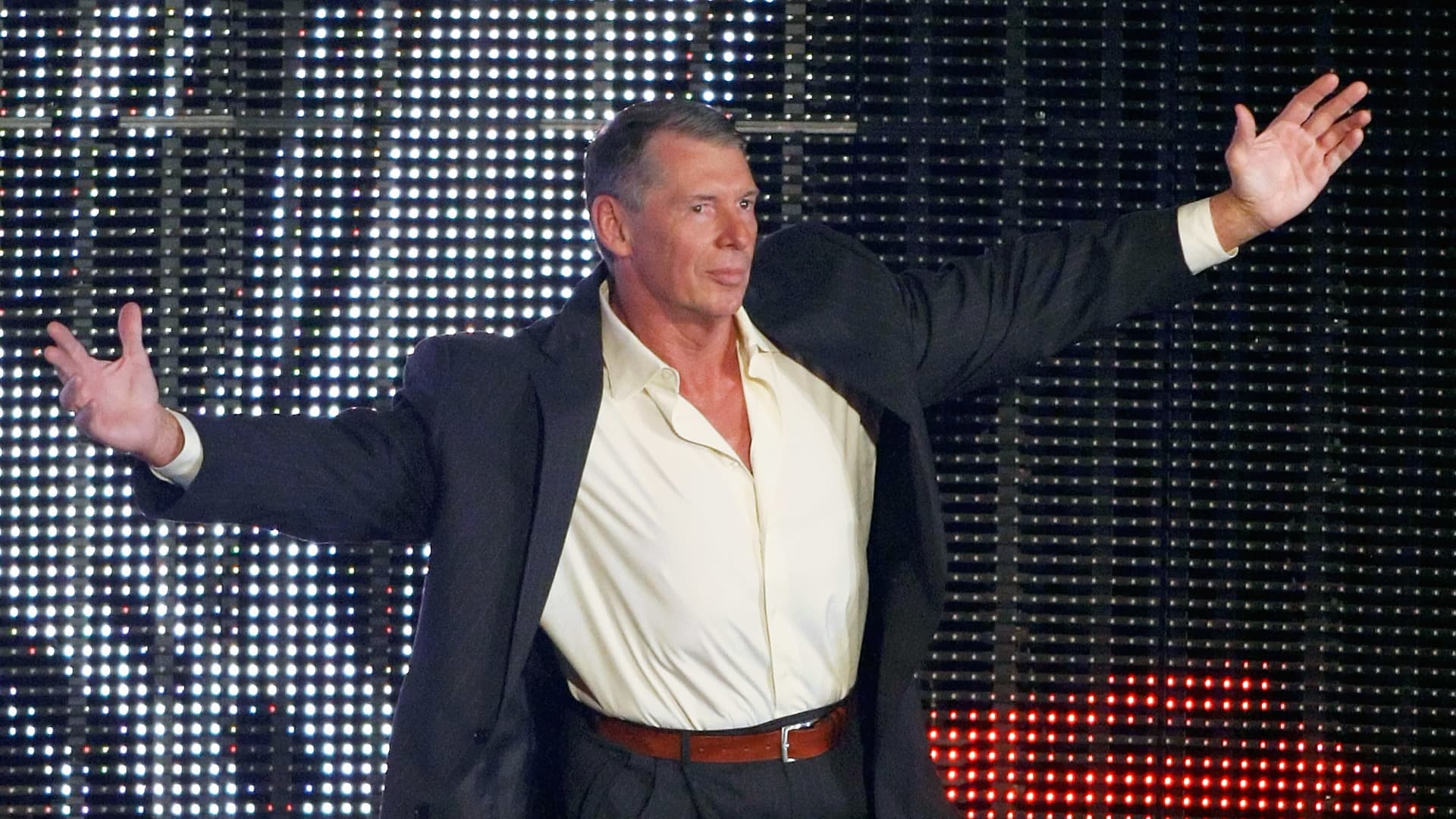

The Chairman of the Board of Directors of World Wrestling Entertainment Inc. was introduced. Vince McMahon during WWE Monday Night Raw at the Thomas & Mack Center on August 24, 2009 in Las Vegas, Nevada.

Ethan Miller | Getty Images

Vince McMahon is back World Wrestling Entertainment The Board of Directors to facilitate potential sale talks prior to renewing the company’s media rights.

The idea of selling WWE is not new. CNBC reported meIt looked like a sell target in April And It only looked more attractive in July After a sexual misconduct scandal. The rationale is fairly clear: WWE is valuable intellectual property.

Owning an IP allows streaming services to offer content exclusively without the inconvenience of winning licensing rights in an auction every few years. WWE also has value to offer in the field of merchandising and theme parks.

WWE has hired JPMorgan to help the company advise on a potential sale, according to people familiar with the matter. JPMorgan declined to comment. A WWE spokesperson could not immediately be reached for comment.

If a deal does happen, it will likely happen in the next three to six months, said the people, who asked not to be named because the discussions are private. WWE plans to speak with potential buyers before deciding on TV rights renewal agreements.

Facilitate the sale

McMahon’s return should help the sale run smoothly, though there are still some hiccups.

The 77-year-old former CEO and President and controlling shareholder of WWE. Quit yet Investigation I found it paid Approximately $15 million for four women over the age of 16 To suppress allegations of sexual misconduct and infidelity. Returning to the board will give potential buyers confidence that he supports the details of any transaction.

“My return will allow WWE, as well as any other parties to the transactions, to participate in these operations knowing that they will have the support of the controlling shareholder,” McMahon said in a statement on Thursday.

McMahon’s return does not affect the current leadership. McMahon’s daughter, Stephanie, and former CAA agent Nick Khan are co-CEOs. But it remains unclear what kind of role, if any, McMahon would want in WWE if he sold the company. WWE has it He told investors that McMahon’s role in the company is central to “our ability to create iconic characters and creative stories.” Currently, McMahon has no official say in the company’s creative direction.

Mansour (below) competes with Mustafa Ali during WWE’s Crown Jewel pay-per-view in Riyadh, Saudi Arabia, on October 21, 2021.

Fayez Noureddine | AFP | Getty Images

Whether the buyer would be comfortable with McMahon taking a more hands-on role in the company is unknown. But WWE is McMahon’s life’s work. The sale can only take place with at least some chains attached.

WWE has a market capitalization of over $6 billion having grown by nearly 17% percent on Friday, supported by increased selling speculation.

There are three categories of potential buyers for WWE – legacy media companies, broadcast companies and entertainment holding companies. Here who might be interested.

Comcast

ComcastInc., which owns NBCUniversal, is likely to be a buyer for WWE. McMahon already has an exclusive streaming deal with Comcast’s streaming service Peacock, and a cable TV deal with NBCUniversal’s USA Network. Comcast has a market capitalization of over $160 billion and could easily afford the company — especially with a check for $9 billion (or more). Coming as soon as January 2024 from Disney for a 33% stake in Hulu.

Comcast could lock up WWE forever without having to pay increments for upcoming rights renewals and could use the company’s IP address for theme parks, movies, and other series.

However, Comcast CEO Brian Roberts said in October “The bar is the highest in terms of mergers and acquisitions” He has said repeatedly that the company is in no rush to pursue an acquisition.

Fox

Disney

Returning CEO Bob Iger might want to make a cool acquisition as he takes back the throne Disney. WWE fits in with Disney the same way it fits in with Comcast. It would boost Disney’s streaming ambitions (possibly ESPN+), bolster the network’s linear business, and add some heft to its merchandising and theme parks business.

Comcast didn’t want Disney to move away from Fox in 2019 and He raised the price by tens of billions by exceeding Iger’s initial offer. Could Iger see WWE as the next IP battle between Disney and rival Comcast?

Disney CEO Bob Iger attends the European premiere of Star Wars: The Rise of Skywalker at Cineworld Leicester Square on December 18, 2019 in London, England.

Victor Szymanowicz | Publishing in the future | Getty Images

Discovery Warner Brothers

Netflix

Netflix He has long stayed away from sports and other live events, however He has recently become open to the idea of owning a league or taking an ownership interest. Having a sports league would give Netflix the ability to create separate video games and series without friction. Netflix has had success with the Formula 1 documentary series “Drive to Survive,” giving co-CEO Reed Hastings faith that certain sports properties will resonate with Netflix’s huge global audience. But Netflix does not own Formula 1, which limits its future options.

Acquiring WWE or another sports league would be a way to offer live entertainment without renting content — similar to Zaslav’s thinking.

“We haven’t seen a profitable avenue for big sports hire,” said co-CEO Ted Sarandos. Last month at the UBS Global TMT Conference. “We’re not anti-sports; we’re just for-profit.”

Amazon

Endeavor Holdings Group

questmanaged by super agent Ari Emanuel, WWE could add to the steadiness of its assets next Agree to buy 100% of the UFC in 2021.

Emanuel bought the UFC to increase the scope of the talent agency’s business for live events. WME-IMG, now just a part of Endeavor, represents many UFC players – as well as WWE superstars. The UFC deal has been a success for Endeavor, which paid out nearly seven times its 2016 earnings of $600 million in 2016. It generated more than $1 billion in revenue in 2022.

Ari Emanuel speaks on stage during the 2017 LACMA Art + Film Gala Honors Presented by Gucci at LACMA on November 4, 2017 in Los Angeles, California.

Stephanie Keenan | Getty Images Entertainment | Getty Images

Endeavor’s enterprise value of just $11 billion makes WWE a huge turnaround for the company. The company’s small balance sheet will likely prevent Endeavor from winning the bidding war against the media giants. But McMahon’s inflated personality may suit Emmanuel’s brashness and UFC President Dana White’s.

The sale to a third party would also allow WWE to further renew the rights every few years. This may or may not be positive for the company’s long-term future as the media distribution ecosystem changes.

Liberty Media

While Endeavor owns the UFC, Liberty Formula One Collection Formula 1 is owned by John Malone, controlling shareholder of Liberty, and CEO Greg Maffei, along with Formula 1 CEO Stefano Domenicali, figure out how to market the motor racing league globally, including breaking with American culture after decades of obscurity.

Malone and Maffei have extensive track records of maximizing media ratings and acquiring media assets under $10 billion, including Formula 1, Sirius XM and Pandora. Formula 1’s global success could provide a roadmap for WWE’s future strategy.

Disclosure: Comcast owns NBCUniversal, the parent company of CNBC.

WATCH: Jim Cramer gives his take on how Disney has fared this year

“Freelance entrepreneur. Communicator. Gamer. Explorer. Pop culture practitioner.”

More Stories

The Gen Z pop star launched Harris’ campaign. Puerto Rican musicians might just get it over the finish line

Menendez resents suspicion as prosecutor seeks clemency from Newsom

Ariana Grande and Cynthia Erivo look forward to the Oscars