The Russian invasion of Ukraine entrenched inflation in countries around the world.

Prices rose last year against the background supply chain clogsCovid-19-related shutdowns and rising energy costs – problems that were expected to fade in 2022.

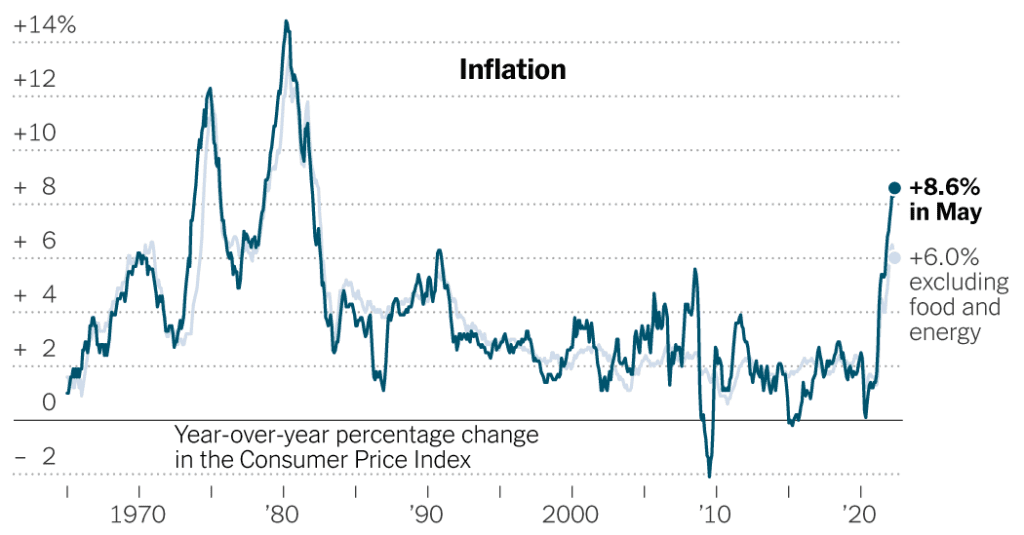

Six months ago, the OECD estimated that hardly any of its 38 members would see inflation rise above 6 percent. The main exceptions were Turkey and Argentina, which were already contending with hyperinflation mostly unrelated to the pandemic.

since then, Sanctions against Russia, one of the world’s largest producers of energy and grain, has surplus prices for food, fuel and fertilizer. Russian bombing, siege, and seizures have cut off the flow of Cereals from Ukraineanother great product, raising the specter of starvation in The poorest food-importing countries.

At the same time, China’s policy of locking down areas where the Covid-19 virus is spreading has exacerbated the problem.

The Organization for Economic Co-operation and Development announced this week Realistic Updates. In seven Eastern European countries, inflation is now expected to rise above 10 percent. The estimated rate for the Netherlands this year has almost tripled to 9.2 percent; Australia doubled to 5.3 percent. and like United StateInflation rose by 8.6 percent during the month of May, Britain Germany saw inflation soar to its highest levels in four decades, well above previous expectations.

This is likely to erode household income and savings while hampering companies’ efforts to invest and create jobs.

The central banks of the US, UK, Australia and India have moved aggressively recently to contain rapidly rising prices by raising interest rates. Even the European Central Bank, which has been reluctant to raise interest rates for fear of a recession, said on Thursday it would end asset purchases and Raise the main interest rate By a quarter of a point at its meeting next month, and possibly more in September.

But there is a limit to what political and financial leaders can do about rising inflation – especially given the various causes. In many regions, such as Europe, inflation is driven by skyrocketing food and energy prices. The Organization for Economic Co-operation and Development has warned that raising interest rates will not solve core supply problems.

By contrast, regulation partly blamed inflation in the United States on “excessive demand, which is more responsive to tighter monetary policy. Compared to Europe, the US labor market is tighter and nominal wage growth is higher.

Although inflation is causing severe pain in some areas, the long-term outlook is more positive. The World Bank expects global consumer price inflation to fall below 3 percent next year.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote