The Dow fell at the open on Wednesday, along with the S&P 500 and Nasdaq Composite, but far from pre-market lows as Federal Reserve Chairman Jerome Powell told Congress that policy makers will move aggressively to fight inflation, but say the US economy can handle however. Treasury revenues and crude oil prices also declined significantly.

X

Vertex Pharmaceuticals (VRTX) And the Bristol-Myers Squibb (BMY) regained their 50 streaks on Tuesday, while United Therapeutics (UTHR) in the scope of purchase. All three drug stocks have it Lines of relative force at altitudes.

while, Tesla (TSLA) and Google Parent the alphabet (The Google) Two of the massive sulfurs that have yet to break remain lows in late May. This is not market leadership, but a solid mass of strength.

UTHR stock is up SwingTrader. Google Inventory is on Long-term leaders of IBD. Vertex stock and BMY are on file defect 50 And the IBD Big Cap 20.

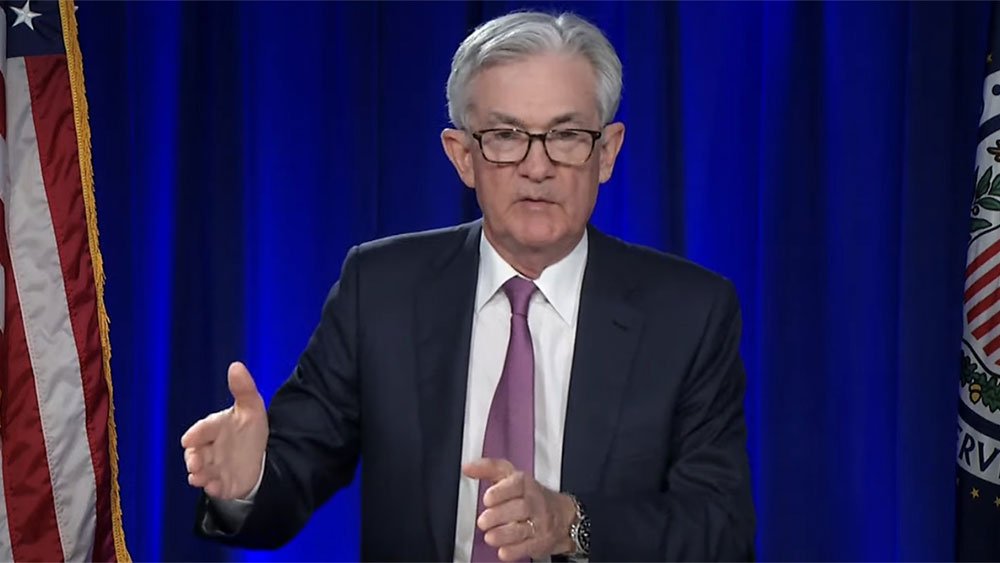

Fed Chairman Powell testifies

Federal Reserve Chairman Powell will testify before the Senate Banking Committee on Wednesday, followed by the House Financial Services Committee on Thursday. The session was scheduled to begin at 9:30 a.m. ET, right at the opening bell.

In his prepared remarks, Powell reaffirmed the central bank’s commitment to taming inflation It reached a 40-year high in May According to the consumer price index.

“At the Fed, we understand the difficulties that high inflation causes,” Powell said in his remarks. “We are strongly committed to bringing inflation back down, and we are moving quickly to do so.”

But he said the United States can handle large interest rate increases and reduce the risks of a recession. “The US economy is very strong and well-positioned to handle a tighter monetary policy.”

On Wednesday, Citigroup sees a 50-50 chance that the US will plunge into a recession. The most likely recession would be a mild “parks”-type slowdown, but there are risks of a “hard landing” and “stagflation”.

The Fed raised interest rates by 75 basis points on June 15, the largest increase in 28 years. After the Fed meeting was announced, Powell said policy makers could raise interest rates by 50 basis points or 75 in late July. Markets almost fully priced it in another move of 75 basis points.

Dow Jones today

The Dow Jones Industrial Average was down 0.9%. The S&P 500 fell 0.7% and the Nasdaq Composite fell 0.45%. Futures pointed to much larger losses ahead of the opening.

US crude oil prices are down more than 6%, trading below $105 a barrel and crude oil futures pointing toward their first monthly decline since November. Oil markets are increasingly concerned about a recession that is eroding demand for oil. Meanwhile, President Joe Biden has called on Congress to suspend the federal gasoline tax of 18.4 cents per gallon for three months.

Copper prices fell more than 3%.

The 10-year Treasury yield fell to 3.15% from 3.31% on Tuesday.

Join IBD experts as they analyze actionable stock market actionable shares on IBD Live

stock to watch

Vertex stock rebounded above the 50-day line on Tuesday after a strong move on Friday. The biotech giant has 292.85 buy point, but investors can use 279.23 as an early entry. The downward sloping trend line may offer a slightly lower entry.

Vertex stock was flat Wednesday morning.

BMY stock jumped again above the 50-day line on Tuesday, arguably offering an early entry. Technically, Bristol stock is a few weeks into a new base, but it can also be said that it is in a consolidation state going back to early April. Stocks changed little on Wednesday morning.

UTHR stock jumped 4.3% on Tuesday to 228.84, rebounding from its 21-day line and breaking a short downtrend. United Thera stock is still in a range of 218.48 buying points. UTHR stock fell 1.5% on Wednesday.

Tesla stock jumped 9.3% to 711.11 on Tuesday, just above its 21-day moving average. But it’s still below the fast-declining 50-day streak, with a 200-day average well above that. Last week, TSLA stock fell to 626.08, but settled above an 11-month low of 620.57 on May 24. Shares rose 1% on Wednesday.

Google stock rose 4.1% to 2230.88 on Tuesday, just below the 21-day streak. It’s not too far from the fast-declining 50-day streak, but the 200-day streak is a long way off. Last week, GOOGL stock fell to just over 2100, just above the May 24 low of 2037.69. Shares were flat early Wednesday.

Market Gathering Tuesday

The Dow Jones Industrial Average rose 2.15% on Tuesday stock market trading. The S&P 500 Index jumped 2.45%. The Nasdaq Composite Index jumped 2.5%. Small cap Russell 2000 rose 1.8%.

Tuesday’s solid gains were fine, but the markets saw many one-day or short-term rallies in the midst of sharp downtrends. The big drop in the Dow Jones futures contracts on Wednesday indicates that the attempt to rise the new stock market is already facing problems.

Assuming that the major indicators do not reduce last week’s lows, investors can look for Follow-up day To confirm try the new assembly.

Top 5 Chinese stocks to watch right now

What are you doing now

Investors should remain on the sidelines, waiting for a confirmed upward trend in the market. Even so, investors should be careful. The relative lack of good stocks in a position to buy is probably one of them.

Read The Big Picture Every day to keep up with the trend of the market, stocks and leading sectors.

Please follow Ed Carson on Twitter at Tweet embed For stock market updates and more.

You may also like:

Get the next winning stocks with MarketSmith

Best growth stocks to buy and watch

IBD Digital: Unlock IBD Premium Stock Listings, Tools & Analysis Today

Tesla vs. BYD: Which burgeoning EV giant is the best to buy?

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote