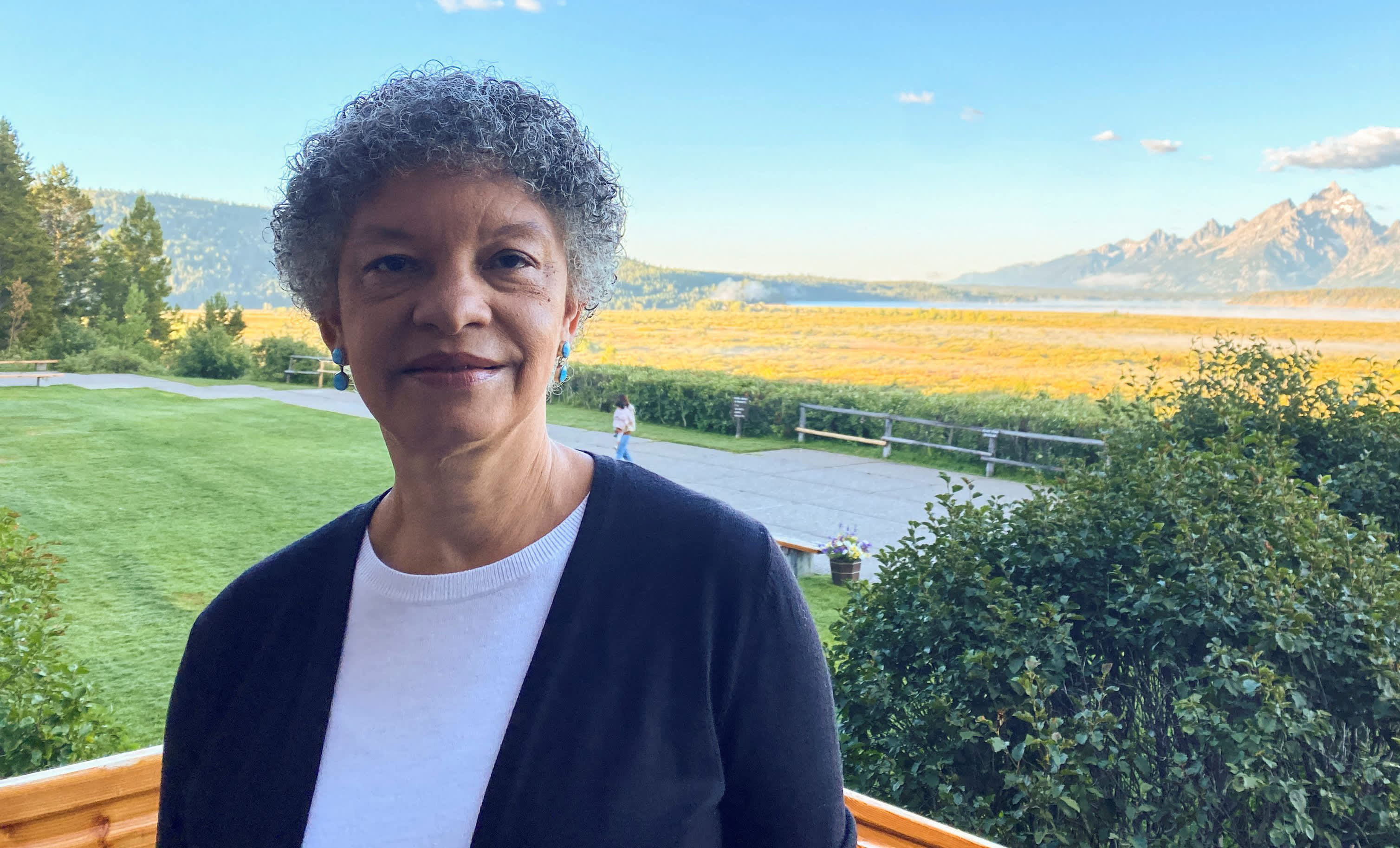

Boston Federal Reserve Bank President Susan Collins stands behind the Jackson Lake Lodge in Jackson Hole, where the Federal Reserve Bank of Kansas City holds its annual economic symposium, in Wyoming, Aug. 24, 2023.

Anne Safir | Reuters

Boston Fed President Susan Collins on Wednesday called for a patient approach to policymaking while saying she needed more evidence to convince her that inflation has been tamed.

In remarks in line with the sentiment of other key central bankers, Collins said the Fed may be “near or even at a peak” for interest rates.

However, she noted that more increases may be needed depending on how the data looks from here.

“Overall, we are well-positioned to proceed cautiously in this uncertain economic environment, recognizing the risks while remaining firm and data-driven, while being flexible to adapt as circumstances warrant,” Collins said in prepared remarks for a speech in Boston.

These sentiments align with recent comments from Federal Reserve Chairman Jerome Powell and Governor Christopher Waller. Both endorsed a patient approach with the caveat that they view recent positive developments on inflation with caution and are willing to agree to additional interest rate increases if needed.

And in an interview with CNBC on Tuesday, Waller emphasized that the Fed can “proceed cautiously” on policy while noting that it has “been burned twice before” in the past few years by inflation that seemed to slow but then came back. .

In her speech, Collins also noted some good news on inflation, as the Fed’s preferred measure rose just 0.2% in July while wage growth appears to have slowed as well.

But she cautioned, “It’s hard to extract the signal from the noise in the data.” She added that if the improvement was transient, “further tightening may be warranted”.

“There are promising developments, but given continued strength in demand, my view is that it is too early to take the recent improvement as evidence that inflation is on its way back to 2%,” said Collins, a non-voting member. Member this year of the Federal Open Market Committee, which sets interest rates. Collins will vote again in 2025.

Collins also spoke about the slowdown he believes Fed policy is working with.

In general, economists believe that it takes a year to a year and a half for interest rate increases to seep into the economy. However, Collins said factors related to COVID-19 and the general strength of household and corporate balance sheets could prolong this lag, calling for more caution on policy.

“The goal is an orderly deceleration that better matches demand with supply, which is necessary to ensure that inflation is on a sustainable path back to target,” she said.

Market prices indicate a strong possibility that the Fed will not raise interest rates at its policy meeting scheduled for September 19-20. According to CME Group data. However, it is a close call for the period from October 31 to November. 1, with traders assigning a 43% probability of an eventual rally.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote