Take profits in the chip giant Nvidia (Nasdaq: NVDA) It was a popular move among billionaire hedge fund managers in the first quarter, as a number of prominent figures reduced their stakes in the company. Given the market the stock has taken, it’s perhaps not surprising that some big-name investors have been taking some profits.

Among the billionaires who reduced their stakes in Nvidia was Stanley Druckenmiller of Duquesne Capital Management. David Tepper of Appaloosa Management, Paul Tudor Jones of Tudor Investments, and Philippe Laffont of Coatue Management.

Druckenmiller spoke about why he reduced his stake in Nvidia, saying in an interview with CNBC that he still loves Nvidia but that Artificial Intelligence (AI) It may be overrated in the near term. However, he said the payoff could be significant in four to five years, and that AI may be underappreciated in the long term.

While it’s common to see billionaire hedge fund managers taking some profits into stocks like Nvidia, many top hedge fund managers are also accumulating the alphabet (NASDAQ:GOG) (Nasdaq:Google). Among the investors who bought shares aggressively in the first quarter were Chase Coleman of Tiger Global, Glen Kacher of Light Street Capital, Gavin Baker of Atreides Management, and Michael Pausic and Nick Lawler of Foxhaven Asset Management.

Let’s take a look at the reasons why these investors think Alphabet is an attractive investment.

Alphabet attracts investor interest

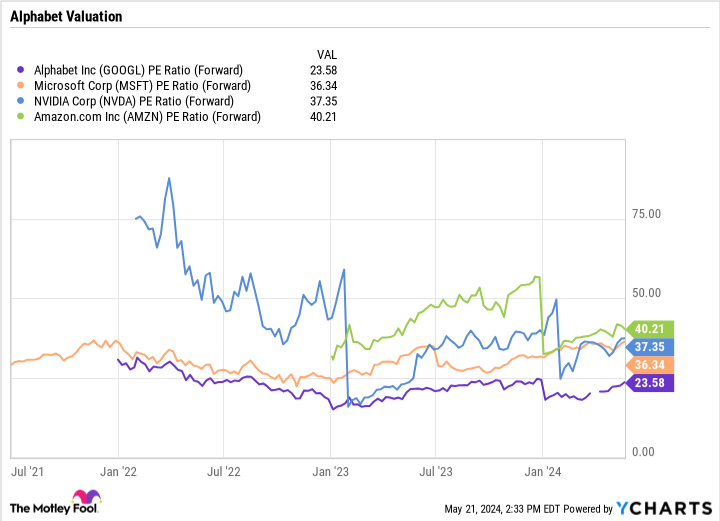

Valuation is one of the first things that tends to catch the attention of hedge fund managers. Alphabet is trading at a very significant discount to many other AI-related stocks with a price-to-earnings (P/E) ratio of just 23.6 times. A number of competitors are trading at more than 35 times.

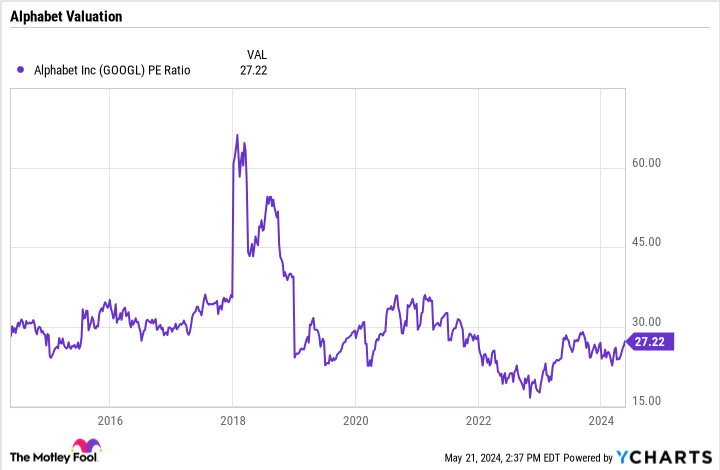

Additionally, this is lower than the multiple at which Alphabet historically traded before the pandemic when it often traded above a P/E ratio of 30 times.

This gives Alphabet shares room to rise, but valuation alone is not a reason to buy the stock by respected hedge fund managers.

An investment in Alphabet is an investment in a company that has two dominant businesses with Google search and the video platform YouTube. Google is almost a monopoly with about 90% share in global search. Although there are some concerns about AI impacting its search business, the company is embracing the technology, rolling out AI overlays at the top of page results to answer more complex questions.

Alphabet will look to new ad formats to help monetize its latest artificial intelligence efforts to drive growth. Since only about 20% of search results include ads, this is actually a very big opportunity for Google Search to become more profitable in the future by monetizing search results that it doesn’t currently make money on.

Alphabet’s YouTube platform should also not be overlooked. While many streaming services are out Netflix Alphabet has profitably struggled with these issues due to content costs, but the revenue-sharing model Alphabet uses with content creators has long mitigated these issues. At the same time, the company has a strong opportunity to capitalize on TikTok-competing short-form videos, which it is only just starting to monetize. If its competitor is banned in the US, this could be a big opportunity for the company.

Additionally, Alphabet’s cloud computing business is still in the early days of increasing profitability. Given the company’s high fixed costs, profitability must now grow much faster than revenue, which will be driven by AI adoption.

Should retail investors follow suit and buy Alphabet?

Alphabet is a relatively inexpensive stock with a dominant position in search and a huge opportunity ahead with artificial intelligence. While the stock has had a strong year, up nearly 27% year to date, it’s not too late for hedge fund billionaires to follow the stock.

The company has a long runway for future growth and multiple expansion potential (which is an increase in multiples of its valuation, such as P/E). Together, this is a powerful combination and makes for a buy for the stock.

Should you invest $1,000 in Alphabet now?

Before you buy shares in Alphabet, consider the following:

the Motley Fool stock advisor The analyst team has just defined what they think it is Top 10 stocks Let investors buy it now… and Alphabet wasn’t one of them. The 10 stocks that were discounted could deliver huge returns in the coming years.

Think when Nvidia I prepared this list on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $652,342!*

Stock advisor It provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. the Stock advisor The service has More than four times The return of the S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Susan Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeffrey Seller He has positions in the alphabet. The Motley Fool has positions in and recommends Alphabet, Netflix, and Nvidia. The Motley Fool has Disclosure policy.

Billionaires are selling Nvidia and buying this stock instead Originally published by The Motley Fool

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Elon Musk Denies Reports He’s Directing $45 Million to Trump PAC

This extra-long yellow Cadillac electric sedan has a fridge in the back seat.

CrowdStrike shares fall as IT disruption continues