Early Friday Dow Jones futures fell slightly, along with S&P 500 futures and Nasdaq futures. Investors will turn to the November jobs report on Friday morning.

X

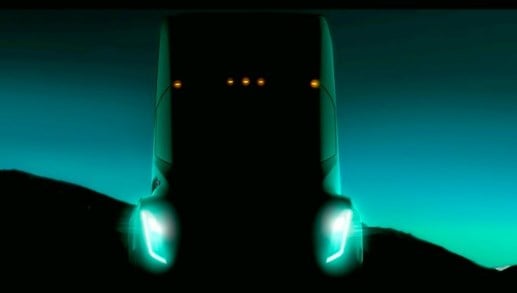

The Tesla Semi Truck Delivery event was held Thursday night with Tesla (TSLA) Arch-rival BYD is set to release buoyant EV sales numbers.

The stock market rally showed a strong move on Thursday, with mixed indicators, but it consolidated the huge gains made on Wednesday after the comments of Federal Reserve Chairman Jerome Powell. Thursday’s PCE inflation report, the Fed’s preferred rate measure, showed smaller-than-expected monthly increases as headline and core inflation eased slightly again.

Ulta Beauty (Ulta) headlined earnings reports Thursday evening. ULTA stock was little changed overnight after announcing strong earnings and raising guidance. Shares of the beauty products retailer have already hit record highs, stretching from points of purchase. Veeva systems (VEEV) beat the third quarter financial views, but the fourth quarter guidance was just below the midpoint of the consensus. VEEV stock fell modestly in the extended trade. The stock closed above the 200-day line, near an early entry.

Meanwhile, Giant Dao Larva (cat) continues to appear robust, with a CAT stock just below a Point purchase. Cyber Security Leader Palo Alto Networks (Banu) And the Marriott International (MarchBuy signals are also flashing.

Boeing stock works SwingTrader. It was a caterpillar on Thursday IBD stock today.

Dow jones futures today

Dow Jones futures fell against fair value. S&P 500 futures sank 0.1%. Nasdaq 100 futures fell 0.3%.

The 10-year Treasury yield rose 2 basis points, to 3.55%.

Dow futures, Treasury yields and more will swing on the November jobs report, due at 8:30 a.m. ET.

Remember to work in overnight Dow Jones futures contracts and elsewhere that does not necessarily translate into actual trading in the next regular session Stock market session.

Jobs report

Economists expect the November jobs report to show an increase in nonfarm payrolls of 200,000, down from 261,000 in October. Pay attention to the household survey, which showed jobs fell by 328,000 in October. The unemployment rate, based on the household survey, is expected to remain steady at 3.7%, with the labor force participation rate rising to 62.3%.

Other employment data this week generally indicated a gradual slowdown. Initial jobless claims unexpectedly fell, but continuing claims rose again. ADP reported a sharp slowdown in private sector hiring last month, while the JOLTS survey for October saw job openings decline slightly.

Tesla Half delivery event

The Tesla Semi Model Truck delivery event began shortly after 5 p.m. PST.

Tesla CEO Elon Musk will deliver some Tesla Semi EVs to… PepsiCo (PEP) Thursday night. Recently, the Tesla Semi was unveiled for the first time in six years and was supposed to enter production in 2020.

Musk says the Tesla Semi, which will use the same Plaid drive units as the high-end Model S, has a range of 500 miles on a single charge. Investors will look for accurate price, range and commodity specifications. That will be important because Tesla Semi takes on the large electric vehicles already on the market from Volvo, Nikola (NKLA), BYD (BYDDF) and more.

The other big question is what will be Tesla Semi production in the coming months. Musk has not provided clarity on that front.

Meanwhile, Tesla is now offering discounts of $3,750 for the Model 3 and Model Y in the US this month. The idea is to encourage people to deliver now. On January 1st, new US tax credits of $7,500 went into effect, subject to certain price and income caps, keeping many potential buyers waiting. The tax credits should apply to most Model 3 sedans and Model Y crossovers, though the government has yet to provide clarity.

Tesla also halved the 8,000 yuan ($1,133) insurance subsidy for December purchases, as planned, but is now offering free tolls and other perks said to be more than 15,000 yuan.

Tesla stock closed flat at 194.70 on Thursday. On Wednesday, TSLA stock rose 7.7%, regaining its 21-day streak, amid a market rally and as China EV stocks rose.

Tesla vs. BYD: Which EV giant is the best to buy?

BYD sales

China’s electric vehicle giant BYD is expected to release November shipments on Friday or Saturday, setting another record. BYD is expected to be the No. 1 automobile brand in China for this month, overtaking Volkswagen (VWAGY). It is likely to remain Volkswagen Group No. 1 including Audi.

BYD stock fell 2.2% to 25.07 but is still above the 50-day line. BYDDF jumped 9.9% on Wednesday, along with other China EV stocks.

Join IBD experts as they analyze actionable shares in the bullish stock market on IBD Live

Stock market rise

The stock market rally saw a 30-minute decline Thursday morning, but gradually improved to mixed, a solid performance after Wednesday’s big gains.

The Dow Jones Industrial Average fell 0.6% on Thursday Stock market tradingwith Salesforce.com (CRM) big negative. The S&P 500 fell 0.1%. The Nasdaq Composite Index rose 0.1%. Small cap Russell 2000 declined 0.2%.

US crude oil prices rose 0.8% to $81.22 a barrel.

The 10-year Treasury yield fell 17 basis points to 3.53%, the lowest since late September. On the heels of Fed Chair Powell’s comments and the PCE inflation report, markets came close to a 50bp rate hike on December 14, ending a series of four 75bp meetings. Moreover, there is now a 50-50 chance of a rate hike of only a quarter point in February.

The dollar, moving with the returns, fell to its lowest level in nearly three months.

Stocks near buy points

CAT shares fell 0.3% to 235.69. Stocks pause around a still valid 238 buy point of A cup base Back in April, according to MarketSmith Analysis. Investors could see 239.95 as another buy point, either as a higher handle for the 7-month cup base or as a traditional handle for a larger consolidation starting in June 2021.

Cybersecurity firm Palo Alto Networks rose 5% to 178.40, jumping above its 200-day line, and regaining that key level for the first time since mid-September. It comes after it bounced off the 50-day line during the day on Wednesday, shrugging off a large profit sell-off in peers. CrowdStrike (CRWD). Investors can consider PANW shares to be of great size, Double bottom base With 193.01 buy points. But the stock is already actionable from crossing the 200 day line and the downward sloping trendline from the April peak.

MAR fell 0.1% to 165.19, and remained above the 164.99 handle buy point from the bottom base as of August 16th.

Exchange Traded Funds

between the The best mutual fundsand the iShares Expanded Tech-Software Sector ETF (IGV) down 1.1%, even with the sale of shares of CRM Holdings Big. VanEck Vectors Semiconductor Corporation (SMH) decreased by 0.3%.

SPDR S&P Metals & Mining ETFs (XME(down 0.8% and US Global X Infrastructure Development Fund)cradle) increased by 0.1%. US Global Gates Foundation ETF (Planes) decreased by 0.4%. SPDR S&P Homebuilders ETF (XHB) increased by 1.25%. Energy Select SPDR ETF (xle(Down 0.3% and Financial Select SPDR ETF)XLF) sank 0.6%. SPDR Health Care Sector Selection Fund (XLV) advance 0.3%

Reflecting more speculative stories, the ARK Innovation ETF (ARK)ark(up 1.1% and the ARK Genomics ETF)ARKG) increased by 0.6%. Tesla stock represents significant weighting across Ark Invest ETFs. Cathie Wood’s Ark also has a small position in BYD stock.

Top five Chinese stocks to watch now

Market rally analysis

The stock market rally showed a constructive move on Thursday, essentially holding on to the big gains on Wednesday.

The S&P 500 rebounded intraday from a pullback to its 200-day moving average, after finally reclaiming that key level on Wednesday. The Russell 2000 also held the 200-day streak. Nasdaq still has work to do to get back to 200 days.

Dow Jones gave up only a portion of its gains on Wednesday, largely due to Salesforce. Several Dow Jones stocks, including those of Caterpillar, Boeing and United Nations, are showing strength. This reflects broader strength in the industrial, financial, health services and other fields.

The PCE inflation report for October was slightly better than expected. After a strong rebound in the market on Wednesday on Federal Reserve Chairman Jerome Powell – who didn’t sound particularly dovish – just holding on to those gains on Thursday was constructive.

Friday’s jobs report is another hurdle. If employment data indicates some slack in the labor market, it could provide an additional tailwind for stocks. But a hot job market can lead to a big sell-off.

Treasury yields and the dollar have fallen sharply in the past two days and the past few weeks, providing a significant tailwind for stocks. Yields rebound and the dollar will not be surprising.

Consider that a market rally has a number of large gains in one day, followed by a sideways movement or a sliding movement. This has made it difficult for investors to make progress even as indices have trended higher over the past several weeks.

It’s time to market with IBD’s ETF Market Strategy

What are you doing now

There were reasons to buy or not to be indifferent to Wednesday’s big move. On Thursday, investors could have added a little exposure, but the jobs report is a big question mark.

Friday’s market rally in the November jobs report could lead to a number of buying opportunities. But don’t cheat on promising stocks before the big news. Instead, work on your watchlists until you are ready to go. But also be prepared to reduce exposure if the market or your property goes sharply south.

Read The Big Picture Every day to keep up with the market trend, stocks and leading sectors.

Please follow Ed Carson on Twitter at @tweet For stock market updates and more.

You may also like:

Why simplify this IBD tool burntthe classroom for top stock

Best growth stocks to buy and watch

IBD Digital: Unlock IBD blue-chip stock listings, tools and analytics today

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Elon Musk Denies Reports He’s Directing $45 Million to Trump PAC

This extra-long yellow Cadillac electric sedan has a fridge in the back seat.

CrowdStrike shares fall as IT disruption continues