“We believe in the line”. Playing on words with a stamp printed on the US dollar – the God we believe in or the God we believe in – a group around They resumed the debate over whether 100 billionaires should raise more taxes. It was a way out Open letter issued in the framework of the World Economic Forum Davos 2022, A place that received strong criticism for creating discussions from the tables, and then not translated into concrete actions.

“Hope – in politics, in society, in each other – is not built in small rooms accessible only to the rich and very powerful. Patriotic millionaires, In a direct reference to some of the richest people in the world, such as Elon Musk and Jeff Bezos. Participate in space racing and pay less and less taxes, they themselves travel to the universe.

“As millionaires, we know that the current tax system is unjust. Most of us can say, in fact, that the world has suffered the most in the last two years. We have seen our wealth increase during epidemics; However, few of us can honestly say that we pay our fair share of taxes, “he continued, pointing to the international tax system” designed to further enrich the rich. ”

In this context, the group of millionaires makes an extraordinary request to world governments: “Tax the rich and do it now“. Former U.S. President George W. Bush. The organization became known in 2010 for opposing tax cuts for the rich during the Bush administration. They identify themselves as winners in the capitalist system and as those who want to save capitalism from its own excesses. Their demands usually revolve around an increase in the wealth tax, the correction of financial loopholes where taxes are legally evaded, and even an increase in the minimum wage.

Who are the patriotic millionaires

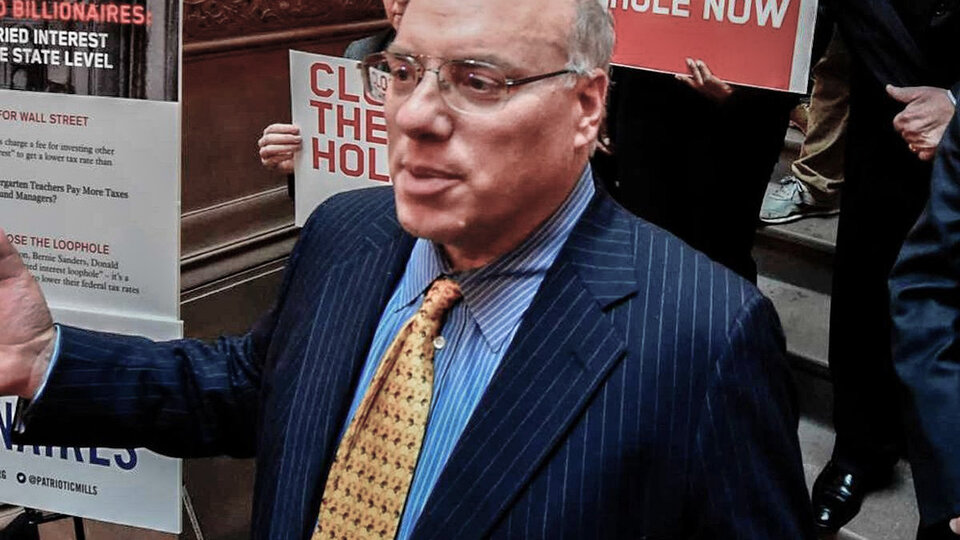

The group is headed by former BlackRock executive Morris Pearl.. Among the signatories, in addition to Pearl, is the list of grandchildren and heirs and businessmen of Abigail and Tim Disney, co-founder Roy Disney, as well as some politicians, investors and philanthropists not only from the United States but also from the UK. Canada, Germany, Austria, Denmark and Greenland.

Responding to this letter, the forum spokesman Indian A Reuters One of the company’s policies is to pay fair taxes and “tax on wealth, as it is in Switzerland, based on that system, which would set a good precedent for its growth elsewhere”.

Discussion of tax on large assets

There was a discussion about taxing huge wealth during the visible epidemic crisis that exacerbated the inequality between rich and poor around the world. In 2021, progress was made on a similar plan during the G20 Economic Ministers’ Meeting. It is proposed to implement a 15 per cent global tax on multinational corporations with the aim of reducing tax breaks.

The agreement has the support of the majority member states of the Organization for Economic Co-operation and Development (OECD) and will begin collecting from 2023. Argentina supported the plan, despite proposals to increase the number to more than 15. Economy Minister Martin Guzman suggested. 21 to 25 percent.

The epidemic exacerbated the inequality

The letter came just hours after the submission of the “Inequality Kills” report confirming that Between March 2020 and November 2021 The ten richest people in the world have doubled their wealth It goes from $ 700,000 million to $ 1.5 trillion at a rate of $ 15,000 per second or $ 1,300 million per day. In the meantime, More than 160 million people worldwide are living in poverty Compared to the pre-infection period. That is, they make less than $ 5.5 a day.

According to a study by Patriotic Millionaires in collaboration with Oxfam and other nonprofits, progressive property taxes will start at 2 percent for those over $ 5 million and rise to 5 percent for billionaires, raising $ 2.52 trillion, raising 2.3 billion people. Ensuring health care and social security for individuals living in poverty-stricken, low-income countries.

“Introvert. Thinker. Problem solver. Evil beer specialist. Prone to fits of apathy. Social media expert. Award-winning food fanatic.”

More Stories

Two influencers drown after refusing to wear life jackets: “ruining selfies”

Uruguay 2024 election results: who won and when is the second round | Waiting to know whether there will be a runoff or not

Uruguay: Lacalle Pou leaves with his figure on the slopes | The Marcet and Asteziano scandals hit the right-wing ruler