- QNT struggled to break the resistance level at $85, with support remaining at $75 amid mixed RSI signals.

- On-chain indicators showed whale accumulation and a positive funding rate, indicating a potential upside.

Quantity [QNT] It continues to attract the attention of both retail traders and institutional investors due to its strong bullish sentiment.

according to Recent dataHowever, market sentiment remains optimistic, raising questions about whether QNT is able to maintain its momentum or face further challenges.

At press time, QNT was trading at $75.36, down 1.88% over the past 24 hours. Despite this slight decline, many investors are still eyeing a potential breakout, but several factors will determine whether QNT is able to maintain its upward trend.

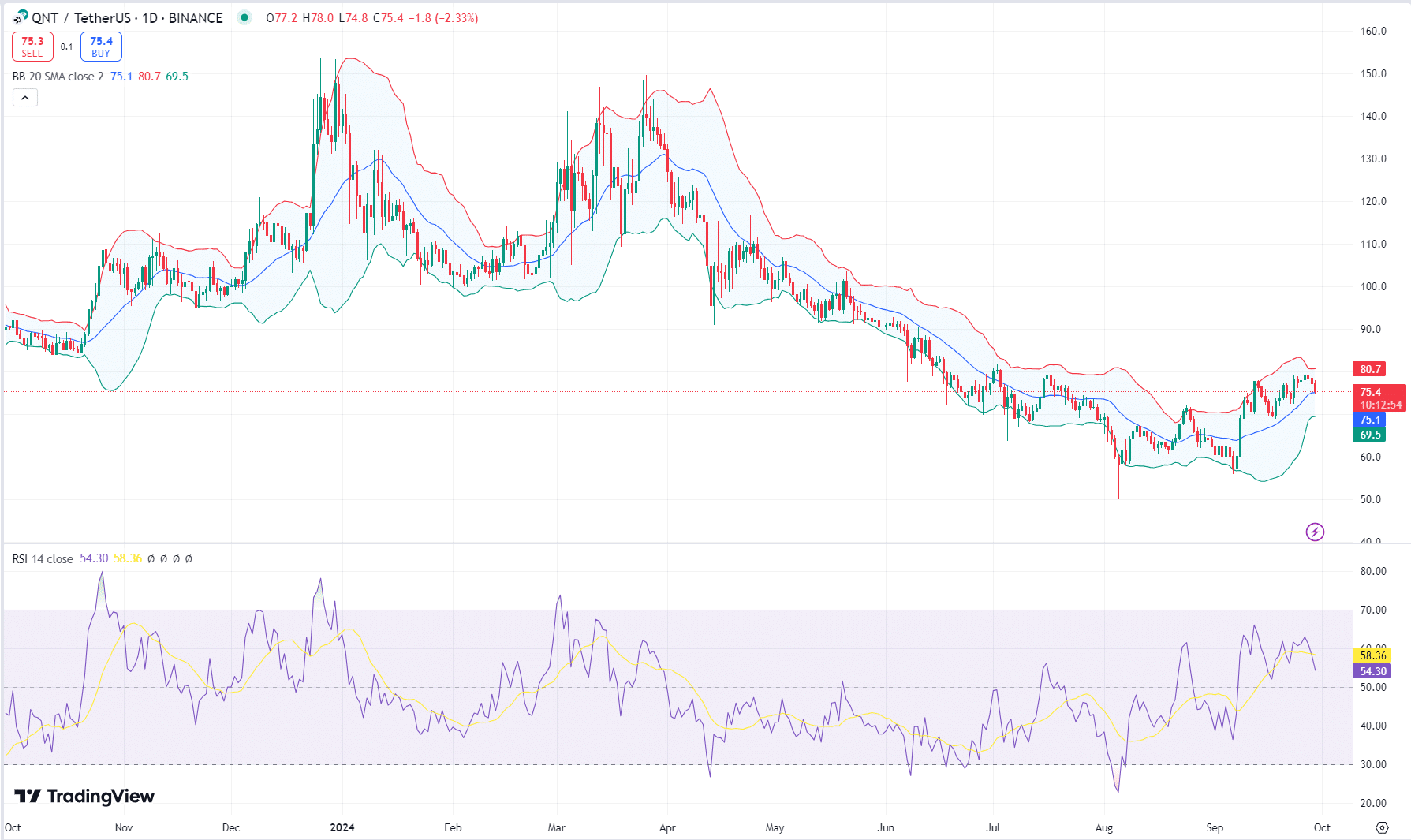

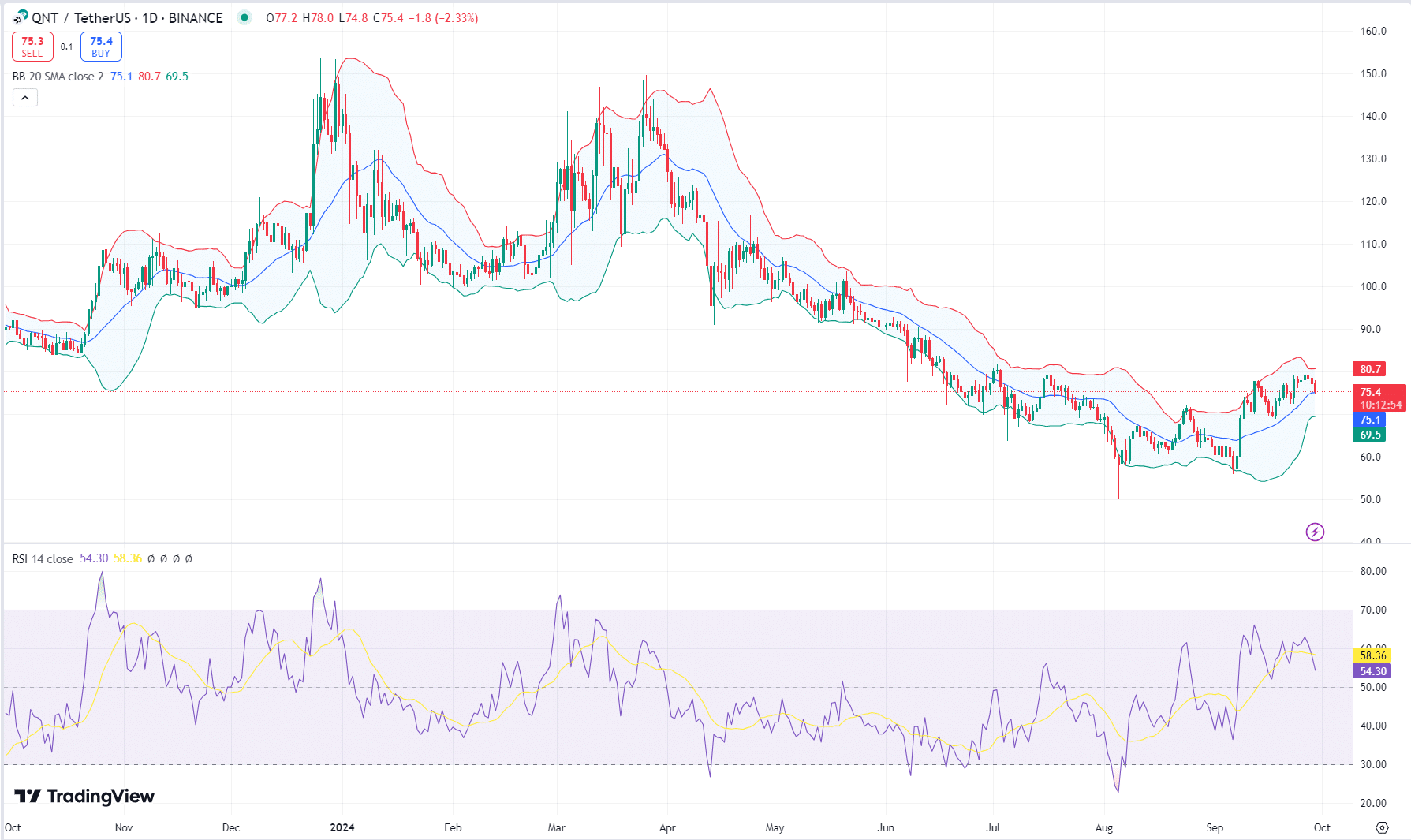

Key resistance levels and price action analysis

QNT recently tested the $85 resistance level after a steady rise earlier in September. However, the price had difficulties breaking out and retreated to the mid-$70 range. At press time, the 20-day simple moving average (SMA) was at $75.1, providing crucial support.

Therefore, stability at this level is vital for any further upward continuation. If QNT remains above this limit, it may retest the upper Bollinger Band boundary at around $80.7, providing short-term relief to the bulls.

Additionally, the Relative Strength Index (RSI) at 58.36 does not indicate an overbought or oversold condition, indicating that there is room for price movement in either direction.

However, if QNT drops below the $75 level, the next important support is near $69.5. A break below this support could indicate a deeper correction, making it difficult for QNT to regain its upward momentum.

Source: Trading View

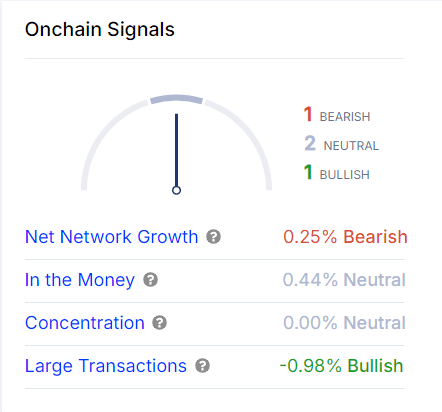

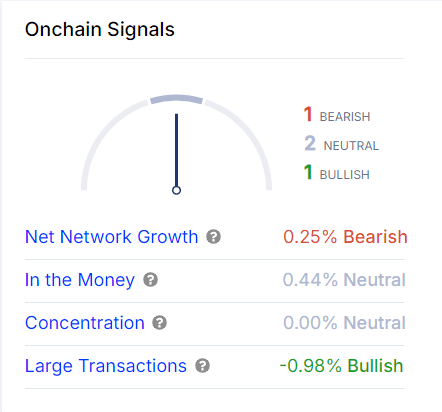

Mixed signals for network growth and transactions

Onchain metrics paint a mixed picture for QNT. Net network growth showed a slight downward signal, declining by 0.25%, indicating that fewer new participants are joining the network.

However, large transactions are showing bullish activity, with a 0.98% increase, indicating that whales and institutional investors are accumulating QNT. Therefore, this could lead to upward pressure in the near term.

In contrast, the “at the money” measure remains neutral at 0.44%, implying that most current bondholders do not realize significant gains or losses.

In addition, the concentration of holdings remains unchanged, which reinforces the stable outlook.

Source: IntoTheBlock

What could fuel more growth?

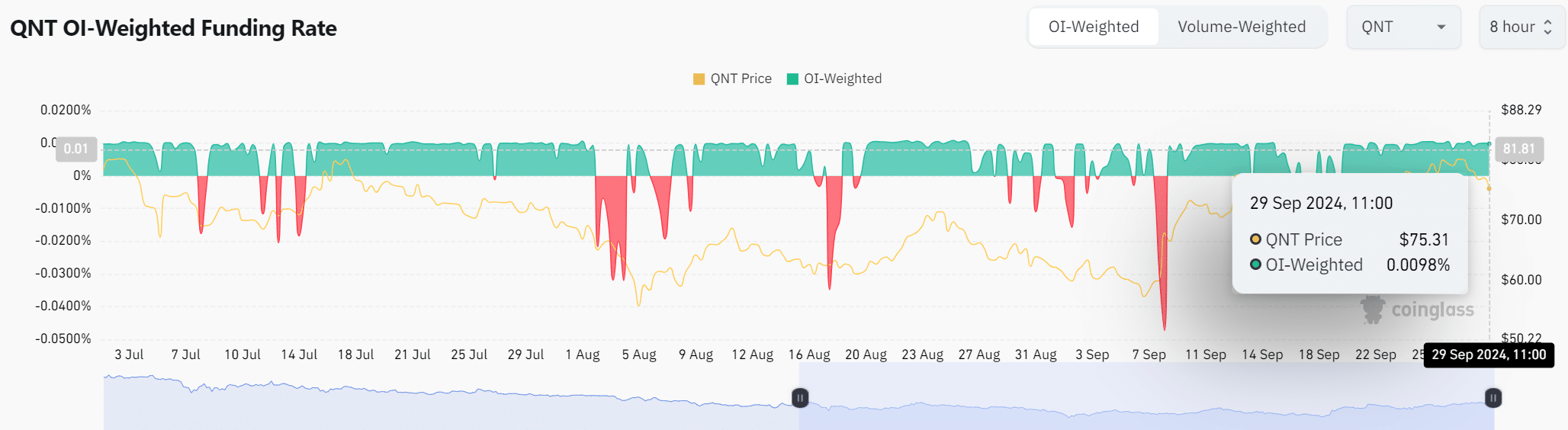

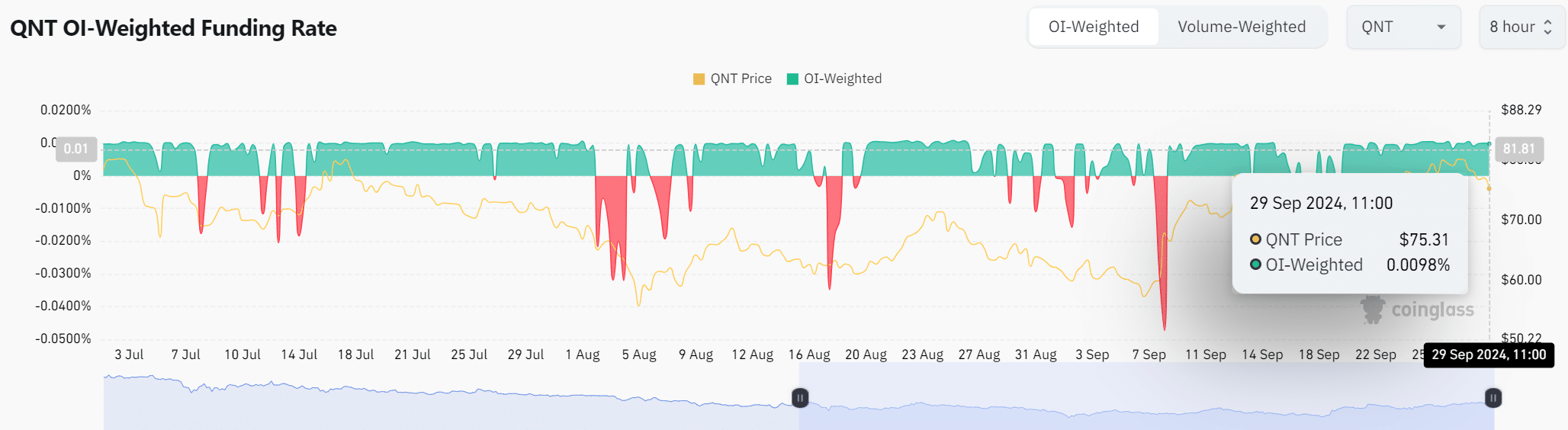

Meanwhile, QNT’s OI weighted financing rate revealed a slight positive trend, standing at 0.0098% as of September 29.

This slight rise indicates growing confidence among long positions, and therefore, futures traders may push QNT higher in the short term.

Read quant [QNT] Price forecasts 2023-2024

If the OI weighted funding ratio continues to improve, we may see a bullish rally driven by derivatives trading.

Source: Coinglas

While QNT shows potential for upward momentum, maintaining the support level at $75 is crucial. The next few sessions will reveal whether QNT can break the resistance level at $85 or face another consolidation phase.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote