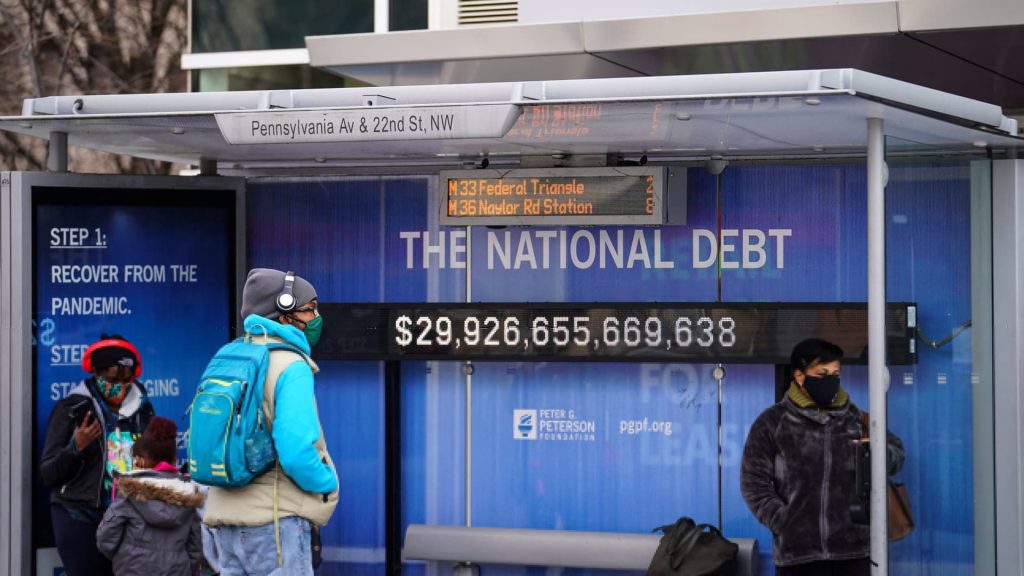

People wearing protective masks wait at a bus stop with a display of the current national debt amid the coronavirus (COVID-19) pandemic in Washington, Jan. 31, 2022.

Sarah Selbiger | Reuters

LONDON – Global sovereign debt is expected to rise 9.5% to a record $71.6 trillion in 2022, according to a new report, while new borrowing is also expected to remain broadly high.

In its second annual Sovereign Debt Index, published on Wednesday, British asset manager Janus Henderson forecast a 9.5% rise in global government debt, driven primarily by the United States, Japan and China but expected to increase borrowing from the vast majority of countries.

Global government debt jumped 7.8% in 2021 to $65.4 trillion, as each assessed country saw increased borrowing, while debt servicing costs fell to a record low of $1.01 trillion, an effective interest rate of just 1.6%, according to the report. .

However, debt servicing costs are set to rise significantly in 2022, to around 14.5% on a constant currency basis to reach $1.16 trillion.

The UK will feel the biggest impact on the back of higher interest rates and the impact of higher inflation on the large amounts of debt tied to the UK benchmark, along with the costs associated with canceling the Bank of England’s quantitative easing programme.

“The pandemic has had a significant impact on government borrowing — and the after-effects are set to last for some time now,” Bethany said. “The tragedy unfolding in Ukraine will also likely put pressure on Western governments to borrow more to fund increased defense spending.” Payne, global bond portfolio manager at Janus Henderson.

Germany has already pledged to increase its defense spending to more than 2% of GDP in a sharp policy shift since the Russian invasion of Ukraine, along with the allocation of 100 billion euros ($110 billion) to a fund for its armed services.

New sovereign borrowing is expected to reach $10.4 trillion in 2022, nearly a third more than the average before the COVID-19 pandemic, according to Standard & Poor’s latest global borrowing report published Tuesday.

“We expect borrowing to remain elevated, due to high debt renewal needs, as well as challenges to fiscal policy normalization posed by the pandemic, high inflation, and a polarized social and political landscape,” said Karen Vartapetov, credit analyst at Standard & Poor’s.

The report highlighted that the global macroeconomic repercussions of the ongoing conflict are expected to lead to further upward pressure on government financing needs, while the tightening of monetary conditions will increase government financing costs.

This presents another problem for sovereigns that have so far struggled to reignite growth and reduce reliance on foreign currency financing, whose interest bills are already large.

Standard & Poor’s said that in advanced economies, borrowing costs are expected to rise but are likely to remain at a level that will allow governments time to budget consolidation, giving governments time to consolidate budgets and focus on growth-stimulating reforms.

Opportunities for investors

Monetary policy convergence emerged as a theme during the first two years of the pandemic, as central banks cut interest rates to historical lows to help support struggling economies.

However, Janus Henderson noted that the divergence is now emerging as a major theme, as central banks in the US, UK, Europe, Canada and Australia look to tighten policy controls to contain inflation, while China continues to try to stimulate the economy with a more accommodative policy stance.

Payne suggested that this divergence provides opportunities for investors in short-term bonds that are less susceptible to market conditions, focusing on two locations in particular.

“The first is China, which is actively involved in easing monetary policy, and Switzerland, which is more protected from inflationary pressures as energy consumes a much lower proportion of the inflation basket and its policy is tied to the European Central Bank, but is lagging,” she said.

Janus Henderson also believes that short-term bonds look attractive nowadays compared to riskier long-term bonds.

“When inflation and interest rates are rising, it’s easy to dismiss fixed income as an asset class, especially since bond valuations are relatively high by historical standards,” Payne said.

“But many other asset classes have a higher valuation and investor weights for government bonds are relatively low, so there is a benefit from diversification.”

What’s more, she argued, markets have often priced in higher inflation expectations, so bonds bought today benefit from higher returns than they would have received a few months ago.

Correction: This story’s headline has been updated with the correct number of global government debt.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote