(Bloomberg) — Next week's U.S. consumer price data, which comes on the heels of surprisingly strong jobs numbers, is expected to show a sharp slowdown in core inflation that explains the Federal Reserve's cautious approach to cutting interest rates.

Most read from Bloomberg

The March core CPI, a measure of core inflation that excludes food and fuel, is expected to rise 0.3% from the previous month after a 0.4% rise in February. Wednesday's report is expected to show a similar increase in the overall CPI.

The core price measure is expected to rise 3.7% from a year ago, representing the smallest increase since April 2021. While the annual figure is well below the peak of 6.6% reached in 2022, recent progress has been uneven. .

The closely watched inflation figures come on the heels of the latest monthly jobs report, which beat expectations for the fifth month in a row. While Fed officials have pointed to moderation in labor demand over the past year as a possible precursor to lower interest rates, the 303,000-job jump in payrolls for March may raise questions about the extent of this cooling, and its implications for inflation.

Many Fed officials speaking over the past week have been consistent in their messaging that it is appropriate to wait until there is a clearer indication that inflation is slowing toward their target before taking the first step toward lowering borrowing costs.

What Bloomberg Economics says:

“The focus is now shifting towards the path of inflation, which is currently a more important factor in the Fed's reaction function. We expect the March CPI report to show a modest slowdown in the monthly pace of core inflation to 0.3% – which remains consistent with the core inflation target.” Fed's annual rate of 2.0%.Even if annual headline inflation hovers around 3.0% through the end of the year, sustained lower inflation in the core should allow the Fed to cut interest rates this summer.

—Anna Wong, Stuart Ball, Elisa Wenger, and Estelle Au, economists. For the full analysis, click here

US central bankers meet next April 30-May 1, and are widely expected to keep interest rates steady. Minutes from the March meeting are due on Wednesday, and traders will also be watching New York Fed President John Williams' remarks at Thursday's event.

Read more: Explosive jobs data increases chance of smaller Fed rate cuts

Thursday's report on prices paid to US producers is expected to show more moderate monthly progress. However, recent increases in the prices of crude oil, copper and some other commodities suggest lower commodity inflation in the coming months.

Heading north, the Bank of Canada is widely expected to keep its key interest rate at 5% on Wednesday, with the economic outlook revised to reflect stronger-than-expected growth at the start of this year and the longer-term effects of Trudeau government policy. Cap on temporary residents.

Elsewhere, central banks from New Zealand to the eurozone to Peru are also set to hold firm, while economists are split between a cut and a pause in Israel. Meanwhile, former Fed Chairman Ben Bernanke is scheduled to provide a review of the Bank of England's forecast errors on Friday.

Click here to see what happened last week. Below is a summary of what will happen in the global economy.

Asia

A large group of central banks in Asia are holding meetings next week, and authorities in the Philippines, New Zealand, Thailand and South Korea are expected to maintain policy stability.

Any hints of when they might shift to easing cycles will be in focus, with RBNZ Governor Adrian Orr expected to give an update on Wednesday on the timeline for normalizing interest rates as the New Zealand economy continues to fluctuate.

In the data, China's consumer inflation is expected to slow to 0.4% in March, while the decline in producer prices may deepen slightly to 2.8%, supporting the need for further stimulus. Exports are expected to decline for the second month.

India gets inflation numbers for March and industrial production for February.

In Japan, cash earnings data may show lower real wages for February 23, a trend that is expected to end when wage increases for the new fiscal year begin – the largest in more than three decades.

Europe, Middle East, Africa

The European Central Bank is set to keep interest rates steady on Thursday in what is globally expected to be the final pause before it begins monetary easing in June. President Christine Lagarde's words will be searched for clues about what might happen next, with some officials already pushing for successive steps.

After last week's weaker-than-expected inflation reading, policymakers won't get much additional data before the meeting, although Tuesday's quarterly bank lending survey may provide some insight.

European finance ministers are scheduled to meet for their regular meeting in Luxembourg at the end of the week. They will discuss exchange rate developments, inflation and competitiveness of the region.

Heading east, Hungary is set to publish the minutes of its latest policy meeting, in which it cut its benchmark by 75 basis points and said it would continue to ease back on easing. Serbia is scheduled to keep interest rates unchanged.

Russia gets inflation data on Wednesday, the same day Bank of Russia Governor Elvira Nabiullina may present her annual report in the State Duma.

In Britain, GDP figures on Friday are likely to confirm a second month of growth in February, putting the economy on track for a moderate recovery after a shallow recession in 2023. The Bank of England will release a report that day from Bernanke, setting out recommendations on how Officials could improve forecasting and communication after criticism that they were slow to recognize the inflation crisis that began after the pandemic.

Read more: Bernanke advises BoE towards 'scenario outlook' on Fed plans

Israel's interest rate decision on Monday is likely to be a close match between a fix and a 25 basis point rate cut. The decline would boost the economy as the six-month-long war in Gaza continues to impact consumption and sectors from tourism to construction. But it may also increase pressure on the shekel, which has weakened since early March.

Uganda is likely to be more confident, with analysts predicting that the Monetary Policy Committee will leave the key interest rate unchanged after increasing it by 50 basis points to 10% at an unscheduled meeting last month. This is as inflation begins to decline again and the currency grows stronger against the dollar.

Meanwhile, Zimbabwe will launch its new currency – the ZiG – on Monday.

latin america

Putting the inflation genie back in the bottle has central bankers around the world well-prepared, as Rosanna Costa in Chile, Victoria Rodriguez in Mexico, and Roberto Campos Neto in Brazil attest.

Data in Chile will likely show consumer prices falling back closer to January's reading of 3.8% after jumping in February. The central bank raised its forecast for 2024 to 3.8% from 2.9%.

In Mexico, where disinflation has proven difficult and protracted, the early consensus was to re-accelerate full-month and bi-weekly readings.

Brazil, which had already had inflation below target since last June before a 203 basis point increase in the third quarter, is likely to see consumer prices fall for the sixth straight month, within the central bank's tolerance range but still well above. Goal.

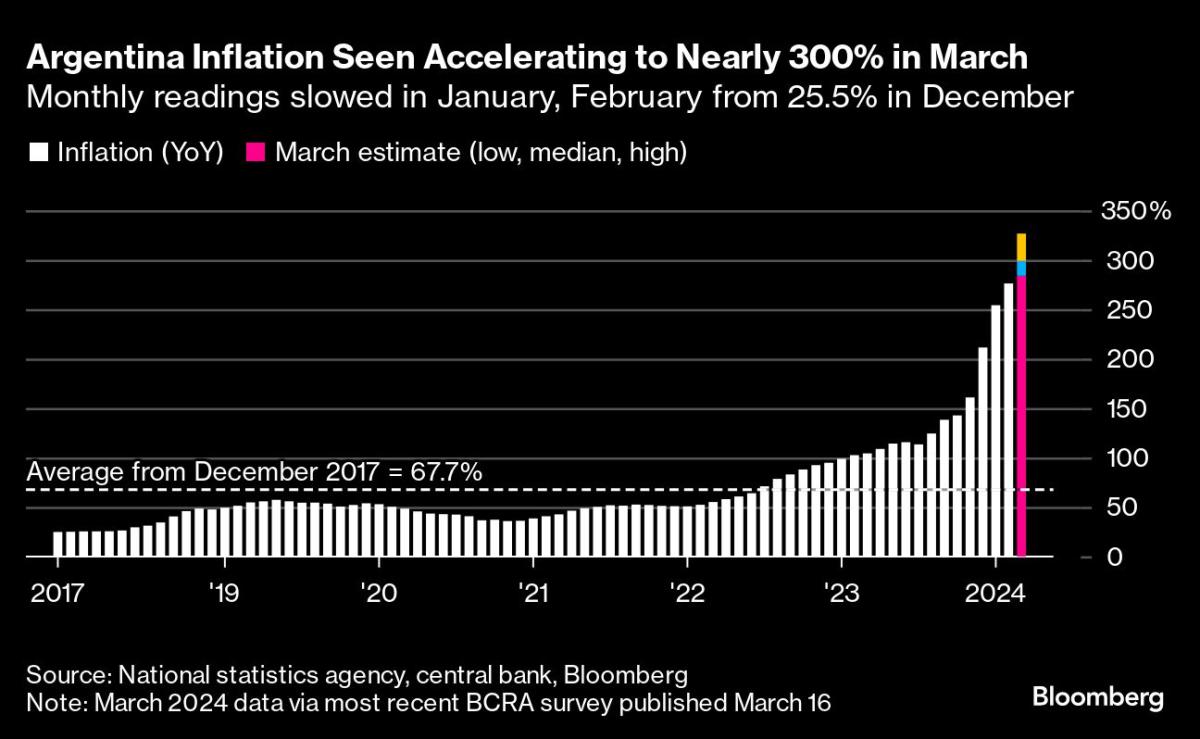

The latest is Argentina, where monthly data released for March may record a single-digit rise, according to a member of the President's Advisory Council, Javier Miley. Analysts surveyed by the central bank believe this rate is just over 14%, which is enough to push the annual result higher by 300%.

The Peruvian Central Bank may move on Thursday to hold interest rates for a second consecutive time at 6.25% after March inflation numbers exceeded all economists' estimates.

-With assistance from Robert Jameson, Brian Fowler, Laura Dillon Keen, Reed Lundberg, Paul Wallace, Monique Vanek, Tony Halpin, and Alexander Weber.

(Updates with Zimbabwe in EMEA section.)

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Skydance puts a revised offer on the table for Paramount

ChatGPT's “hallucinations” issue has faced another privacy complaint in the EU

Solana-based tokens JUP and JTO have achieved major milestones: what about SOL?