- Network activity declined in September.

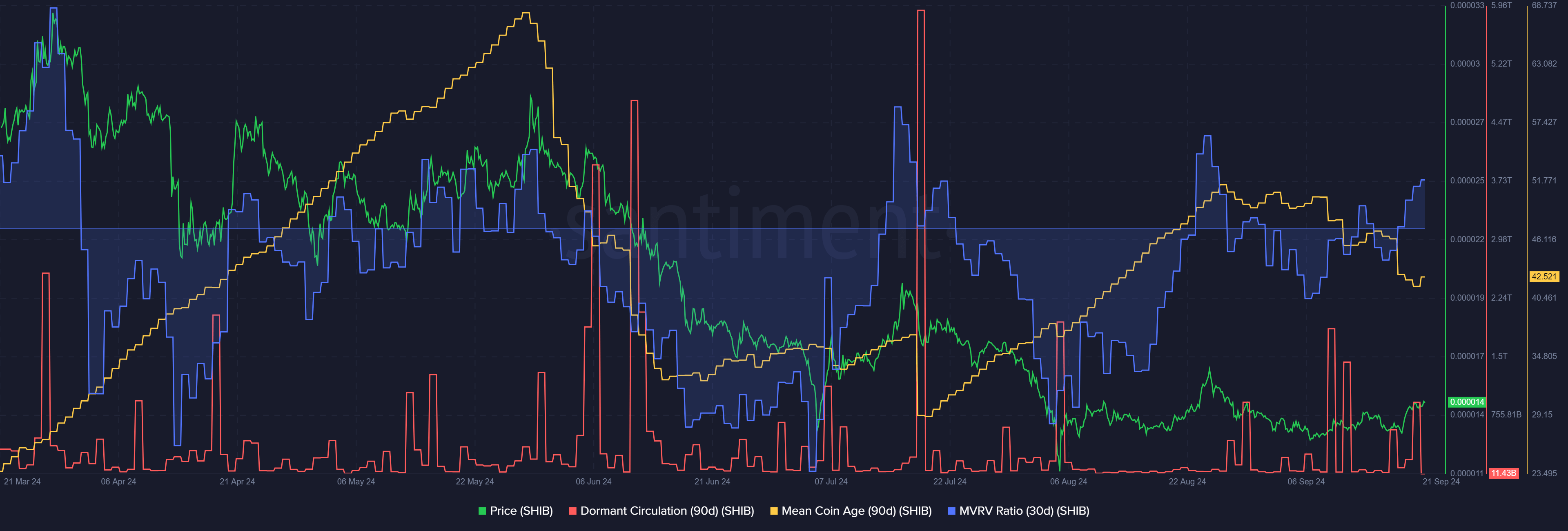

- The average coin age and MVRV have shown a downward trend in the short term.

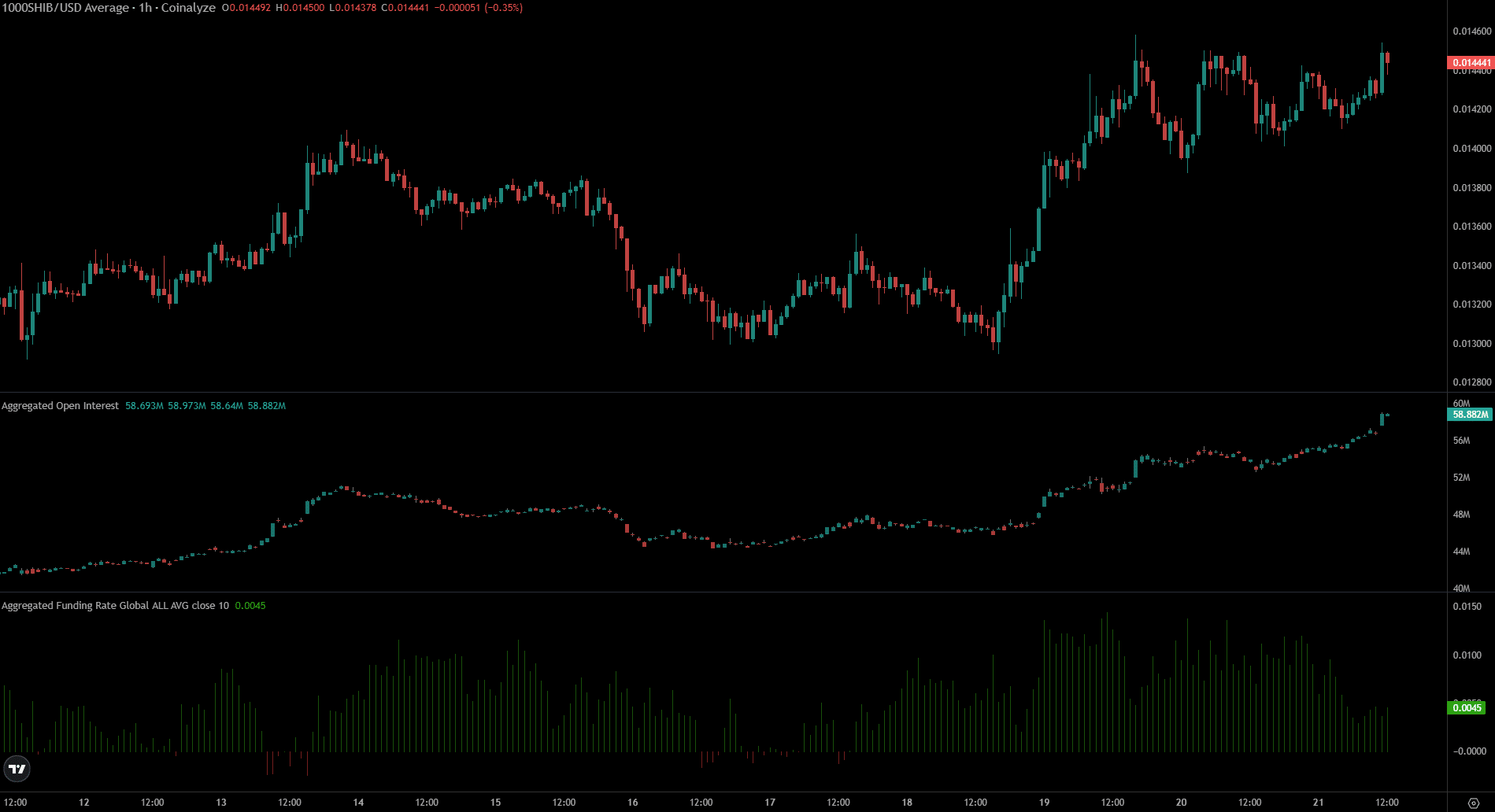

Shiba Inu [SHIB] It has been trading inside a 75-day triangle pattern. The meme coin promises strong performance in the coming months after breaking out of this triangle last week.

Since Monday, September 16, the entire crypto market has been trending upwards, with gains of around 7%. Shiba Inu gained 8%, and a break of the local resistance at $0.000014 signaled another 7%-8% rise.

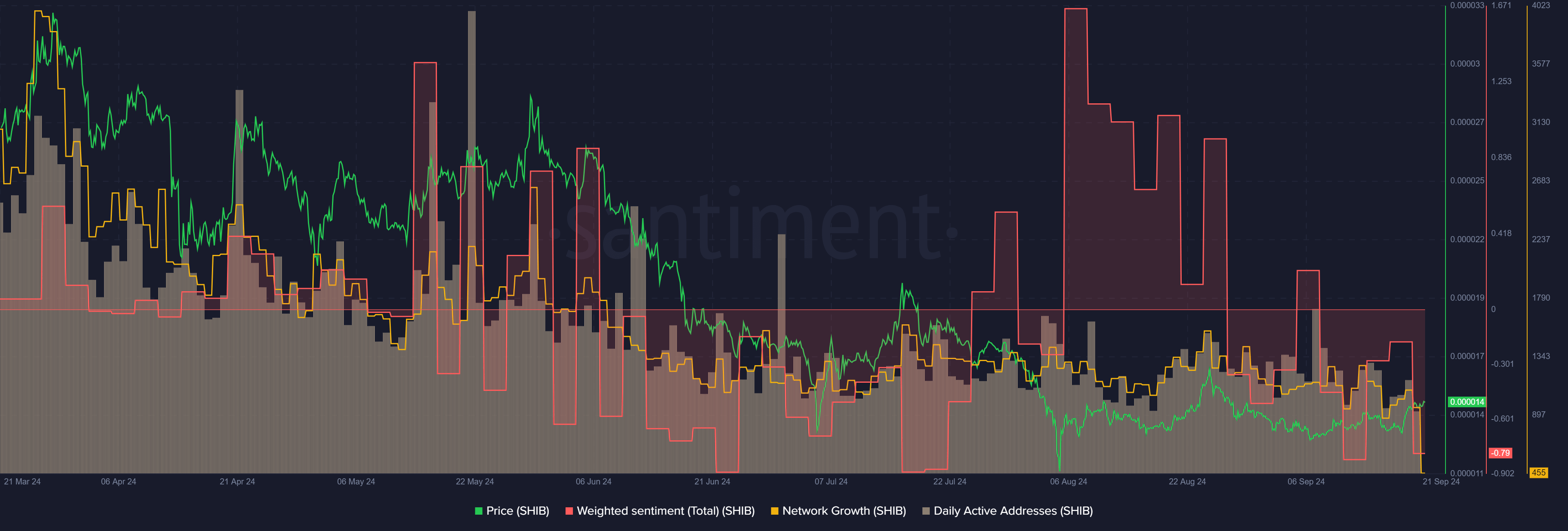

Network activity was down.

Daily active addresses saw a downward trend from May through July, but began to stabilize until late August. There was a spike in activity in early September, but since then the metric has declined again.

The latest drop means daily activity is at its lowest since the first week of February earlier this year. Network growth has also been declining since the last week of August.

Sentiment was strongly positive in August, but like active addresses and network growth, it also took a hit in September. Overall, Shiba Inu doesn’t seem likely to see a surge in demand from rising user numbers in the near term.

SHIB Stock Short Term Bearish Trend

The 30-day weighted average interest rate was positive. The last time we saw a significant positive spike was on August 24, followed by a sharp 12% price correction over the next three days.

The dormant trading saw a significant increase on September 20, another sign of short-term bearish pressure. Meanwhile, the average age of the coin has also been on a downward trend over the past month, indicating a distribution across the network.

Open interest has been rising alongside prices over the past week, indicating strong bullish sentiment. The funding rate has also been very positive but has been declining over the past 24 hours.

Whether it’s real or not, here’s SHIB’s market cap in terms of BTC

This drop in funding rate indicated that the imbalance between long and short positions was decreasing, but that longs were still favored. Overall, on-chain metrics indicated that some short-term selling pressure was expected.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote