Google's parent company, Alphabet (Nasdaq:Google), rose yesterday, and ended the day with an increase of 4.6%, after Bloomberg Report that Apple (Nasdaq: Apple) He may look to Google Gemini Like the AI built into the iPhone. In fact, a potential partnership between Apple and Google Gemini in the field of artificial intelligence could reflect their treatment of research, which has been subject to a great deal of regulatory scrutiny in recent years.

Although the Google-Apple AI partnership is sure to draw the ire of antitrust regulators, I see this move as a potentially major win for both companies as they seek to gain (more) ground in the AI race.

With Microsoft (NASDAQ:MSFT) which is leading the assault on generative AI through its stake in OpenAI, Apple must find a way to make up for lost time on the AI front. Collaborating with Google is a way to connect with industry leaders like Microsoft. Also, this could be a straightforward way forward as Apple has access to one of the most powerful large language models (LLMs), Google Gemini. Given this, I remain bullish on both AAPL and GOOGL.

Apple: Collaborating with a powerful AI company could be wise

While I'm sure Apple can integrate its MBA into its devices, I think Google is the better option at this early stage of the AI boom. Why? Although MBAs have been doing well in recent quarters, they are still not immune to hallucinations (making things up, seemingly out of the blue).

Only time will tell when we will have a robust, hallucination-free MBA ready for the market. Regardless, given Apple's history of launching polished products that are really ready to take off, I don't see Apple putting itself out there with some sort of LLM product in the works.

Despite their impressive capabilities, the latest versions of Google Gemini and ChatGPT-4 Turbo are still technically a work in progress, at least in my opinion.

Neither LLM is perfect, especially at this stage of the AI's life cycle, when hallucinations still occur regularly. I think it may take some time before LLMs are polished enough that mistakes will become incredibly rare (or perhaps almost impossible).

We may be a few quarters or even a few years away from the flawless AI that many of us envision as a kind of holy grail in AI. Given how quickly generative AI technologies are advancing (think exponential rates, not linear), hallucination-free LLMs are probably a lot closer than many of us might think.

By now, I think the masses have come to accept that occasional hiccups are bound to occur when using the best LLMs out there today. Users of these LLMs can simply check the sources themselves to ensure they are not on the receiving end of a hallucination. In fact, fact checking can be a bit difficult when using LLMs like Gemini or GPT-4, but it's a relatively small compromise. Moreover, it's between that and using an old-fashioned search engine.

What does the future hold for the Google-Apple AI partnership?

I don't think Apple really has anything to gain by rushing an LLM product to market right now, especially given that Today's LLMs are prone to errorsAnd the negative headlines, the lawsuits, the public outrage, and all kinds of negativity.

When the ideal time comes (perhaps when the LLMs have more polish), I think Apple could have the option to replace Google's Gemini with its own MBA, just like it did when it gave Intel (NASDAQ:INTEC) boot from your Mac when it's ready to run on its Apple Silicon back.

In these early stages of the AI boom, Apple will benefit from all the positives of AI by using Gemini without having to deal with the negatives. If something goes wrong, Gemini LLM, not Apple, is responsible. In the meantime, look for Alphabet to gain traction as Gemini introduces itself to Apple's golden install base, which is billions of users strong.

In fact, Gemini in iPhone could eventually help Google and Apple edge out Microsoft in the LLM race. It will be interesting to see how the potential partnership between Google and Apple develops. However, if any deal is signed, I expect GOOGL stock to face a significant valuation expansion, perhaps closer to one of its biggest AI peers, MSFT stock, even if Alphabet has to pay a huge sum for Apple.

Even after rising 4.6% in one day, GOOGL stock still appears to have room to rise 25.4 times price to earnings (P/E) If he catches up with her MSFT stock has a P/E of 37.7 times.

Is GOOGL stock a buy, according to analysts?

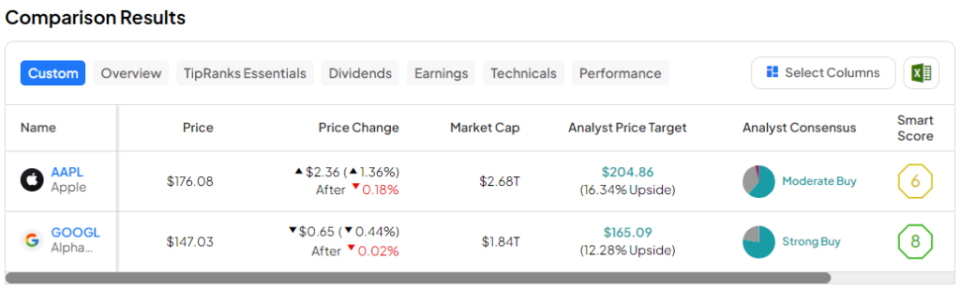

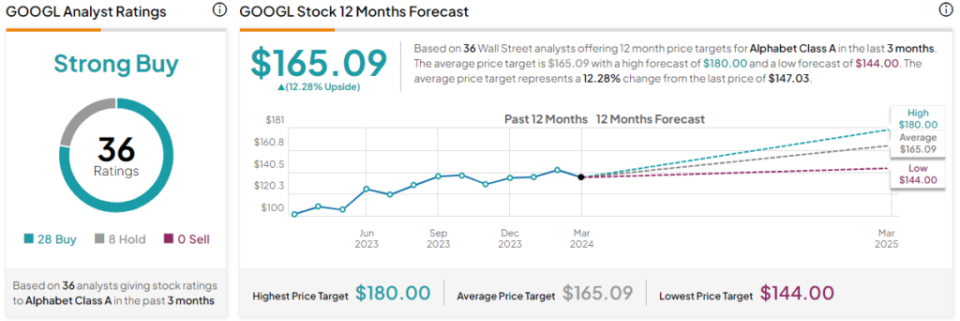

Alphabet stock is a strong buy, according to analysts, with 28 buys and eight holds set in the past three months. the Average price target for Alphabet stock The price of $165.09 indicates an upside potential of 12.3%.

Is AAPL stock a buy, according to analysts?

Apple stock is a moderate buy, according to analysts, with 16 buys, nine holds and one sell set in the past three months. the Average Apple stock price target $204.86 indicates an upside potential of 16.3%.

Bottom line

The Google-Apple Gemini AI deal looks like it will be a win for both companies as they try to get ahead in the generative AI race. It is important to note, however, that all we have is a report from Bloomberg About possible talks between the two companies.

The chatter around the chatter means that nothing has been decided yet, although recent market action suggests that the dotted line has already been signed. In any case, look for Apple to look for an AI partner as it seeks “buy-in” at this still early (and unrefined) stage of generative AI.

“Certified food guru. Internet maven. Bacon junkie. Tv enthusiast. Avid writer. Gamer. Beeraholic.”

More Stories

Google hints at ‘amazing things’ coming in Android 17 as AI takes center stage

Nintendo is launching a music app with themes from Mario and Zelda, and more importantly, a Wii Shop channel

The Google Pixel Tablet 3 will take another step towards replacing your laptop