The Treasury market flashed a warning signal on Tuesday as investors piled on safe-haven assets, evidence of fears of a possible recession that has gripped global markets.

Return on 10 years US government bonds It fell below those on two-year bonds for the third time this year. So-called yield curve swings have preceded every US recession in the past 50 years — not immediately, but over the next two years.

Investor sentiment has dented in recent days on signs that persistent inflation that has driven up prices of products from fuel to food, along with rising borrowing costs as the Federal Reserve raises interest rates, is having a larger impact on businesses and households.

A survey by the Institute for Supply Management late last week on the US manufacturing sector indicated declines last month in new orders and employment, adding to concerns about the state of the world’s largest company. Economie.

The Atlanta Fed forecast that takes into account incoming economic data now points to an annual decline of 2.1 percent in US economic output in the second quarter, after a decline in the first quarter. A recession is usually defined as two consecutive quarters of contraction.

In the UK, Bank of England Governor Andrew Bailey warned that “the global economic outlook has deteriorated significantly”.

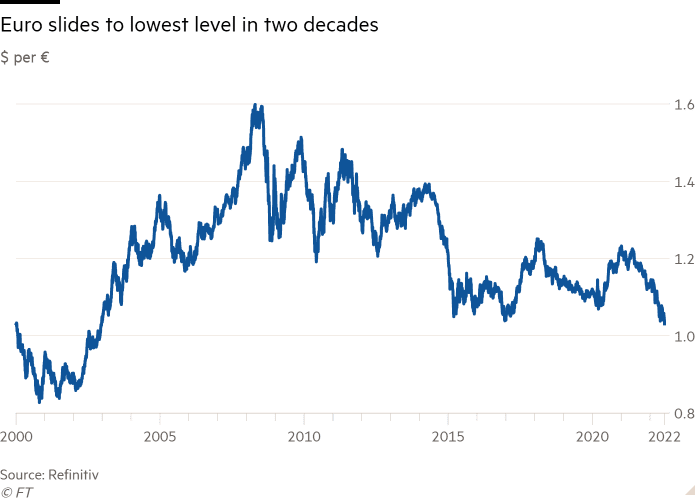

Meanwhile, the euro fell to its lowest level in two decades as traders rushed to the safe-haven dollar.

The dollar remains the primary safe haven. . . This is an aggravating factor [euro] a movement. “People want dollars in times of stress and anxiety,” said Jane Foley, Rabobank’s head of FX strategy.

Investors are scaling back their expectations for Fed rate increases as the economic outlook deteriorates. Futures markets are indicating that the US central bank is now expected to raise benchmark interest rates to 3.3 percent by early 2023, down from expectations three weeks ago of 3.9 percent.

The Fed’s benchmark interest rate stands in the 1.5 percent to 1.75 percent range after a series of increases this year.

Details of the Federal Reserve’s latest monetary policy meeting, due to be published on Wednesday, may provide more clues about how prepared it is to tighten monetary policy. Friday’s US jobs report will also indicate the level of capacity in the country’s labor market, a criterion that may also influence the Fed’s decision-making process.

However, the slowdown in the US economy and the still-aggressive federal tightening plans have replaced some inflation concerns. Oil prices – a critical component of inflation gauges – on Tuesday extended their biggest drop since March, as demand concern hit the commodity market. International benchmark Brent tumbled 9.5 percent to $102.77 a barrel, while US West Texas Intermediate fell 8.2 percent to $99.50.

Commodity analysts at Citigroup said on Tuesday that a recession is “increasingly likely.” In this scenario, they said, the oil price may reach $65 per barrel by the end of this year and $45 by the end of 2023, assuming that OPEC and its allies do not interfere in the market.

Fading inflation risks also lifted the Nasdaq Composite Index, ending the day 1.7 percent higher. The index is heavily weighted toward technology stocks, which are particularly affected by inflation as much of their valuations are based on expected future earnings. The S&P 500 preferred stock index ended the day 0.2 percent higher.

Additional reporting by Nico Asgari

Financial Times Survey: How do you deal with rising inflation?

We’re exploring the impact of the rising cost of living on people around the world and want to hear from readers about what you’re doing to combat costs. Tell us via short opinion poll.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote