PPI and Core PPI spike services.

by Wolf Richter to Wolf Street.

The producer price index for final demand rose 1.4% in March from February, and 11.2% from a year ago, the two biggest and worst increases in annual data going back to 2010, according to the Bureau of Labor Statistics. today. Having been stuck at around 10% for four straight months, producer price inflation has now spread – to use the term stock trading.

Final Demand PPI tracks input prices for consumer facing industries whose selling prices in the coming months are picked up by Yesterday’s consumer price index, WHOOSH, already reached 8.5%. The final PPI demand shows what the CPI has in store for the coming months. There is no ‘easing’ in store, and the PPI for services is now starting to rise.

Over the past 15 months, producer prices have risen relentlessly. Five straight months of double-digit producer price inflation is okay. Today’s hack is awesome.

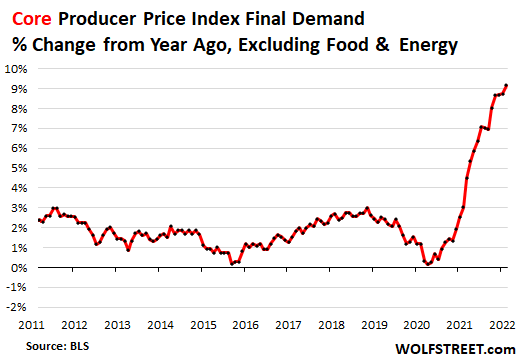

Without volatile food and energy costs, core PPI rose 1.0% in March from February and 9.2% year over year, the highest in the data, rising relentlessly since late 2020:

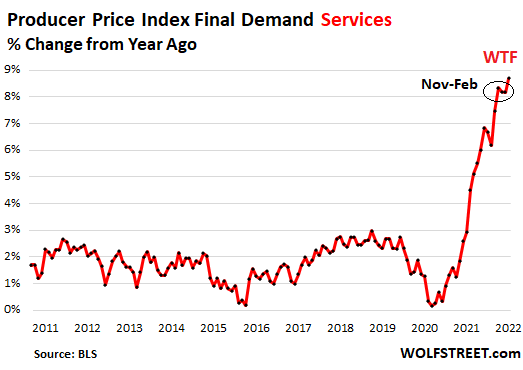

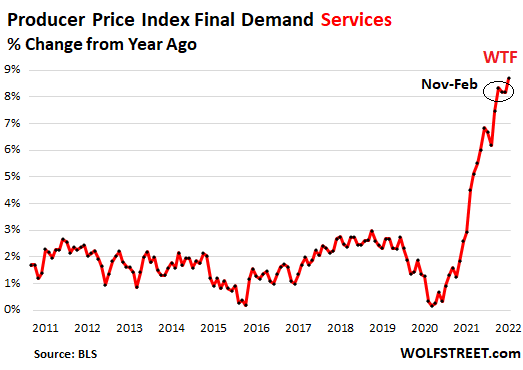

and services! The PPI for final demand services increased 0.9% in March compared to February and 8.7% year-over-year, the highest in data going back to 2010.

What companies along supply chains have found is that they can pass on cost increases to the next company and consumers. And consumers were playing with passion, having gone from being fairly skilled buyers and shoppers to paying just about anything. This is the inflationary mentality that has taken hold.

This inflationary mentality flourished and suddenly flourished due to two massive, unprecedented factors:

- The Fed’s reckless monetary policies to suppress interest rates and $4.8 trillion in money printing, resulting in massive inflation in asset prices and the purchasing power it disposes of;

- The government has spread $5 trillion in borrowed money across the land in just 24 months.

With this outpouring of money, which led to the most overstimulating economy ever, price no longer matters, and everyone figured it out.

Price increases move through the economy in uneven waves, with the costs of some goods and services rising while others may be stable or may decline, and after a month or two the prices of other goods and services rise dramatically in the inflation game. -the mole.

And companies have realized that not only can they pass on higher costs, but under the cover of a now burgeoning inflationary mindset, they can pass on much more than the additional costs, leading to huge profit margins.

Companies always charge the maximum price possible, limited only by their desire to reach their sales targets. When price resistance begins among their customers, companies consider whether to roll back these price increases to stimulate volume, or continue to raise prices further until some kind of ceiling is reached. With online purchases, this equation is now recalculated in real time and continuously.

What has changed compared to 2019 is that buyers are now infected with an inflationary mindset and are now able and willing to pay anything, rather than hold back. This decline puts a damper on price increases – and thus on broader inflation. But that bounce has now been broken from consumers all the way up the supply chains. The entire pricing dynamics became a loser.

We’ve seen that a roof is being hit Used cars as prices increased by 40% and buyers began to resistIndustry-wide sales are now declining despite the supply glut. But in other products and services, buyers’ resistance has not yet been met. Even if the price of one product reaches the level of resistance, the price of another product collapses.

These double-digit increases in producer prices show that higher inflation is trending toward consumers, and will continue to do so until consumers start to fall back, either because they are no longer able to, or because they are no longer willing to pay anything. That’s a long way from happening, and those trillions of dollars are still circulating across state and local governments, businesses and consumers, and it will be spent, even though that spending may shift into different categories, such as from goods to services.

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a mug of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

“Web maven. Infuriatingly humble beer geek. Bacon fanatic. Typical creator. Music expert.”

More Stories

Dow Jones Futures: Microsoft, MetaEngs Outperform; Robinhood Dives, Cryptocurrency Plays Slip

Strategist explains why investors should buy Mag 7 ‘now’

Everyone gave Reddit an upvote