BitMEX Founder Arthur Hayes looks into the possibility that Bitcoin may have already printed a bear market bottom, saying that three major players have likely sold out. BTC for sale.

In a new blog post, the veteran cryptographer Identifies Three groups of investors have been forced to dump their bitcoin pool this year due to the abuse of leverage: centralized lenders and trading firms, and ordinary bitcoin miners and speculators.

Looking at centralized firms first, Hayes says these institutions likely dumped most of their bitcoin after the collapse of crypto hedge fund Three Arrows Capital (3AC) and Sam Bankman-Fried’s trading firm Alameda Research.

“When these two companies [Alameda and 3AC] We got into trouble, what did we see? We’ve seen large transfers from the most liquid cryptocurrencies – Bitcoin (WBTC in DeFi) and Ether (WETH in DeFi) – to centralized and decentralized exchanges which are then sold off. This happened during the big move down…

I can’t prove that all of the bitcoins held by these failed institutions were sold during the multiple crashes, but it seems they did their best to liquidate the most liquid crypto collateral they could use right before they crashed.

The [centralized lending firms] And all the big trading companies have already sold most of their bitcoins. All that is left now are illiquid sh** coins, private stakes in crypto companies, and locked pre-sale tokens.”

As for Bitcoin miners, Hayes says they have been net selling bitcoin since the first credit crunch in June when the crypto-king fell below $20,000 for the first time in over 18 months.

“They have to do this in an effort to stay on top of a large mandatory debt load. And if they don’t have debt, they still need to pay the electricity bills — and since the price of bitcoin is so low, they have to sell more of it to keep the facility running.”

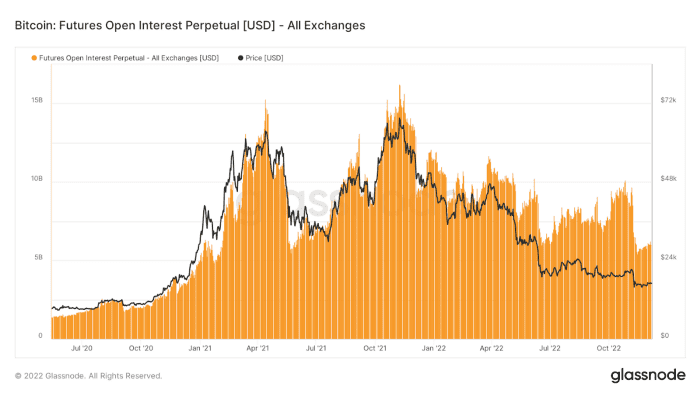

When it comes to regular speculators, Hayes says he looks at the amount of open interest (OI) on long and short contracts to gauge the level of speculation in the markets. According to him, OI’s all-time high coincided with BTC’s all-time high. OI also fell along with the market down, which indicates that speculators have been eliminated.

Taking a look at total OI across all major crypto derivatives central exchanges, we can see that lower local OI also coincided with a stab below $16,000 by Bitcoin on Monday, November 14. Now, OI is back to levels not seen since early 2021.

The timing and scale of the OI cut leads me to believe that most of the excessively leveraged long positions have been extinguished.”

Hayes concludes that he is not 100% sure if Bitcoin’s current bear market drop around $15,900 is an absolute bottom, but says that BTC rebounded from that level due to a “forced sell-off caused by a credit deflation.” It also indicates that everything is cyclical.

“What goes down will rise again.”

At the time of writing, Bitcoin is changing hands for $17,170.

Don’t miss out – Subscription Get encrypted email alerts delivered straight to your inbox

check price action

Follow us TwitterAnd the Facebook And the cable

browse Daily Huddle Mix

nbsp

Disclaimer: The opinions expressed on The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in bitcoin, cryptocurrency, or digital assets. Please be aware that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend buying or selling any cryptocurrency or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl engages in affiliate marketing.

Featured image: Shutterstock/kersonyanovicha/David Sandron

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote