A growing number of traders, academics and bond market experts are concerned that the $24 trillion US Treasury debt market could head into crisis as the Federal Reserve began its “quantitative tightening” on high alert this month.

With the Fed doubling the pace that its bond holdings will “roll” its balance sheet in September, some bankers and institutional traders worry that already diminishing liquidity in the Treasury market could set the stage for economic disaster — or, in short, it has a host of other flaws.

In the corners of Wall Street, some have been pointing to these risks. A particularly stark warning was issued earlier this month, when Bank of America BAC said,

Interest rate strategist Ralph Axel warned bank clients that “low liquidity and the resilience of the Treasury market poses one of the biggest threats to global financial stability today, possibly worse than the housing bubble of 2004-2007”.

How can the usual Treasury market become ground zero for another financial crisis? Well, Treasurys play an important role in the international financial system, with their proceeds setting a benchmark for trillions of dollars in loans, including most mortgages.

Worldwide 10-Year Treasury Bond Yield TMUBMUSD10Y,

It is considered a “risk-free rate” that establishes a baseline against which many other assets – including stocks – are valued.

But huge and erratic moves in Treasury yields aren’t the only problem: Since the bonds themselves are used as collateral for banks seeking short-term funding in the “repo market” (often described as the “beating heart” of the US financial system) it is possible that Should the treasury market stall again – almost as it has in the recent past – the various credit channels including corporate, household and government borrowing will “stop,” Axle wrote.

Without a mass explosion, poor liquidity comes with a host of other drawbacks for investors, market participants, and the federal government, including higher borrowing costs, increased volatility between assets and – in one particularly extreme example – the possibility that the federal government could default if Newly issued Treasury auctions have stopped working properly.

Dwindling liquidity has been a problem since before the Fed began allowing its massive balance sheet of about $9 trillion to shrink in June. But this month, that split will accelerate to $95 billion a month — an unprecedented pace, according to two Kansas City Fed economists who published a paper on these risks earlier this year.

Not supported

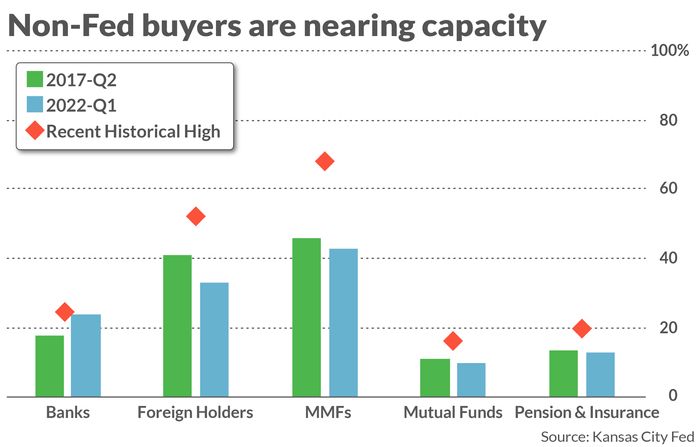

According to Kansas City Fed economists Rajdeep Sengupta and Lee Smith, other market participants who might otherwise help offset the less active Fed are already at or near capacity in terms of their holdings of Treasury.

Not supported

This could exacerbate poor liquidity, unless another class of buyers arrives – making the current period of Fed tightening much more chaotic than the previous episode, which occurred between 2017 and 2019.

“This is Qt [quantitative tightening] “An episode could play out very differently, and it probably wouldn’t be as calm and serene as the previous episode started,” Smith said during a phone interview with MarketWatch.

“Since the balance sheet space for banks is less than it was in 2017, it is likely that other market participants will have to step in,” Sengupta said during the call.

Sengupta and Smith said that at some point, the higher returns should attract new buyers. But it’s hard to say how much a yield boost is needed before that happens – though the Fed has pulled out, the market looks set to find out.

Liquidity is very bad now

Treasury market liquidity has certainly been weak for some time now, with a range of factors at play, even when the Fed was still collecting billions of dollars in government debt per month, something it only stopped doing in March.

Since then, bond traders have noticed unusually high volatility in a market that is usually considered more sedate.

In July, a team of interest rate strategists at Barclays Park,

Discuss the symptoms of a weak treasury market in a report prepared for bank clients.

These include wider spreads between supply and demand. The spread is the amount that brokers and dealers charge for facilitating a trade. According to economists and academics, small spreads are usually associated with more liquid markets, and vice versa.

But wider spreads aren’t the only symptom: Volume has fallen dramatically since the middle of last year, the Barclays team said, as speculators and traders increasingly turn to the Treasury futures markets to take short-term trades. According to Barclays data, the treasury’s total average nominal trading volume has fallen from about $3.5 trillion every four weeks at the start of 2022 to just over $2 trillion.

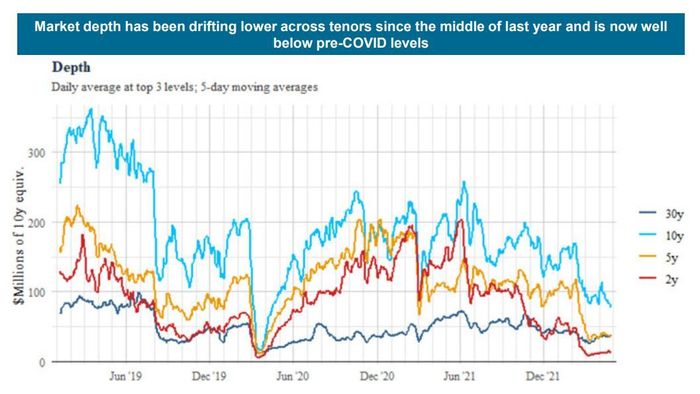

At the same time, market depth — the dollar amount of bonds offered through dealers and brokers — has deteriorated dramatically since the middle of last year. The Barclays team illustrated this trend with a chart below.

Source: Barclays

Other measures of liquidity in the bond market confirm this trend. For example, the ICE Bank of America Merrill Lynch MOVE Index, a popular measure of implied bond market volatility, was above 120 on Wednesday, a level that indicates options traders are preparing for more auctions in the Treasury market. The metric is similar to the CBOE Volatility Index, or “VIX,” Wall Street’s “fear scale” that measures expected volatility in stock markets.

The MOVE index reached nearly 160 in June, not far from the 160.3 of 2020 peak seen on March 9 of that year, the highest since the financial crisis.

Bloomberg also maintains a liquidity index in US government securities with a maturity date greater than one year. The index rises when Treasurys are trading away from their “fair value,” which typically occurs when liquidity conditions deteriorate.

It hit nearly 2.7 on Wednesday, close to its highest level in more than a decade, if we exclude the spring of 2020.

The liquidity squeeze has had the greatest impact on the length of the short end of the Treasury curve – because short-term Treasurys are usually more vulnerable to interest rate hikes by the Federal Reserve, as well as changes in inflation expectations.

Also, Treasurys “outside the long run,” a term used to describe all but the most recent of each period’s Treasury issues, have been affected more than their “runaway” counterparts.

Because of this poor liquidity, traders and portfolio managers told MarketWatch that they need to be more careful about the size and timing of their trades as market volatility increases.

“Liquidity is very poor at the moment,” said John Luke Tyner, portfolio manager at Aptus Capital Advisors.

We’ve had four or five days in recent months where for two years the Treasury has moved over 20 [basis points] In a day. It’s definitely an eye opener.”

Tyner previously worked in the corporate fixed income office at Duncan-Williams Inc. He has been analyzing and trading fixed income products since shortly after graduating from the University of Memphis.

The importance of being a questioner

Treasury debt is a global reserve asset – just like the US dollar is a reserve currency. This means that foreign central banks are widely owned and need access to dollars to help facilitate international trade.

To ensure Treasurys retain this position, market participants must be able to trade them quickly, easily and inexpensively, Fed economist Michael Fleming wrote in a 2001 paper, Measuring Treasury Market Liquidity.

Fleming, who still works at the Federal Reserve, did not respond to a request for comment. But interest rate strategists at JP Morgan Chase & Co. JPM,

Credit Suisse CS,

And TD Securities told MarketWatch that maintaining ample liquidity is just as important today – if not more so.

Treasurys’ reserve status gives the US government countless benefits, including the ability to finance large deficits relatively cheaply.

What can he do?

When chaos upended global markets in the spring of 2020, the treasury market was not without repercussions.

As the G30 Treasury Market Liquidity Working Group mentioned in a report recommending methods to improve the performance of the treasury market, the repercussions came surprisingly close to causing the global credit markets to come to a standstill.

While brokers were withdrawing liquidity in fear of being burdened with losses, the treasury market saw huge moves that did not seem to make sense. Treasury yields with similar maturities are now completely unbreakable.

Between March 9 and March 18, supply and demand margins exploded and the number of trade “failures” — which occur when a booked deal fails because one of the counterparties has no money, or assets — rose to nearly three times the normal rate.

The Fed eventually came to the rescue, but market participants were notified, and the G-30 decided to explore how to avoid a repeat of these market turmoil.

The committee, chaired by former Treasury Secretary and New York Fed President Timothy Geithner, published its report last year, which included a set of recommendations to make the Treasury market more resilient in times of stress. A G-30 representative was unable to make any of the authors available for comment when contacted by MarketWatch.

The recommendations included creating a global clearing for all Treasury and repo trades, creating regulatory cuts to regulatory leverage ratios to allow traders to store more bonds on their books, and creating permanent repurchases in the Federal Reserve.

While most of the recommendations in the report have yet to be implemented, the Fed has already established permanent repo facilities for domestic and foreign traders in July 2021. The Securities and Exchange Commission is taking steps toward authorizing a more central clearing.

However, in a status update released earlier this year, the working group said the Fed’s facilities had not gone far enough.

On Wednesday, the Securities and Exchange Commission is preparing to announce that it will propose rules to help reform and disinfect how Treasury trades, including making sure more Treasury deals are centrally liquidated, as recommended by the G-30, MarketWatch reported.

As noted by the G-30, SEC Chairman Gary Gensler expressed support for the expansion of centralized Treasury clearing, which would help improve liquidity during times of stress by helping to ensure all trades are settled on time without any hiccups.

However, if regulators appear complacent when it comes to addressing these risks, it is probably due to their expectation that if something goes wrong, the Federal Reserve can simply come to the rescue, as it has in the past.

But Axel of Bank of America thinks this assumption is misleading.

“It is not structurally sound for US public debt to become increasingly dependent on federal quantitative easing. The Fed is the lender of last resort to the banking system, not the federal government,” Axel wrote.

– Vivian Lu Chen contributed to the report

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote