Coming every Saturday Hodler’s Digest It will help you keep track of every important news that happened this week. Best (and worst) quotes, top adoption and regulation, leading currencies, forecasts and much more – a week on Cointelegraph in one link.

This week’s top news

BREAKING: Crypto Historic Day as Proof of Stake Ethereum Merge Happens

The highly anticipated Ethereum was switched to a Proof of Stake (PoS) consensus algorithm, dubbed “Merge,” at 6:42:42 AM UTC on September 15. The move is a major part of a comprehensive multi-year transition to the Ethereum blockchain. “It starts a chain reaction of the changes,” Eli Ben Sasson, co-founder and president of StarkWare, told Cointelegraph about the merger. The merger is said to help the Ethereum blockchain reduce power consumption by around 99%.

During the viewing party Before the network switched from Proof of Work (PoW) to PoS, Ethereum co-founder Vitalik Buterin said:[It] It has obviously been a dream for the Ethereum ecosystem almost from the start. We started our proof-of-stake research with this blog post on Slosher in January 2014.

A party known as ETHW Core does not agree to the transfer, however, Aiming to preserve PoW copy of Ethereum via fork in the 24 hours following merger. Multiple crypto exchanges plan on listing The forked chain asset, ETHPoW (ETHW).

“Abra” announces plans for an American bank that supports digital assets

Digital asset trading platform Abra has announced that it is in the process of creating two financial institutions: a US bank and an international crypto business. With the aim of opening in 2023, the US government bank will operate under the name Abra Bank and will be compatible with digital assets in a format similar to cash in traditional banks, or so it appears. Centered outside the US borders, a subsidiary known as Abra International is also in the plans. The company is looking to tick all the boxes for Abra Bank and Abra International in terms of regulation.

Norway’s central bank is using Ethereum to build a national digital currency

Norway’s central bank, Norges Bank, is using the Ethereum blockchain to build its central bank digital currency (CBDC). The bank is still in the early stages of building its own CBDC, but has unveiled open source code for its asset test network via a sandbox. Several countries have expressed interest or started working on a central bank digital currency, although the asset does not necessarily need to be built on the blockchain. The Bahamas and Nigeria already have live CBDCs.

The Saudi Electricity Company deals with the increasing deposits of cryptocurrency issuers through specialized offices

For the remainder of 2022, the US Securities and Exchange Commission (SEC) will add two new offices, one of which will assist in its crypto regulatory endeavors. The Crypto Asset Office, which is under the Corporation Finance Division’s Disclosure Review Program, will evaluate digital asset deposits. This crypto issuer’s deposits have increased, likely due to the SEC’s increased activity in the cryptocurrency industry. This week, the US government also unveiled a crypto regulatory framework covering many topics, with nine government departments involved in creating the framework.

Lawyer Says Bitcoin Possession Is Still Legal in China Despite Ban

The Chinese regulatory system for cryptocurrency remains unclear. “So far, the holding of cryptocurrencies has not been banned in China,” Lesperance & Associates founder David Lesperance told Cointelegraph. In fact, holders of cryptocurrency in the country are protected by law in matters related to theft, embezzlement or breach of loan agreement. “It does not make commercial trading of this type of property legal, as the government has specifically banned cryptocurrency exchanges in China,” he added.

win overNearby and the losers

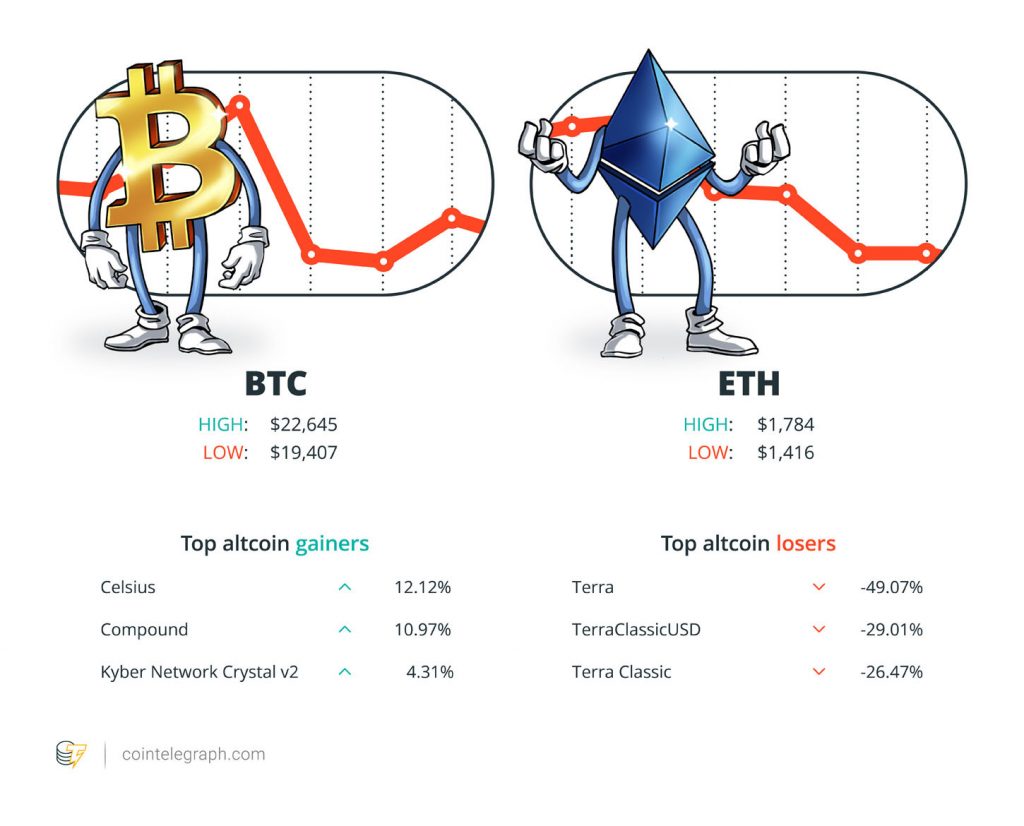

At the end of the week, Bitcoin (BTC) in $19,462ether (ETH) in 1425 USD And the XRP in $0.33. Total market value at US $949.92 Billion , according to To CoinMarketCap.

Among the top 100 cryptocurrencies, Celsius were the top three gainers of the week (CEL) At 12.12% compound (comp) by 10.97% and Kyber Network Crystal v2 (KNC) by 4.31%.

The top three altcoin losers of the week are TERRA (luna) At -49.07%, TerraClassicUSD (USTC) at -29.01% and Terra Classic (your color) By -26.47%.

For more information on crypto prices, be sure to read Cointelegraph Market Analysis.

Most unforgettable quotes

“I think the market, not just the crypto markets but the stock market, is holding out hope that one day the Fed will magically say, ‘Okay, I think this will be the last rally or the last price hike. “

Marcel BichmannMarket Analyst and Cointelegraph Contributor

“Music NFTs are against genre. We see a lot of diversity and creative freedom in NFTs – as if artists are finally free to create for the sake of creativity and not conform to algorithms.”

Adrian Sternco-founder and CEO of Reveel Technology

“DeFi insurance is a sleeping giant. With less than 1% of all cryptocurrency covered and less than 3% of DeFi being covered, there is still a huge market opportunity that has yet to materialize.”

Dan ThompsonChief Marketing Officer, InsurAce

“If enough people stand behind a crossroads for whatever reason, we feel the free market will decide what should live and what should not live.”

Bradley DukeCo-CEO of ETC Group

“It will be an important success mark when you are the first [Ethereum] The block is produced by proof of stake. But that’s like finishing a missile launch – we still have the rest of the flight ahead, which will pose its challenges.”

Elie Ben Sassoonco-founder and president of StarkWare

“Web3 seeks to protect individuals’ legitimate claims to complete control of their data and put privacy at the center of their online lives.”

Ursula OckingtonsDirector of Communications and Partnerships at Web3 Foundation

Predicting the week

Bitcoin Price Threatens $19.6K As Ray Dalio Predicts 30% Stock Collapse

Bitcoin surged above $22,000 this week, but then fell below $20,000 in the following days, according to Cointelegraph’s BTC Price Index.

Billionaire investor and hedge fund manager Ray Dalio expects traditional markets to face downward pressure due to higher inflation and higher interest rates. Crypto assets have been trading alongside traditional markets lately.

“I estimate that rising rates from where they were to about 4.5 percent would have a negative 20 percent effect on stock prices (on average, although greater for assets with longer duration and less for assets with shorter duration) based on the value discount. In a post on Sept. 13, Dalio said:

FUD of the week

Thai SEC plans to ban cryptocurrency lending in the country

The Securities and Exchange Commission of Thailand wants to ban “digital asset business operators” from providing cryptocurrency lending and warehousing services to clients, according to a September 15 announcement from the government agency. The ad requests comments from the public regarding a possible ban, with October 17 as the deadline to consider the case.

South Korea issues arrest warrant for founder of Terra Do Kwon

South Korean authorities are said to be searching for six people, including Terraform Labs co-founder Do Kwon, although Kwon and the others are currently in Singapore. The six people were reportedly the subject of an arrest warrant issued by a Seoul court. The attorney general said Kwon violated South Korea’s capital markets law. Terraform Labs headed the Luna crypto project, which suffered a dramatic collapse earlier in 2022. Saw more news Prosecutors are seeking to revoke the passports of all six who took part in the Luna crypto project. In addition, prosecutors are seeking an international warrant for the arrest of the six.

Stone Ridge Board of Directors Approves Plan to “Dissolve” Its Bitcoin Fund

Stone Ridge Bitcoin Strategy Fund will close shop after October 3, and liquidation is expected around October 21. . The fund uses, in part, futures products to give investors exposure to bitcoin.

Cointelegraph’s Best Features

Ethereum is eating the world – ‘You only need one internet’

Is there a need for more than one internet? We know the answer is ‘hell no’.

A guide to the real-life crypto OGs you meet at a party (Part 2)

“I think the OGs are core believers who did their best when no one else was paying attention to space.”

Boom and Boom: How Do Defi Protocols Deal With a Bear Market?

A look at how DeFi protocols performed during the recent bear market and the importance of continuing to build during periods of downturn in the market.

The best of blockchain, every Tuesday

Subscribe to thoughtful explorations and a leisurely read from the magazine.

By subscribing you agree to Terms of Service and Privacy Policy

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote