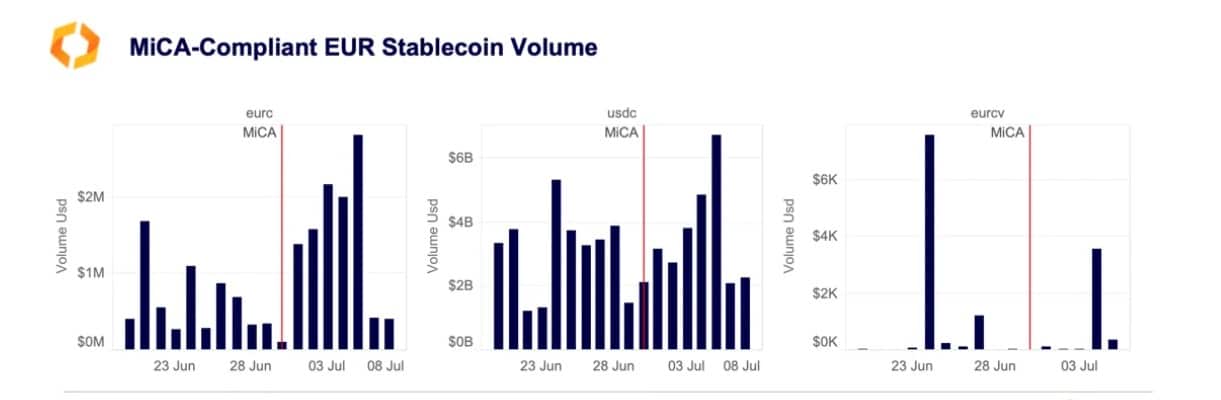

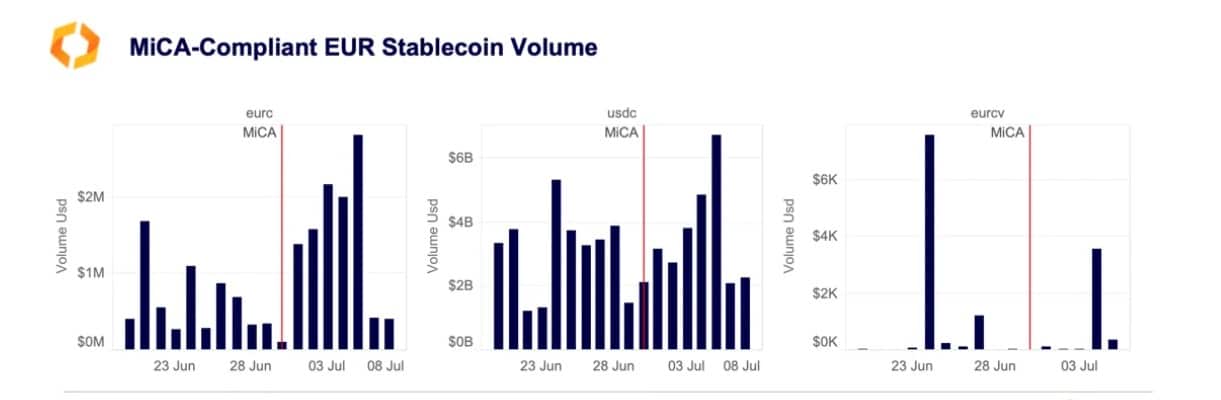

With the rise in trading on major cryptocurrency exchanges like OKX, Binance, and Bybit, USDC has become a serious competitor to Tether. Moreover, MICA’s approval of CIRCLE has significantly boosted USDC’s market share and trading volume.

As is also the case Key Rock Trading Shared on X, USDC outperforms Tether in terms of flexibility and accessibility. He noted that,

“USDC’s offering is more flexible than Tethers’. It provides a free and accessible instrument, as dealing with Tethers requires long transfer times to smaller banks in the Virgin Islands.”

EU Regulation of Stablecoins

It is worth noting that the European Markets in Crypto-Assets Regulation (MICA) is set to challenge the continued dominance of non-compliant stablecoins.

With MICA requirements coming into effect, exchanges like Kraken may have to reconsider their stance on stablecoins like Tether. These regulations have raised concerns among major players about their operations in the EU, even when it comes to approved stablecoins.

For example, Tether’s CEO claimed that these requirements could lead to complications among stablecoin issuers.

On a broader scale, MICA sets a precedent that could challenge existing cryptocurrencies in the EU.

Source: Kaiko

Tether Waiting to Suspend USDT Refunds

According to official reports, Tether is expected to suspend USDT redemptions across major blockchains by September 2025.

Source:X

francesco Notice this development on X (formerly Twitter), and share it,

“Tether has announced that it will stop minting USDT on EOS and Algorand effective today. However, USDT redemptions on these blockchains will continue for the next 12 months.”

This comes after Tether USDT was suspended in 2023 on other blockchains such as Bitcoin, Kusama, and Bitcoin Cash. Over the next 12 months, Tether will suspend operations within several chains in order to leverage efficient networks to improve user experience and the overall stability of the stablecoin.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote