(Bloomberg) — Shares of online auto retailer Carvana fell to an all-time low as investors grew concerned about a continuing decline in used car prices.

Most Read from Bloomberg

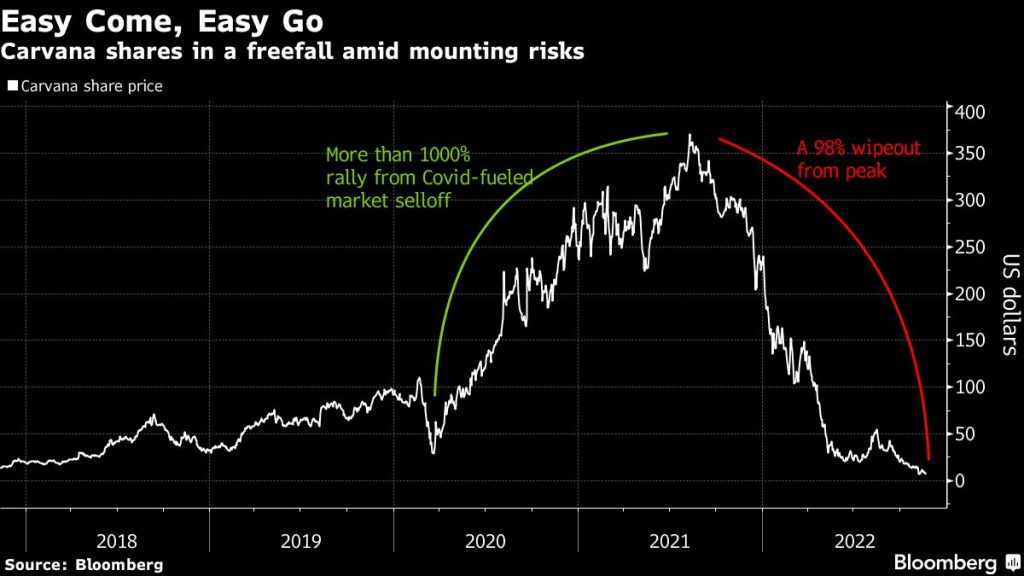

The company’s share price closed down 13% to $7.05, a record low. Carvana, once described as an industry disruptor to used-car dealers for its online sales, has seen recession-wary investors flee this year from risky and expensive growth stocks.

Shares of Carvana are down 97% so far this year as potential buyers grapple with rising interest rates and stubborn inflation. Just last week, the company said it would cut about 1,500 jobs, or 8% of its workforce, after it burned $2 billion in cash over the six months ending March 31 through at least one measure. Meanwhile, trading in his bonds shows that the market believes there is a high chance of default.

“With used car prices falling, we believe Carvana will struggle to make a profit on cars previously purchased at high prices,” Argus Research analyst Taylor Conrad wrote in a note Monday, the highly leveraged company. “We think the shares are overvalued.”

Overall, Wall Street’s stance on Carvana has taken a major turn this year, as valuations of unprofitable companies have plummeted across the market, as investors flee for safety and money becomes scarcer. The average analyst price target at the company is currently $24, a far cry from the $375 of just a year ago.

It mirrors the story of another stock market darling in times of a pandemic, whose business faces challenges returning to a more normal pace after a surge in demand. In the third quarter, hedge funds reduced their positions in Carvana, making it among the largest declines in the consumer discretionary group.

(Move inventory updates in the second paragraph and header of the first deck.)

Most Read by Bloomberg Businessweek

© Bloomberg LP 2022

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Elon Musk Denies Reports He’s Directing $45 Million to Trump PAC

This extra-long yellow Cadillac electric sedan has a fridge in the back seat.

CrowdStrike shares fall as IT disruption continues