- The exchange flow meter shows that a local bottom may be in place for BTC and ETH.

- Market sentiment was not bullish, and the behavior of stockholders at critical support levels was the main factor for the next price move.

Bitcoin [BTC] and Ethereum [ETH] Bulls struggled to turn the market dynamics in their favor. Big losses in the last 10 days mean that the price is back at the support area where buyers are expected to stop sellers.

Ethereum’s MVRV and NVT ratios show that the asset may be undervalued. The liquidity pocket at $3,500 could see a short squeeze, but otherwise the momentum is bearish.

Meanwhile, another Bitcoin investigation showed that mining activity had slowed and miners were selling Bitcoin. However, selling pressure has started to decline sharply over the past two days.

AMBCrypto decided to look at the movement of both assets from exchanges to gauge market sentiment. It revealed that the bulls may not have much to cheer about yet.

What does net exchange flow meter indicate?

The net exchange flows measure provides valuable insights into the market. When flows are positive, it indicates greater inflows.

This in turn is a sign of potential selling pressure on the asset, as it means that participants are sending cryptocurrencies to exchanges to sell them.

Values below zero mean that outflows are larger, which is a good sign for buyers.

It indicates that market participants are withdrawing their assets from exchanges, likely placing them in safer storage places, and indicates accumulation.

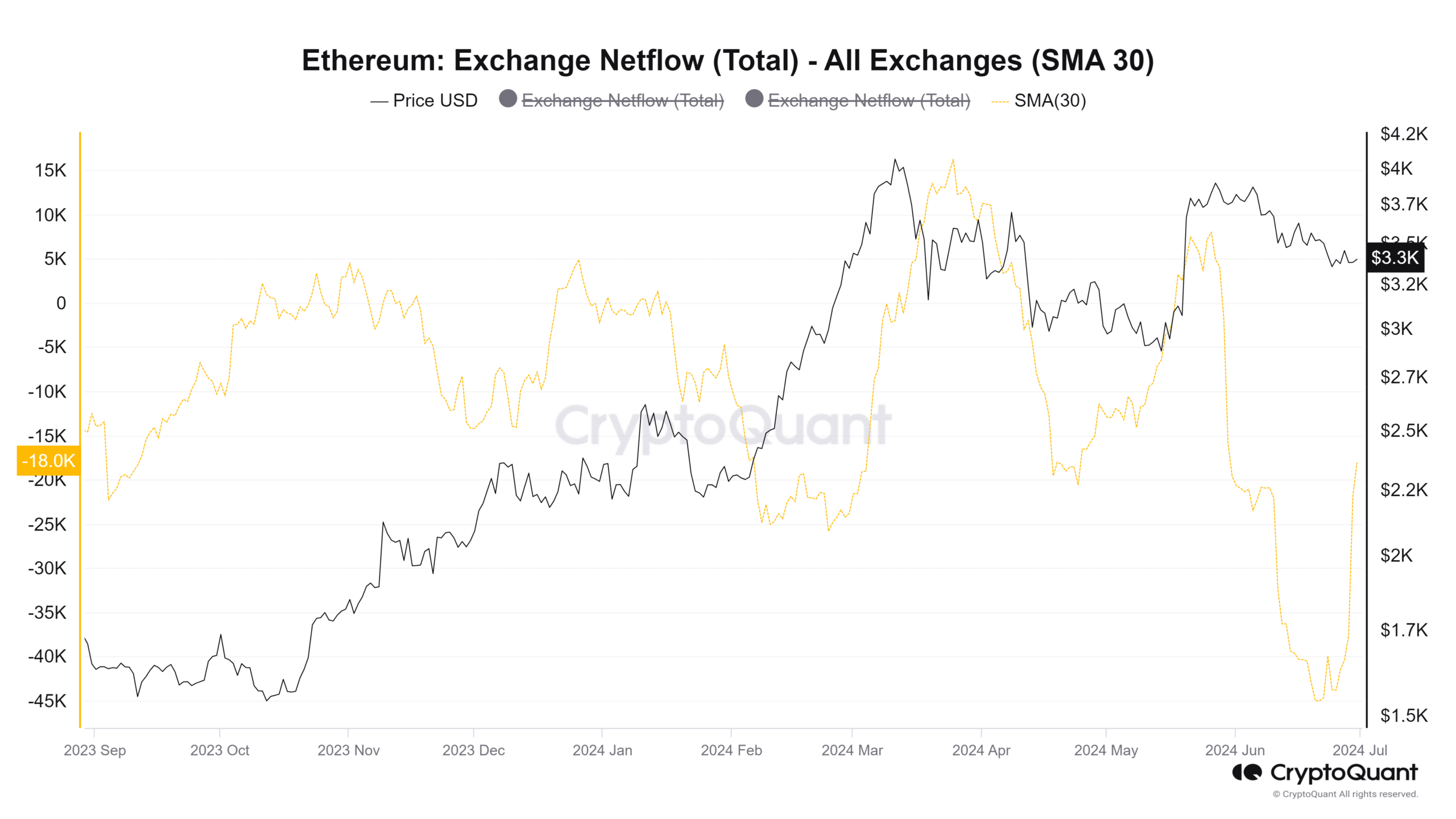

source: Cryptoquant

The 30-day simple moving averages were used to better understand the exchange flow trends. ETH inflows were significant in mid-March and late May.

Both events constituted a local peak for the price.

Over the past month, the net flow has been significantly negative, indicating accumulation. Over the past eight days, outflow has slowed, but net inflow over the 30DMA has remained in negative territory.

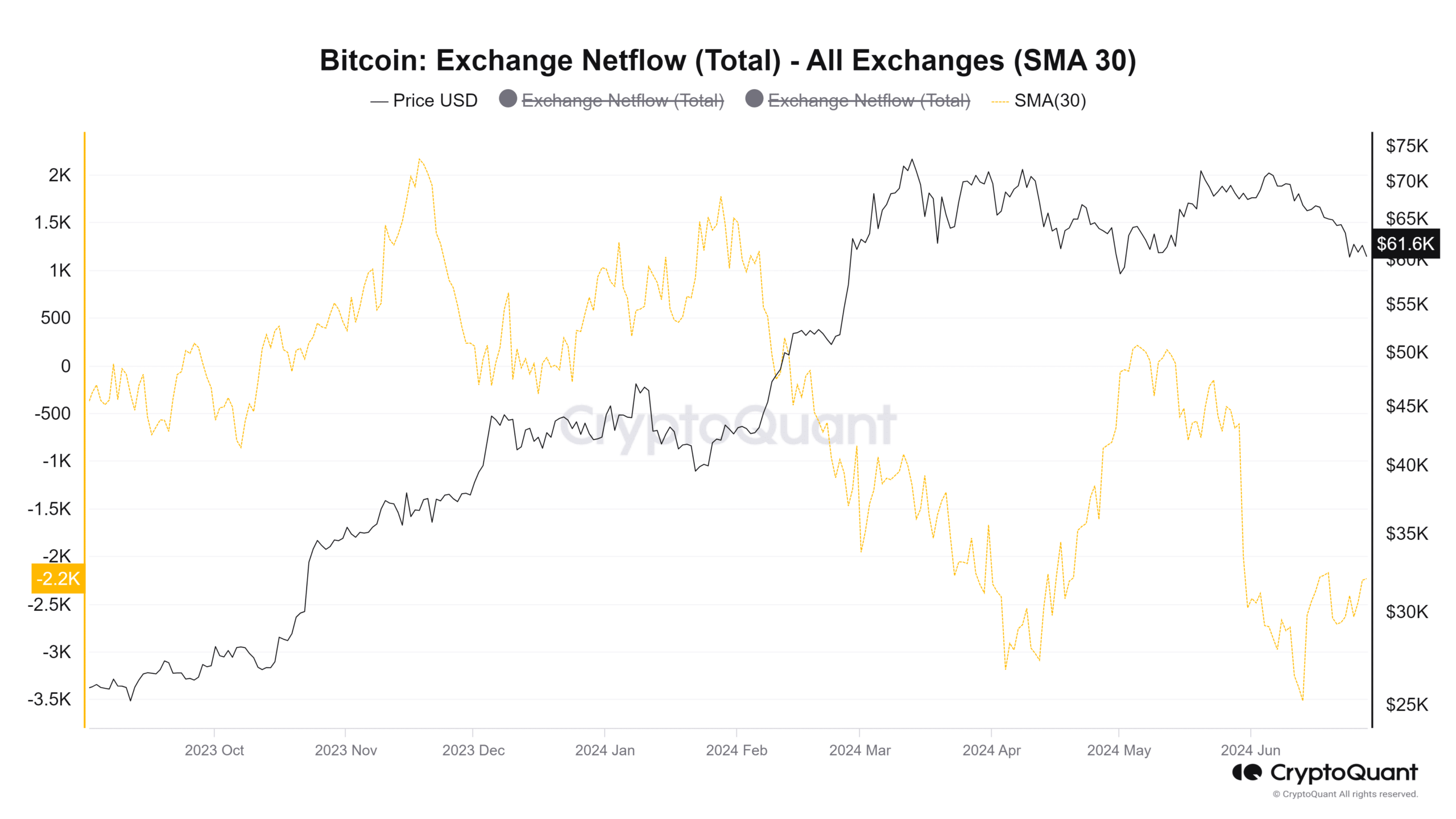

source: Crypto Quant

Meanwhile, Bitcoin saw steady accumulation in February and March. The 30DMA showed that BTC outflows from exchanges continued to dominate.

In late April and on May 21, there were spikes in Bitcoin flows, but they were exceptions to this trend.

Are Bitcoin and Ethereum Heading for Consolidation?

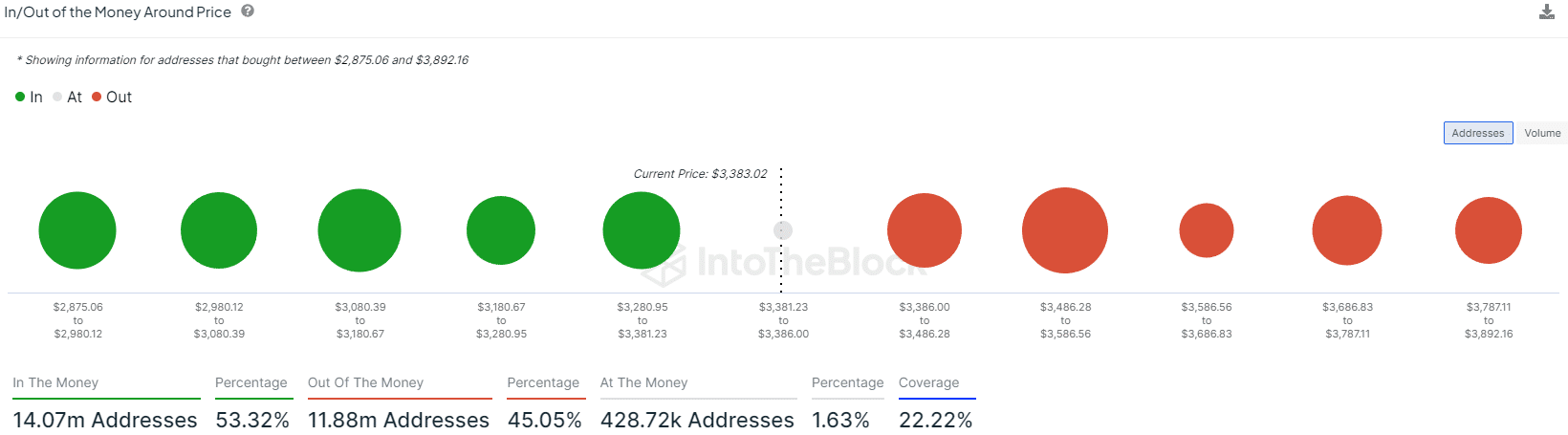

source: IntoTheBlock

AMBCrypto’s examination of IntoTheBlock’s entry and exit data highlighted key support areas.

The entry and exit from the money around the price has shown that Ethereum has a strong support bastion at $3080-$3180 and $3280-$3381. Similarly, the $3486-$3586 area is also a strong resistance.

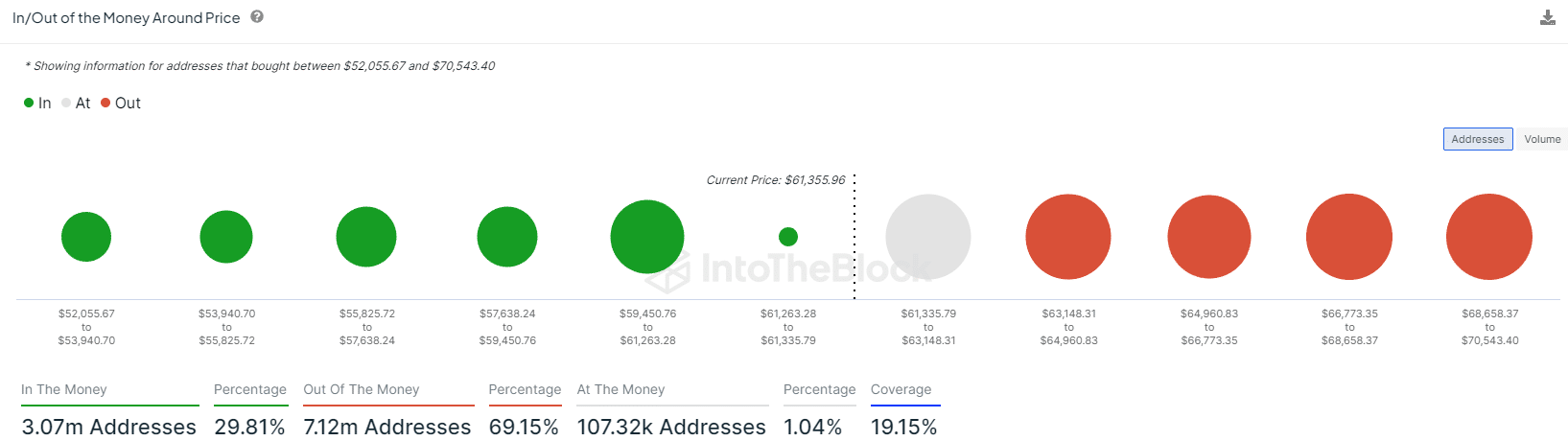

source: In the mass

Read about Bitcoin [BTC] Price forecasts 2024-25

For Bitcoin, the support level is $59,450-61,263, and the resistance level is $63,148-64,960.

This means that the current price consolidation of these two crypto market leaders could be limited to these levels and lead to the formation of a range.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote