- Despite trading within a broader bullish structure, PEPE may have to look for stronger support areas.

- If PEPE remains unable to remove this resistance, an extended accumulation phase may follow.

baby [PEPE] It had a great performance last month, rising by 23.7%. However, these gains are now at risk, as Pepe’s program gradually loses momentum.

Currently, the asset is down 2.46% on the daily charts, indicating that this downward trend may continue.

According to a recent analysis by AMBCrypto, this decline may continue, as the current market sentiment is bearish, with limited buying pressure to maintain the upward movement in PEPE price.

Baby faces a big obstacle

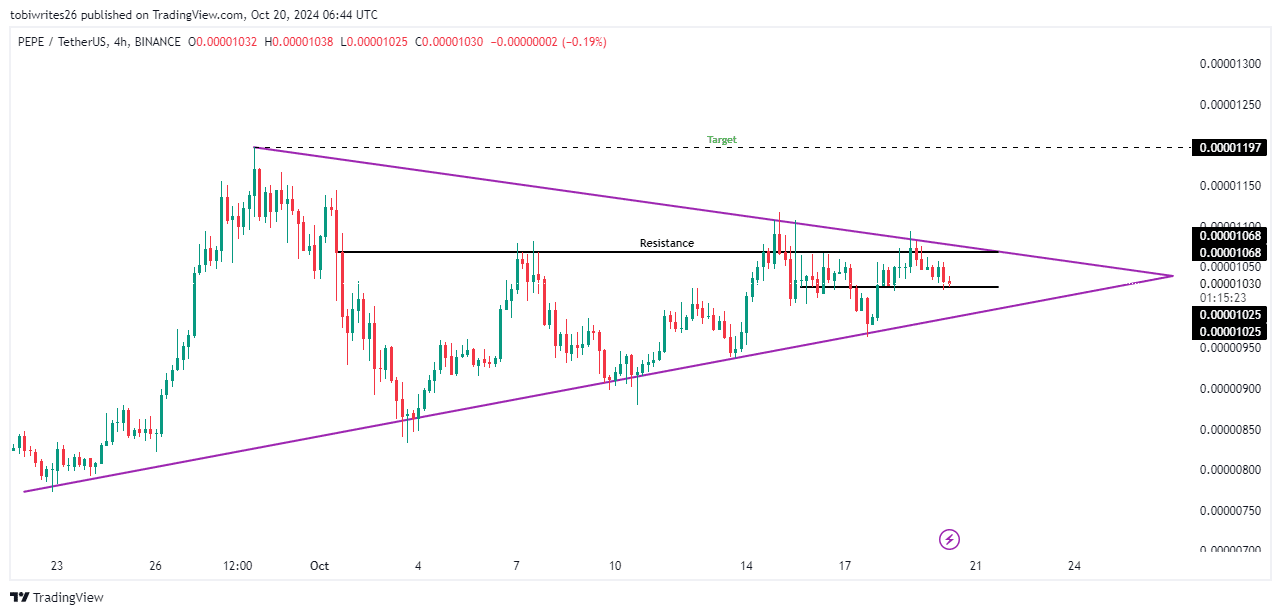

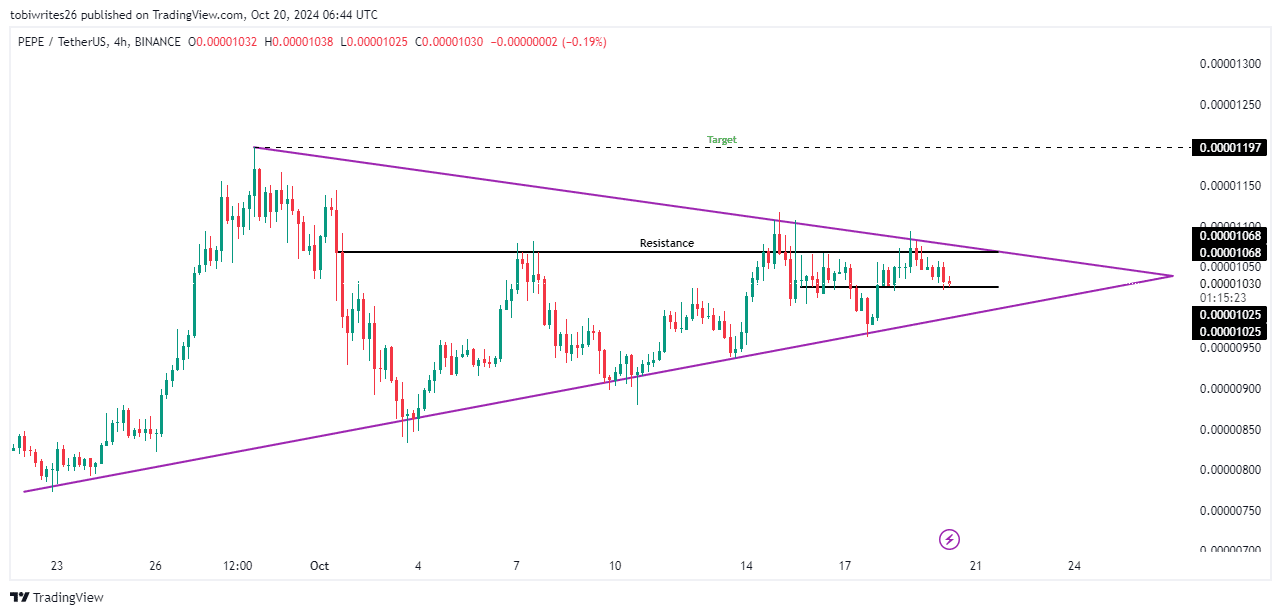

PEPE was trading within a symmetrical triangle at the time of publication, a pattern typically seen as a precursor to a price breakout after a period of accumulation.

The token recently interacted with resistance at $0.00001068, a level that rejected price rallies twice, indicating significant selling pressure in this area.

During this period, PEPE was hovering around a support level of $0.00001025. Suppose this support continues and sufficient buying pressure emerges.

In this case, the price is expected to rebound, possibly retesting the resistance level and breaking out of the pattern, pushing PEPE towards the upper border of the triangle.

Source: Trading View

However, if this support level fails to hold, PEPE may fall further to the lower support of the ascending triangle, an area of high liquidity that may generate enough buying momentum to push the price higher.

Will PEPE support level hold?

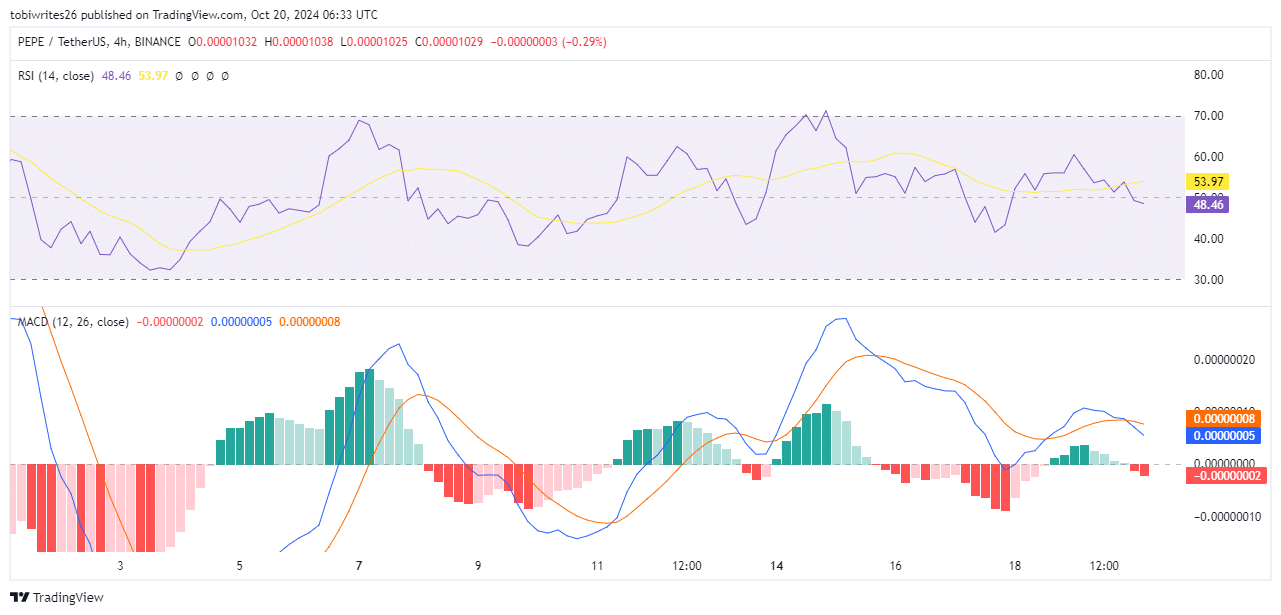

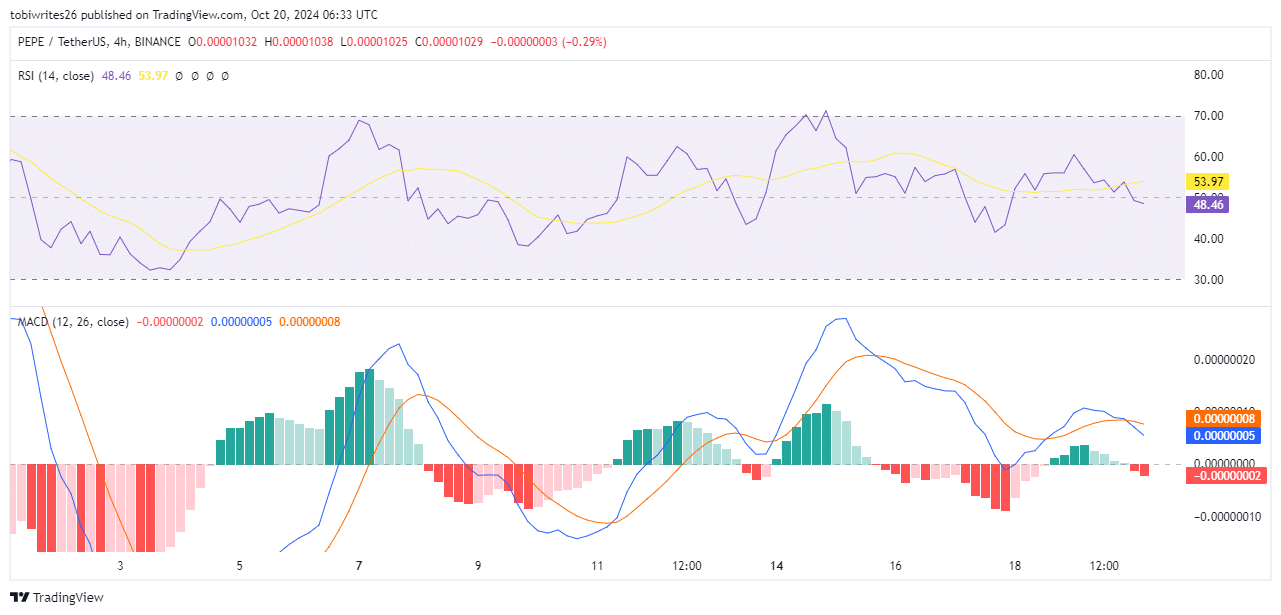

According to AMBCrypto results, the current support level for PEPE seems unlikely to hold, as technical indicators point to increased selling pressure from traders.

The Relative Strength Index (RSI) is currently at 48.46, below the neutral 50.00 mark, indicating that market sentiment is bearish and PEPE price may follow suit.

The Relative Strength Index measures the speed and variability of price movements in an asset.

The Moving Average Convergence-Divergence (MACD) has also formed a ‘death cross’, with downward momentum gaining strength.

This occurs when the MACD line (blue) crosses below the signal line (red), indicating that traders are more inclined to sell rather than hold the asset.

Source: Trading View

If this trend continues, PEPE price may fall below the support level, leading to further declines.

Interest in PEPE continues to wane

Open interest, which is used to measure market sentiment by tracking whether participants are buying or selling, indicated that selling pressure was increasing at the time of publication.

Read baby [PEPE] Price forecasts 2024-2025

According to data from Quinglassopen interest in PEPE decreased by 3.61%, with a current value of $165.20 million in the near term.

This decline in open interest indicates the potential for further decline in PEPE prices, making a decline from its current level seem inevitable.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote