Double-digit inflation has already begun in many European countries.

by Wolf Richter about Wolf Street.

German consumer price inflation started rising in January 2021, over a year ago Russia’s invasion of Ukraine was already 6.0% in November 2021. Energy costs rose significantly for a year as well.

In March, consumer price inflation rose 7.6% compared to March 2021, according to preliminary estimates by the German Statistical Agency. Destatis, based on the harmonized Eurostat method. The Russian invasion of Ukraine added fuel to the fire that broke out a year earlier.

The eurozone is one of the places where a crazy central bank is imposing negative interest rates on policy, and thus negative bond yields, and increasingly negative interest on bank deposits, on the economy and households. The European Central Bank left its negative interest rate policy (NIRP) unchanged at its last meeting, with the deposit rate remaining at -0.5%, and it continues to buy bonds.

The European Central Bank’s policies are inexplicably reckless in light of the inflation that began to explode in January 2021.

But interest rate hikes – too timid and too late – are now seen later in 2022. The European Central Bank has already drastically cut its bond-buying program and will cut it further.

Month to month, consumer price inflation in Germany rose by a shocking 2.5% (30% annually!). And both inflation numbers, 7.6% year-on-year and 2.5% month-to-month, wiped out the already high expectations economists had dared to put up with.

Based on the German method of calculating inflation, consumer prices are up 7.3% from a year ago, the highest since 1981, according to Destatis.

The agency cited energy costs (+39.5% year-on-year), and “delivery bottlenecks” causing overall commodity prices to rise 12.3%. Food prices jumped 6.2%.

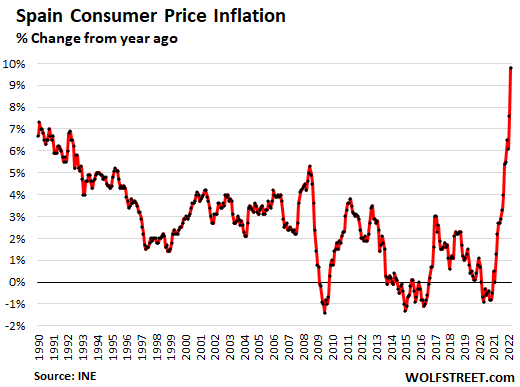

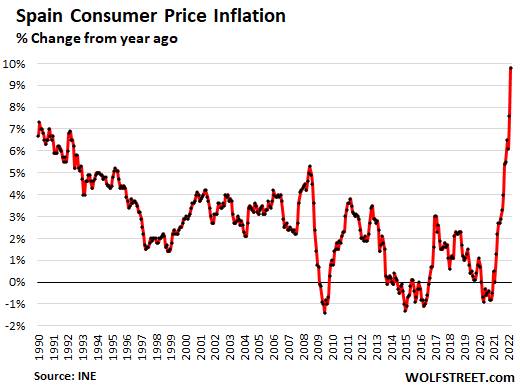

In SpainConsumer price inflation rose 3.0% in March from February (36% annually!), and 9.8% year-over-year, the highest rate since May 1985, according to the Preliminary estimates Spanish statistics agency INE today.

But that rally started in March 2021 and by December 2021 had already reached 6.5%, the highest level since 1990. The war in Ukraine that caused already high energy prices made it worse:

For February, three European countries are already reporting double-digit inflation year-on-year: the Czech Republic (10.0%), Estonia (11.6%), and Lithuania (14.0%), with Belgium not far behind (9.5%). March will look much worse.

The Czech Republic’s central bank, which is not in the eurozone and can still set its monetary policies, raised its monetary policy rate four times, from 0.5% in July last year to 3.5% at its last meeting in February.

And for some much-needed inflation-related humor: In Turkey, which is not in the European Union, Erdogan set out to destroy the lira wholesale by expelling recalcitrant central bank chiefs and replacing them with interest rate cuts, cutting the interest rate by 5 percentage points to 14%. Inflation has now exploded to 54%, compared to 16% a year ago.

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a mug of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote